The current global environment features rate hikes by central banks, creating an environment for banks to cash in on the need for investors and organizations to finance post-pandemic activities geared toward achieving post-pandemic numbers. The regional bank niche is a corner of this industry that can give exposure to the exponential profits expected. The low earnings reported by banks for the first quarter call for a diversified investment approach to this sector, and regional bank ETFs are a great place to start.

What is the composition of regional bank ETFs?

Regional banking ETFs comprise banks that operate within a specific geographical region and thrift, providing the following services; brokerage services, banking services, insurance brokerage services, and investment management payment facilitation.

Top 5 regional bank ETFs for effective money management in 2022

The road from the post-pandemic global economy to the pre-pandemic level will be guided by the banking and financial services, with the demand for finances by individuals, investors, and organizations providing the profitability updraft for the banking sector. These five regional banks’ ETFs offer diversified exposure to a corner of this industry and a chance to profit significantly from the current rate hikes and the looming double-digit hikes, coupled with the significant need for finances.

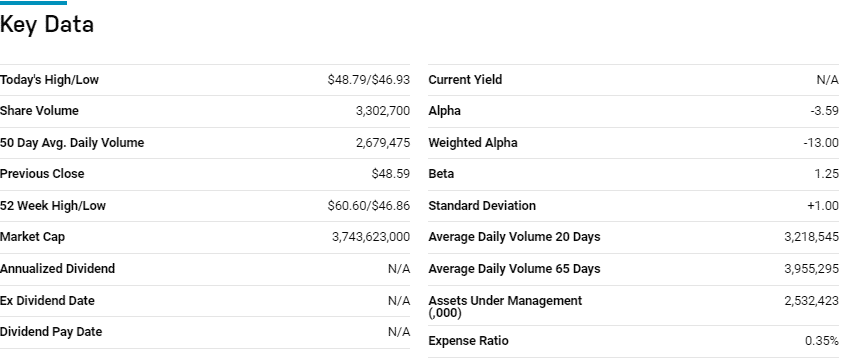

№ 1. SPDR S&P Bank ETF (KBE)

Price: $47.06

Expense ratio: 0.35%

Dividend yield: 1.94%

KBE chart

The SPDR S&P Bank ETF tracks the S&P Banks Select Industry Index, investing at least 80% of its total assets in the tracked index securities. It exposes investors to the US publicly traded money centers and regional banks.

In a list of 31 financial exchange-traded funds, the KRE ETF is ranked № 1 for long-term investing among passively managed funds.

The top three holdings of this fund are:

- Jackson Financial Incorporation Class A – 1.41%

- Voya Financial, Inc. – 1.34%

- Northern Trust Corporation – 1.34%

The KBE ETF has $2.51 billion in assets under management, with investors having to part with $35 annually for a $10000 investment. A pretty even weighting despite only having 25 holdings provides for a fund free of concentration bias which mitigates the inherent volatility of the financial segment.

The combination of two different financial sub-segments also provides diversification resulting in a resilient fund that can result in significant returns and consistent income in this interest rising environment; 5-year returns of 26.17%, 3- year returns of 16.93%, 1-year returns of -7.52%, and a decent dividend yield of 1.94%.

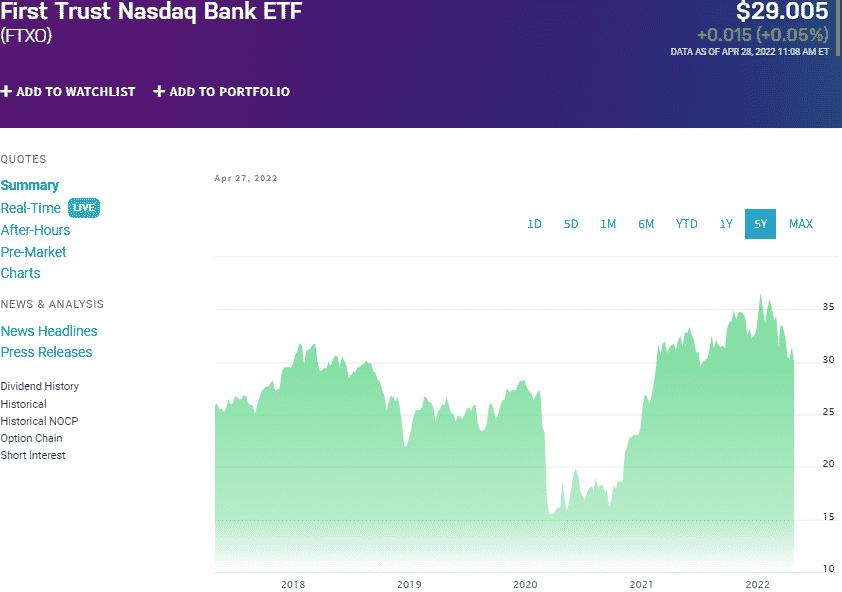

№ 2. First Trust Nasdaq Bank ETF (FTXO)

Price: $29.00

Expense ratio: 0.35%

Dividend yield: 1.52%

FTXO chart

The First Trust Nasdaq Bank ETF tracks the performance of the Nasdaq US Smart Banks IndexTM, investing at least 90% of its total assets in the securities comprising the tracked index and depositary receipts representing the tracked index underholding’s. It exposes investors to the US regional and national banking segment.

