If you are actively engaged in the crypto space, you might have come across the term AMM, which stands for the automated market maker. These platforms are the key players in the burgeoning DeFi sector of the crypto market. At their core, AMMs use liquidity provider (LP) tokens to run the business.

Meanwhile, liquidity providers are crypto investors stashing coins in DEX. These locked coins provide liquidity in these exchanges. In return, investors get a portion of transaction fees earned by the network. On top of that, investors have full control over their coins.

LP tokens to watch and buy

You can use LP tokens as evidence to claim that you gave a liquidity pool permission to use your crypto assets. You can also use LP tokens to engage in yield farming on many DeFi platforms. This article presents five of the most popular LP tokens used by world-renowned DeFi networks. The order of market cap arranges these from highest to lowest.

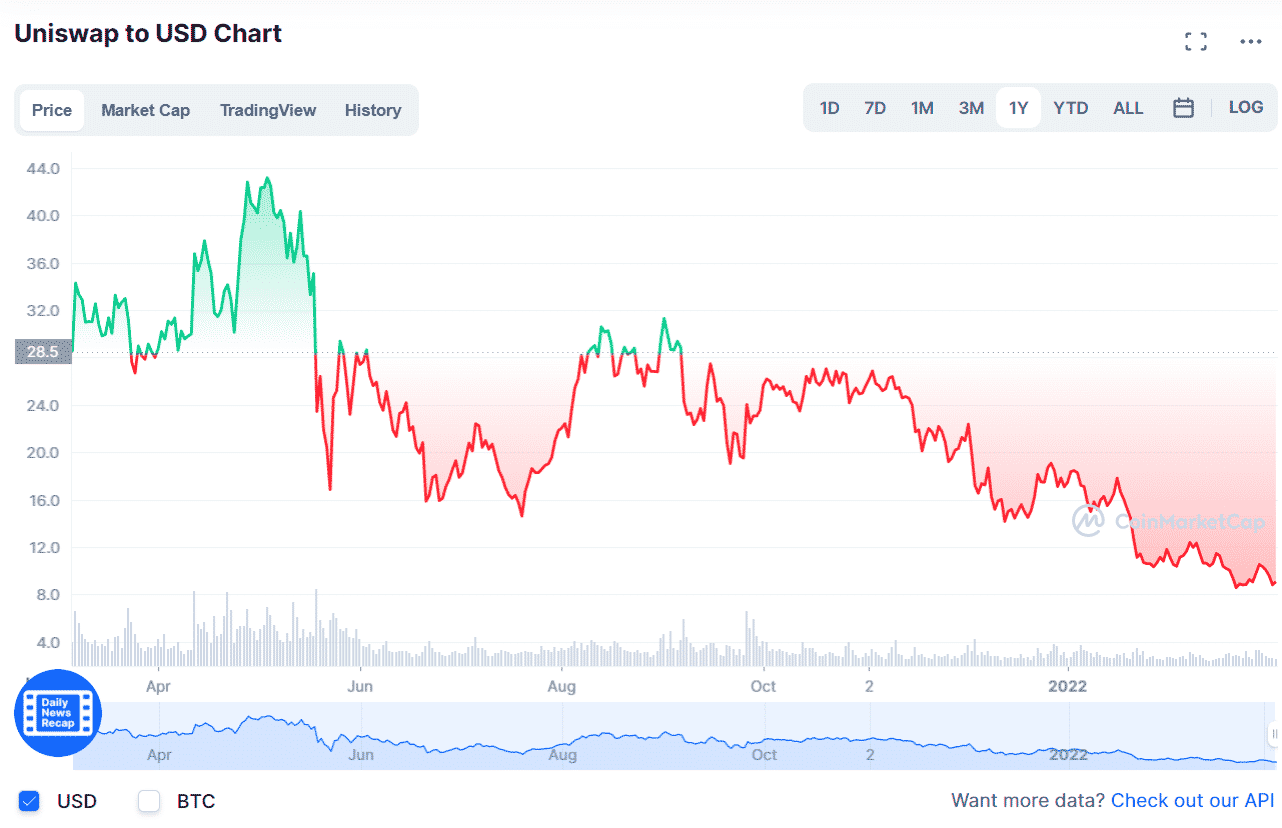

№ 1. Uniswap (UNI1)

Price: $8.79

Market cap: $5.246 billion

UNI1/USD daily chart (1Y data)

When you lock crypto in Uniswap, you will get fungible ERC20 LP tokens in return. At your disposal, you can utilize these tokens in the Ethereum DeFi network. This way, although you cannot buy and sell LP tokens, it is possible for you to use them as collateral when you lend crypto from platforms such as MakerDAO or Aave.

