Human beings have always been fascinated with flying, while countries are always looking at how best to safeguard their borders. In most cases in the modern-day world, the aerospace and defense industries are mentioned in the same breath due to their interdependence.

They represent a corner of the industrials sector valued at $2.3 trillion in 2021, with an expected CAGR of 7.7% to 2025. In addition to being a trillion-dollar market, the aerospace and defense market tends to thrive in highly volatile markets exhibiting correction and downturn, making it an ideal defensive option in a post-pandemic environment.

Borders are also opening up, and a resurgence of the airline sector plays into bullish sentiment for the aerospace segment. Most of these companies are established blue-chip equities quite expensive to acquire as single stocks, and when you think about diversification, an alternative investment option becomes necessary.

The answer is aerospace and defense exchange-traded funds. These investment vehicles are relatively cheaper than individual equities and help you achieve instant diversification by pooling together equities from across these segments.

Aerospace and defense ETFs: how do they work?

The world billionaires might be scrambling for outer space, but that is just a tiny corner of the aerospace segment. The aerospace and defense ETFs comprise equities that manufacture, distribute, and sell aircraft and their related components, producers of military equipment and components including radar equipment, aircraft and weapons, and all equities providing ancillary services to these sectors.

Top 3 aerospace and defense ETFs to skyrocket portfolio returns

The aerospace and defense segment is so attractive because the primary customer has bottomless pockets, global governments. The cold war and race for arms might have taken a backseat with governments now racing for technology advancement; this does not mean governments aren’t marshaling up their defenses for eventualities.

The escalating turmoil between Ukraine and Russia, not to mention the US and North Korea tension, will accelerate the marshaling of defense equipment. Couple this to opening borders post-pandemic, and the aerospace and defense segments provide numerous opportunities to mint money and skyrocket portfolio returns.

The three ETFs below offer broad exposure to these two industrial niches and are in pole position to benefit when they go bullish.

№ 1. iShares Dow Jones US Aerospace and Defense ETF (ITA)

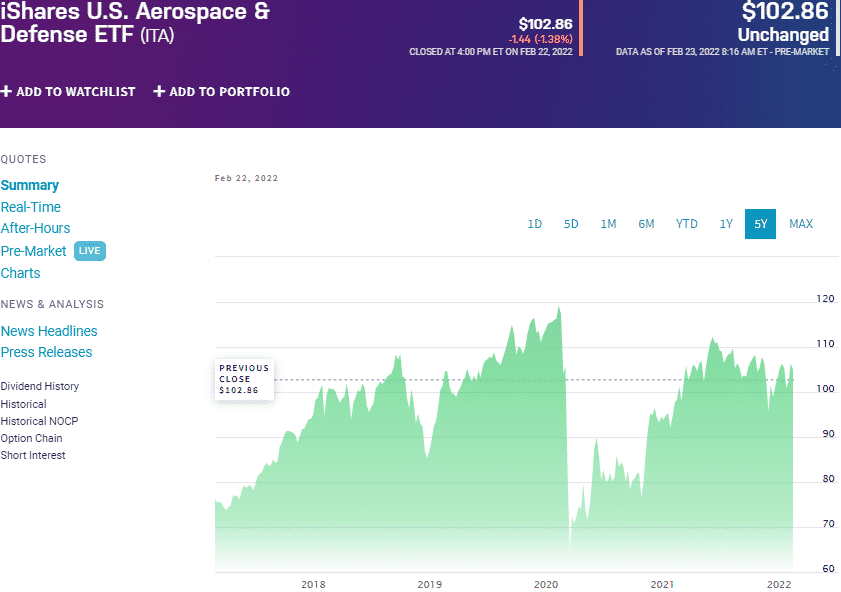

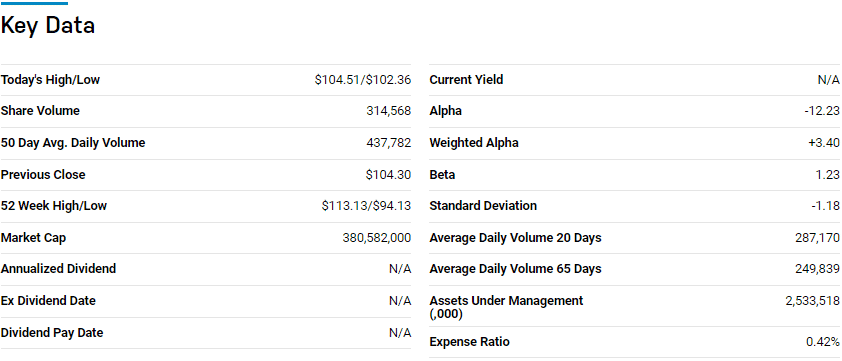

Price: $102.86

Expense ratio: 0.42%

Dividend yield: 0.83%

ITA chart

The iShares Dow Jones US Aerospace and Defense ETF track the performance of the Dow Jones U.S. Select Aerospace & Defense Index, investing at least 80% of its total assets in the components of its tracked index and other securities of like economic characteristics. The fund manager also has the discretion to invest not more than 20% of the total fund’s assets in futures, swap contracts, cash, options, and cash equivalents, which is correlated to the composite index. It exposes investors to the best US companies in the aerospace and defense segments.

