Introduced in the 1990s, ETFs are popular with investors. Today they are crowding out hedge funds and mutual funds due to their simplicity and low fees, and the profitability does not depend on the efficiency of the managers. Even the famous Warren Buffett recommends ETFs for inexperienced investors.

The rationale is pretty simple, rather than invest in individual equity stocks, bonds, or real estate property, why not invest in a fund that cuts across the industry spectrum of interest. In the long run, the economy as a whole is bound to grow, and your long-term investment will be fruitful. This kind of thinking might be the fuel for increasing the popularity of the ETFs to the extent of their evolution to encompass the trigger-happy investors.

For the thrill-seeking investor, the patient involved in wealth creation over the long-term via ETF investing is not appealing. Therefore, this popular investment instrument has evolved to satisfy the risk-taking appetite of the active traders through leveraged ETFs.

The traditional ETFs are a haven investment with minimized risk, while leveraged ETFs are a high-risk investment asset class.

How do leveraged ETFs work?

An ETF is a basket of investment assets that track the performance of a particular index. Traditional ETFs’ only objective is to match the performance of their index and invest heavily in the underlying assets.

For example, the double-leveraged ETF that tracks the S&P 500 aims to provide 200% of the daily return on the underlying index. If the index increases in value by 5%, the double-leveraged ETF should increase by 10%.

The 2x, 200%, and 2:1 ETF designations for 2x leverage ETFs refer to the same leverage ratio. Likewise, if the index falls 5%, the leveraged ETF will fall 10%. Thus, leveraged ETFs provide the potential for more significant gains but also greater potential losses.

Leveraged ETFs, on the other hand, actively seek to outperform the index they track. Thus, they comprise the underlying assets, the index itself, and the derivatives of the underlying index.

So why complicate the ETF composition further?

To try and outperform the underlying index by two or three times. To achieve this objective, leveraged ETFs deal in.

- Options: contract giving the right to buy/sell investment assets at a predetermined price in the future.

- Futures: a binding agreement to buy/sell an asset on a specific date at a particular price and in specific quantities.

- Swaps: a contract that allows for the exchange of cash flows or liabilities between two different financial instruments. For example, a leveraged ETF might agree to pay the returns of maturing municipal bonds in exchange for two times the returns of the Dow Jones index.

Despite leveraged ETFs dealing in futures contracts and strategies that seem future-focused, they are better off trading on a day-to-day basis. This is because the compounding effect of losses and profits results in the overall long-term leveraged ETFs falling short of the expected returns.

As such, leveraged ETFs are better off trading on a day-to-day basis rather than a long-term investment.

Pros of leveraged ETFs

Leveraged ETFs expose investors to more risk than their traditional counterparts but continue to endear to the larger ETF market because:

- Enhanced liquidity

Leveraged ETFs trade like traditional ETFs throughout the day. With leveraged ETFs, this liquidity heightens since they are more profitable in intraday trading.

- Loan option

Leveraged ETFs offer investors a way to invest more than their capital: allow for in-the-fund borrowing for trading purposes. As a result, one can enjoy enhanced returns without investing more than your investment.

Cons leveraged ETFs

As high-risk, high-return investment instruments, investors in leveraged ETFs have to deal with:

- Short-term trading

Leveraged ETFs are for intraday trading-proven to produce high returns as short-term investments.

- Compounding

As a result of leverage, these ETFs experience a negative compounding effect hence inaccuracy in tracking the performance of the tracked index as intended — two or three times the returns.

- Higher risk

Leveraging provides an avenue for double or triple returns and results in equal losses. For example, if the ETF is three times leveraged, then the potential return is three times the investment, but the loss is also three times the staked amount.

Who should invest in leveraged ETFs?

The chief reason for ETF investing is low-cost investing for consistent returns with low volatility and risk. Unfortunately, leveraged ETFs don’t offer these assurances. Whereas regular ETFs focus on long-term gains, leveraged ETFs focus on daily returns-seek two or three times the daily returns of the tracked index. Therefore, these ETFs are for the trigger-happy investors that love the thrill of active daily trading.

