Investing in the cryptocurrency markets comes with high risk, as Bitcoin price fluctuations primarily dominate the market.

Index funds can be the solution for those who prefer a less risky option. Thus, you do not own the underlying asset, but you can benefit from the fund’s diversification.

There is an increasing number of crypto index funds since investors are starting to see the value of index funds vs. directly buying an asset. Bitwise Asset Management is the world’s largest crypto fund manager, with assets under management of $1.3 billion.

They offer various funds for investors to diversify their current portfolios, mainly targeted at those with an appetite for cryptocurrency.

One of the Bitwise funds is the Bitwise 10 Crypto Index fund that tracks the top ten cryptocoins.

Crypto fund overview: what is Bitwise 10 Crypto Index Fund?

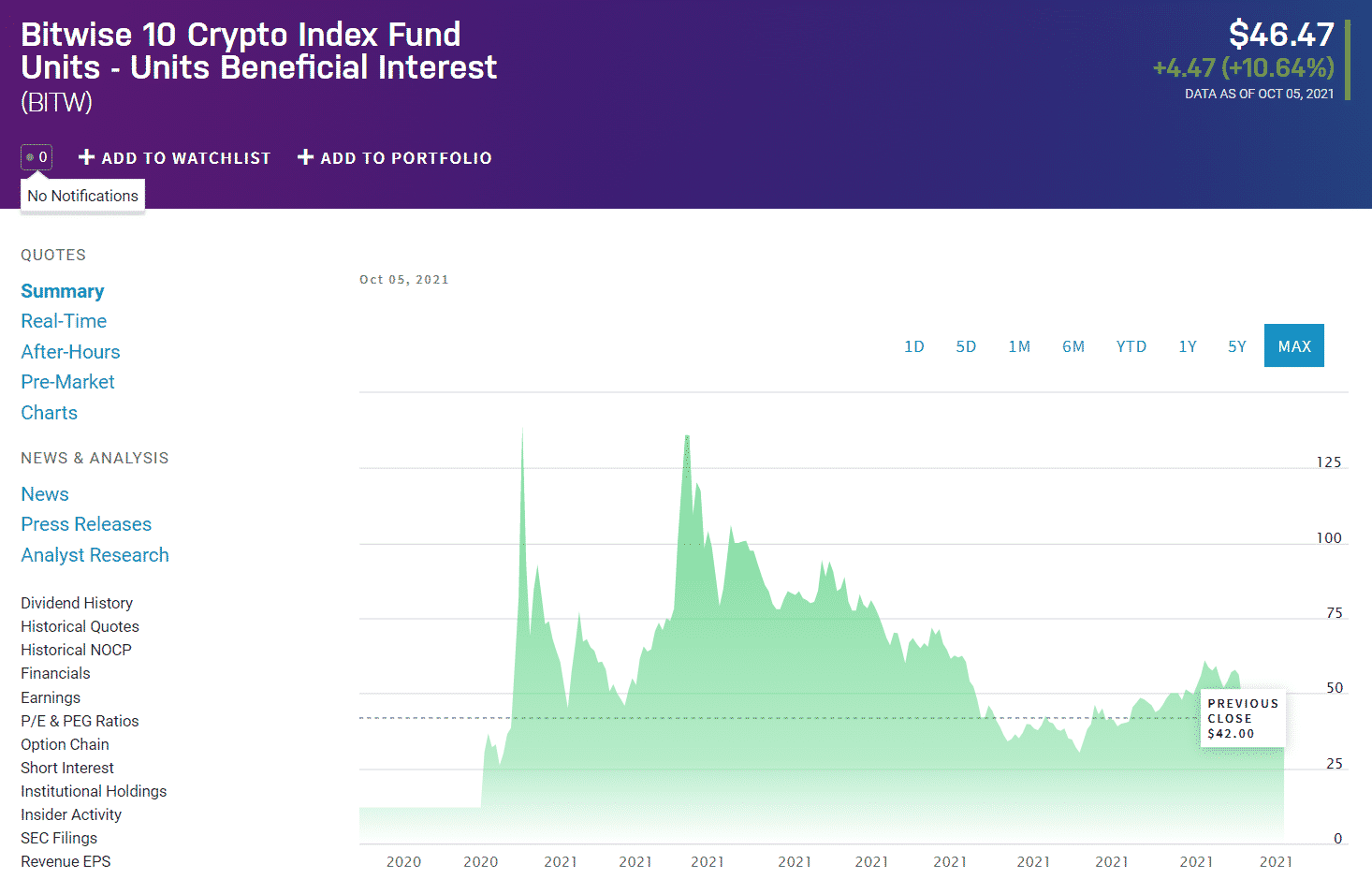

BITW chart

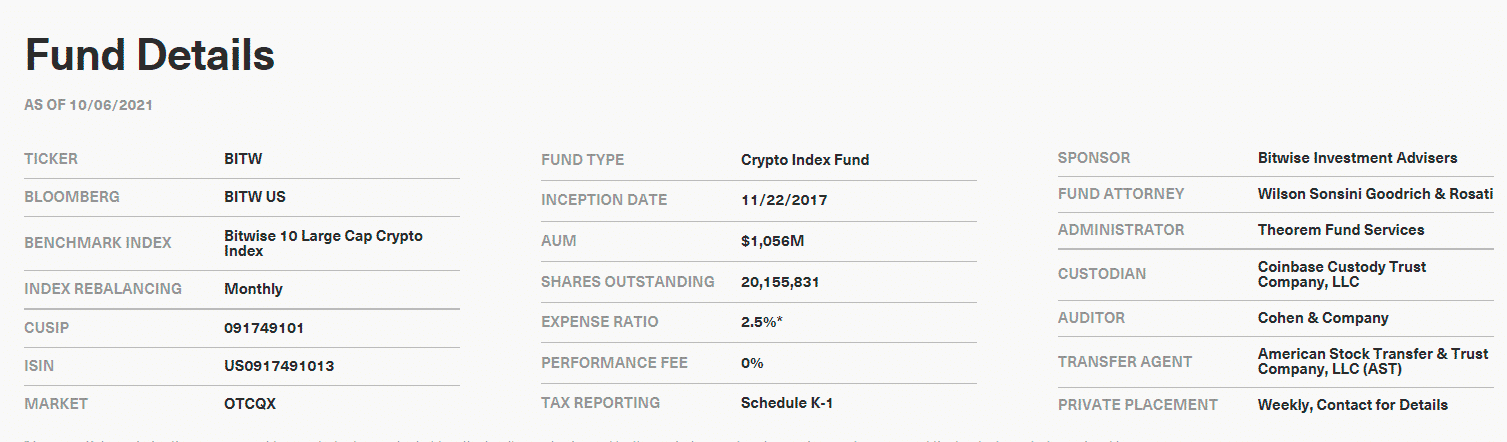

The BITW fund’s inception was on 22 November 2017, and the custodian of the fund is Coinbase Custody Trust Company, LLC. Currently, this fund has 52 investors.

The Bitwise 10 Crypto Index fund tracks an Index comprising ten cryptocurrencies with the highest value. The fund provides shares tradable under the ticker BITW via brokers that support index funds.

The BITW fund has an expense ratio of 2.5%. To date, the fund has 20,155,831 shares outstanding.

Assets are held in 100% cold storage with multi-signature configuration. Bitwise uses a third-party custodian and continuously evaluates security developments to stay in line with industry best practices.

What cryptocurrency is the Bitwise 10 Crypto Index Fund invested in?

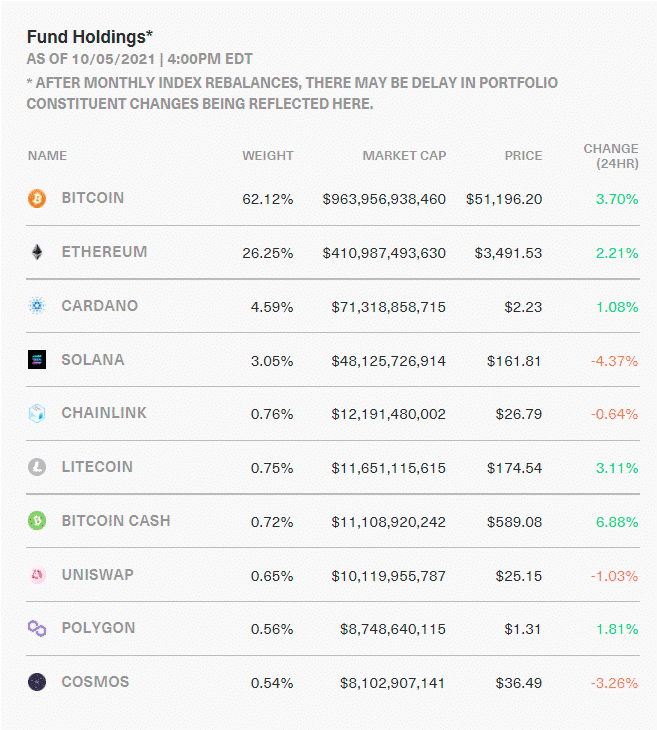

This fund tracks the top ten cryptocurrencies with the highest value. It undergoes monthly rebalancing, and its current holdings are displayed below.

BITW holdings

The coins on the list include the most popular and high-value cryptocurrencies. However, the fund rebalances the holdings due to the market fluctuation. Therefore, the list might change depending on the coin’s ranking in terms of value.

Bitcoin and Ethereum make up over 80% of the fund’s holdings, and it splits it as roughly 61% and 26%, respectively. The rest of the assets comprise the less valuable coins; however, these are still among the top ten.

