Grid Master Pro is an FX robot from the FXautomater group. The popular free BF Grid Master EA has been tweaked to create this pro version. The optimizations include the presence of additional trading approaches and parameters to make the EA improve its performance and flexibility. Although it works mainly on the GBPUSD pair, it supports the NZDCAD pair and other instruments with certain changes.

The FXautomater group consists of a team of professional FX experts with over 15 years of experience in trading and 10 years of experience in creating automated systems. With over 10000 clients and more than 15 years in the field, the company has developed more than 30 FX robots. Forex Diamond and Forex Trend Detector are some of the products of this company.

While the company boasts of several years of experience, there is lack of transparency concerning the contact info. We could not find the location address or phone number for contact. An online contact form is the only support method available.

Features of Grid Master Pro EA

As per the vendor, the main features that make this EA stand apart from its competitors are:

- Filters for news, volatility, and overbought/oversold conditions

- Ability to choose from long-only and short-only options

- An improved trading logic

- Alerts sent via email and push notifications

- Protection from high slippage and unscrupulous brokers

- Choice of manual and automated trading.

Some of the recommendations the vendor provides for using this FX robot include a minimum capital of $1000 to begin with and a recommended capital of $3000. While default settings are for the GBPUSD pair only, the EA has a set file for the NZDCAD pair. The timeframe recommended is M15.

Trading strategies and currency pairs

As the name implies, this FX EA uses the grid approach which many traders are not comfortable with due to the high risk involved. However, the vendor maintains that when used with the appropriate risk settings, it can provide consistent profits. According to the vendor, the EA can spot the right entry and subsequent recovery trades that are grid-based. The additional recovery feature helps to compensate for the losses.

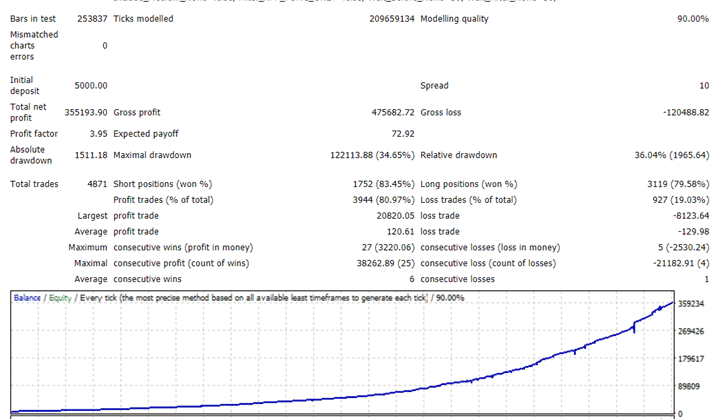

Backtests are provided by the vendor for this EA. Here is a strategy tester report for the GBPUSD pair done using the M15 timeframe and a modeling quality of 90%.

Backtesting report for Grid Master Pro EA

From the above report, we can see a total net profit of 355193 was generated with an initial deposit of $5000. The test done from 2009 up to 2020 had executed 4871 trades with profitability of 80.97% and a profit factor value of 3.95. A maximum drawdown of 34.65% was present for the account. From the high drawdown, we know that the approach is risky despite the claims of the vendor to the contrary.