Leveraged ETFs also conform to the universal rule of the higher the risk, the higher the returns. To enjoy the two or three times returns these ETFs promise, investors have to deal with higher risks and increased volatility than traditional funds. It is never easy to make investment losses, but with leveraged ETFs, this is compounded-the leverage factor magnifies losses by that factor.

Leveraged ETF worth to invest in

Leveraged ETFs are a high-risk investment, but well-timed choices can result in quite the pay-off. Let’s look at the top three leveraged ETFs that are worth investing in.

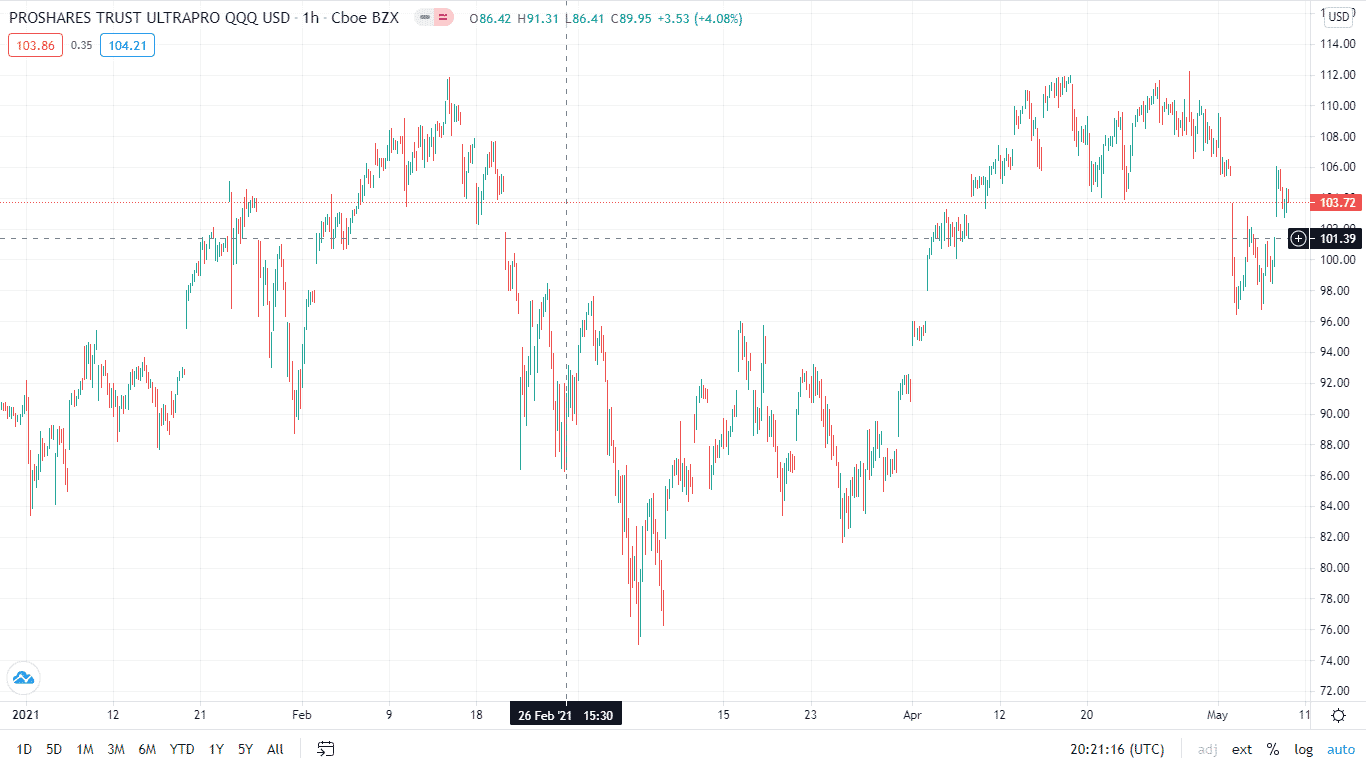

TQQQ

ProShares UltraPro QQQ is a non-diversified fund that seeks 3X the returns of the Nasdaq-100 index daily. TQQQ underlying holdings are Nasdaq listed non-financial organizations — top 100, market capitalization basis, international and US-based companies.