Why has the Uniswap price risen?

Uniswap now occupies the 26th spot in the crypto space in terms of market cap. If DEX continues to expand, Uniswap is likely to climb the ladder. It has announced a plan to launch itself in Polygon, and investors received this news with great interest. If this plan comes to fruition, it could drive the price of Uniswap higher.

What is the perspective of the Uniswap?

Uniswap has reached a key position in the crypto sphere. Market analysts predict that Uniswap might maintain its performance in the next five years, so its price could rise higher in the future.

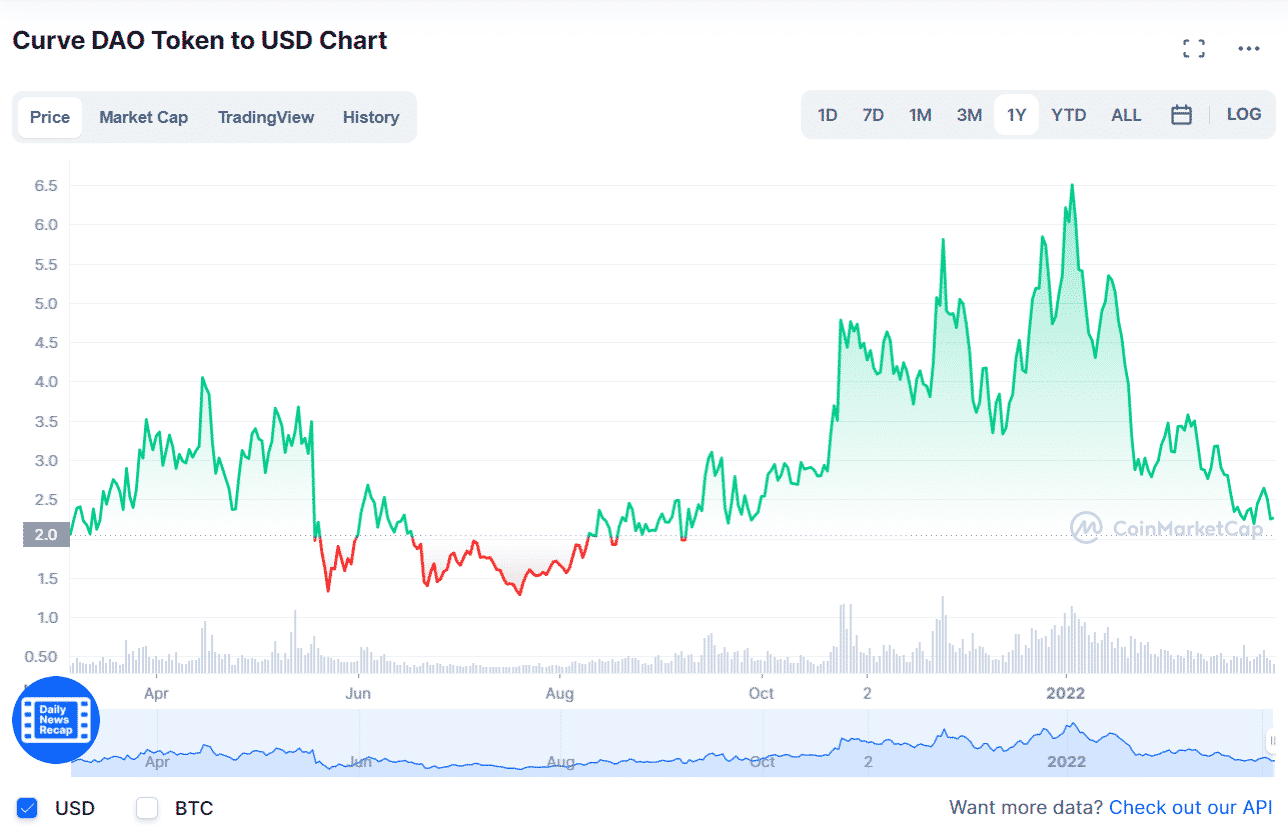

№ 2. Curve DAO (CRV)

Price: $2.26

Market cap: $935.254 million

CRV/USD daily chart (1Y data)

By locking coins in Curve, you are bound to get a particular type of LP token instead of an LP token connected to a tradable crypto pair. For example, if you lend ETH to a DeFi platform, you will get cETH LP token and earn interest over time.

Why has the CRV token price risen up?

The CRV token has grown in price and volume for at least three reasons. One reason is the platform’s partnership with Yearn Finance. Another reason is the favorable developments in US regulations. Finally, more users have found interest in using the platform, resulting in increased total value locked.

