The main claim in FXQuasar’s presentation is that the trading system can generate profits for users. It achieves this through a smart analysis of the market, 6 autonomous sessions, and a risk limiting system. However, the EA’s past and present trading results show that it is unreliable. In other words, its strategy is not working as purported.

The identity of people who developed FXQuasar has not been revealed. This is disappointing as we cannot determine their professional backgrounds, including their proficiency in Forex trading. So, the devs are essentially untrustworthy.

The robot works on the MT4 and MT5 platforms. The vendor says that it has a mode that enables it to work with NFA regulated brokers and on any account type. Other features offered include a detailed user manual, high-quality technical support, and free updates.

Trading strategies and currency pairs

FXQuasar is designed to trade the AUDUSD currency pair. It doesn’t work with any other instrument.

The EA works with several strategies, but their explanations are too general to our liking. First, we are informed that it assesses the market and price movements using quotes and internal algorithms. The results are then used to make trading decisions.

Secondly, the software trades in 6 distinct sessions. Three of the sessions are dedicated to using long positions, while the remaining three focus on placing sell orders. Every session assesses the market individually from the long or short positions’ point of view. Lastly, a special risk limiting system is used to prevent losses. However, this system is not specified. So, we are left to speculate what it could be.

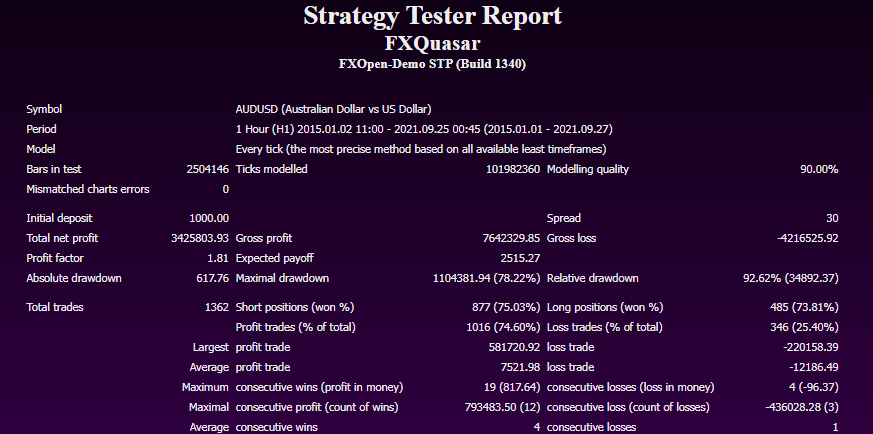

The devs indicate that they tested the robot on historical quotes to comprehend how good or bad the above strategies are. We have posted the backtest results below:

Backtest data

From the backtest results above, it is obvious that the strategies used by this EA were unable to win most trades. We can see this through an insane drawdown of 78.22% and a high average loss trade of -$12,186. Although the total net profit of $3,425,803.93 looked impressive, the reported profit factor of 1.81 reveals that the loss rate was also high. There were win rates of 75.03% for short positions and 73.81% for long ones.

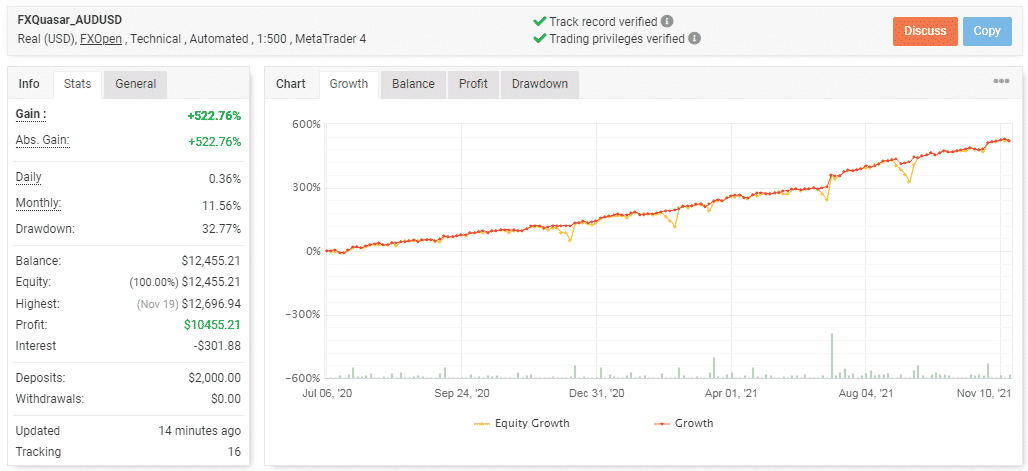

FXQuasar trading statistics

Live trading results

These live results also show that the EA still works with dangerous algorithms. As you can see, it has generated a huge drawdown of 32.77% from 323 trades within 4 months. A profit of $10455.21 has been made from a $2000 deposit. Subsequently, the account’s standing has risen to 522.76%.

