ETF full name: Vanguard US Dividend Appreciation ETF CAD-H

Segment: Large-cap blend (US Equity)

ETF provider: Vanguard

| VGH details | |

| Issuer | Vanguard |

| Dividend | $0.18 |

| Inception date | 2 August 2013 |

| Expense ratio | 0.30% |

| Management company | Vanguard Equity Index Group |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 17% |

| Investment objective | Seeks to track the performance of the S&P US Dividend Growers Index (CAD-hedged) |

| Investment geography | North America |

| Benchmark | S&P US Dividend Growers Index (CAD-hedged) |

| Leveraged | N/A |

| Median market capitalization | $191.9 billion |

| ESG rating | N/A |

| Number of holdings | 268 |

| Weighting methodology | Weighted |

About the VGH ETF

The Vanguard US Dividend Appreciation ETF CAD-H inception was on 2 August 2013. The VGH fund trades on the Toronto Stock Exchange under the ticker symbol, VGH.

The fund aims to track stocks of US companies that have a record of increasing dividends over time, whose Index is hedged to the Canadian dollar. The fund benchmarks the S&P US Dividend Growers Index (CAD-hedged).

Vanguard Investments Canada Inc. manages the VGH fund.

VGH Fact-set analytics insight

The VGH ETF has a net expense ratio of 0.30%. The fund has a median market cap of $191.9 billion and total net assets of $413 million. Furthermore, the fund has a daily trade volume of 33,613 units. The VGH fund has a spread of 0.08%.

VGH performance analysis

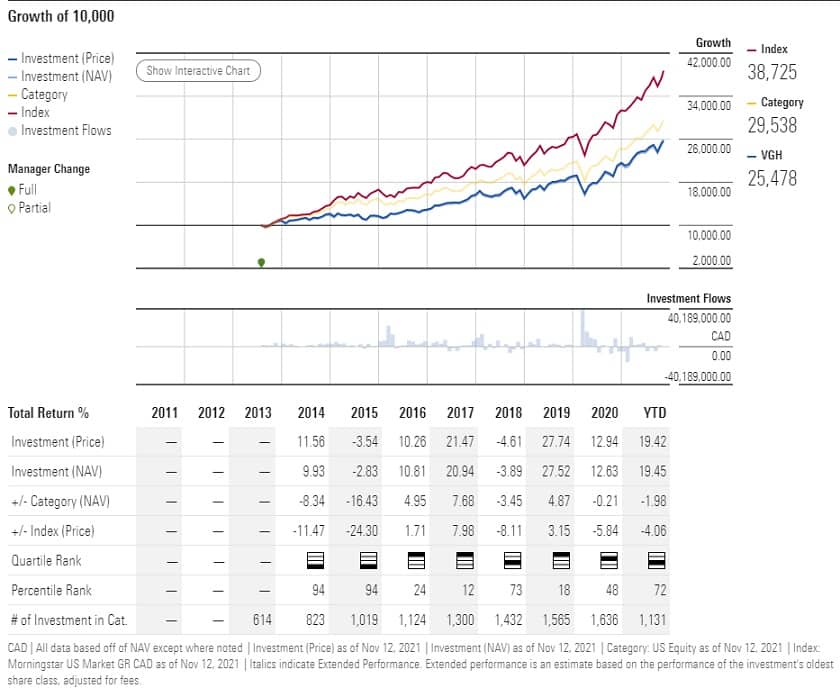

The projected growth of a $10,000 investment since inception came to $25,478. The VGH fund has no ESG ratings. The fund is currently trading at $56.22 per share.

VGH ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| VGH Rating | N/A | N/A | N/A | *** | N/A |

| VGH ESG Rating | N/A | N/A | N/A | N/A | N/A |

VGH key holdings

The VGH fund has a total of 268 holdings. The fund invests in US equities, and therefore, its geographical distribution is in North America only.

The fund’s top sector breakdown is as follows:

- Industrials 22.1%

- Consumer discretionary 15.6%

- Financials 15.4%

- Health care 13.9%

- Technology 13.4%

Below is a list of the top ten holdings by company.

| Ticker | Holding name | % of assets |

| MSFT | Microsoft Corp. | 4.5 % |

| JPM | JPMorgan Chase & Co. | 3.9% |

| JNJ | Johnson & Johnson | 3.8% |

| UNH | UnitedHealth Group Inc. | 3.3% |

| V | Visa Inc. | 3.2% |

| HD | Home Depot Inc. | 3.1% |

| PG | Procter & Gamble Co. | 3.0% |

| CMCSA | Comcast Corp. | 2.3% |

| ABT | Abbott Laboratories | 1.9% |

| PEP | PepsiCo Inc. | 1.8% |

Industry outlook

The VGH fund had an average annual return of 10.4% over the past eight years. The stock is currently trading in the 70%-80% percentile range relative to its historical stock score levels.

The fund has an expense ratio of 0.30%, which is quite affordable compared to its peers in the category.

The fund is ideally suited for investors looking to benefit from long-term large-cap equities. Furthermore, the projected growth of the fund is showing significant returns, with a 254% return on investment since 2013.

Analysts have rated the fund a buy right now. However, investors should consider the risks related to the stock market carefully.

Comments