Brazil has been the trailblazer quasi-developed economy for a long time, achieving rank 12 globally in GDP and the most significant Latin American economy. Ample natural resources, a budding industrial sector, and a young demographic place Brazil among the global emerging markets superpower nations.

Like many nations in this bracket, the Brazilian economy faces multiple challenges requiring an investment vehicle with diversification to mitigate against the associated investment risks. It is for this reason that Brazilian exchange-traded funds exist.

What is the composition of a Brazil ETF?

In this article, Brazil ETFs featured have significant exposure to the Brazilian equity market, and those with Brazil equities form the top ten weightings in their composition.

The 7 best Brazil ETFs

Brazil was one of the countries that took the brunt of the Covid-19 pandemic, resulting in its economy shrinking by upwards of 4%. However, the world bank expects the Brasilia economy to stage a comeback and recover by upwards of 5%, under the guidance and favorable policies of president Bolsonaro. The seven Brazilian ETFs below give investors exposure to this emerging market and a chance at portfolio value, growth, and geographical diversification.

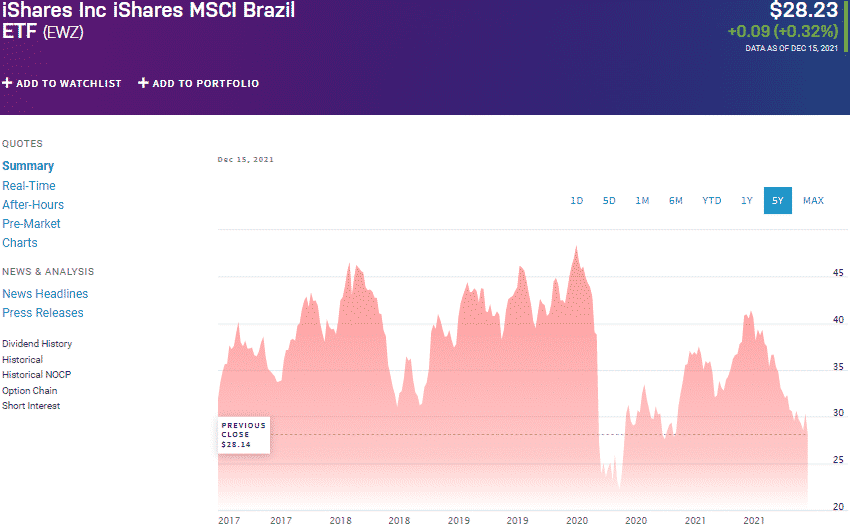

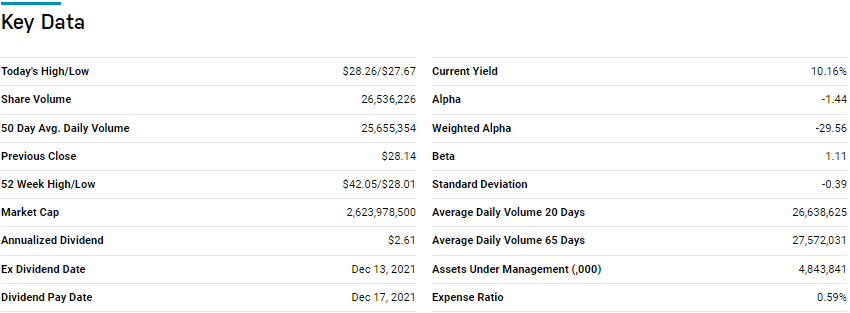

iShares MSCI Brazil ETF (EWZ)

Price: $28.23

Expense ratio: 0.59%

Annual dividend yield: 2.87%

EWZ chart

The iShares MSCI Brazil ETF tracks the performance of the MSCI Brazil 25/50 Index, investing at least 80% of its assets in the underlying holdings of the composite index and the associated depository notes. The underlying index is a free float-adjusted market-cap index, with no single issuer making up more than 25% of the weighting and issuers with more than 5% weighting not exceeding 50% of the total fund weight. It exposes investors to liquidity and market capitalization in the best publicly traded large-cap Brazil equity market.