The FTXO ETF is ranked № 11 for long-term investing among passively managed funds in a list of financial exchange-traded funds.

The top three holdings of this ETF are:

- Popular, Inc. – 8.30%

- Wells Fargo & Company – 8.00%

- KeyCorp – 7.59%

The FTXO ETF has $304.3 million in assets under management, with an expense ratio of 0.60%. Concentrating on the most liquid banking ETFs that provide value and growth while mitigating against volatility. However, it is a fund with only 30 equities in its portfolio and might still experience relatively higher volatilities.

Despite this, the FTXO ETF still posts decent returns and provides consistent income; 5-year returns of 25.97%, 3- year returns of 19.85%, 1-year returns of -7.90%, and a decent dividend yield of 1.52%.

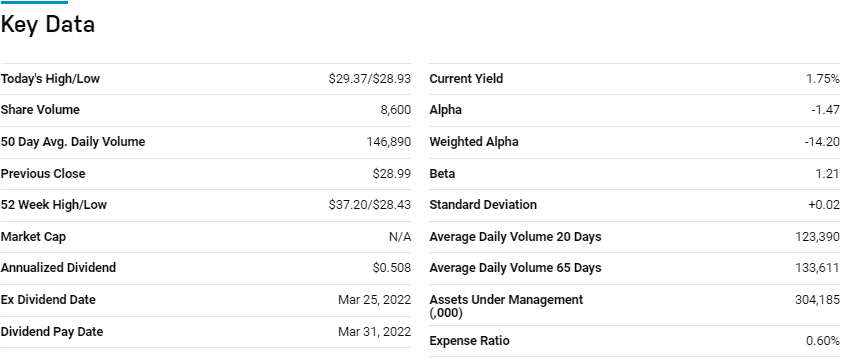

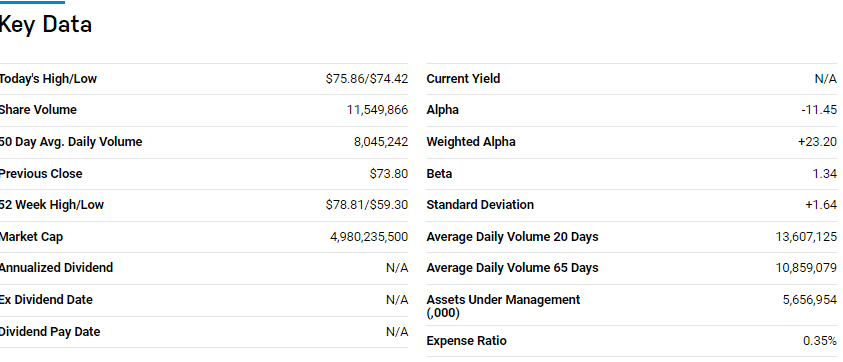

№ 3. SPDR S&P Regional Banking ETF (KRE)

Price: $62.88

Expense ratio: 0.35%

Dividend yield: 1.87%

KRE chart

The SPDR S&P Regional Banking ETF tracks the total return performance of the S&P Regional Banks Select Industry Index. It invests at least 80% of its total assets in the securities to achieve its investment objective, making up the composite index. It exposes investors to the US regional banking segment.

In a list of 30 financial exchange-traded funds, the KRE ETF is ranked № 11 for long-term investing among passively managed funds.

The top three holdings of this ETF are:

- First Horizon Corporation – 1.62%

- M&T Bank Corporation – 1.61%

- SVB Financial Group – 1.59%

The KRE ETF is the largest regional banking pureplay fund, boasting $4.18 billion in assets under management, with an expense ratio of 0.35%. An even weighting cap coupled with a holding base of small and mid-cap stocks provides for a fund that is resilient while offering growth and value attributes; 5-year returns of 27.17%, 3- year returns of 23.42%, 1-year returns of -6.35%, and a pretty decent dividend yield of 1.87%. The composition of this ETF ensures independence from the movement of wall street-based banking equities and an indirect play on the banking sector.