What is the perspective of the CRV token?

The Curve token may hit a minimum of $7, a maximum of $9, and an average of $8 in 2023. The future looks bright for the Curve DAO token.

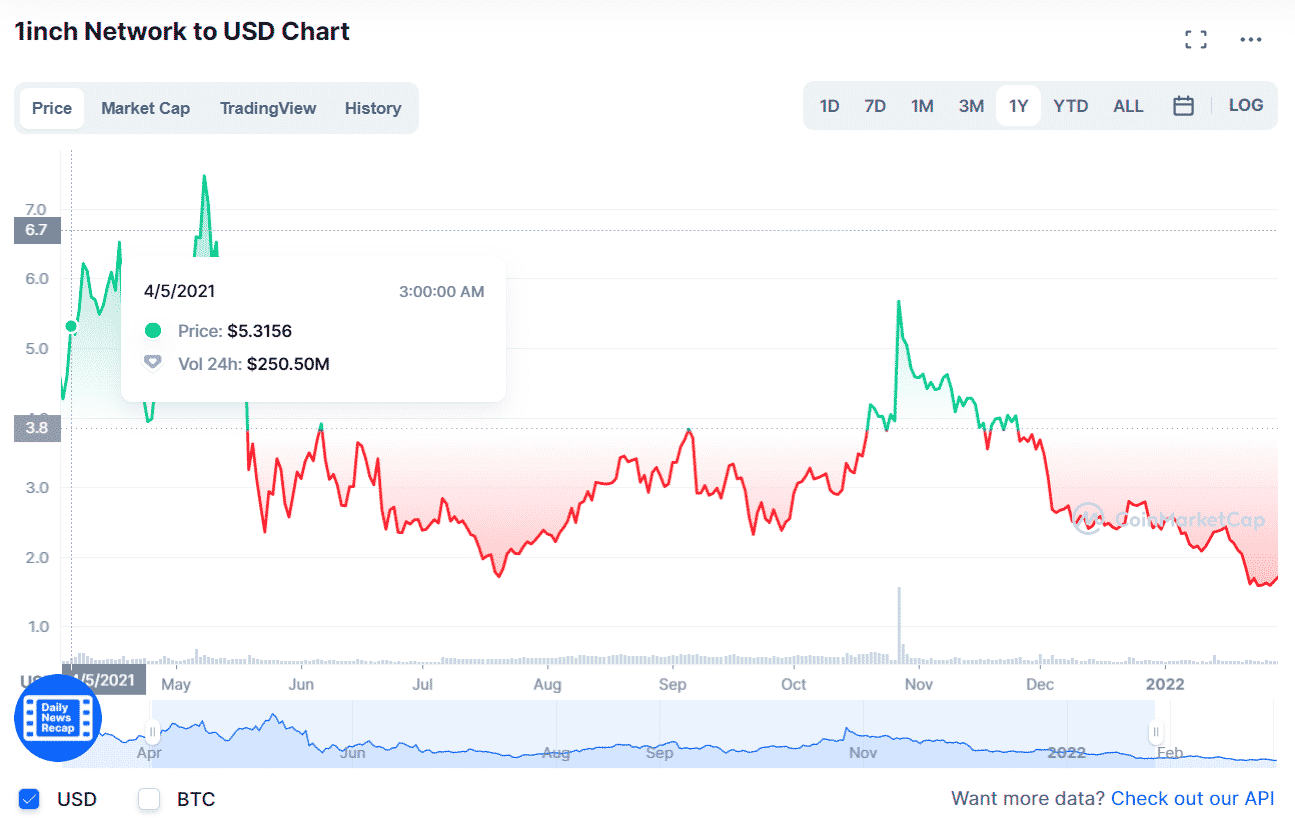

№ 3. 1Inch Network (1INCH)

Price: $1.64

Market cap: $524.48 million

1INCH/USD daily chart (1Y data)

When you lock 1INCH tokens on this platform, you will earn interest from trading fees earned by the network. The interest is given in the 1INCH token, which doubles as a governance token. With a decentralized governance method, the 1INCH network gives token holders the privilege to propose how the platform is governed and vote accordingly.

Why has the 1INCH token price risen up?

1INCH has about one million users in Ethereum, and in the past two years, its trading volume has reached over $100 billion. The network is looking to deploy 1inch Pro, a service that aligns with US directives. This project might bring more users to the platform.

What is the perspective of the 1INCH token?

Using technical analysis, 1inch Network expects its 1INCH token to get to a minimum of $4.1 in 2022. The anticipated maximum is $4.7, and the average is $4.4.

