The home building industry is a good indicator of what is the general state of the economy. Like the auto industry, it can be viewed as a weather vane for how optimistic people feel about the future and the near-term trend.

If the economy is running at full speed, people will likely want to buy a house or do some reconstruction work on their existing home. If there is a crisis, they are more likely to hold onto their assets until the storm passes. It is what we call “cyclical stocks.”

Just so we are all on the same track, let’s quickly define what a homebuilding ETF would be. The homebuilding industry includes companies whose businesses revolve around the construction and improvement of residential homes. Industry-oriented exchange-traded funds include those businesses, as well as big home-improvement retailers.

Why are home builders a good investment?

Covid-19 crisis hit the construction businesses harder than some of the other niches. The construction and house improvement field has outperformed other broader markets in the recent year by almost one-third despite the crisis.

During the pandemic, and especially during the outbreak-prompted lockdowns, more people took up home repairs to be productive and active during the time they had to spend inside. Now, when lockdowns are a thing of the past in the world’s most prominent part, the second prong of the industry, construction, is starting to pick up pace itself.

What are the best five homebuilder ETFs?

Here are the top five homebuilders ETFs that you could consider.

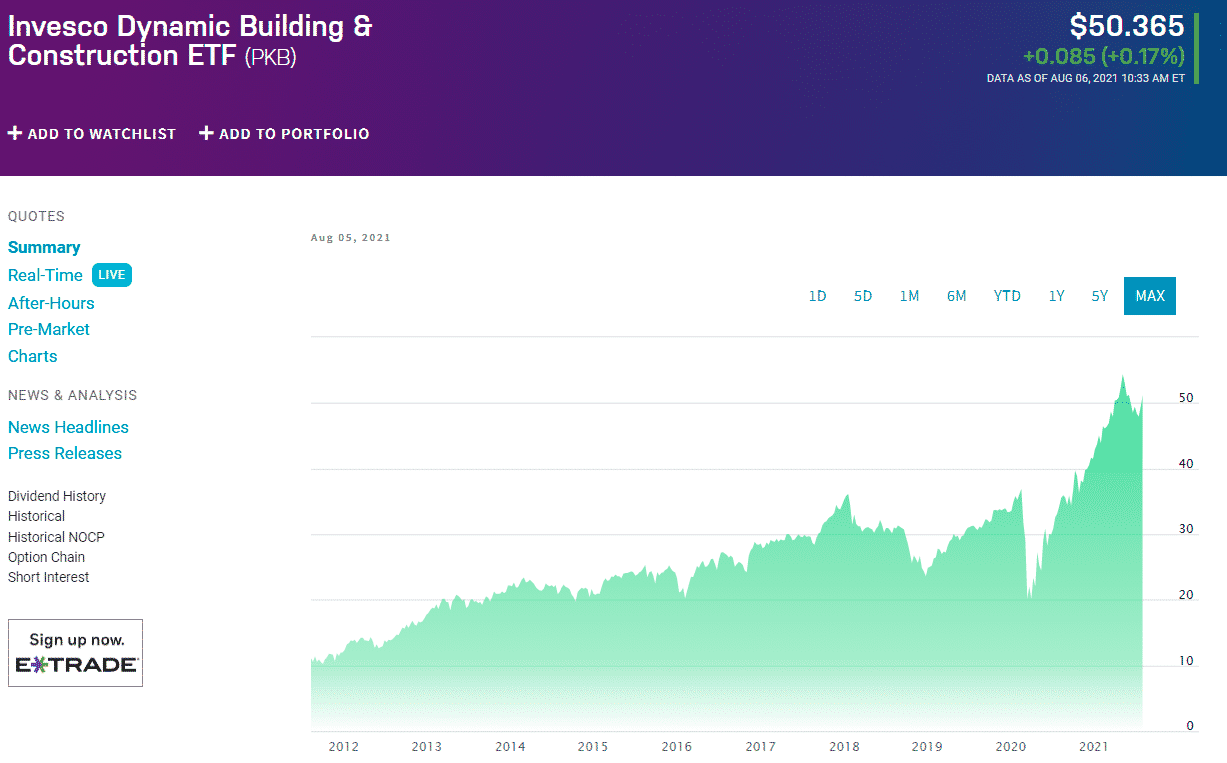

№ 1. Invesco Dynamic Building & Construction ETF (PKB)

Invesco Dynamic Building & Construction ETF Chart

For all of those feeling confident that the United States’ construction industry will do well, Invesco Dynamic Building & Construction ETF sounds like an almost perfect choice. Launched in 2005, Invesco Dynamic Building & Construction ETF provides a valuable insight into the general state of the US economy as a whole, thanks to its cyclical nature.