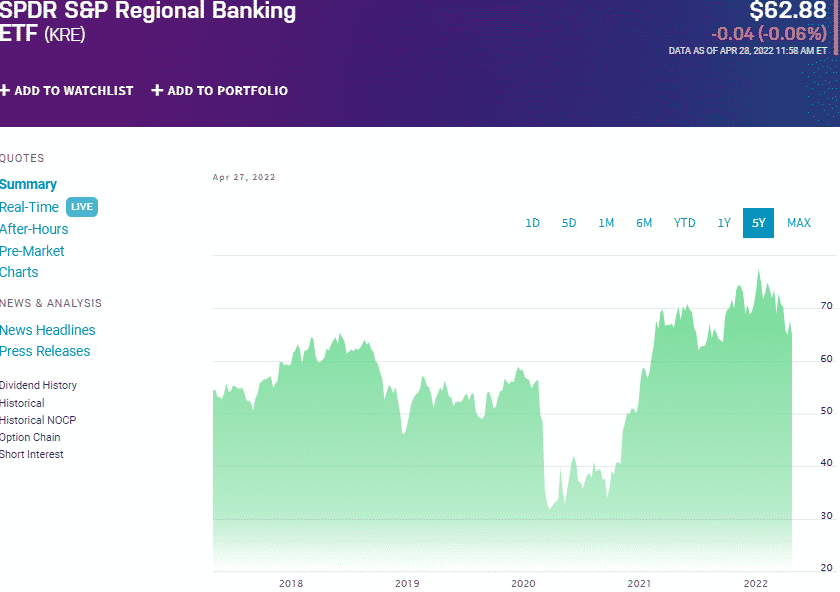

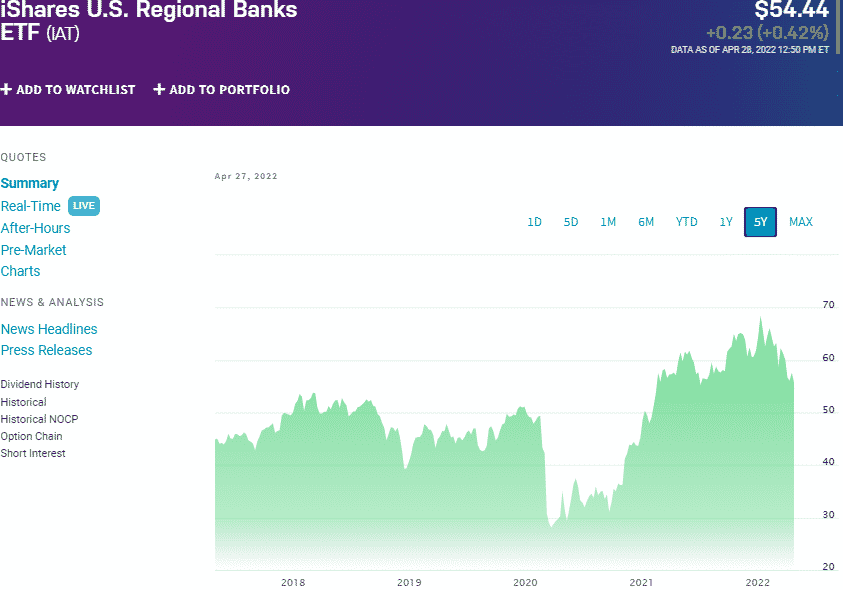

№ 4. iShares US Regional Banks ETF (IAT)

Price: $54.44

Expense ratio: 0.41%

Dividend yield: 1.75%

IAT chart

The iShares US Regional Banks ETF tracks the investment performance of the Dow Jones U.S. Select Regional Banks Index. It invests at least 90% of its total assets in the tracked index holdings to achieve its investment objective, exposing investors to mid-cap and small-cap equities operating within the US regional banking sector.

In a list of 25 financial exchange-traded funds, the IAT ETF is ranked № 14 for long-term investing among passively managed funds.

The top three holdings of this non-diversified ETF are:

- PNC Financial Services Group, Inc. – 12.39%

- US Bancorp – 11.68%

- Truist Financial Corporation – 11.56%

The IAT ETF has $1.04 billion in assets under management, with an expense ratio of 0.41%. This ETF is a unique play on the financial services sector by coupling small and mid-cap regional banking equities to ensure value and growth attributes. The result is a resilient fund in times of market downturn while providing phenomenal returns in bullish markets; 5-year returns of 34.97%, 3- year returns of 24.88%, and 1-year returns of 6.61%, and a more than the average dividend yield of 1.75%.

