In 2000, the market value of exchange-traded products was $70 billion. Two decades later, the value of exchange-traded funds alone, as of 2021, was upwards of $7 trillion. This shows that exchange-traded products have evolved to the most traded investment asses in the globe.

When discussing exchange-traded products here, we delve into the exchange-traded funds and notes. They have both gained a lot of popularity since their introduction, which has resulted in their exponential growth.

By the end of this guide, there should be clarity to the following answers:

- Difference between ETNs and ETFs?

- Pros and cons of ETF?

- Pros and cons of ETN?

What are an ETN and ETF?

An ETF and an ETN are investment assets that track a composite index without diving into details. However, different investment strategies are needed for effective investment in either.

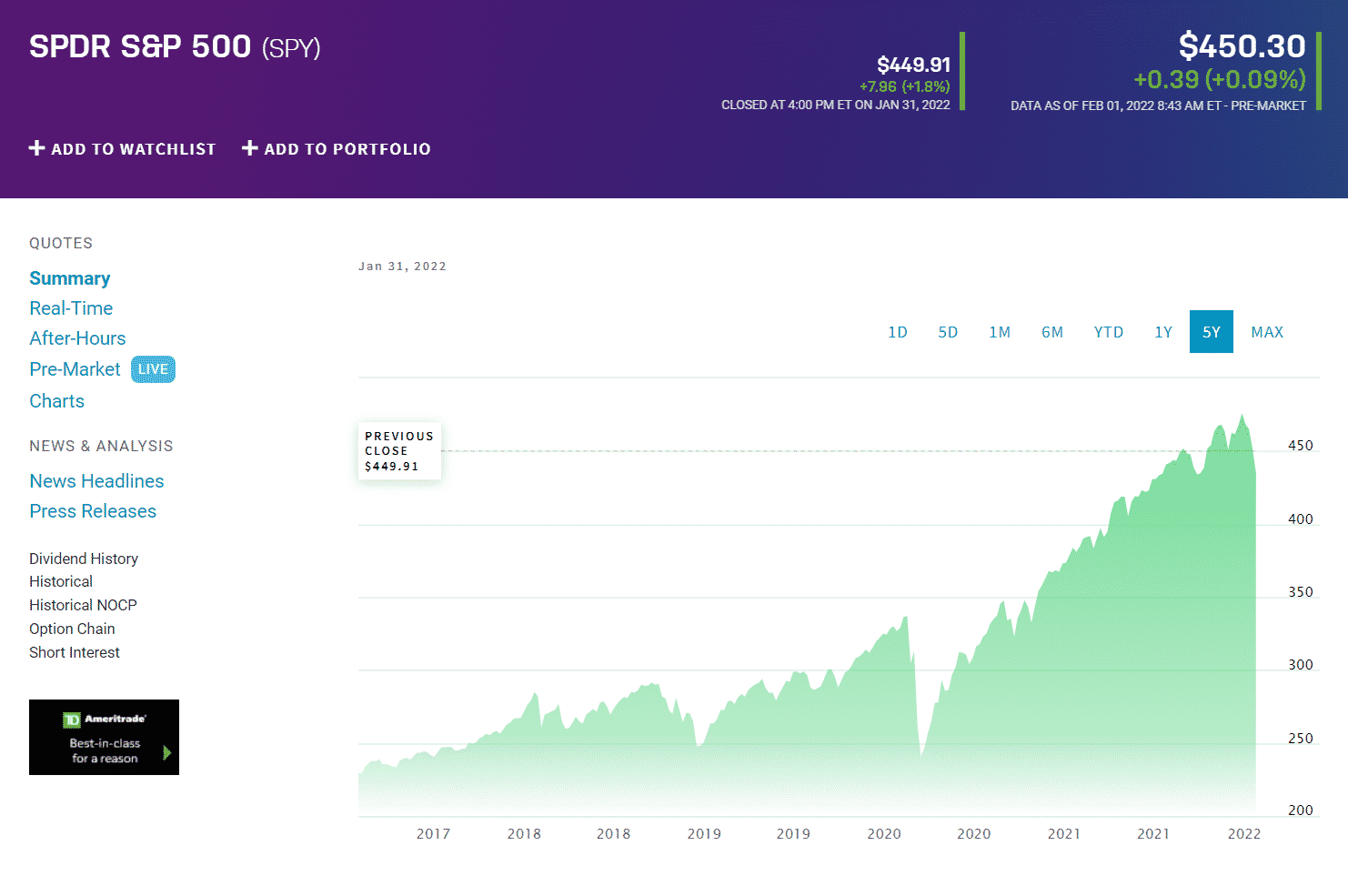

The SPY’s first ETF was availed to investors in 1993 and has evolved to be the most liquid and exchanged large blend fund globally. An exchange-traded fund comprises investment assets of economic characteristics pooled into a single tradable instrument. For example, the SPY ETF consists of the largest US blue-chip companies and is hence used to gauge the economic health of the United States. Since that first ETF, this world has evolved to provide exchange-traded funds that track almost every corner and niche of the economy.

SPY 5Y price chart