The TQQQ has an average daily return of 2.5%, which isn’t too far off from its target of 3X. In addition, it boasts of 11.28 billion in assets under management, with investors coughing up 0.95% to acquire it.

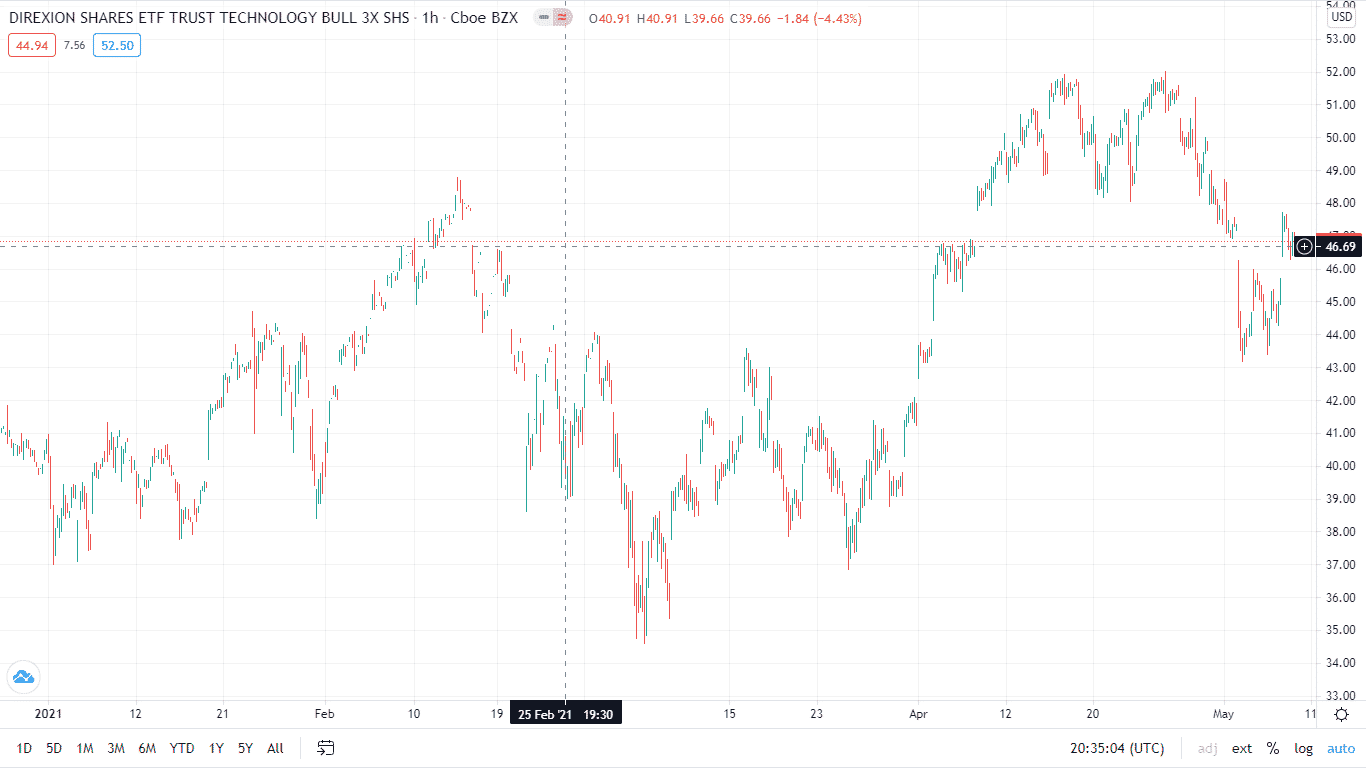

TECL

It is the top dog in leveraged ETFs. From it, we have the Daily Technology Bull 3X Shares, a tech-focused fund tracking the technology select sector index and seeks 3X the sector’s returns.

The TECL has so far surged 30% compared to 9% for its tracked index-very close to the 300% return it seeks. The fund has $2 billion in assets under management and an expense ratio of 1.01%.