ITA is ranked № 9 by US News among thirty of the best industrial ETFs for long-term investing.

The top three holdings of this non-diversified ETF are:

- Raytheon Technologies Corporation – 22.26%

- Boeing Company – 18.60%

- Lockheed Martin Corporation – 5.70%

ITA ETF is the largest ETF in the aerospace and defense space, with $2.53 billion in assets under management, with an expense ratio of 0.42%. The top two holdings of this fund take the lion’s share of the weighting, but its concentration on market leaders in the aerospace and defense segments has ensured significant returns traditionally despite the concentration risk; 5-year returns of 43.81%, 3-year returns of 2.78%, and 1-year returns of 5.82%. This fund provides stability due to the long-term government contracts held by most of its under holdings, making it an excellent defensive ETF for the current volatile markets to ensure returns.

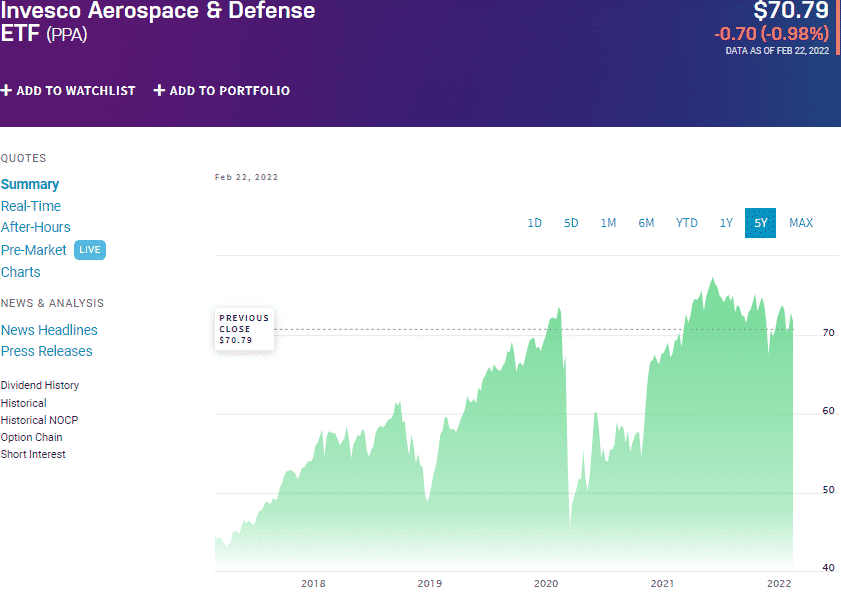

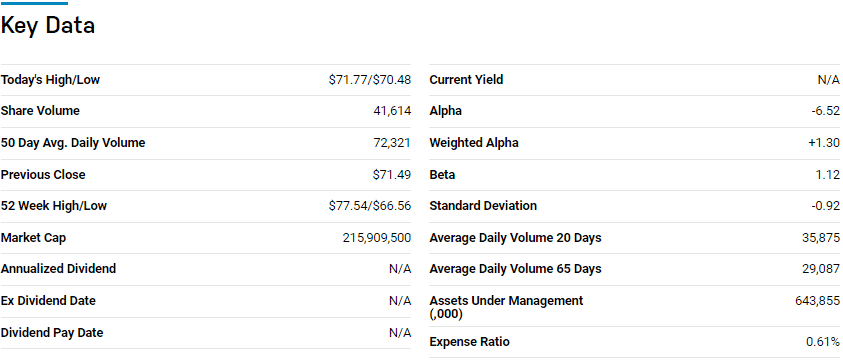

№ 2. Invesco Aerospace & Defense ETF (PPA)

Price: $70.79

Expense ratio: 0.75%

Dividend yield: 0.58%

PPA chart

The Invesco Aerospace & Defense ETF tracks the performance of the SPADE Defense Index, net of expenses, and fees. It invests at least 90% of its total assets in the holdings of its composite index. It exposes investors to equities of the primary defense contractors and big aerospace wigs manufacturing aircraft, developing operational support systems to the defense segment including homeland, military, and national guard, and government and space operations support.

The top three holdings of this non-diversified ETF are:

- Lockheed Martin Corporation – 7.07%

- Raytheon Technologies Corporation – 6.97%

- Boeing Company – 6.50%

PPA ETF might be older than ITA by a year but has not accumulated as many assets as the latter. It has $643.9 million in assets under management, with investors’ parting with $61 annually for every $10000 invested. Despite being relatively more expensive than IAT, PPA weighting is more even mitigating against concentration risk and offers broader exposure to the defense and aerospace segments.

