Dynamic Pro Scalper is a fully automated trading system that is said to have a very low drawdown. We are informed that since its trading strategy is not risky, traders can begin trading with $100-$500 in their account. Also, traders can test the robot on a demo for a month.

Automated Forex Tools is the company responsible for developing this trading system. The organization was founded in 2015, and up till now, it has developed a variety of trading tools. Some of its other inventions are Forex Impulse Trader, Forex Pulse Detector, and Forex Trend Hunter.

According to the devs, the EA has the below listed features:

- Fully automated and customizable

- Compatible with all brokers but protects traders from the rogue ones

- High slippage and real spread protection

- Comes with money management feature

- Equipped with automated GMT protection

- Is easy to use

Trading strategies and currency pairs

Dynamic Pro Scalper supports nine currency pairs. They are: USDJPY, USDCHF, GBPCAD, USDCAD, GBPUSD, EURCAD, EURCHF, GBPCHF, and EURGBP.

In reference to the trading strategy, the robot is claimed to be an Asian scalper. In essence, the method involves making profits out of small price movements in the market during the Asian session. In many of the cases, the profits made are usually minute. Notably, new features have been added to the system, which allows it to also use the following trading styles:

- Simple Grid

- Grid & Martingale

- Recovery system

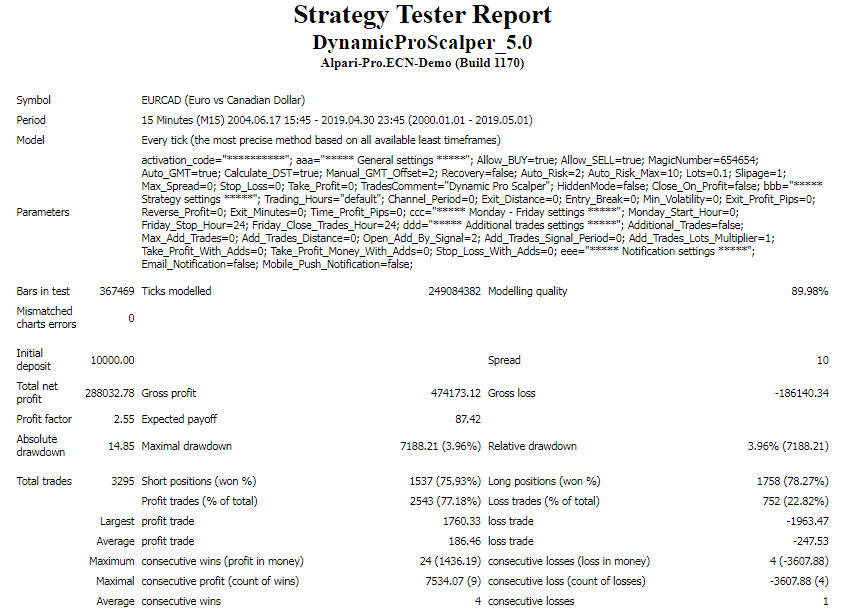

Backtest results

We see that the EA managed to make a profit of $288,032.78 between the 2004 and 2019 trading period. This outcome was preceded by 3295 trades conducted using a $10,000 deposit. The robot had a high losing streak, as illustrated by a much larger average loss trade of -$247.53 compared to the average profit trade of $186.46.

The win rates for short (75.93%) and long positions (78.27%) were far from being excellent. A drawdown rate of 3.96% is good as it meant the robot took small risks as it traded. There was a profit factor of 2.55. This indicates the system had the potential to double the capital invested.

