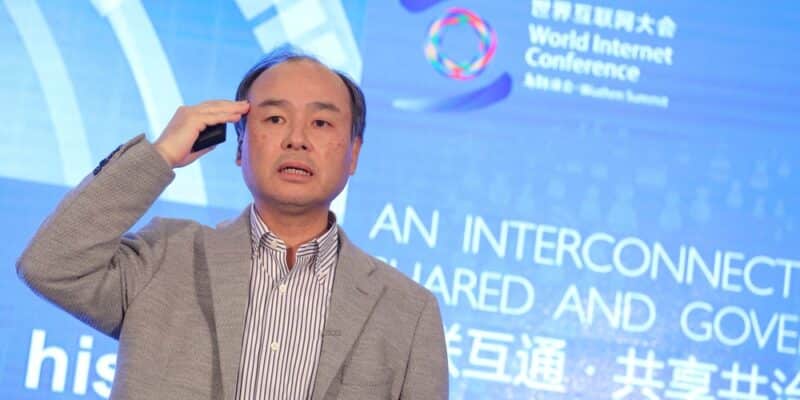

SoftBank founder Masayoshi Kid stated the Nasdaq stayed his “favorite” venue for the planned listing of Arm in spite of an intensive UK lobbying campaign for a London share offering of the British chip designer.

The Financial Times reported this week that the UK federal government has questioned using national protection regulation to compel SoftBank to detail Arm in London, as the world’s largest tech investor reevaluates holding an initial public offering for the firm solely in the United States.

“Nasdaq is the preferred,” Boy informed the annual conference of SoftBank shareholders in Tokyo when asked where he prepared to provide Arm. The remarks were his very first public statements on the problem because the UK project began in February.

He added that a lot of the chip developer’s clients remained in Silicon Valley which “stock exchange in the United States would certainly likewise enjoy to have Arm”.

However the 64-year-old billionaire acknowledged that the group had “received a strong love telephone call” from London as well as was seeking advice from experts on what would certainly remain in Arm’s benefit as well as where regulations would certainly be most favourable. Son said nothing had been made a decision.

Head Of State Boris Johnson has actually sent out a letter to SoftBank executives while Lord Gerry Grimstone, Britain’s financial investment preacher, has met the team’s executives to lobby for the listing.

Shoring up Arm’s picture as a UK success story has actually become a highly sensitive political issue after objection that Britain was no more an attractive location for globally important companies.

SoftBank purchased Arm in 2016 for $32bn. A scheduled sale to California-based Nvidia collapsed this year over governing issues, pushing Boy to reevaluate a public listing.

A successful offering at a targeted valuation of a minimum of $50bn would certainly be necessary to improve SoftBank’s funds after its Vision Fund reported a historical yearly financial investment loss of ¥ 3.5 tn ($ 27bn) last month. Its portfolio companies were hit by a regulative suppression in China and a sell-off in modern technology shares.

Mirroring these pressures, score agency Moody’s has cut SoftBank’s credit score expectation from “steady” to “adverse”, pointing out a decrease in the worth of its profile as well as estimating that SoftBank’s take advantage of has increased.

Moody’s said the collapse of Arm’s sale to Nvidia “showcases the challenges around quickly realising amount for such stakes”. It included that SoftBank’s plans to list Arm “face execution danger in the timing and valuation.”

SoftBank stated Moody’s assessment was “based upon their subjective assumptions and theory with no practical basis for support.”

In contrast to a sombre profits presentation in May, during which Son described a change to a more defensive posture, on Friday the SoftBank chair sought to predict confidence.

“I have never ever, given that the begin of my firm, been in question even for eventually that the info change will come,” stated Son.

To show the point, he offered slides showing SoftBank’s growth matching the rise in net traffic throughout the years and also predicted that the fad would certainly proceed.

“I rely on the vision of future progression and that’s what I purchase. it will certainly come for sure,” Kid claimed.

Comments