An evaluation of eight Latin America equity funds ETFs by US News has the EWZ at rank № 3 for long-term investment.

The EWZ ETF has $4.84 billion in assets under management, with an expense ratio of 0.59%. The recent past has not been kind to EWZ investors, but with economies recovering from the pandemic, it might be time to buy the deep and stake on this emerging market expanding; 5-year returns of 4.18%, 3-year returns of -16.13%, pandemic year returns of -15.69%, and current year to date returns of -17.60%.

In the short-term, investors get to enjoy dividends to the tune of 2.87%, above the average dividend yield for wall street ETFs.

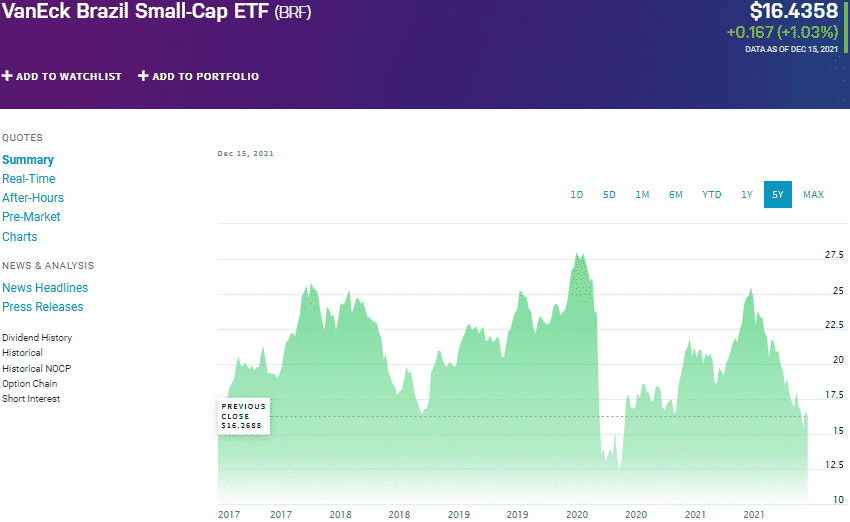

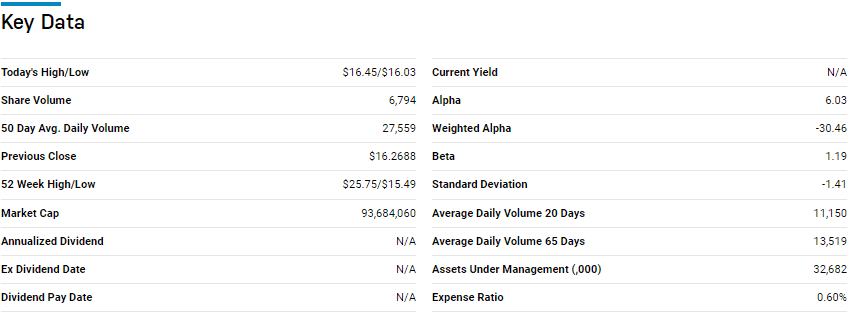

VanEck Brazil Small-Cap ETF (BRF)

Price: $16.4358

Expense ratio: 0.60%

Annual dividend yield: 1.89%

BRF chart

The VanEck Brazil Small-Cap ETF tracks the MVIS Brazil Small-Cap Index, investing at least 80% of its assets in the holdings of the composite index and their depository receipts. It exposes its investors to small-cap equities either domiciled in Brazil but derives 50% of its revenues from Brazil.

BRF ETF has $32.7 million in assets under management, with an expense ratio of 0.60%. Similar to the EWZ, the last five years have not been the best for the BRF, but its exposure to the small-cap equities facilitates a buy and hold strategy; 5-year returns of 18.93%, 3-year returns of -14.07%, pandemic year returns of -23.66%, and current year to date returns of -23.62%. In addition to its potential value, it comes with a decent dividend yield of 1.89%.