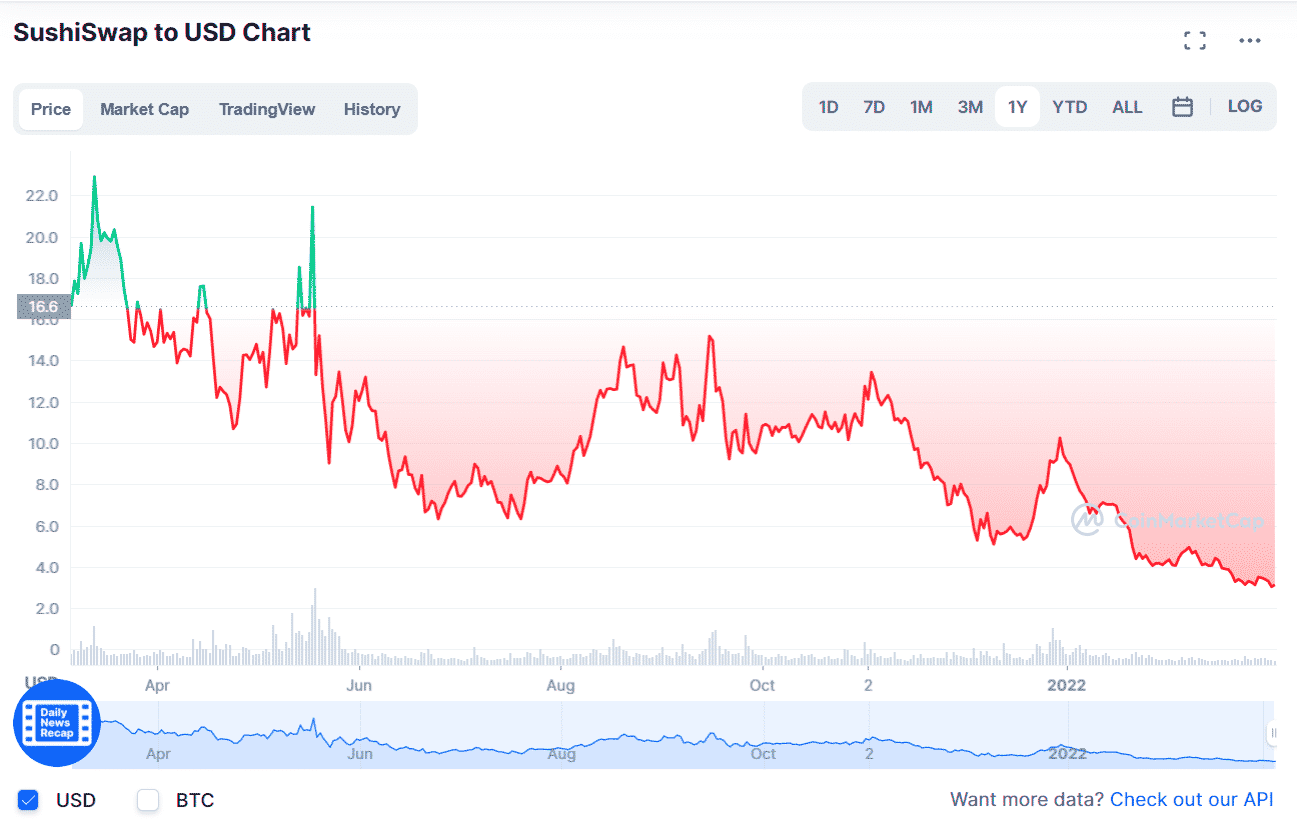

№ 4. Sushiswap (SUSHI)

Price: $3.12

Market cap: $377.457 million

SUSHI/USD daily chart (1Y data)

Participating in a liquidity pool in Sushiswap entitles you to receive SLP tokens corresponding to the staked crypto coins. For example, if you put ETH and DAI tokens into a liquidity pool, you will get DAI/ETH SLP tokens. Then you can deposit these SLP tokens into the designated liquidity pool to earn SUSHI tokens.

Why has the SUSHI token price risen?

Utilizing a decentralized governance approach, Sushiswap listens to the voice of its user base, particularly the token holders. Users are looking to shift toward DAO in terms of governance. If this plan comes to pass, the votes of token holders will become binding and will get implemented through smart contracts.

What is the perspective of the SUSHI token?

Sushiswap expects its SUSHI token to reach $5.1 in 2022 and $5.6 in 2023. By the end of 2031, the long-term price forecast is $11.35.

