ETF full name: JPMorgan Equity Premium Income ETF (JEPI)

Segment: Equity: US Large-cap

ETF provider: JPMorgan Chase

| JEPI details | |

| Issuer | JPMorgan Chase |

| Dividend | $0.37 |

| Inception date | 20 May 2020 |

| Expense ratio | 0.35% |

| Management company | JP Morgan |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 14.89% |

| Investment objective | The fund invests in S&P 500 stocks that exhibit low-volatility and value characteristics and sells options on those stocks to generate additional income. |

| Investment geography | Developed markets |

| Benchmark | S&P 500 Index |

| Leveraged | N/A |

| Median market capitalization | N/A |

| ESG rating | 6.68 / 10 |

| Number of holdings | 104 |

| Weighting methodology | Market value |

About the JEPI ETF

The JEPI fund’s inception on the New York Stock Exchange Arca was 20 May 2020. JPMorgan Chase is the fund’s issuer, and they manage the portfolio as well.

JEPI is an actively managed fund. The fund’s objective is to invest in S&P 500 stocks that exhibit low-volatility and value characteristics and sells options on those stocks to generate additional income. Furthermore, the ETF benchmarks the S&P 500 index.

JEPI Fact-set analytics insight

Since the fund is relatively new, the market cap data is not available. However, JEPI has assets under the management of $5,203.3 million. The fund follows a proprietary weighting scheme. The fund has 83,950,000 shares outstanding. JEPI has a net expense ratio of 0.35% regarding management fees.

JEPI performance analysis

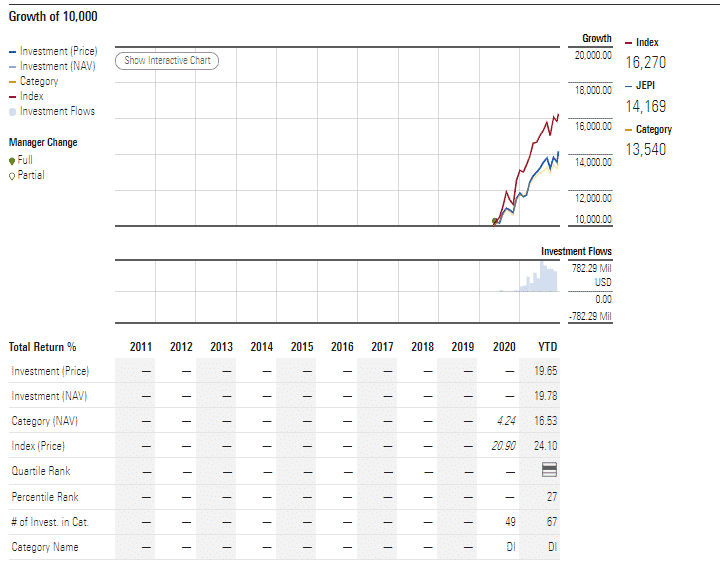

JEPI ETF performance chart

JEPI had annual returns of 14.89% and year-to-date returns of 19.65%. The fund’s monthly dividends are $0.37 per share. Furthermore, its annual dividend yield was 7.95%.

JEPI ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| JEPI Rating | A+ | N/A | Quintile 1

(7th percentile) |

N/A | N/A |

| JEPI ESG Rating | 6.68 / 10 | N/A | N/A | N/A | N/A |

JEPI key holdings

The JPMorgan Equity Premium Income ETF has 104 holdings. In terms of sector, the majority of the fund’s assets are in finance (15.37%), followed by technological services (11.07%) and transportation (6.64%). The top three sectors make up 33.71% of the fund’s total holdings.

In terms of geographical footprint, the fund invests in developed markets. However, 88.4% are US firms and 6.4% Irish.

JEPI’s asset allocation is common/ordinary shares of 97.83% and a cash component of 2.17%.

| Ticker | Holding name | % of assets |

| CAN | Accenture Plc Class A | 2.00% |

| ODFL | Old Dominion Freight Line, Inc. | 1.94% |

| MSFT | Microsoft Corporation | 1.92% |

| GOOGL | Alphabet Inc. Class A | 1.87% |

| DTE | DTE Energy Company | 1.87% |

| INTU | Intuit Inc. | 1.85% |

| TMO | Thermo Fisher Scientific Inc. | 1.74% |

| LOW | Lowe’s Companies, Inc. | 1.72% |

| LLY | Eli Lilly and Company | 1.70% |

| ABBV | Trane Technologies plc. | 1.69% |

Industry outlook

Although the JEPI fund is pretty new, the ETF has shown consistent performance. The annual returns are up 14.89%, and this year the price has already increased by 19.89%. These are impressive numbers considering the impact that Covid-19 had on the financial sector.

Furthermore, the fund has a net expense ratio of 0.35%, making it easily affordable regarding management fees. However, investors should note that it is an actively managed fund which means fund costs might pile up in the long run.

Comments