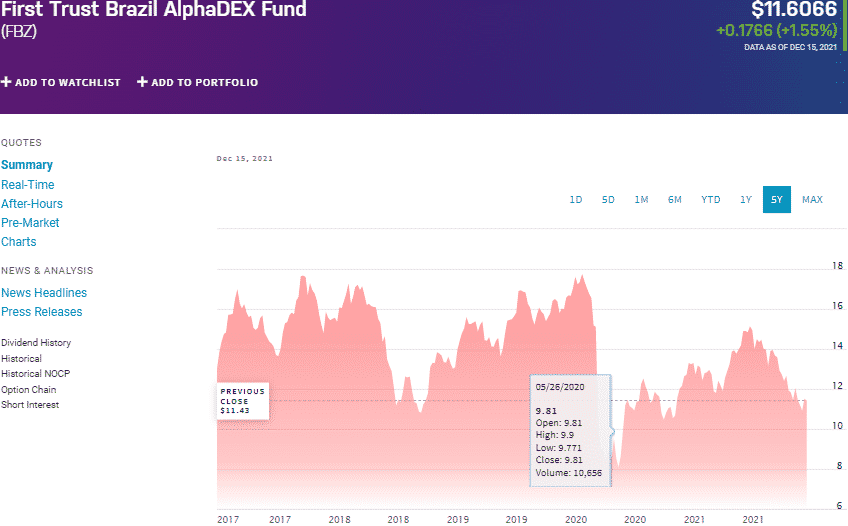

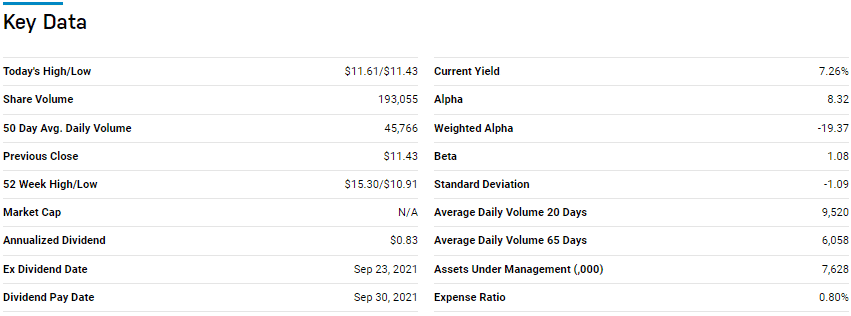

First Trust Brazil AlphaDex ETF (FBZ)

Price: $11.6066

Expense ratio: 0.80%

Annual dividend yield: 4.07%

FBZ chart

The First Trust Brazil AlphaDex ETF seeks to replicate the performance of the NASDAQ AlphaDEX Brazil Index, net of expenses and fees. FBZ invests at least 90% of its total assets in the underlying holdings of its composite index, REITS, and ADRs of the underlying holdings. It exposes its investors to equities chosen via the AlphaDex methodology, ensuring energy stocks from the NASDAQ Brazil index generate positive alpha.

The FBZ ETF has $7.5 million in assets under management, with a relatively higher expense ratio of 0.80%. Except for the pandemic year and current year, the AlphaDex formula has ensured positive returns for this fund; 5-year returns of 30.67%, 3-year returns of 2.36%, pandemic year returns of -9.22%, and current year to date returns of -11.52%. AlphaDex methodology ensures a balanced portfolio in weighting, hence mitigating against concentration risk while looking for enhanced returns.