Unlike some other ETFs that focus solely on construction companies, the PKB ETF also includes accompanying industries. So, besides having construction and home repairs companies among its top holdings, it also has Home Depot and Lowe’s amid its most prominent units.

It has a decent 7.74 ESG score on the 1-10 MSCI scale, while its yearly returns stand at 51.02%. The fund pays a quarterly dividend of $0.04 at an expense ratio of 0.59%.

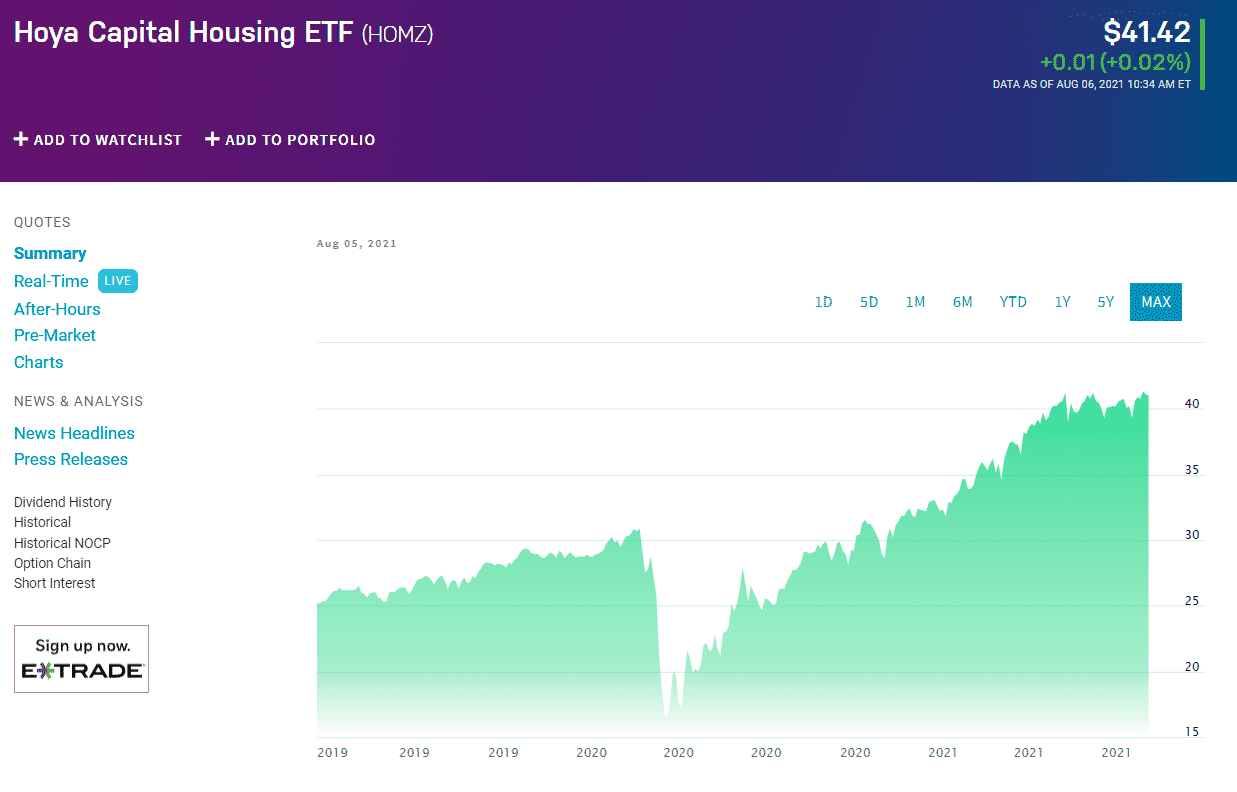

№ 2. Hoya Capital Housing ETF (HOMZ)

Hoya Capital Housing ETF HOMZ Chart

Hoya Capital Housing ETF HOMZ is an interesting one. It tracks the index with a pretty straightforward purpose: to include the top 100 construction companies based in the US. The benchmark is reconstituted and rebalanced every six months to ensure that the businesses included are the very best of the niche.