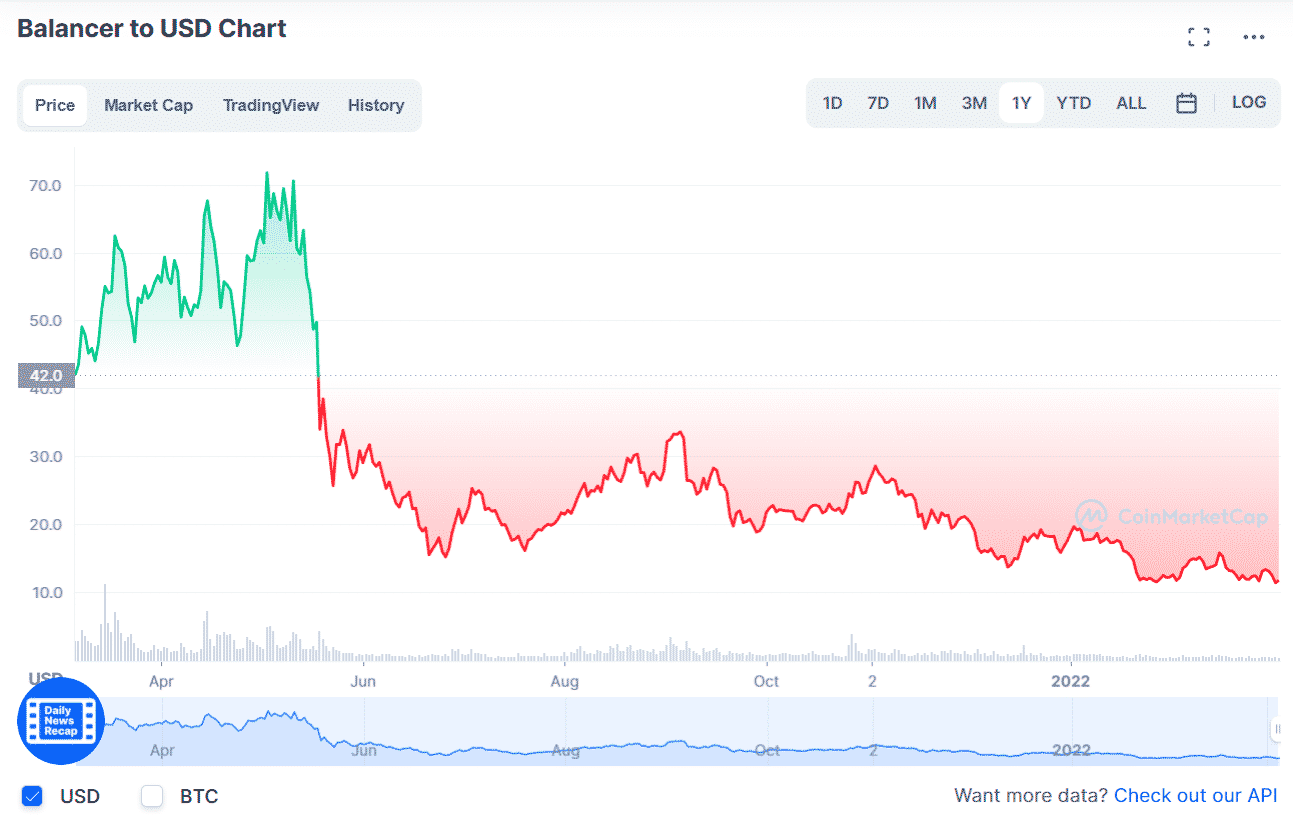

№ 5. Balancer (BAL)

Price: $11.36

Market cap: $76.637 million

BAL/USD daily chart (1Y data)

The liquidity pools of Balancer are composed of multiple assets with unequal weighting. Balancer offers LP tokens (BPT) that are ERC20 tokens. As such, you can utilize them to enjoy services provided by Ethereum’s DeFi platform. Keep in mind that BPT tokens require a set of crypto coins.

Why has the BAL token price risen?

The price of BAL token has been appreciated due to two main reasons. One reason is that users have heard that Coinbase might include the token in its listing. The second reason is the revitalization of blue-chip DeFi ecosystems.

What is the perspective of the BAL token?

PricePrediction.net claims that Balancer is a good investment option for the near term. It expects the token to rise in value to $25 in 2023. This is a bolder forecast compared to the milder prediction of $13.4 by WalletInvestor and $13.9 by TradingBeast.

Final thoughts

LP tokens serve essential functions in the DeFi space, such as AMMs, DEXs, and DEX aggregators. Although you cannot trade LP tokens, they are instrumental in discovering new ways to make money in the crypto space. By holding specific types of crypto in a DeFi platform, you are bound to make passive income. This is only one way to generate an income through LP tokens.

Comments