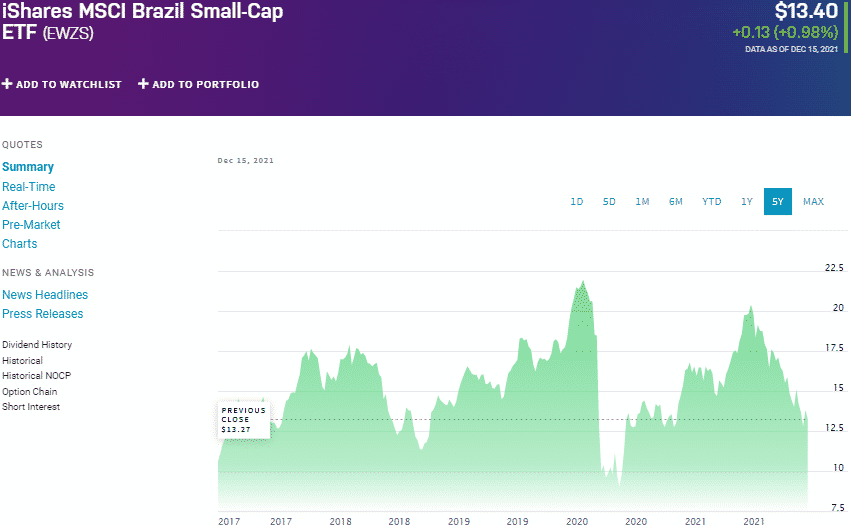

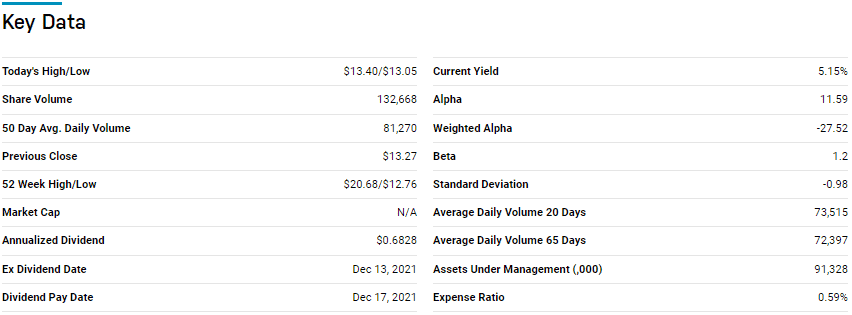

iShares MSCI Brazil Small-Cap ETF (EWZS)

Price: $13.40

Expense ratio: 0.59%

Annual dividend yield: 2.28%

EWZS chart

The iShares MSCI Small-Cap ETF tracks the performance of the MSCI Brazil Small Cap Index, investing at least 80% of its assets in the underlying holdings of the composite index and the associated depository notes. The underlying index is a free float-adjusted market-cap index, exposing investors to small-capitalization equities domiciled in Brazil.

EWZS has $88.3 million in assets under management, with an expense ratio of 0.59%. This fund has had better fortunes than others on this list, posting only negative returns during the pandemic; With 70 holdings and moderate concentration in its top ten holdings, this Brazilian small-cap ETVF is worth looking into for value and growth, attributable also to one of the best dividend yields in the ETF space.

