ETF full name: Renaissance IPO ETF

Segment: Energy

ETF provider: State Street Bank and Trust Company

|

IPO key details |

|

| Issuer | Renaissance Capital |

| Inception date | October 14, 2013 |

| Expense ratio | 0.6% |

| Management company | Smith Ng |

| Average P/E ratio | 49.45 |

| Average Annualized Return Since Inception | 16.96% |

| Investment objective | Growth |

| Investment geography | Small-Cap Growth |

| Benchmark | Renaissance IPO Index |

| Leveraged | N/A |

| Median market capitalization | $115.45 Billion |

| ESG rating | B: 2.49 out of 10 |

| Number of holdings | 63 |

| Weighting methodology | Market capitalization |

About the IPO ETF

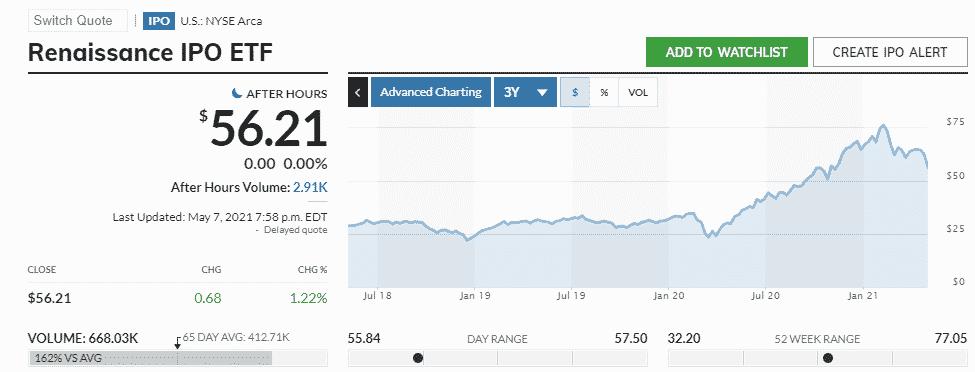

Investors got a chance to invest in the IPO ETF for the first time in October 2013. The unabbreviated name for this ETF is the Renaissance IPO ET. It is a non-diversified fund made up of small-cap organizations cutting across the entire economic spectrum.

It adds its holdings within 90 days of an initial public offering and removes them after 500 days of trading. Since its inception, the IPO ETF has recorded an average annualized return of 16.96%.

IPO Fact-set analytics insight

The Renaissance IPO index comprises 63 small-cap companies, giving investors early access to budding companies with growth potential. It is, therefore, a non-diversified small-cap ETF with the majority of its holding in the US and scattered presence in the international market; Asia emerging, Asia developed, Latin America, Canada, and the Eurozone.

The IPO ETF remains true to its objective by adding its budding holdings on a fast entry basis coupled with quarterly reviews for more additions and subtractions, as need be. As a result, investors get a chance to invest in IPO companies with reduced risk and before they appear on other equity indices. The fund has a 10% capping on its constituent holdings.

IPO annual performance analysis

The novel coronavirus has not been kind to the economic sector as a whole. However, the pandemic has also given rise to a new way of doing things and living, and with it numerous opportunities. Tech and logistics organizations have cropped up to ensure that people live in comfort and connect virtually despite the lockdowns and cessation of movement. Renaissance LLC has also assured that the fund is available on the Mexican stock exchange-the largest in Latin America.

The venturing of this ETF into the cryptocurrency market through Coinbase Global is evidence of its commitment to start-ups, no matter the economic sector. Moreover, as more emerging markets spur the listing of budding companies, the bullish outlook is constant.

The Renaissance IPO ETF has $558.48 million in assets under management, with investors parting with 0.6% in expenses for a piece of the action.

On the MSCI scale, IPO ETF has a B rating; its composition makes it more volatile than other popular ETFs.

IPO ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| IPO Rating | A | B 31 | 5 | **** | N/A |

| IPO ESG Rating | BB: 2.49 out of 10 | B: 2.49 out of 10 | N/A | N/A | N/A |

IPO key holdings

The top holding company of the IPO ETF is Zoom Video Communications Inc. Class A ordinary shares, 8.94%. With most organizations reduced to remote workspaces and school learning happening virtually, Zoom Inc. had been at the forefront of providing seamless support to the pandemic virtual interaction.7

The next big-name company contributing to this ETF is Uber Technologies Inc., 8.83%. Globally public interaction is minimal to try and curb the spread of covid19. As a result, this taxi-hailing company has benefited due to the shunning of public transport means.

The third top holding of this ETF currently is Coinbase Global Inc. Class A shares, 6.42%. The global community is actively taking note of the cryptocurrency market, and if the last year is anything to by, this strategic market positioning is ripe for a bullish rally. Before the 2-year membership period lapses, Coinbase will continue pushing the bullish outlook at the current rate of cryptocurrency adoption.

Here are the top 10 holdings making up the IPO ETF.

|

Ticker |

Name |

Weight |

Market Cap in billions |

| ZM |

Zoom Video Communications Inc Class A |

8.94% | $89.6 |

| UBER | Uber Technologies Inc. | 8.83% | $87.8 |

| COIN | Coinbase Global Inc Ordinary Shares – Class A | 6.42% | $52.53 |

| CRWD | Crowdstrike Holdings Inc – Ordinary Shares – Class A | 6.08% | $42.35 |

| PINS | Pinterest Inc. – Ordinary Shares – Class A | 5.05% | $38.12 |

| PTON | Peloton Interactive Inc – Ordinary Shares – Class A | 4.27% | $24.68 |

| WORK | Slack Technologies Inc – Ordinary Shares – Class A | 4.15% | $23.98 |

| AVTR | Avantor Inc. | 3.16% | $18.17 |

| RPRX | Royalty Pharma plc – Ordinary Shares – Class A | 2.72% | $24.87 |

| RBLX | Roblox Corp Ordinary Shares – Class A | 2.7% | $37.38 |

Industry outlook

The improving covid19 metrics due to mass vaccination and the change in lifestyle presents numerous opportunities for budding organizations to go into IPO and scale-up. In addition, the recent listing of Coinbase Inc. is also set to lead a new wave of virtual currency companies following suit and making the Renaissance holding cut-off. According to both CNBC and Zacks experts, the result of all these is a bullish price rally.

Comments