AVIA account management service can work with many brokers and comes with different packages that differ based on risk management. The company makes profits by charging a fixed amount of performance fee. Our article will take all the pros and cons of the company into account and consider the fact if you should invest in it or not.

AVIA has the following features with their service:

- The company provides a range of brokers from which the trader can choose from

- The strategy can work with accounts that allow hedging

- They offer a free 30-day trial who want to test them out

- There are multiple investment packages to choose from

How it works

You have to deposit the designated amount in the broker account and send over the login credentials to the company’s email. Traders have to sign the investor application form, and after doing so, the account managers will start trading the account.

Trading strategies and currency pairs

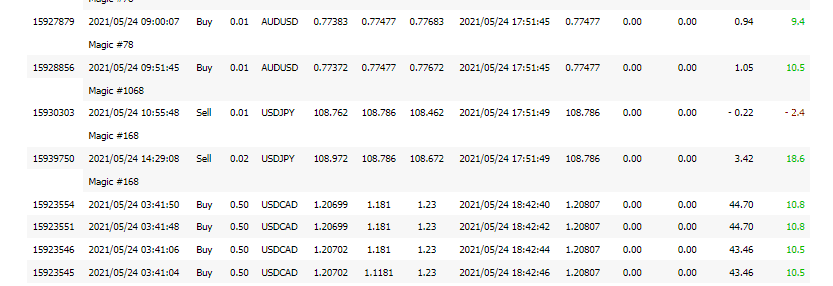

The company doesn’t share any information on its strategy, so we head over to the history of FXBlue records. From there, we observe that the company trades on multiple currency pairs and uses a martingale strategy. They start from a 0.1 lot size up to 0.5. After 0.5, they won’t increase the lot and use grid trading to get profits.

Trading history on FXBlue

There are no backtesting results available that can provide us with an insight into their historical output. They should state if they are using a robot and managing the trades manually afterward. It is pretty easy to test manual strategies using forex simulators. Lack of records raises great concerns over the performance of the system.

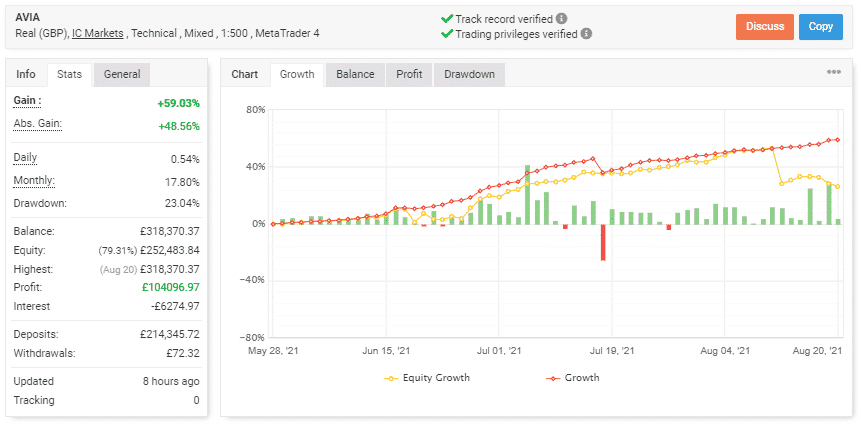

AVIA trading statistics

Verified trading records are available on Myfxbook, which shows records from May 28, 2021, till the current date for conservative settings. The robot provided an average monthly gain of 17.80%. During the duration, there were 2680 trades. It had a winning rate of 78% with a profit factor of 2.68. The best trade was 2206.08 pounds, while the worst was -5900.23 Pounds. The drawdown is 23.80% that is x3 times more than the company mentions on the website. This states that we should be cautious while investing as the managers are not adhering to their set rules for maintaining risk.

Trading records on Myfxbook

Pricing and refund

The company only charges a performance fee on the account, which can vary based on the deposit. As the account size increases, the costs become lower. The maximum is 36% for a portfolio with a minimum value of $3000. For accounts of $150K, the charges are reduced to 25%. It is clear that the company wants traders to invest more money with their program.

What else should you know about AVIA?

There are no customer reviews available on Forex Peace Army, and there are only performance tracking records. FPA states that the company started tracking their new account on 2021-03-05 and the previous records were closed. We got access to the old history from the additional statements tab and found out that the account had resulted in a margin call with a relative drawdown of 99.60%. The company couldn’t remove the records on FPA as they could have done on FXBlue and Myfxbook.

AVIA is no longer available

There is no sign of the Avia account management service on the website. Leafturn company even decided to change the link to their website to remove all possible signs of Avia. So, instead of Avia account management service, we have Alphi. The presentation is almost the same with some changes applied. Similar to Avia, Alhi trades with a high risk/reward ratio. So, it is obvious that Alphi will end the same way as Avia. It is only a matter of time.

Comments