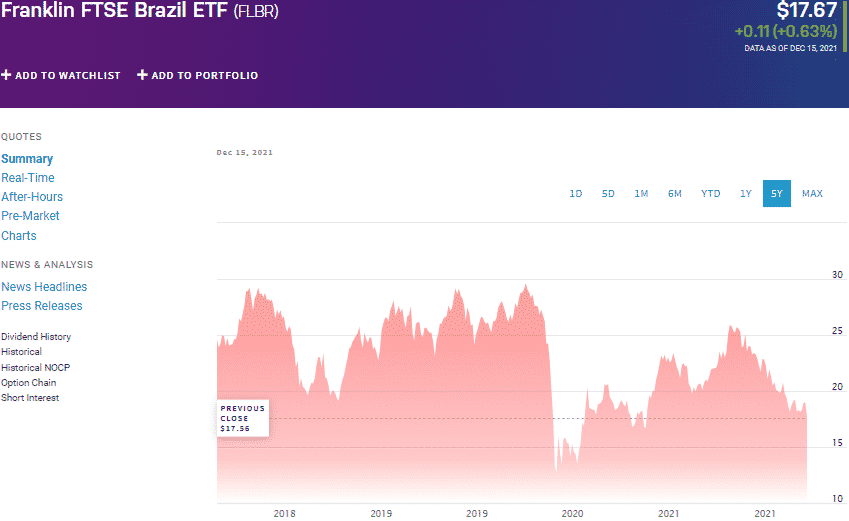

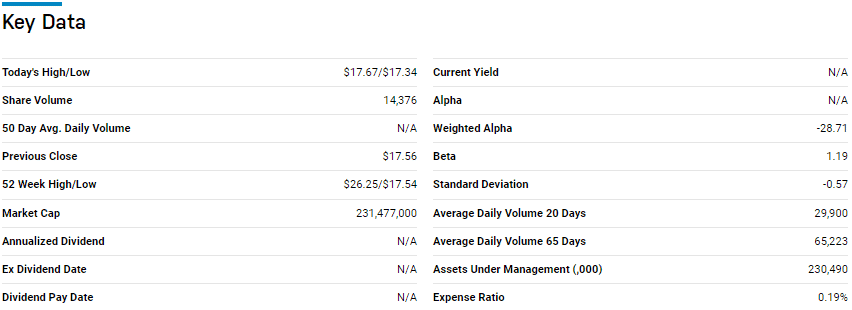

Franklin FTSE Brazil ETF (FLBR)

Price: $17.67

Expense ratio: 0.19%

Annual dividend yield: 3.45%

FLBR chart

The Franklin FTSE Brazil ETF tracks the performance of the FTSE Brazil RIC Capped Index, investing at least 80% of its total assets in the underlying holdings of the composite index and their ADRs. It exposes investors to Brazil’s large and mid-cap equities.

The FLBR ETF has $232.3 million in assets under management, with an expense ratio of 0.19%. Since its launch, this Brazilian fund has not posted positive returns, meaning investors can. Still, the dip as the economy recovers from the coronavirus has a stake in the best Brazilian value and growth equities. In addition, it has an annual dividend yield of 3.45%.

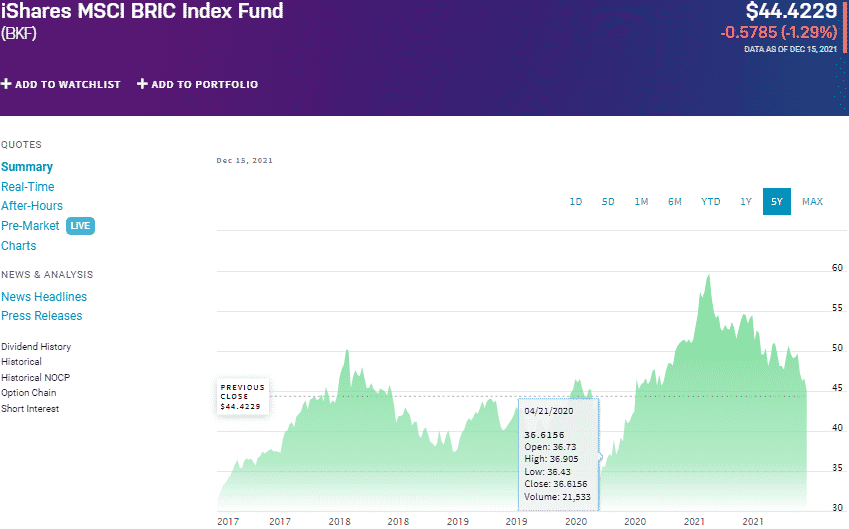

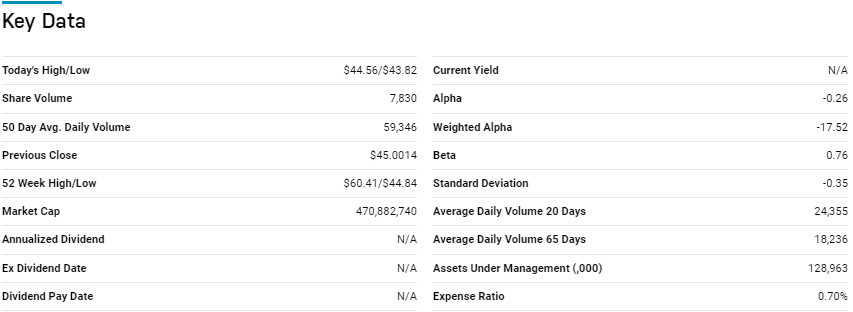

iShares MSCI BRIC ETF (BKF)

Price: $44.4229

Expense ratio:0.70%

Annual dividend yield: 1.01%

BKF chart

The fund tracks the performance of the MSCI BRIC Index, investing at least The iShares MSCI BRIC ETF tracks the performance of the MSCI BRIC Index, investing at least 80% of its assets in the underlying holdings of the composite index and any other security of like economic characteristics. Investors in this ETF get exposure to the top best-emerging market equities.

