Tip Toe Hippo is said to prioritize safety through drawdown control. Unfortunately, the vendor does not say anything else that could help us understand what the system is and what it brings to the table. Therefore, traders can easily decide to ignore it and direct their attention to trading tools that take their sales pitch seriously.

The developers behind this EA are incognito. Their background information as well as the profile of the company they work under is unknown.

Oddly enough, the vendor does not think it is important to introduce us to the features of the product. This is bad practice as traders interested in this system are denied the chance to know what exactly they are paying for.

Trading strategies and currency pairs

The trading logic used by this tool is not mentioned or explained. Therefore, we do not know the formula it uses to make profits.

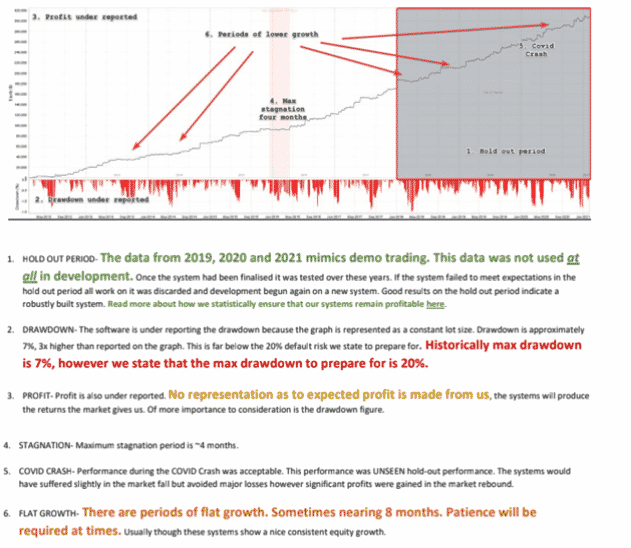

The developers do not provide us with the standard backtest report. It is hard to figure out the performance of the trades conducted when the system was being tested. We do not know the success rates of the long and short trades, the profit factor, drawdown level, and total net profit. However, let’s have a look at what the team has to say about their backtest data:

Profits report

We are told that the historical maximal drawdown of the system is 7%. However, traders are warned to watch out for a drawdown of 20%. It was also disturbing to discover that the developers were unaware of the bot’s profit potential when they were testing it. Even more perturbing was the realization that the EA stagnated for 4 months. In addition, periods of flat growth were present, sometimes nearing 8 months.

Tip Toe Hippo trading statistics

Trading stats

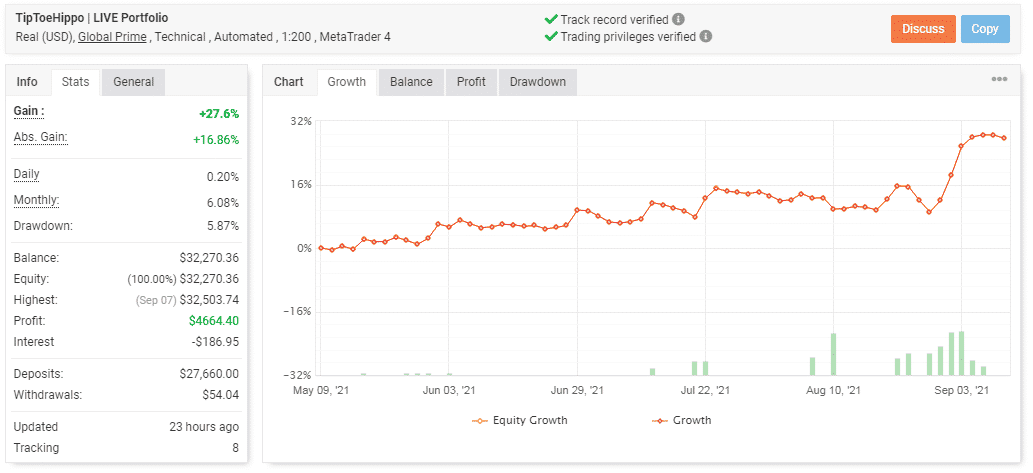

We are introduced to a real USD account that is being run by this robot on Myfxbook.com. It started its operations on May 9, 2021. To date, a deposit of $27660 has been turned into a profit of $4664.40. The system has been making a monthly profit of 6.08%. The drawdown, which is, 5.87% is not high.

