Talk about green and sustainable energy has the world roaring. However, is it possible to only satisfy the global energy needs with green and sustainable energy sources? US, France, South Korea, and other developed markets have already adopted nuclear energy; if all the rave is to be believed, it is not only sustainable but cost-efficient.

In 2021, the nuclear energy market was valued at $40 billion, with an estimated CAGR of 5% to reach the $49 billion mark by 2025. This estimated growth is relatively low given the accelerated growth appetite for zero greenhouse gas emissions, and nuclear energy is the only green energy source with zero carbon emissions.

How do you invest in this corner of the energy sector? Nuclear ETFs are the answer. Uranium, the driving mineral and ingredient in nuclear energy production is pretty rare, and being a sector with controversy, nuclear equities are volatile. Nuclear ETFs provide a diversified and prudent avenue to play this next frontier energy niche.

What is the composition of nuclear ETFs?

Nuclear ETFs comprise organizations in the nuclear energy value chain; equities involved in generating and selling nuclear electricity, uranium exploration, mining, and refinement equities, and all ancillary service equities generating at least 50% of their revenues from nuclear-related activities.

Top 3 nuclear ETFs for wise investing

The world is on the cusp of various significant evolutions, decisions, discoveries, and regulations to drive humanity’s next evolution at the forefront of these brave new frontiers in the global appetite for green energy to secure more friendly and hospitable earth for future generations.

On the energy front, nuclear energy continues to be the only viable zero greenhouse gas emission energy source that is scalable and safe. The result is a segment of the energy sector expected to grow exponentially going forward and with the ability to skyrocket your returns and profits.

№ 1. VanEck Uranium+Nuclear Energy ETF (NLR)

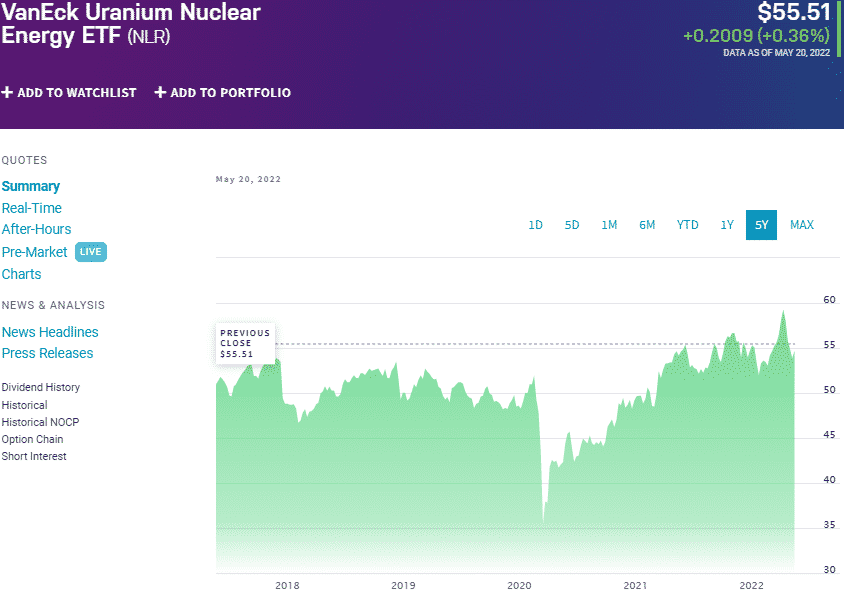

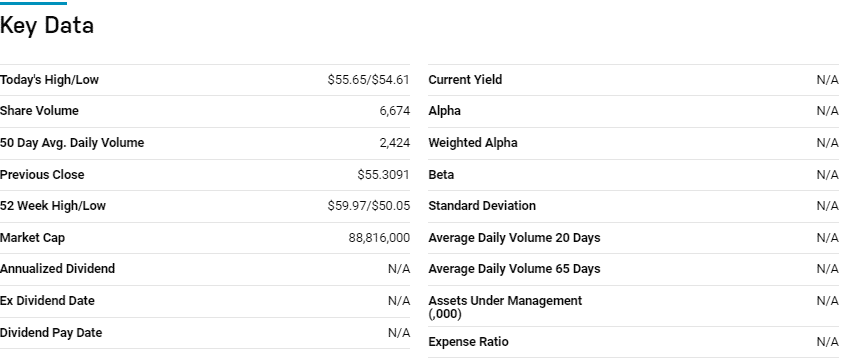

Price: $55.51

Expense ratio: 0.60%

Dividend yield: 1.94%

NLR chart

Investing in nuclear energy without having a stake in the VanEck Uranium Nuclear Energy ETF would be a disservice. This ETF charted the way for all other nuclear ETFs and was launched when conversations about renewable clean energy were in infancy.