An evaluation of 79 diversified emerging markets funds by US News has the BKF at rank № 30 for long-term investment.

This ETF has $129.20 billion in assets under management, with an expense ratio of 0.70%. This ETF is an indirect play at the Brazil economy by diversifying to include other market economies; China, Russia, and India. The historical returns also beg for this ETF to be considered if looking for brazil portfolio exposure; 5-year returns of 51.3% and 3-year returns of 22.64%.

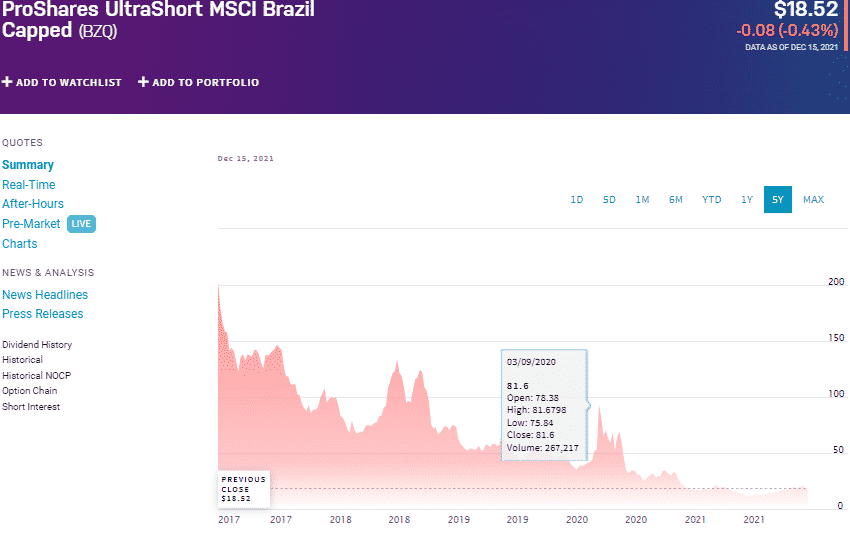

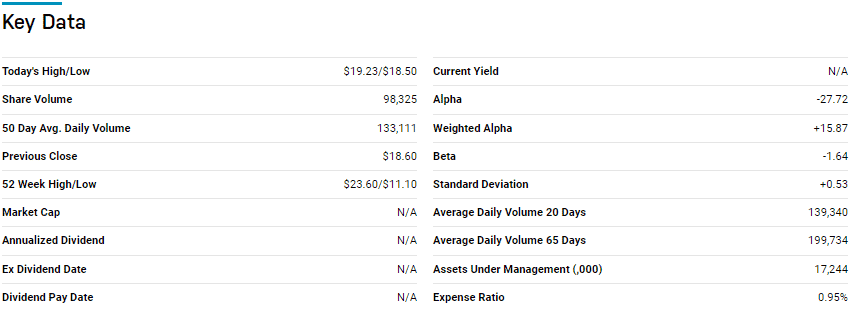

ProShares UltraShort MSCI Brazil Capped ETF (BZQ)

Price: $18.52

Expense ratio: 0.95%

Annual dividend yield: 1.07%

BZQ chart

ProShares UltraShort MSCI Brazil Capped ETF tracks the MSCI Brazil 25/50 Index, aiming for double the inverse results. It invests in financial instruments that, in combination, should result in daily inverse returns of the tracked index.

BZQ has $16.5 million in assets under management, with an expense ratio of 0.95%. Being an inverse ETF for short-term gains in the market downturn, the BZQ is an excellent choice for the current times and any economic turmoil; pandemic year returns of 2.76% and recent year-to-date returns of 8.14%. Before full economic resurgence, economic uncertainties will result in market volatilities, and the BZQ is a way to offset the momentary losses.

Final thoughts

Brazil ETFs are diversified across several sectors, ensuring a representation of the whole Brazilian economy. As this emerging market recovers from the coronavirus, the ETFs above are a great starting point for the start of Latina America’s biggest economy.

Comments