When it comes to ETNs, the composition takes a detour. While ETFs are pools of underlying economic assets, ETNs are unsecured senior debt securities. As such, ETNs structure is akin to zero-coupon funds-accrue no coupon payment before maturity, and on maturity, investors receive the market value net of management expenses.

Despite these disparities, both of these exchange-traded products are listed on stock exchanges to facilitate trading, where their prices represent the prices of the composite index they track.

Pros of investing in ETFs

The exponential growth of ETFs and their ever-increasing popularity is largely due to the befits they offer investors.

Relatively low expense ratio and broker commissions

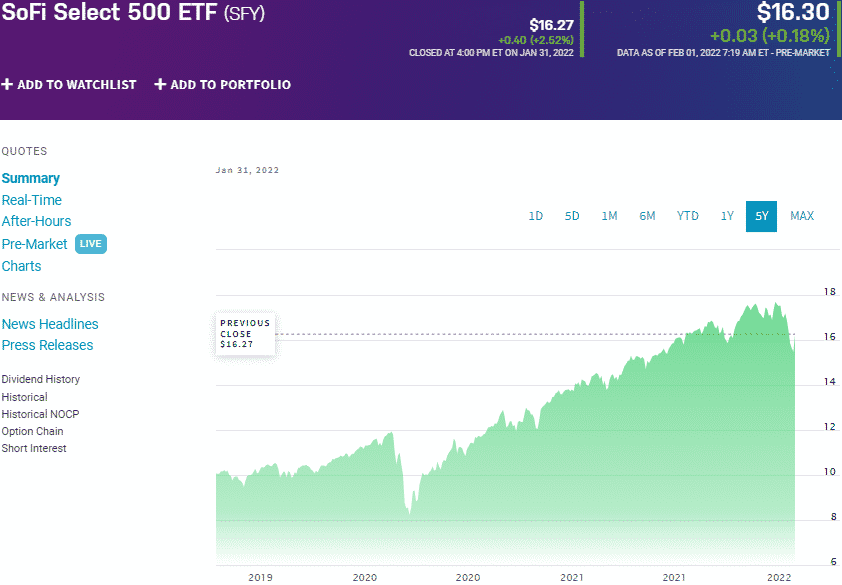

ETFs are a low-cost investment option compared to other investment assets. The majority of ETFs have passively managed investments hence reducing the management fees. Brokers have also adopted zero commissions for the most liquid and popular ETFs, resulting in lower investment fees. For example, the SoFi select 500 ETF attracts zero expense ratio to investors. With $10000 investment capital at the current price, investors go home with 613 shares of this ETF with no fees accruing for this investment.

SoFi price chart

Manage investment risk through diversification

Investors gain instant diversification to the entire industry, sector, niche, or economy through ETFs. The result is a diversified portfolio depending on the level of diversification, able to withstand market volatility by eliminating concentration risk. If holding SoFi ETF shares and Apple hits a rough patch, the remaining 499 holdings readily absorb the bearish Apple movement, and investors can still expect positive returns.