It tracks the MVIS Global Uranium & Nuclear Energy Index, investing at least 80% of its total assets in the holdings making up the tracked index, including all associated ADRs. Its benchmark index exposes investors to the entire nuclear energy supply chain. The result is a fund that exposes investors to global uranium and nuclear equities.

The top three holdings of this uranium and nuclear energy ETF as of now are:

- Duke Energy Corporation – 7.94%

- Dominion Energy Inc – 7.79%

- Public Service Enterprise Group Inc. – 6.90%

Despite being a pioneer fund in the nuclear energy space, the NLR ETF has only amassed $47.4 million in assets under management since its launch over a decade ago, with an expense ratio of 0.60%. Coupling uranium stocks and nuclear stocks mean exposure to the entire nuclear value chain.

This diversification has resulted in a resilient fund capable of withstanding market downturn; 5-year returns of 28.68%, 3-year returns of 20.33%, and 1-year returns of 3.72%. In addition, investors can use this ETF to cushion against waning purchasing power with its annual dividend yield of 1.94%.

№ 2. iShares Global Clean Energy Fund (ICLN)

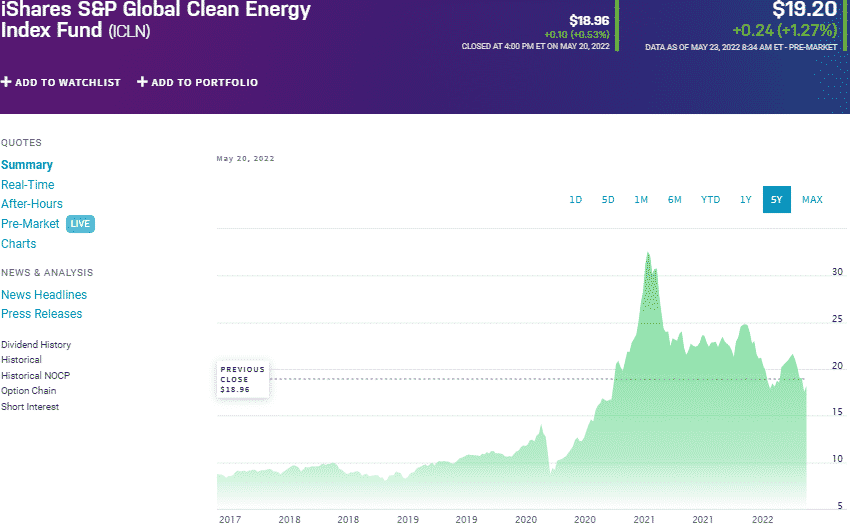

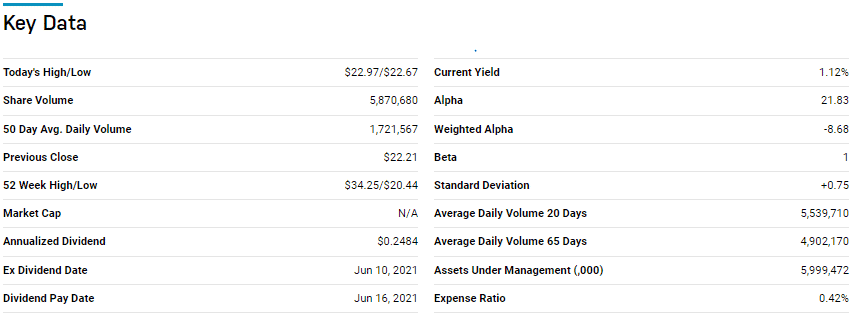

Price: $19.20

Expense ratio:0.42%

Annual dividend yield: 0.67%

ICLN chart

The iShares Global Clean Energy Fund tracks the price and yield performance of the S&P Global Clean Energy IndexTM, net of fees, and expenses. To ensure as minimal deviation as possible from the tracked index performance, it invests at least 80% of its assets in the holdings of the composite index and any other security of like economic characteristics. The result is a fund that exposes investors to the most liquid and largest global clean energy equities.

An evaluation of 47 miscellaneous sectors’ ETFs has the ICLN ETF at rank № 9 for long-term investment by USNews.

The top three holdings of this clean energy fund as of now are:

- Enphase Energy, Inc. – 7.52%

- SolarEdge Technologies, Inc. – 6.81%

- Consolidated Edison, Inc. – 6.70%

The ICLN ETF is one of the most significant funds in the alternative energy niche boasting $4.62 billion in assets under management, with an expense ratio of 0.42%. This ETF is a diversified play on nuclear energy by incorporating equities from all the alternative clean energy segments.