Trading performance

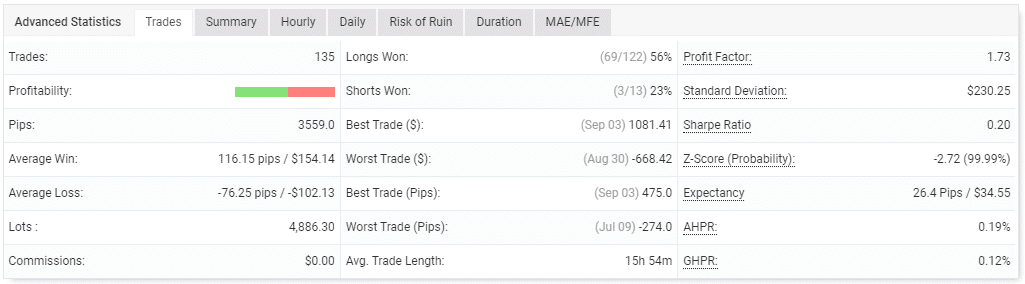

The bot has made 135 trades with 4886.30 lots. From the stats above, it is evident that not many trades are successful. Of all the long positions taken, only 56% of them have been won. The performance is even worse for short positions because only 23% trades have brought in winnings. The profit factor is 1.73. The average win and the average loss are 116.15 pips and -76.25 pips respectively.

Performance of currencies used

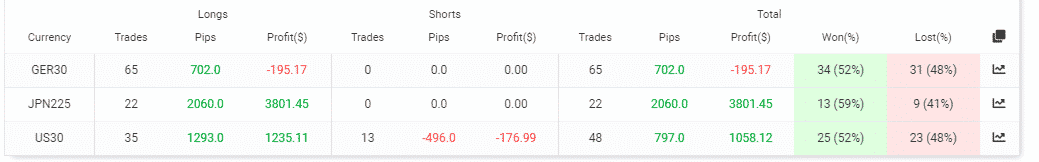

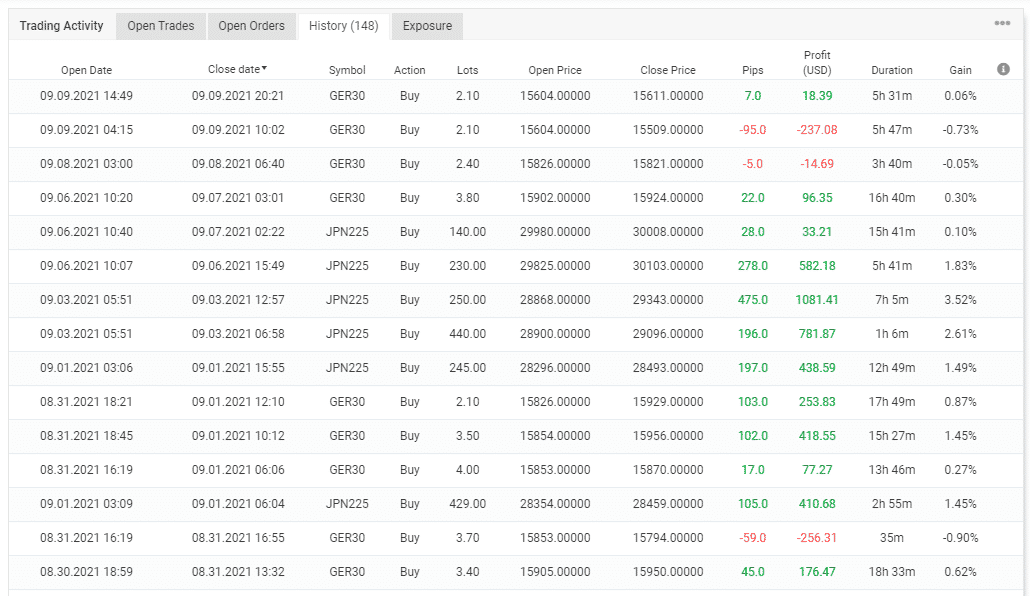

The table above showcases the performance of GER30, JPN225 and US30 currencies. Despite engaging in a majority of the trades, the GER30 is the least profitable instrument. In fact, it is also the only symbol that suffered losses. JPN225 is doing well as it recorded a profit of $3801.45.