Not only does this ETF try to include the 100 top-performing construction companies, but it also aims to represent the essential sub-sectors. The segments include homeownership and rental operations, home building and construction, home improvement and furnishings, financing, technology, and services. Each of these four areas corresponds to its contribution to its gross domestic product.

Its last quarterly dividend came in at $0.08, at an expense ratio of 0.3%. Its yearly return amounted to 53.86%, while the fund itself boasts a 4.94/10 MSCI ESG rating.

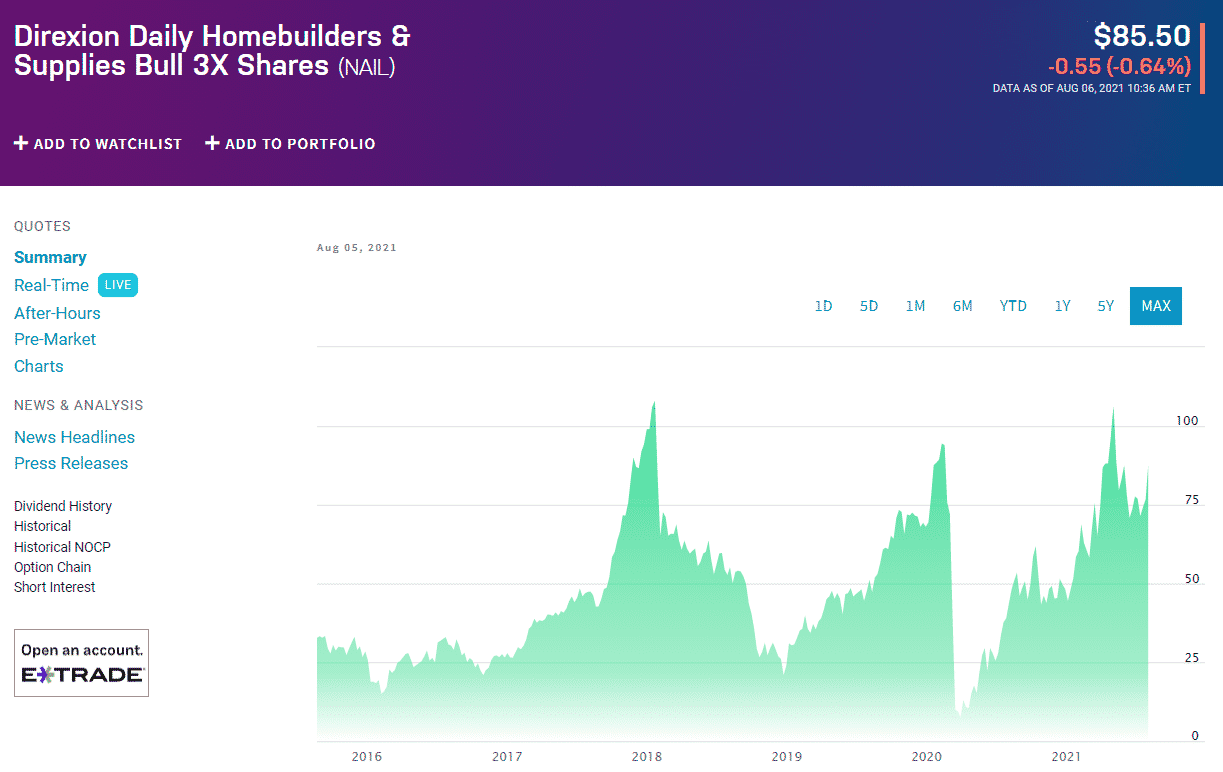

№ 3. Direxion Daily Homebuilders & Supplies Bull 3X Shares (NAIL)

Direxion Daily Homebuilders & Supplies Bull 3X Shares NAIL Chart

Nail is not your typical exchange-traded fund. It came to be in August 2015, and it tracks the performance of the Dow Jones US Select / Home Construction index. To be more exact, it offers a triple-leveraged exposure to the index, which basically means it looks to meet the needs of investors bullish on the United States construction market.

Due to its leveraged nature, investors should in no way see it as a long-term, buy-and-hold investment. Compounding could lead to results significantly different from expected performance if you just took accumulated gains over time into account.

