ETF full name: Invesco MSCI Sustainable Future ETF

Segment: Global environment

ETF provider: Invesco

| ERTH key details | |

| Issuer | Invesco |

| Dividend | $0.1 |

| Inception date | October 24, 2006 |

| Expense ratio | 0.58% |

| Management company | Invesco |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 54.94% |

| Investment objective | Replication |

| Investment geography | Global environment |

| Benchmark | MSCI Global Environment Select Index |

| Leveraged | N/A |

| Median market capitalization | $51.83 billion |

| ESG rating | MSCI 5.49/10 |

| Number of holdings | 223 |

| Weighting methodology | Weighted Market capitalization |

About the ERTH ETF

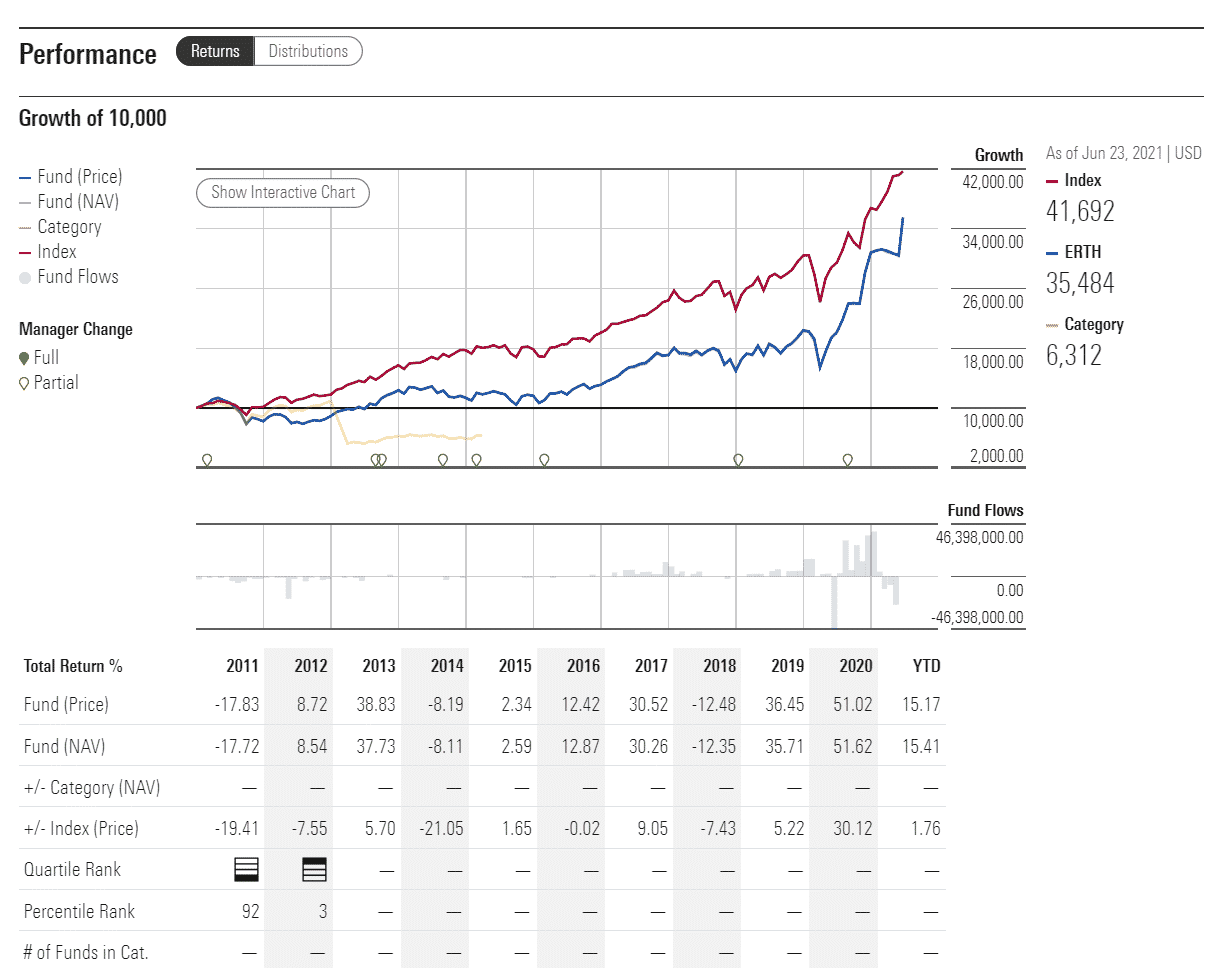

Invesco MSCI Sustainable Future ETF started on October 24, 2006, and it tracks the MSCI Global Environment Select Index. Its market capitalization stands at $51.83 billion, with an average annual return of 54.94%.

ERTH Fact-set analytics insight

The ERTH ETF, previously known as Invesco Cleantech ETF, consists of 223 holdings. The portfolio includes alternative energy, green infrastructure, sustainable agriculture, water management, pollution prevention, etc. A bit under 50% of the holdings is in the United States, with China, Hong Kong, and Japan following, respectively.

ERTH, similar to other ETFs based on the MSCI Global Environment Select Index, uses weighted market capitalization for its methodology.

ERTH performance analysis

The environmental issues represent a much more significant chunk of Joe Biden’s plan than the case with his predecessor. While the Democrats usually rank ecological issues as a top priority, the Republicans are traditionally more concerned about the industry and the job market. The return of the US to the Paris Agreement was an important milestone for the ETF.

Despite some fluctuations in the recent months, ERTH showed admirable resilience and could gain more speed as the global summits dedicated to the greener economy start to occur.

The ERTH ETF pays dividends every quarter. In the last trimester, the dividend amounted to $0.1 on the share at an expense ratio of 0.58%.