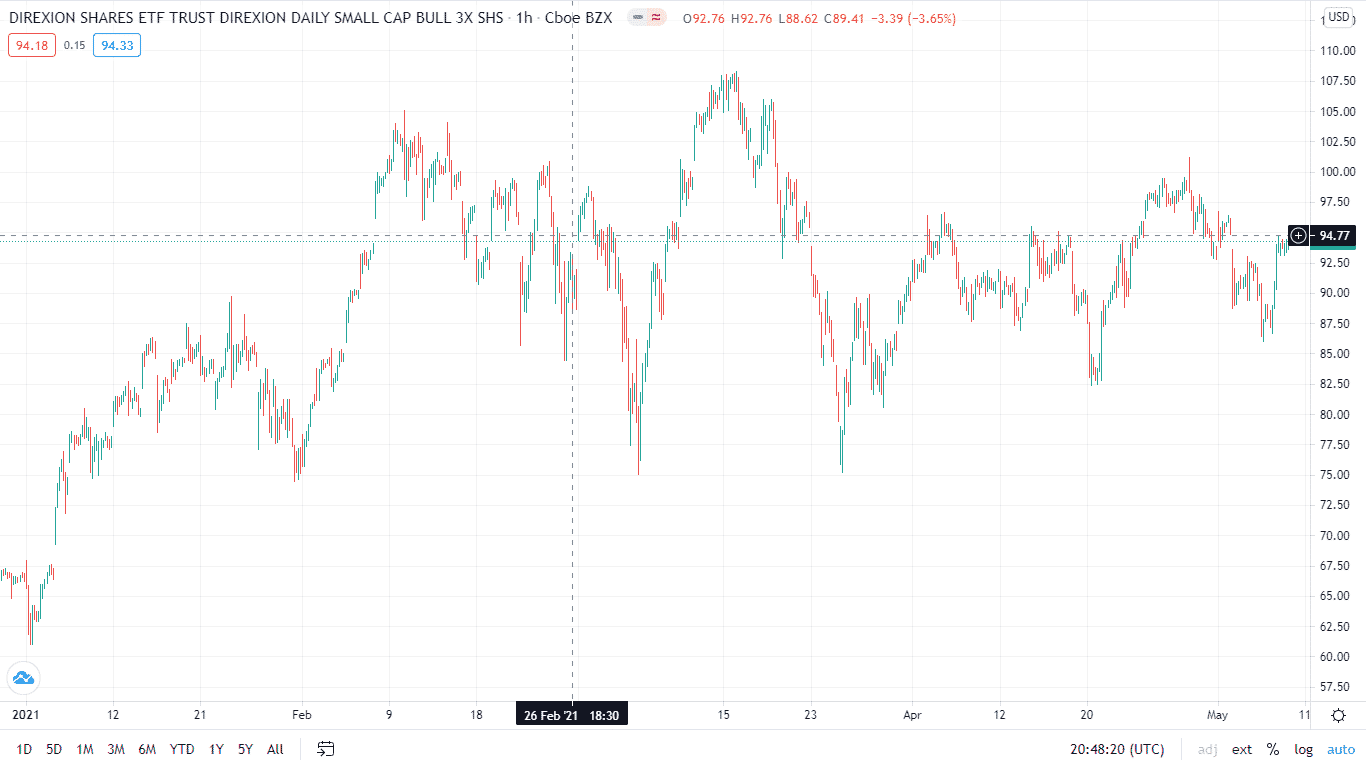

TNA

Direxion Daily Small Cap Bull 3X Shares is yet another direction brain child-confirming the dominance of Direxion as a leveraged ETF provider. It is a non-diversified fund that tracks the performance of the Russell 2000 index, intending to get 300% returns.

The corona pandemic had this leveraged ETF at negative 40%, but as the chart above shows, the recovery of the global economy from the clutches of covid19 has it recovering. Moreover, since it is a fund interested in small-cap companies, 2000 Russel 2000 index companies, the expectation is consistent upward trajectory as they resume full operation post-pandemic. The fund has $1.66 billion in assets under management and an expense ratio of 1.1%.

Comments