ETF full name: ProShares Ultra Yen YCL

Segment: Currencies

ETF provider: ProShares

| YCL key details | |

| Issuer | ProShares |

| Dividend | N/A |

| Inception date | November 24, 2008 |

| Expense ratio | 0.95% |

| Management company | ProShares |

| Average 3-5 EPS | N/A |

| Average Annualized Return | -6.76% |

| Investment objective | Exposure to the USD/JPY cross |

| Investment geography | Leveraged Currencies |

| Benchmark | USD/JPY |

| Leveraged | 2x |

| Median market capitalization | N/A |

| ESG rating | N/A |

| Number of holdings | 1 |

| Weighting methodology | Single asset |

About the YCL ETF

ProShares Ultra Yen YCL ETF started in November 2008. It offers traders a chance to bet on a solid performance of the Japanese yen versus the United States dollar or hedge against existing dollar exposures in their portfolios.

YCL Fact-set analytics insight

YCL ETF resembles a single asset fund with no holdings but the USD/JPY cross rate. It uses the double daily leverage to multiply gains achieved in a single trading session. Given its nature, the accumulation of gains in multiple sessions doesn’t necessarily amount to the target multiple. This consequently means that traders who don’t have the time or the skillset to rebalance their assets daily should not commit to this ETF.

The YCL exchange fund uses single asset tracking for its methodology.

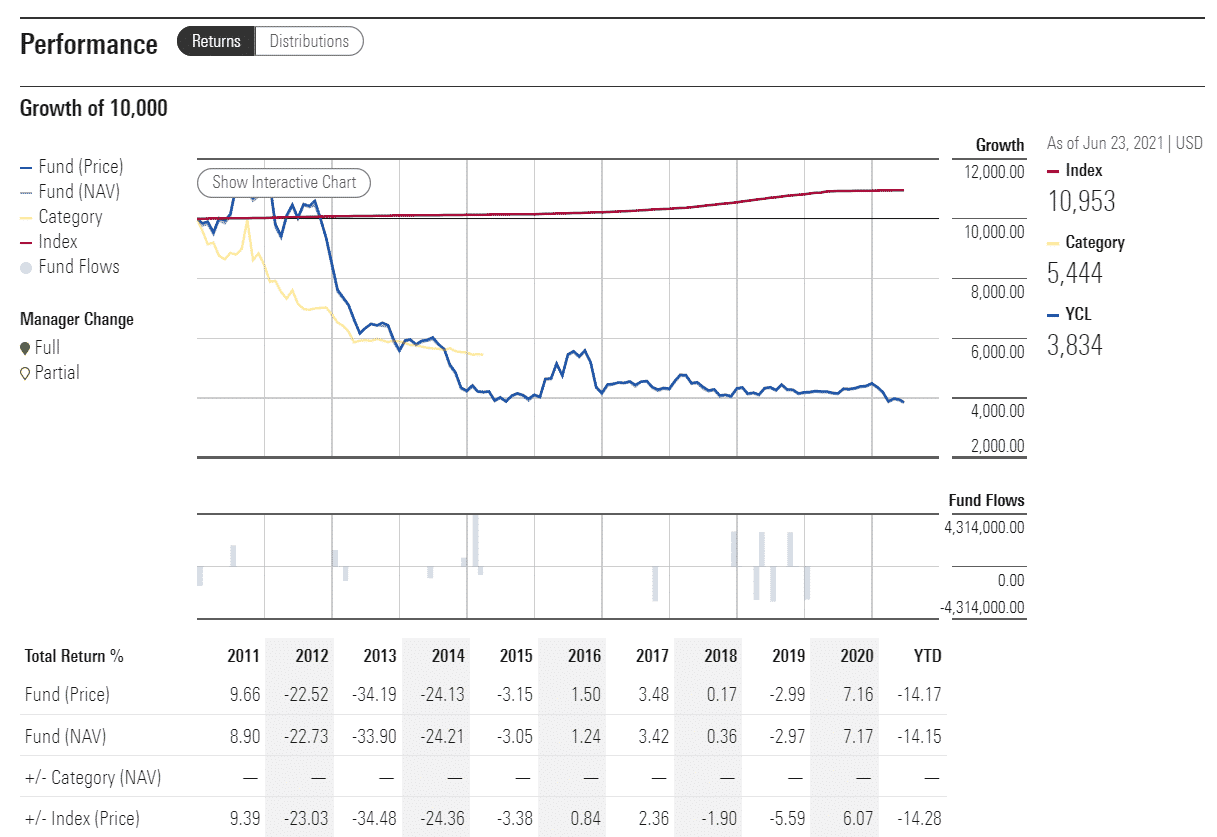

YCL performance analysis

The spike that occurred at the beginning of the Covid-19 pandemic showcases the dual nature of the yen. While its trend resembles the image of the Japanese economy among the traders, it is a ‘safe haven’ asset during times of crisis. Similar to precious metals, the popularity of the Japanese currency skyrockets during times characterized by extensive volatility.

In this case, it is unclear whether the movements are caused by the global upheaval or something specific from within either of the two economies; traders can consult the USD/CHF pair, which is also an asset of the turmoil.

YCL ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| YCL Rating | N/A | 5 out of 5 | Quintile 5 (97th percentile) | N/A | N/A |

| YCL ESG Rating | N/A | N/A | N/A | N/A | N/A |

YLC key holdings

With the nature of this ETF in mind, the holders should be confident that they will commit the necessary time for tracking the fund before deciding to invest. The YLC ETF offers amplified gains across a single trading session, but it takes knowledge and a good deal of experience to anticipate the trend accordingly.

An irresponsible approach could easily lead to amplified losses. The fund issuer attaches a disclaimer that the fund is not the most optimal addition for traders looking for a balanced, low-intensity portfolio.

Industry outlook

With the dual nature of the USD/JPY in mind, the traders need to pay attention to both aspects of the asset. With the vaccine rollout in advanced stages in many vital economies, it can be expected for the safe-haven side of the cross to lose traction, much like it did after the previous recession. On the other hand, global turmoil is not the only thing driving the rate up or down.

Following the monetary policy of the Bank of Japan and the one of the US Federal Reserve can prove crucial to being able to anticipate future trends of the pair. Both central banks recently ruled against tapering the stimulative measures to uphold the countries’ national currencies. At the same time, BoJ’s Governor Kuroda was seemingly more adamant against changing the response shortly than his American counterpart. Be sure to follow the statements of both financial institutions, and you might be able to make the best of trading on the Japanese yen if you decide to do so.

Comments