Provide instant portfolio diversification through a pool of assets

Investing in ETFs avails to investors asset classes otherwise unreachable as single investments. Using the SoFi ETF as an example, an investor gains a single share of this fund at $16.30 while getting exposure to 500 of the largest cap equities publicly trading in the US that offer both value and growth. A single share of the top holding of this ETF, Apple, is worth $174.78 at present.

Cons of ETF investing

All investment assets have a risk element. The same is true for ETFs despite their apparent advantages over other investment assets.

Industry-specific ETFs limit portfolio diversification

Thematic ETFs targeting a particular niche have highly correlated underholding’s which does not limit concentration risk.

Actively managed funds are relatively more costly to invest

ETFs are known for their cost efficiency, but not all are created equal. Actively managed ETFs attract higher management fees than other ETFs and asset classes, making them a more expensive investment option.

Tracking risk

ETFs track an underlying index, but there is, in most cases, the deviation between an ETF performance and the performance of its composite index. Knowing the degree of deviation informs the tracking risk, which helps make informed investment decisions.

Pros of investing in ETNs

Exchange-traded notes are a fairly new addition to the exchange-traded product family but have gained popularity quickly due to the advantages below.

Access to exotic markets and securities

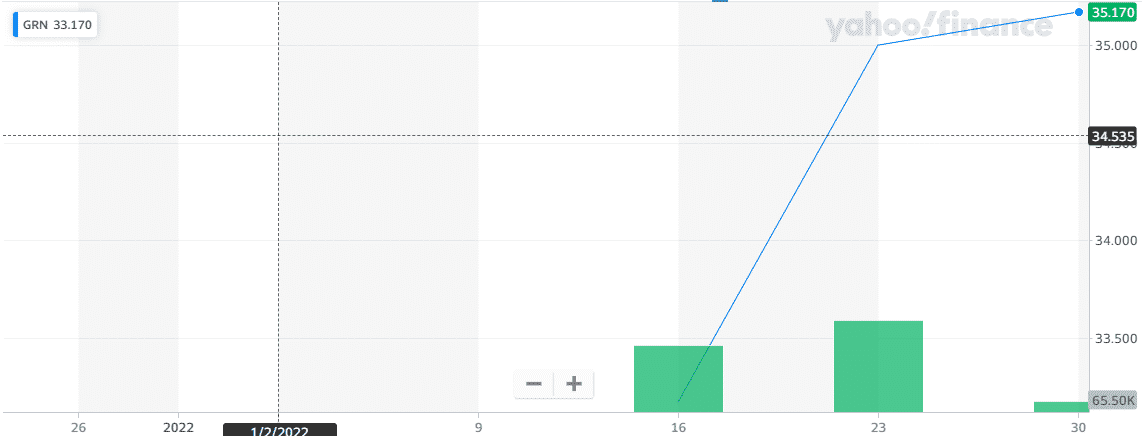

Through ETNs, investors get exposure to exotic markets such as foreign markets and exotic markets such as the currency markets. For example, the GRn ETN exposes investors to futures contracts coupled with reduced carbon emissions.

GRN price chart

Tax incentives

Unlike ETFs, ETNs pay no dividends or any form of interest before their maturity. Unless sold before 12-months lapses, their gains are considered long-term capital gains and attract lower taxation.

Cons of investing in ETNs

Similar to ETFs and other investment assets, ETNs come with a set of demerits to their investment.

Liquidity risk

The ETN market is not as developed as the ETF market; hence, it has relatively lower liquidity. Offloading an ETN investment before its maturity is quite problematic due to the low liquidity.

Early redemption risk

ETNs are a basket of financial debt instruments by their composition. Early redemption of such debts may coincide with a market dip resulting in losses to investors.

Credit risk

By being a debt instrument, the value of ETNs is highly dependent on the credit rating of the debt issuer. Thus, a negative credit rating lowers the ETN value and vice versa.

Default risk

ETN are unsecured debt instruments, and any default by the issuer is an automatic loss to investors.

Final thoughts

Should you invest in ETNs or ETFs? Every investment is dependent on individual investment objectives and acceptable risk levels. However, before investing, analyze the different factors affecting these exchange-traded products to understand their effect on investment for informed decision making to ensure maximum portfolio earnings.

Comments