No industrial niche transcends multiple economic segments like the infrastructure sector. This multi-trillion-dollar industry is expected to grow at a CAGR of 21% between 2021 and 2027, driven by the increasing social infrastructural needs and the emerging markets’ need for modernization of economic, infrastructural networks.

In a post-pandemic world, these global projects are expected to accelerate with the economic stimulus plans to spar fast-paced economic resurgence to post-pandemic levels. The fact that the United States has approved Biden’s $1 trillion infrastructure bill indicates that even developed economies need consistent infrastructure upgrading creating an insatiable demand for this market.

How do you invest in this market? Historically, infrastructure ETFs have outperformed traditional equity firms and provide the best infrastructure investment option with lower investment risks than individual stocks.

Infrastructure ETFs: how do they work?

To understand the composition of infrastructure ETFs and how they work, we first must acknowledge social and economic infrastructure. With this in mind, infrastructure ETFs comprise organizations involved in the construction of buildings, bridges and road networks, sewer and water infrastructure, communications infrastructure, electricity infrastructure, and all firms generating significant revenues from providing ancillary services to the above mentioned. These ETFs track the performance of index funds in the infrastructure sector and give insights into the economic health of this sector.

Top three infrastructure ETFs for gains in 2022

Governments around the globe are working on economic stimulus not only to get their countries to pre-pandemic levels but also to beef up infrastructural networks and policies to ensure they thrive and are better prepared for future global pandemics. These efforts seem to be transcending the normal physical limitations of infrastructural expansion to include the digital world and human infrastructure.

Traditionally a high-return investment segment, this holistic approach brings a plethora of investment opportunities. The three ETFs below are in a prime position to take advantage and result in gains for investors.

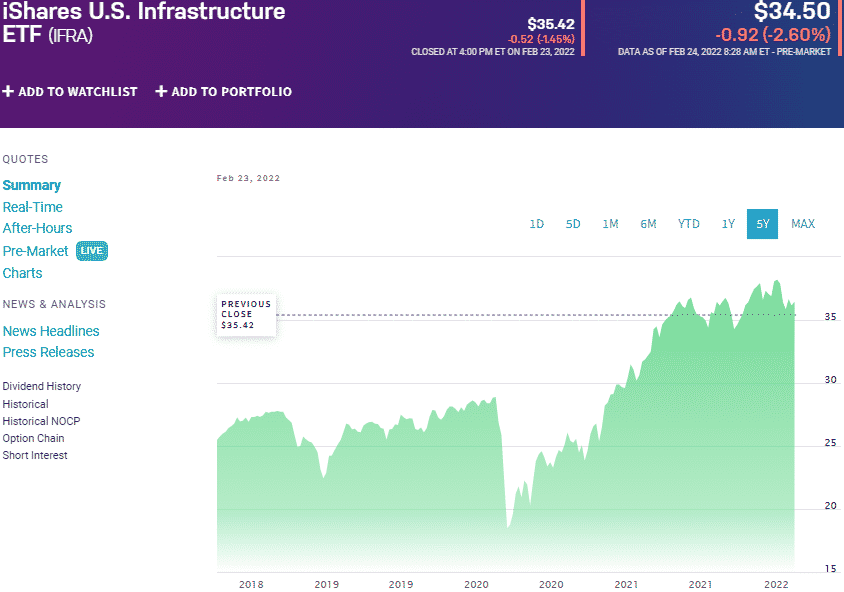

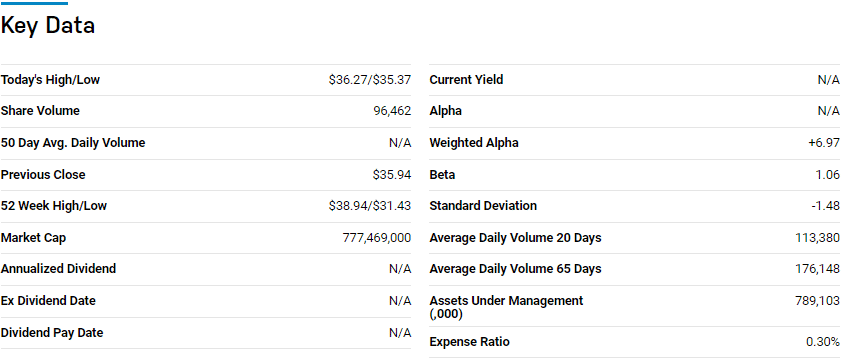

№ 1. iShares US Infrastructure ETF (IFRA)

Price: $34.50

Expense ratio: 0.30%

Dividend yield: 1.81%

IFRA chart

The US economy has been one of the biggest infrastructure spenders globally, providing excellent investment opportunities for top dollar. With the approval of Biden’s $1 trillion infrastructure bill, 2022 is the prime time to invest in the iShares US Infrastructure ETF.

