ETF full name: ProShares Ultra Euro

Segment: Currencies

ETF provider: ProShares

| ULE key details | |

| Issuer | ProShares |

| Dividend | N/A |

| Inception date | November 25, 2008 |

| Expense ratio | 0.95% |

| Management company | ProShares |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 11.76% |

| Investment objective | 2x leveraged exposure to the EUR/USD cross |

| Investment geography | Leveraged Currencies |

| Benchmark | USD/EUR |

| Leveraged | 2X |

| Median market capitalization | N/A |

| ESG rating | N/A |

| Number of holdings | 1 |

| Weighting methodology | Single asset |

About the ULE ETF

ProShares Ultra Euro ULE ETF was initiated in November 2008 and intended to offer investors a chance to hedge versus exposure to the United States dollar by betting on a strong euro performance.

ULE Fact-set analytics insight

ULE ETF is a single asset fund, which means that it comprises no holdings, or one holding to be exact. So this means that the fund is most suitable for traders who look to update their portfolios daily. By utilizing daily leverage, the fund enables traders to amplify their returns over a single trading bout. Due to its leveraged nature, ULE’s performance over multiple back-to-back sessions does not add up to the target multiple.

The ULE exchange fund uses single asset tracking for its methodology.

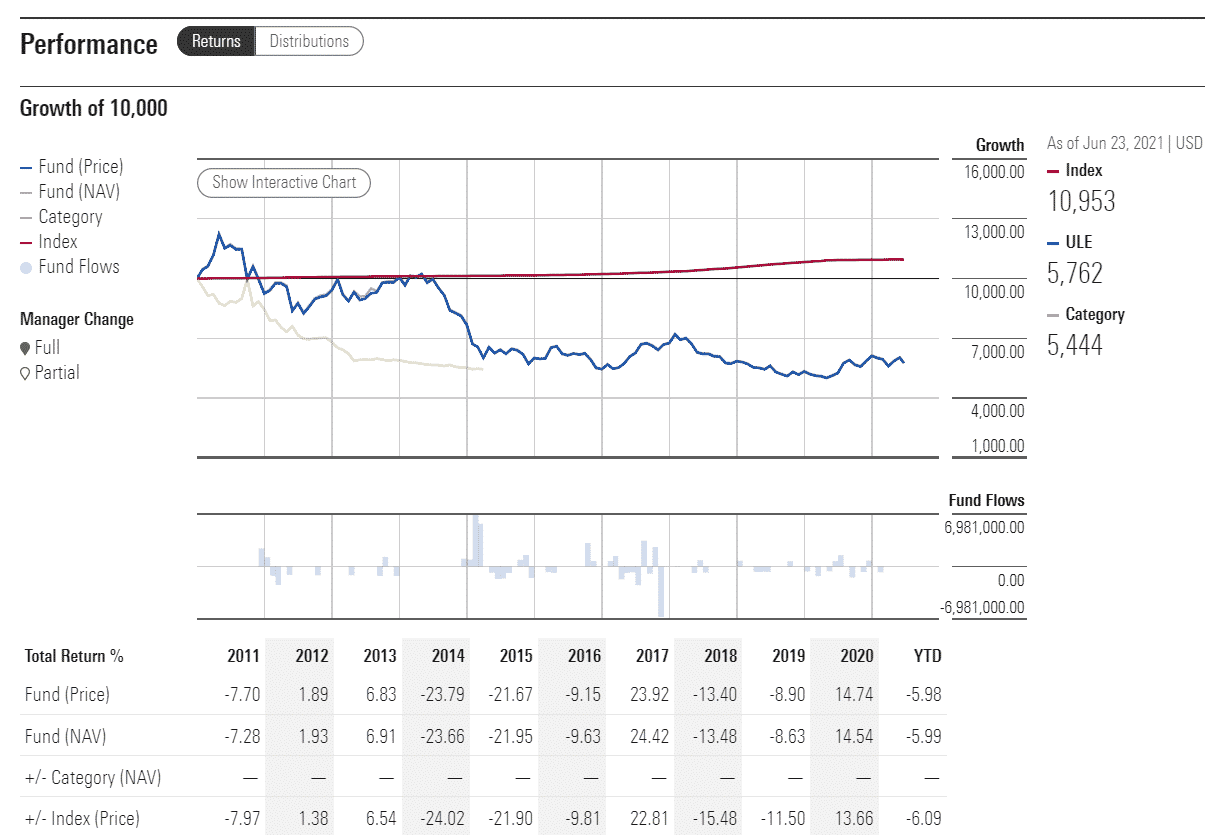

ULE performance analysis

Since both the economy of the United States and the one of the European Union came under fire since Covid-19 spread worldwide, rendering the world to a halt, there is no discernable way to attribute the USD/EUR pair trend to the pandemic.

As the pair depends mainly on the macroeconomic shifts, the sentiment can largely be predicted by significant movements in that sphere. In late 2020, the greenback reached its lowest level against the European currency as the investors anticipated a faster economic recovery in the euro area than in the US. After the change of administrations in the White House, the world’s most widely traded currency stabilized and recovered some initial losses.

ULE ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| ULE Rating | A+ | 5 out of 5 | Quintile 5 (85th percentile) | N/A | N/A |

| ULE ESG Rating | N/A | N/A | N/A | N/A | N/A |

ULE key holdings

Due to the nature of this single-asset fund, the prospective holders should be ready to check their holdings daily, according to the fund’s prospectus. Given the 2x leverage, this fund offers magnified gains.

It bears the risk of amplified losses, so knowledgeable investors should use it with time enough to monitor the holdings as often as possible. It offers a chance to bet on the euro’s strong performance, but it may not pose a valuable addition for most investors who look for a durable option to boost their long-term portfolio.

Industry outlook

When considering the potential movements of the USD/EUR pair, it is important to try to anticipate what the recoveries in both areas will look like. While the European Central Bank remained steadfast on the notion that rewinding the economic stimulus in the near future would be counterproductive, the United States Federal Reserve made some shy remarks on the need to taper in the near future.

The president of the Dallas Fed, Robert Kaplan, made numerous remarks that it is better to be too early to withdraw the stimulus than to do it too late. Following his numerous remarks, even the central bank’s Chair Jerome Powell noted that the interest rate hike could come sooner than expected. Be sure to follow ECB’s and Fed’s monetary policy meetings, as remarks can directly impact the trend of the EUR/USD pair.

Comments