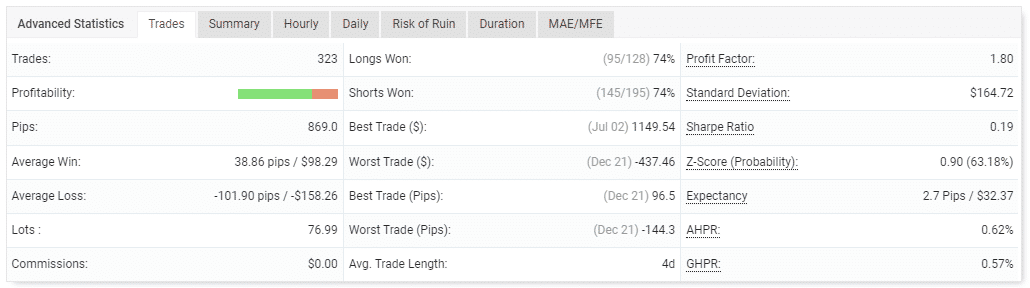

Trading performance

The system has an average win of 38.86 pips, but the average loss of -101.90 pips tells of a system that seems to attract losses more. So, the gains made are smaller. This is well- illustrated by the profit factor (1.80) and the average win rates of 74% for both the long and short positions.

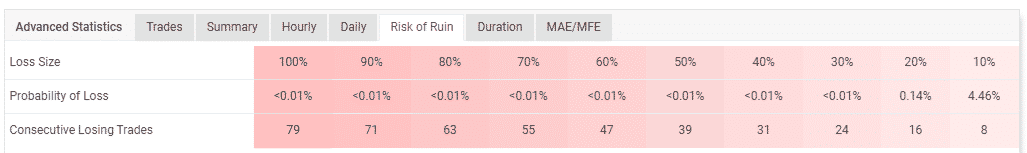

Account’s risk of ruin

This account is about to go under.

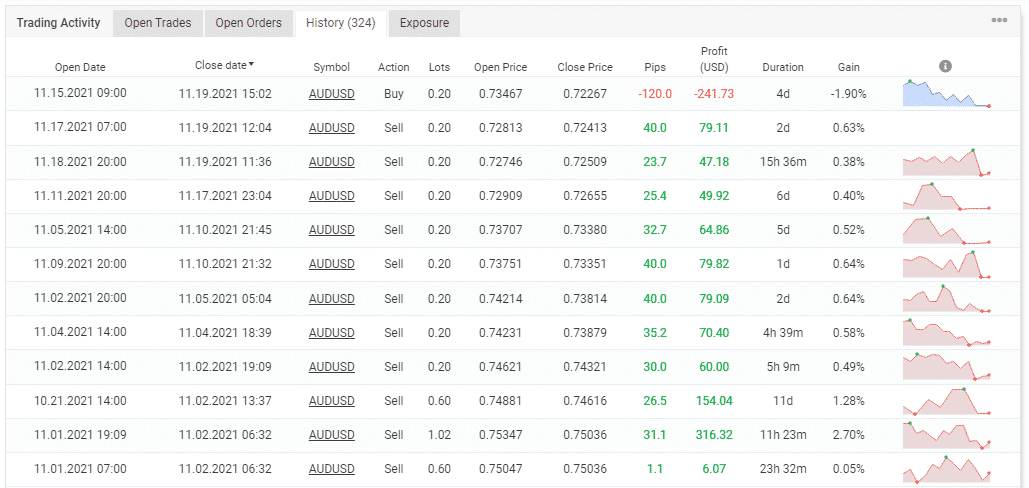

Trading history

The EA has made some good profits, but the large lot sizes used can lead to consequential losses.

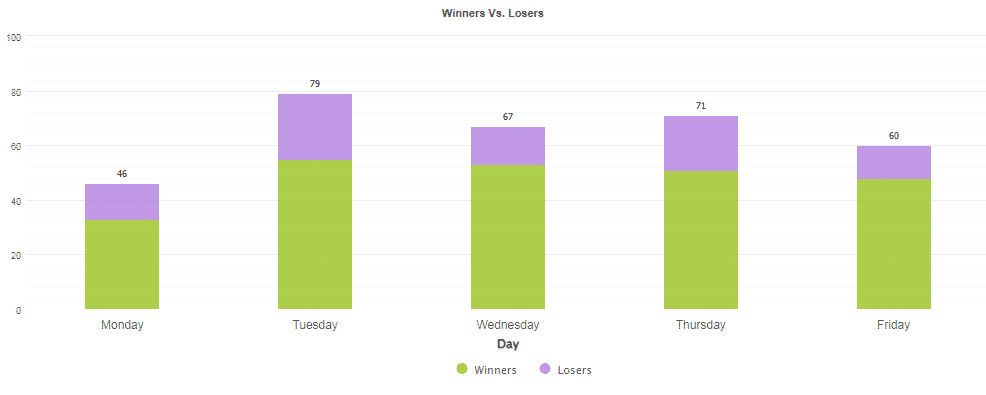

Daily trades

Tuesday was the busiest day as the robot managed to complete 79 trades.

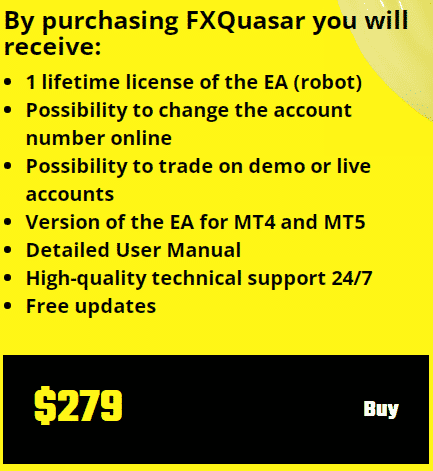

Pricing and refund

FXQuasar has only one pricing plan. The vendor is selling it at $279. A lifetime license, demo/live accounts, a 30-day money-back guarantee, and the ability to change the account number online come with this pack.

FXQuasar’s price

What else you should know about FXQuasar

Customer reviews for this robot are missing. It is highly likely that it has not caught the attention of traders until now.

Comments