On the MSCI ESG scale, ERTH ETF has a 5.49/10 triple-B rating. The fund was declared to be of somewhat lower-than-average resilience in environmental, governmental, and social changes.

ERTH ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| ERTH Rating | BBB | BBB | 4 | N/A | N/A |

| ERTH ESG Rating | 5.49/10 | BBB | N/A | N/A | N/A |

ERTH key holdings

While most of the holdings gravitate towards the same topic, a more in-depth look reveals that the financials, energy, consumer cyclical, and industrials take up a close-to-20% share in the ETF’s pull, each.

With electric vehicle makers such as Tesla and NIO within its top 10 holdings, the volume pull is almost guaranteed. While the Shanghai-based carmaker boasts a $77 billion market capitalization, Musk’s electric vehicle giant stands at $595.9 billion.

Here are the top 10 holdings making up the ERTH ETF.

| Ticker | Holding name | % of assets |

| NIO | NIO Inc. Sponsored ADR Class A | 6.13% |

| DLR | Digital Realty Trust, Inc. | 4.89% |

| TSLA | Tesla Inc. | 4.82% |

| VWS | Vestas Wind Systems A/S | 4.76% |

| 9022 | Central Japan Railway Company | 4.46% |

| ENPH | Enphase Energy, Inc. | 3.56% |

| ALO | Alstom SA | 2.9% |

| PLUG | Plug Power Inc. | 2.85% |

| KRX | Kingspan Group Plc. | 2.8% |

| LI | Li Auto, Inc. Sponsored ADR Class A | 2.56% |

Industry outlook

The green economy and business seem to rank pretty high on agendas of nearly all international players, be it countries or other entities. The European Union has the “Next Generation US” project, while the mantra of the American administration is “build back better” after the Covid-19 crisis.

After withdrawing from the Paris Agreement, the United States rejoined the accord in February, reiterating that the “climate fight” is high on its list of priorities. Russia and China are also dedicating more and more funds to the so-called energy of the future. Investing generally means doing something for your future self. If you want to, at the same time, contribute to sustainable growth, widening your portfolio with a greener set of stocks might be the right choice.

Comments