How to invest in Bitwise 10 Crypto Index Fund?

The fund is open to individual, institutional, and investment managers who have an interest in cryptocurrencies.

The Bitwise 10 Crypto Index fund trades on the OTC markets. Accredited investors can sign up via the website under the private placement portal. Investors have to upload personal details and the relevant supporting documentation for approval.

Individual investors can buy and sell shares under a brokerage that supports the fund in the secondary markets.

As potential investors, it is good to note that the fund has a steep minimum requirement of $25,000.

Furthermore, investors that apply via the private placement service have to undergo a 12-month waiting period until shares are available for sale. In addition, publicly traded shares may be on offer at a premium or discount to the fund’s net asset value.

How big is Bitwise 10 Crypto Index Fund?

The BITW fund has $1,040 million assets under management, and it benchmarks the Bitwise 10 Large Cap Crypto Index. However, market cap data is not available.

The fund has raised a total of $84.5 million of funding in three rounds. The funding occurred in December 2017, May 2019, and June 2021. Most investors participated in the June 2021 round, totaling 42, raising $70 million.

Is Bitwise 10 Crypto Index fund safe?

It is essential to note the risks associated with crypto index funds. Therefore, we will list the pros and cons so investors can make an informed decision.

Pros |

Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Final thoughts

As we mentioned, the Bitwise 10 Crypto Index fund has many pros, but we cannot ignore the cons. To start, the fund requires a significant investment, which makes it difficult for individuals to take advantage of the opportunity.

Furthermore, the performance has been a bit flat, and the returns are not very large compared to traditional index funds. The fund’s expense ratio is also a point to consider and makes it an expensive investment.

Therefore, investors should carefully consider whether this is a viable option based on our shared facts.

Comments