Aeron (Scalper+Grid) makes use of two strategies for ensuring high returns and a low drawdown. As per the vendor, the approaches are customizable and provide consistent returns and minimum risk. The vendor does not provide details of the developer or the team members. There are no company details like founding year, reputation, other products, location address, phone number, etc. Other than the domain registration info there is no data on the vendor. For support, an FAQ and an email address are present.

Features of Aeron (Scalper+Grid)

As per the vendor, the features that make this FX robot stand apart are:

- The MT4 tool uses TP and SL for every position it opens.

- Equity risk management is used allowing you to fix the equity risk percentage.

- Its full automation allows it to increase the lot size with the increase in your equity or balance.

- This ATS is designed to work in volatile and stable market conditions.

- Recommended timeframe for this MT4 tool is M1.

- It works on the EURUSD, USDJPY, AUDCAD, CADJPY, and EURJPY.

- Any leverage and broker can be used for this FX EA.

- It works on cent, micro, and standard accounts.

- You need continuous internet connectivity as the scalping approach used is very sensitive.

For the deposit recommendation, the vendor offers a special tool to calculate the minimum amount needed. The vendor states that a minimum of $100 to $200 is sufficient to start using the EA. However, the account should be a cent account. For the regular accounts, a deposit of $1000 is sufficient. The vendor states that you should not use an amount that is 50% less than the recommended value.

Trading strategies and currency pairs

According to the vendor, this FX robot uses the scalping method that uses high trading frequency aiming at making small profits with each trade. The system also used the grid method which involves hedging. It also involved placing alternate sell and buy orders. In general, the grid approach is considered dangerous as it stands to lose a large amount of capital if you are not careful. There are no backtesting reports present for the EA.

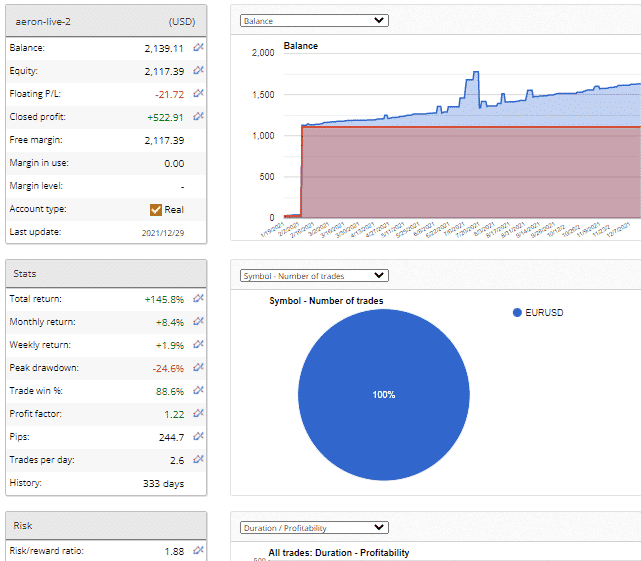

Aeron (Scalper+Grid) trading statistics

Trading stats for Aeron (Scalper+Grid)

A real live USD account verified by the FXBlue site is shown above. From the stats, we can see the account that started in January 2021 has a total return of 145.8%. The weekly and monthly returns are 1.9% and 8.4% respectively. A peak drawdown of 24.6% is present and the profit factor is 1.22. The profitability is 88.6%. The history shows 333 days of trading have been completed with an average of 2.6 trades in a day. From the results, we can see the profit factor is low indicating a below-average performance.

Further, the drawdown is high indicating a risky approach. The growth curve shows a rapid peak followed by a steep drop and subsequent smooth progress. A risk to reward ratio of 1.88 is present. The irregular growth and high risk to reward ratio indicate an ineffective and risky strategy.

Pricing and refund

Pricing of Aeron (Scalper+Grid)

You can buy this FX robot for $230. As per the vendor info, the price is applicable for the initial 50 copies of the software or for the subsequent 2 days, whichever comes first. The final price is $349. We could not find info on the features that are available with the product. There is no refund policy which makes us suspect the reliability of the system. When compared to the prevailing price of competitor products the price of this ATS is a bit expensive.

What else you should know about Aeron (Scalper+Grid)

Unfortunately, there are no reviews available for this product on reputed third-party sites like FPA, Trustpilot, etc. We look for feedback from such sites as they are reputed for their unbiased feedback on FX products.

Comments