Trading history

The system traded with huge lot sizes. It also won large pips.

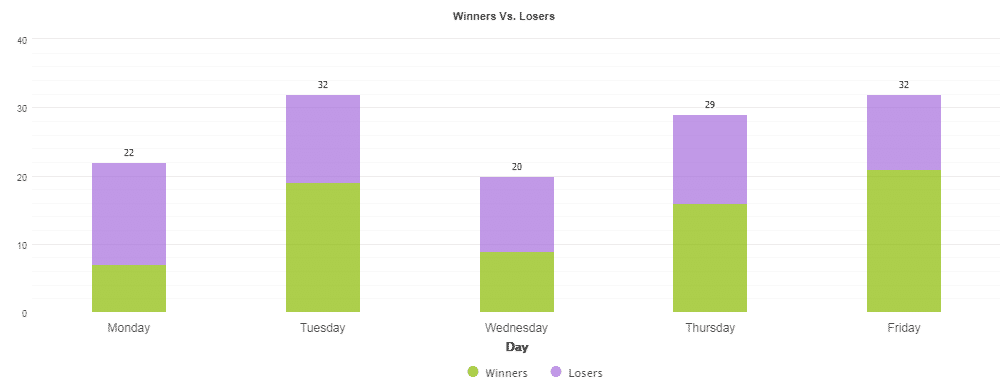

Trades conducted Monday through Friday

The system managed to complete 32 deals on Tuesday and Friday making them the most active days as far as trading is concerned.

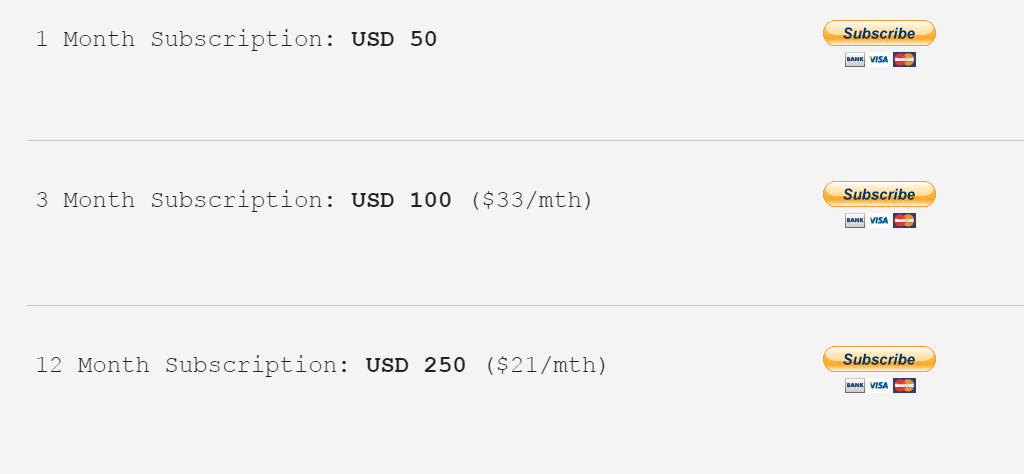

Pricing and refund

Tip Toe Hippo’s pricing plans

There are 3 subscription packages being offered by this vendor. The least amount you can spend is $50, and in return, you can use the robot for 1 month. To get served for a longer period, say 3 months, $100 is needed. Lastly, a full 12 months subscription is available at $250. A money-back guarantee is not featured. Although some of the offers appear cheap, you will still not get value for money. The system’s profitability rate is not something to boast about.

What else you should know about Tip Toe Hippo

This product does not have any customer reviews on platforms like Forex Peace Army, Trustpilot or Quora. Since the system is new in the market, it is possible that many Forex traders are unaware of its existence.

Comments