It has an MSCI ESG rating of 5.63/10, while its assets under management amount to $418.11 million. Its average yearly returns climbed to 97.12%. Be that as it may, it is obvious so far that this fund is not for standard investors.

On the other hand, if you have the time and the skills to pay enough attention to the NAIL ETF, it could be helpful as a trading vehicle in your portfolio.

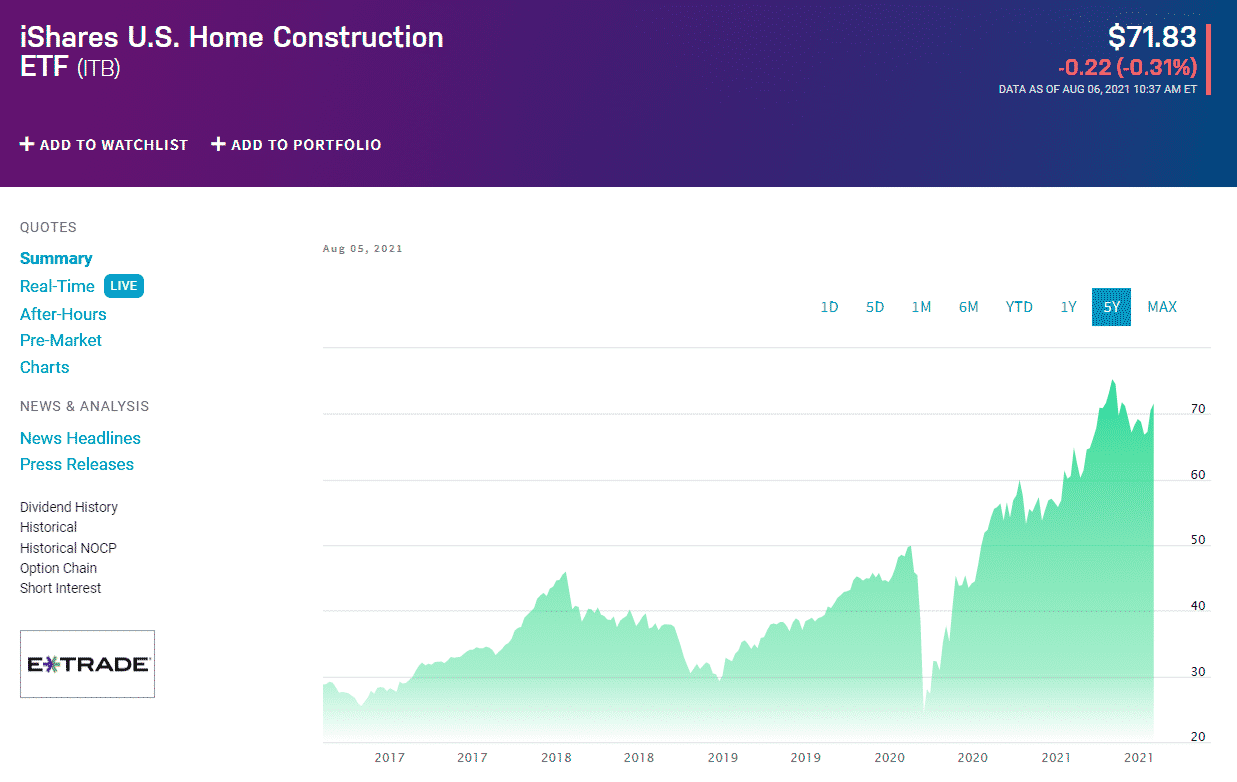

№ 4. iShares US Home Construction ETF (ITB)

iShares US Home Construction ETF ITB Chart

iShares US Home Construction ETF ITB is maybe the widest-encompassing fund on the list. As the fun’s issuer described it, this ETF “traded purity for breadth.” What that means is that it doesn’t rely strictly on industry giants for returns, but it involves smaller-cap companies, as well as firms that even ever-so-slightly touch the industry.

Even though the fund’s index tracks undergo rebalances quarterly, two holdings still account for almost one-third of the ETF’s pull. The first one is D.R. Horton, Inc., a Texas-headquartered construction company, and the second is Fontainebleau-based real estate and home construction firm Lennar Corporation.

Its annual return stood at 38.33%, while its last quarterly dividend came in at $0.07, very much in line with the industry standards.