The result is a fund that has been outperforming its category and segment averages and the more considerable funds in this space; 5-year returns of 67.46%, 3-year returns of 23.05%, and 1-year returns of 2.95%.

A fund that straddles both government and private defense contracts and has several major players involved in space exploration, this fund is in pole position to benefit from all things aerospace and defense and skyrocket portfolio fund returns.

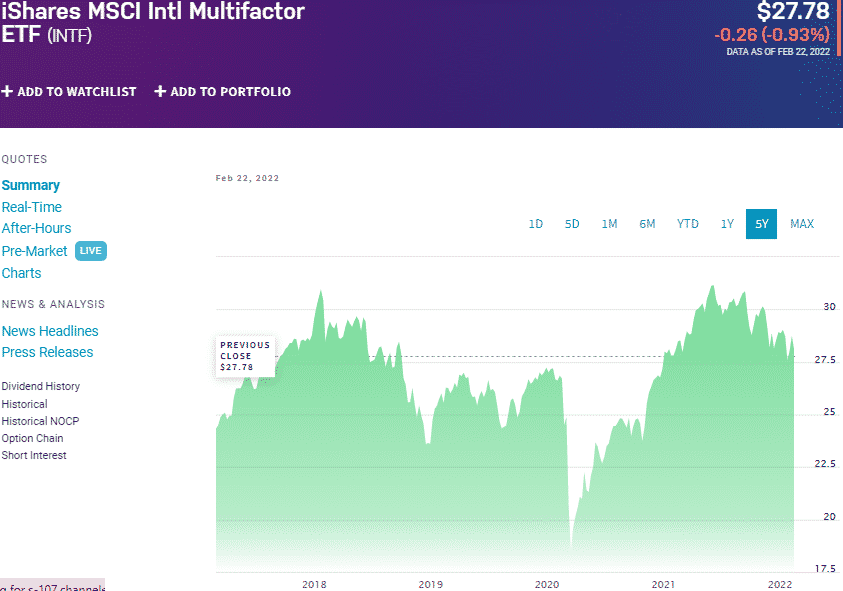

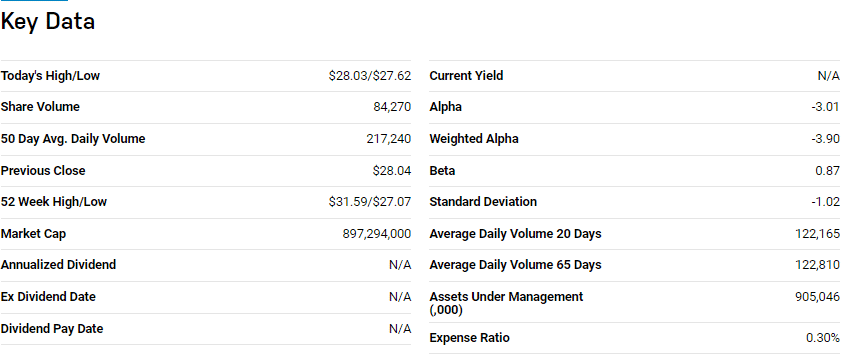

№ 3. iShares Edge MSCI Multifactor Intl ETF (INTF)

Price: $27.78

Expense ratio: 0.30%

Dividend yield: 3.00%

INTF chart

The iShares Edge MSCI Multifactor Intl ETF tracks the MSCI World ex USA Diversified Multiple-Factor Index’s net of fees and expenses. Under normal circumstances, it invests at least 80% of its total assets in the composite index holdings and investment assets of similar economic characteristics. It exposes investors to developed markets large and mid-cap equities, ex-US, in the industrial sector, including aerospace and defense.

INTF is ranked № 29 by US News among eighty-two of the best foreign large blend ETFs for long-term investing.

The top three holdings of this non-diversified ETF are:

- Raytheon Technologies Corp. – 22.26%

- Boeing Company – 18.60%

- Lockheed Martin Corp. – 5.70%

INTF ETF has $905 million in assets under management, with a relatively low expense ratio of 0.30%, compared to the other funds on this list. This ETF is an indirect and diversified play on the aerospace and defense space since it holds significant exposure to aerospace and defense applications in its holdings. Its multi-indicator holdings screening and weighting methodology ensure both value and growth for a portfolio; 5-year returns of 38.01%, 3- year returns of 20.25%, 1-year returns of 8.73%, and a dividend yield of 3.00%.

Final thoughts

Political jostling between Ukraine and Russia and the ever-present tension between North Korea and the USA might ignite the rocket beneath the aerospace and defense market, resulting in an unprecedented bullish run. The ETFs above provide an excellent play on this volatility to skyrocket portfolio fund returns.

Comments