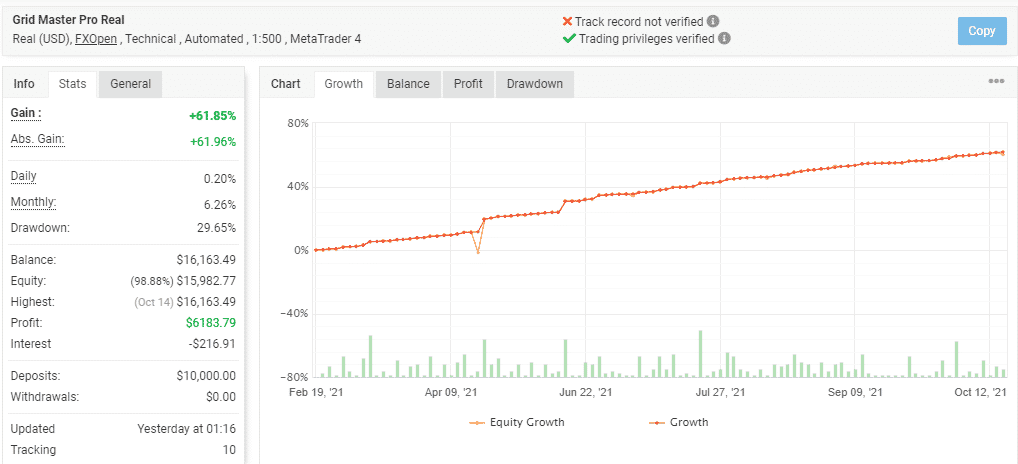

Grid Master Pro trading statistics

A real live account for the EA verified by the myfxbook site is shown here.

Growth curve showing performance of Grid Master Pro EA

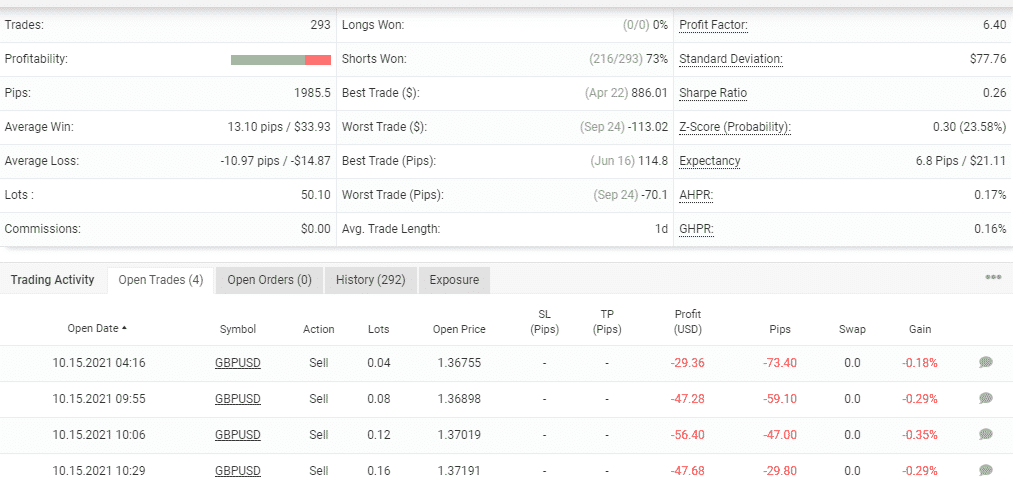

Advanced trading stats for Grid Master Pro EA

From the trading stats seen in the screenshot above, we can see the EA has generated a total profit of 61.85% and an absolute profit of 61.96%. A daily and monthly profit of 0.20% and 6.26% are present for the account. The drawdown is 29.65%. An initial deposit of $10000 was made for the account started in February 2021.

The total number of trades executed is 293 with a profitability of 74% and a profit factor value of 6.40. A varied lot size ranging from 0.04 up to 0.40 is used for the trading. From the high drawdown and varying lot size, it is clear that the approach used is risky. Both the backtesting result and the real trading show a high drawdown indicating the ineffective and dangerous approach.

Pricing and refund

Pricing of Grid Master Pro EA

You can purchase this FX EA for $137. The features included with the package are one real and 3 demo accounts, 24/7 support, and a 60-day money-back guarantee. When compared to the competitor systems in the market, the price is not expensive. However, since the system uses a dangerous approach, we find the price is not worth it.

What else you should know about Grid Master Pro

We could not find user reviews for this FX EA on reputed third-party sites like Forexpeacearmy, Trustpilot, etc. The lack of feedback reveals this is not a popular system among traders.

Comments