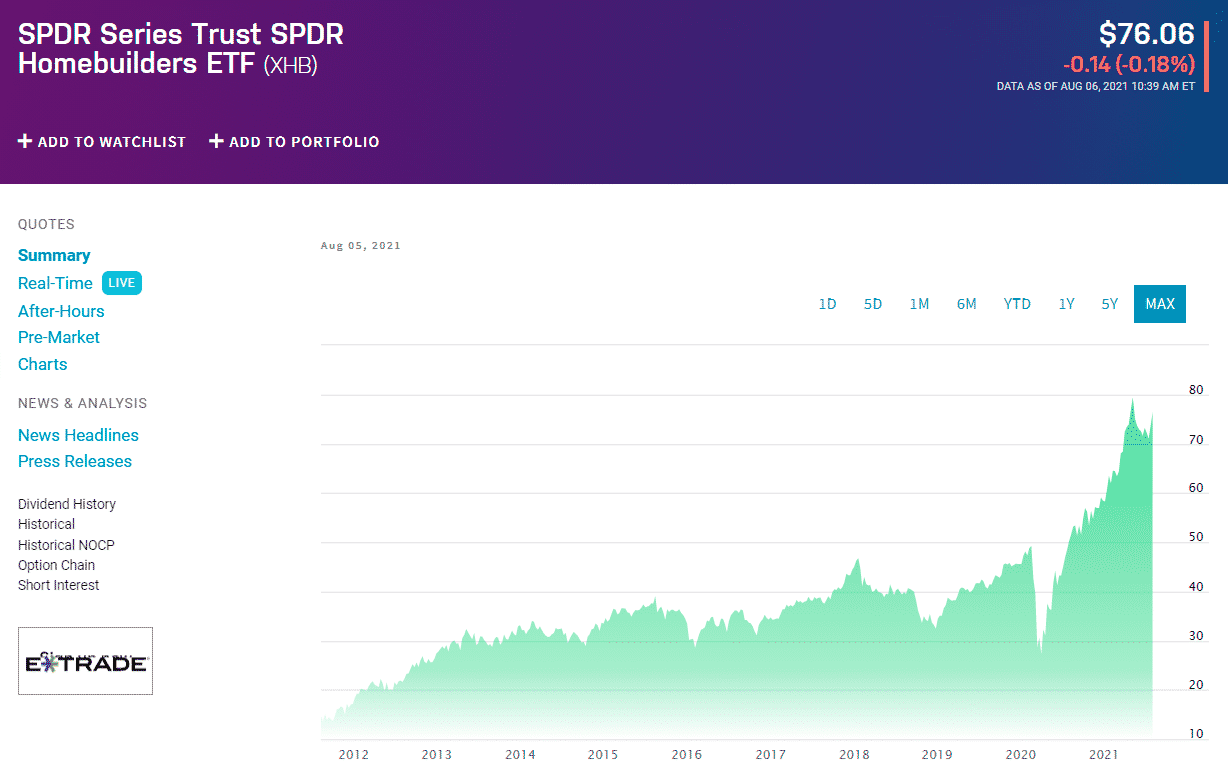

№ 5. SPDR S&P Homebuilders ETF (XHB)

SPDR S&P Homebuilders ETF XHB Chart

Even though the XHB ETF isn’t all that different from the previous funds in any grandiose way, the reason it made its way to the list of top five home construction funds is its cost-efficiency. This means that, depending on your preferences and tactics, this ETF might give you the most bang for your buck, literally.

Its dividend amounts to $0.1, while its expense ratio came in at 0.35%. The pull seems evenly spread across the holdings, providing a wide enough exposure to the industry. No holding surpasses 5% share in the ETF.

XHB’s ESG rating is slightly above average, with a 6.58/10 grade on the MSCI scale. The fund returned 51.87% during the past 12 months.

Final thoughts

Throughout history, people have always wanted to have homes and build places for themselves. It can even be considered one of the pinnacles of independence and taken as a sign that you’ve made it.

Unfortunately, there aren’t too many ETFs revolving around house construction, at least not in the United States. Despite the handicap, you can still find a fund to include in your portfolio if you look hard enough and if it fits your strategy and goals.

Keep in mind that not every ETF was created equal, nor is every one of them made for every investor. Analyze the ETFs, sure, and try to assess your goals and see how to incorporate them in your portfolio best to make gains in the long run.

Comments