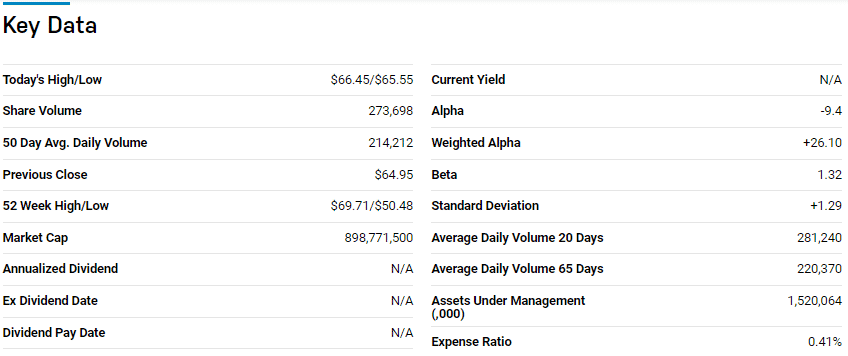

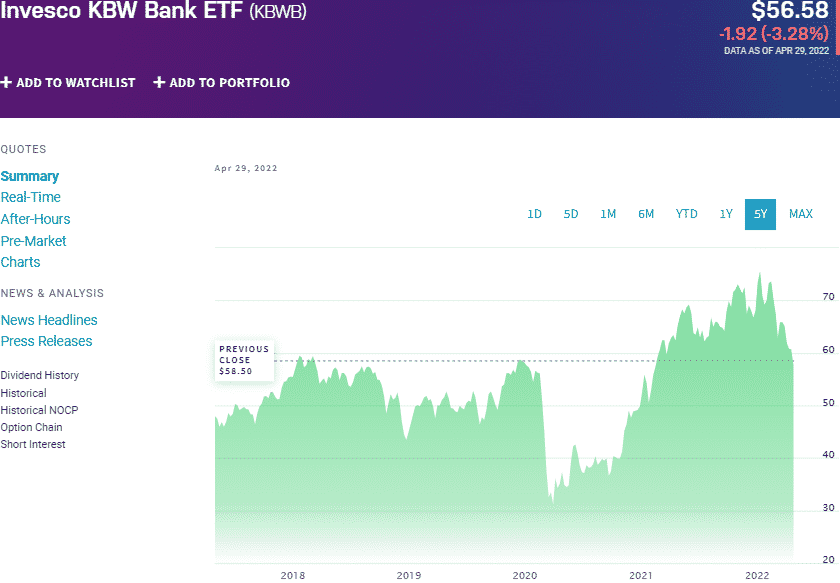

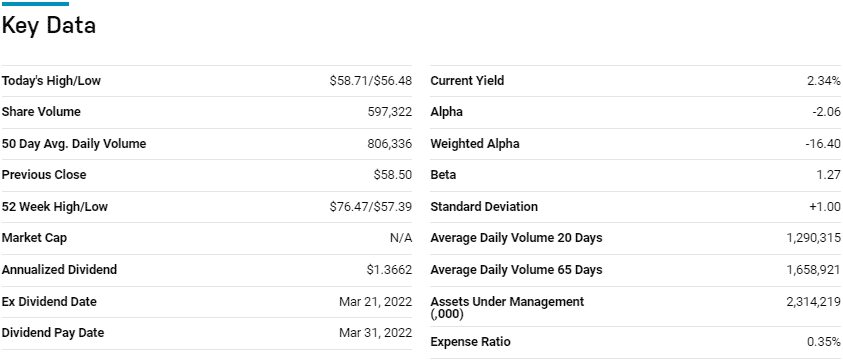

№ 5. Invesco KBW Bank ETF (KBWB)

Price: $56.58

Expense ratio: 0.35%

Dividend yield: 1.79%

KBWB chart

The Invesco KBW Bank ETF tracks the performance of the KBW Nasdaq Bank Index, investing at least 90% of its total assets in the securities comprising the tracked index. The tracked index is a modified market capitalization-weighted index that exposes investors to publicly traded equities operating within the regional bank space, thrift space, and national banks.

The KBWB ETF is ranked № 8 for long-term investing among passively managed funds in a list of 31 financial exchange-traded funds.

The top three holdings of this ETF are:

- US Bancorp – 8.30%

- JPMorgan Chase & Co. – 8.16%

- Citigroup Inc. – 7.98%

The KBWB ETF has $2.31 billion in assets under management, with an expense ratio of 0.35%. Despise the top five holdings accounting for a third of this fund’s total weight, its combination of thrifts, regional banks, and large national banks results in a balance for profitability and consistent income; 5-year returns of 39.06%, 3- year returns of 21.82%, 1-year returns of -8.12%, and a decent dividend yield of 1.79%.

Final thoughts

The FED already implemented a quarter interest rate hike with an expectation of double-figure hikes in June and July. Banks will skyrocket their profits on this backdrop and an updraft of expanding financial services demand. Both organizations and individuals are looking for accelerated growth towards pre-pandemic levels. Coupled with an expected financial sector growth of 70% in 2022, the three ETFs above provide an excellent starting point to cash in on this bullish run.

Comments