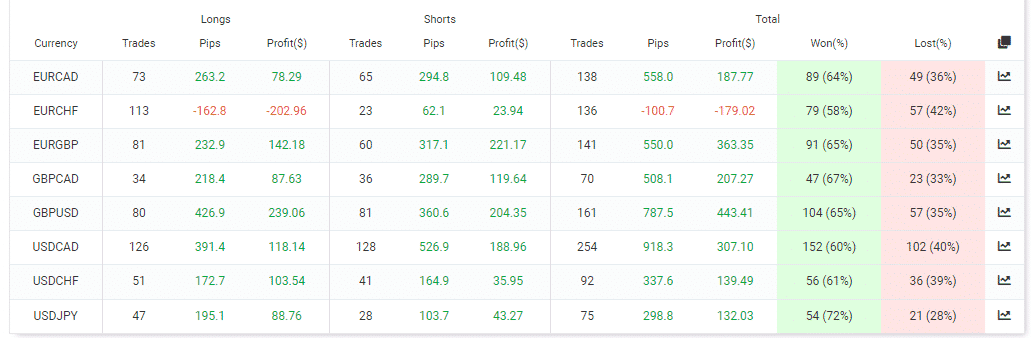

Dynamic Pro Scalper trading statistics

Live trading stats

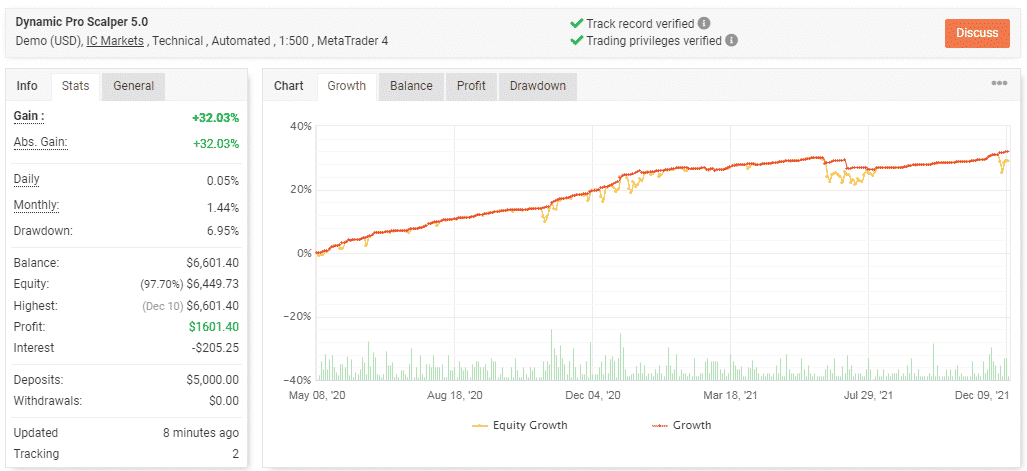

Dynamic Pro Scalper is currently managing a demo account on Myfxbook. It’s quite impressive that the EA has maintained this account for more than a year now. However, the main concern is that the profitability rate is too low.

From the stats above, you can see it only makes 0.05% profits daily and 1.44% profits monthly. Consequently, the cumulative profit so far is $1601.04. The system might have to trade for a few more years before it even returns the capital ($5000) invested. Currently, the drawdown is 6.95%. This means that low risks are involved in trading. So, the capital is safe.

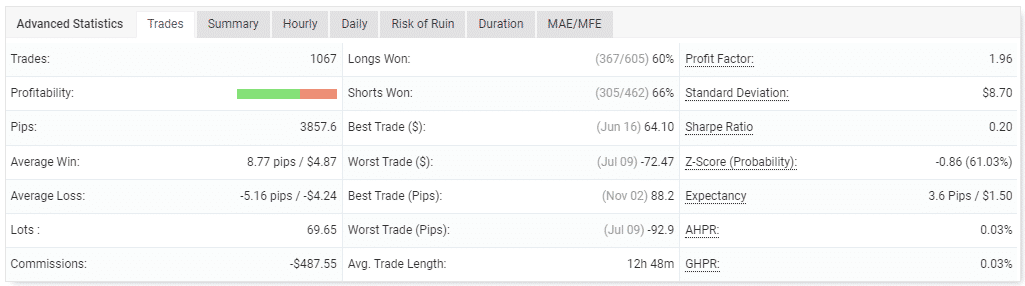

Performance of trades

The EA has a high trading frequency as it has already completed 1067 trades. The bad news is that the win rates for long (60%) and short positions (66%) are quite poor. It means that many of the buy and sell orders are not successful. And a profit factor of 1.96 tells us that the gains made from these orders are not big enough.

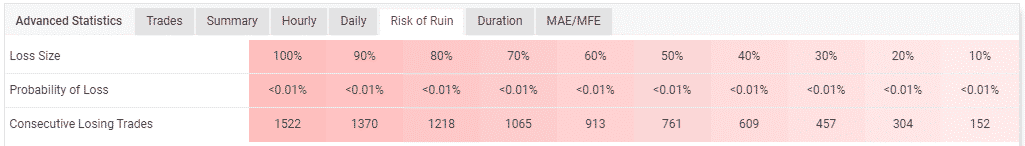

Risk of ruin

The account is not in any danger of being blown up. It will probably survive for a couple of more years.

Summary of trades

The software mostly works with the USDCAD and EURCAD currency pairs. However, the GBPUSD is by far the most profitable instrument.

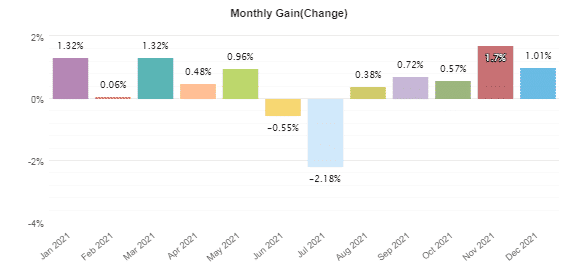

Monthly returns

The monthly returns are very low. The EA didn’t bring any profits in June and July.

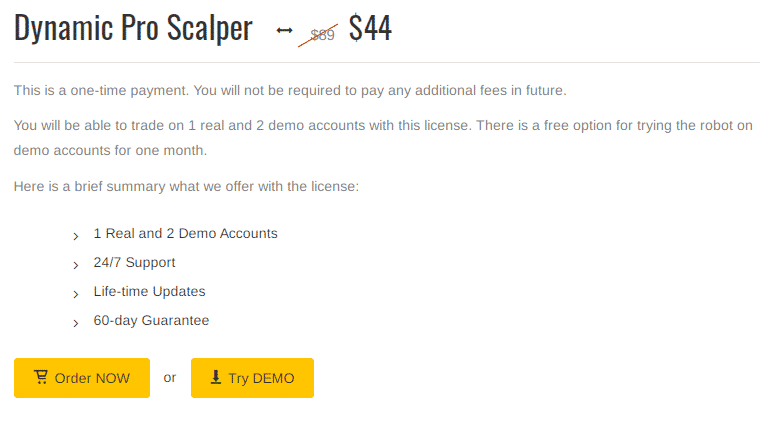

Pricing and refund

The EA’s pricing details

The vendor slashed the price of this EA from $89 to $44. This makes it very affordable. At the new price, you will acquire a license that makes it possible for you to trade 1 real and 2 demo accounts. Other features you will get include life-time updates, 24/7 support, and a 60-day money-back guarantee.

What else you should know about Dynamic Pro Scalper

The EA lacks customer reviews. Therefore, we can’t tell if this robot is helping traders and whether the performance we have seen on the demo account is being replicated in the actual world.

Comments