As a result, it taps into the accelerated clean energy adoption to result in a resilient fund providing both value and growth; 5-year returns of 140.20%, 3-year returns of 98.13%, and 1-year returns of 14.90%, and an annual dividend yield of 0.67%.

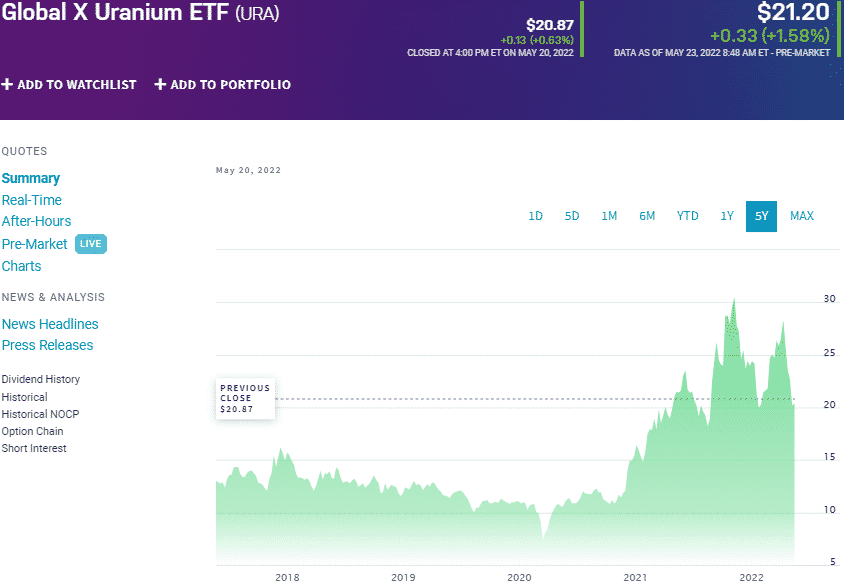

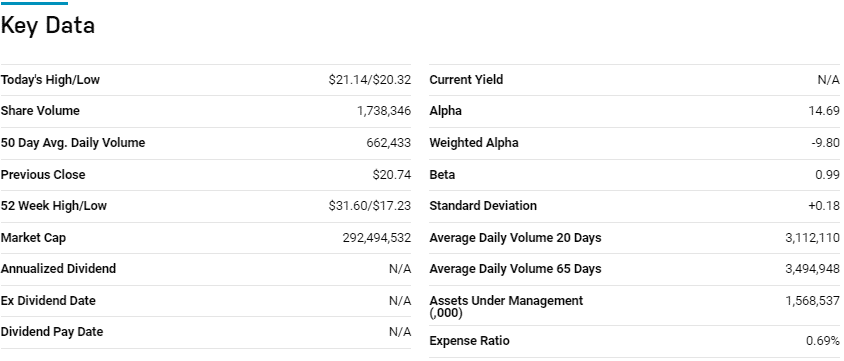

№ 2. Global X Uranium ETF (URA)

Price: $21.20

Expense ratio: 0.69%

Dividend yield: 0.49%

URA chart

The Global X Uranium ETF tracks the price and yield performance of the Solactive Global Uranium & Nuclear Components Total Return Index, net of fees and expenses. To achieve its investment objective invests at least 80% of its total assets in the investment assets making up its composite index, in addition to all associated GDRs and ADRs. The result is a fund that exposes investors to the entire global uranium value chain.

US News evaluated 40 Natural Resource ETFs for long-term investing, and URA ETF came at rank 22.

The top three holdings of this ETF as of now are:

- Cameco Corporation – 21.90%

- Sprott Physical Gold Trust Units – 6.84%

- National Atomic Company Kazatomprom JSC Sponsored GDR RegS – 6.28%

The URA ETF boasts $1.57 billion in assets under management, with an expense ratio of 0.69%. This ETF is a direct but diversified play on the nuclear energy niche by concentrating on global equities involved in acquiring and processing the primary ingredient utilized in this industry.

As one of the pioneer uranium ETFs, the URA ETF has proved to be a cash cow for investors as more countries follow France in adopting nuclear energy as the primary energy source; 5-year returns of 74.23%, 3-year returns of 97.43%, 1-year returns of 1.89%, and annual dividend yields of 0.43%.

Final thoughts

Advancements in technology and science have ensured that harnessing nuclear energy does not result in another Fukushima disaster; radiation from uranium currently accounts for only 1% globally compared to other natural resources. Couple this with the fact that only nuclear energy is scalable and cost-efficient at present while achieving zero carbon emissions. As the appetite for green energy expands, this energy niche is on the cusp of explosion. These three nuclear ETFs provide exposure to this industry and a wise investment avenue for long-term gains.

Comments