Trading software, or day trading software as some call it, is a name for any algorithm or program that helps you analyze and make investments or trades. Some of them can even serve as a kind of autopilot device that executes your investment strategy for you.

While that all sounds excellent, not all software is the same, and with millions of platforms out there for you to choose from, doing your research has never been as important. We are here to help you make the right choice, with a simple set of trading software must-haves that your future program of choice should tick.

1. Fluidity

This seems like an obvious notion to make, but the software you use needs to work seamlessly on your device. Keep in mind that, in most cases in trading, time is one of the essences, and minutes you spend waiting for your program to start or reboot can cost you your hard-earned dollars.

Many oversee this, but you also want to make sure that you have the right tool that is the most compatible with your operating system of choice. So if you are using Windows, go for something that works with no glitches. If you are someone who uses Mac os, find something that will run smoothly on your machine.

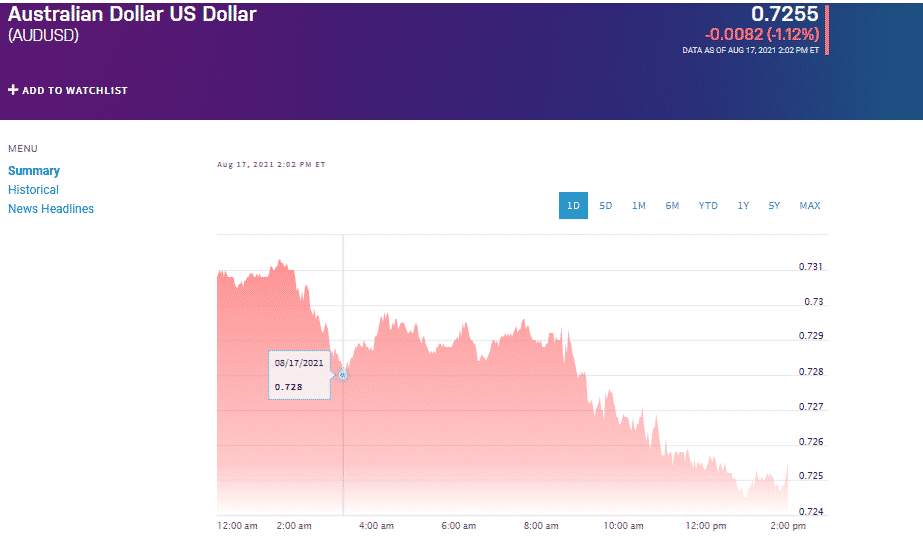

Australian Dollar/US Dollar chart

Looking into the example of AUS/USD, you can see the price drop of the Australian dollar that occurred when New Zealand declared a three-day lockdown. The currency lost more than 1% compared to the US dollar, which led to substantial gains for those who betted against the Aussi. It is times like this that show how important a smooth program with no delays in quotas is.

2. Costs and hidden costs

This might come as a surprise, especially if you are a beginner, but most trading programs are free. Well, at least to some extent. While we understand that you might want to minimize your costs by cutting out anything you don’t need to pay for, you still want to tread carefully.

We mean that some platforms will offer a free-of-charge service and then try to charge extra by introducing premium accounts that have the features you decided you need. Before making a purchase, be sure to double-check what the cost of a program is and what comes with the package you selected.

3. Features

They refer to the things you get from your trading software. While there are many traits that people consider essential, most investors agree on the importance of following.

- The software needs to be user-friendly. The importance of this only increases if you are a beginner. So look for a platform where everything is intuitive and visible.

- The second thing you will want is data and data timing. This refers to how accurate and up-to-date the prices of securities are. In trading, making a profit can be a matter of seconds, so try to avoid platforms that come at a lower cost but have massive delays on most of their quotas.

- Another part of the data trait is the way the prices and trends are presented or charted. The more options the platform has, the better because that will allow you to learn more about how stocks, bonds, or currencies have moved in the past.

Of course, many specific features will depend on your trading strategy, but news and updates are the most important ones we haven’t mentioned yet. This isn’t the case for many, but some trading platforms nowadays include a news section, which can be meaningful on two levels.

The first level is kind of obvious, as having fresh news available will take care of most of your investment information needs. This, in terms, helps you avoid wasting your time visiting ten different websites to get your information and understand current trends. Having everything available without ever leaving the platform is just practical and makes sense.

The other way the news section matters is that it shows commitment. Having a separate financial news team is expensive and challenging. So if the company takes the effort to create a group of individuals dedicated to getting you the most recent and relevant data, the chances are that the company is taking things seriously with other aspects of the platform.

4. Regional coverage and type of securities

When choosing the right trading program, what you are investing in, and where you are investing from can be significant. For example, forex platforms are not suited for trading stocks or bonds, as they might lack the traits you would need to implement a sustainable investment strategy for those kinds of securities.

On the other hand, certain platforms can be geared towards specific markets. So if you are interested in investing in American securities and find a platform that you like in terms of features and price, make sure that the program isn’t made specifically to meet the needs of American commodity investors.

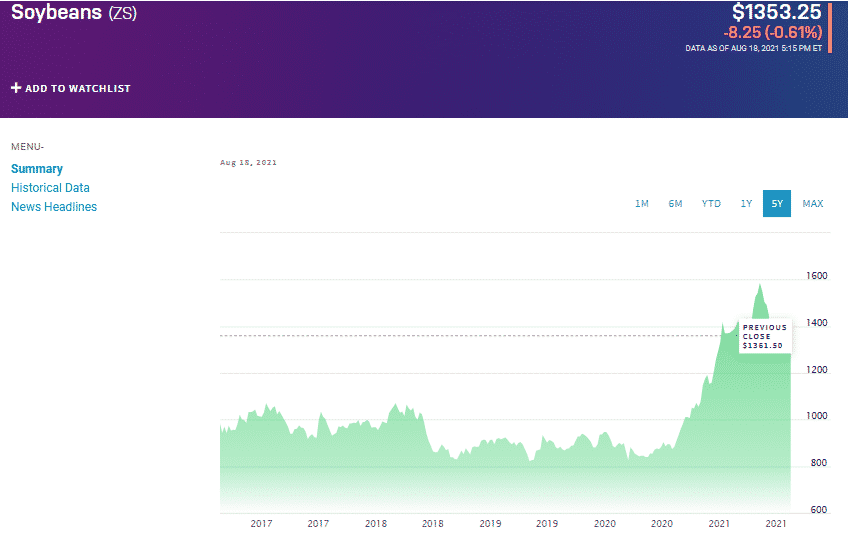

Soybeans chart

Take a look at the spike that the soybeans trading saw at the beginning of 2021, and you will grasp just how lucrative commodities and regional trading can be.

5. Demo versions

Demo versions let you practice with no actual real-life consequences or money loss. As a beginner, that can be worth more than you can imagine. This point might be a bit obsolete, as a large majority of day trading programs come with a free demo version, but it still doesn’t hurt to remind people to make sure to check if their platform of choice will let them practice trading with their training wheels on.

Final thoughts

In today’s day and age, we all thrive on using technology. It helped us make so many areas of our daily living more accessible, so it’s only logical that utilizing trading software can help you bring your investment game to a new level.

Choosing the right trading software is much like buying a new car. It would help if you had the correct info, and you don’t want to invest in it without testing it first. An interesting approach to selecting the perfect trading platform is getting in touch with other traders, such as forums.

After learning the basics here, the group of people passionate about investing can help answer some of the questions you have in more detail. Like always, it’s not about finding the best thing. It’s about discovering the thing that will work the best for you.

Comments