This fund tracks the NYSE FactSet US Infrastructure Index, investing at least 80% of its total assets in the components of its tracked index and other securities of like economic characteristics. The fund manager also has the discretion to invest not more than 20% of the total fund’s assets in futures, swap contracts, cash, options, and cash equivalents, which is correlated to the composite index. It exposes investors to the US equities that benefit from increased expenditure on infrastructure.

IFRA is ranked № 1 by US News among eleven of the best infrastructure ETFs for long-term investing.

The top three holdings of this non-diversified ETF are:

- Allegheny Technologies Incorporated – %1.02

- Century Aluminum Company – 0.97%

- EnLink Midstream LLC – 0.96%

IFRA chart

IFRA ETF has $789.1 million in assets under management, with an expense ratio of 0.30%. It is a diversified fund of 150 holdings, with a cap on its weighting-no holding is more than 1%. Its inclusion of all market participants benefiting from infrastructural gains has resulted in a resilient fund consistently providing returns since its inception; 3-year returns of 39.99% and 1-year returns of 11.43%.

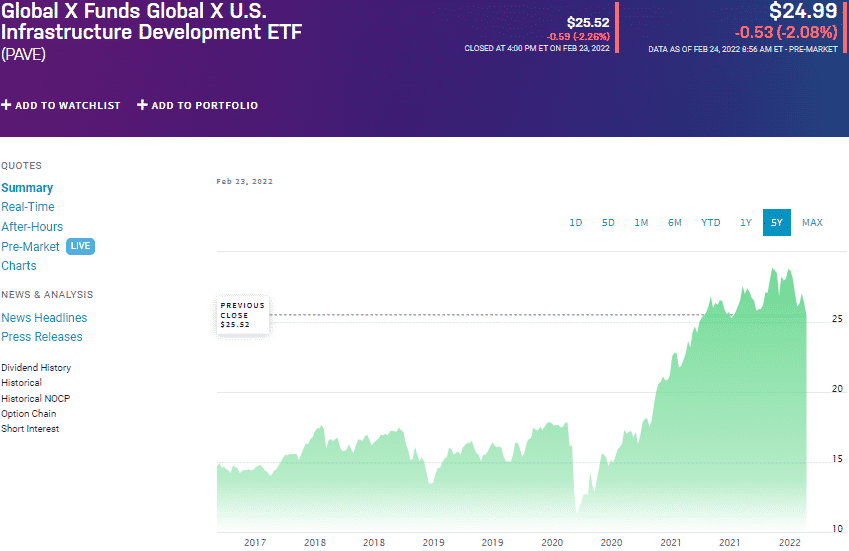

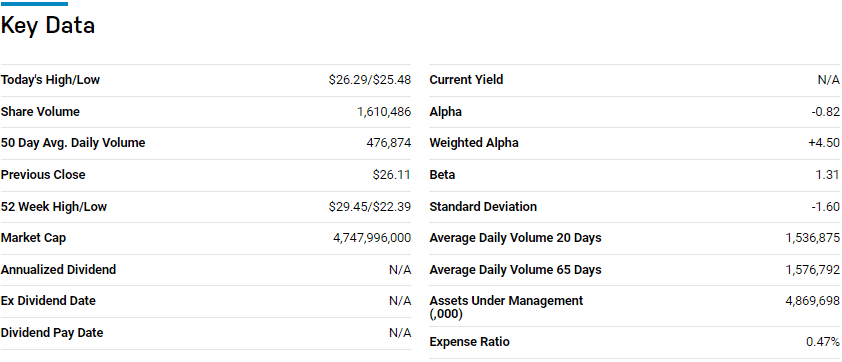

№ 2. Global X US Infrastructure Development ETF (PAVE)

Price: $24.99

Expense ratio: 0.47%

Dividend yield: 0.33%

PAVE chart

The Global X US Infrastructure Development ETF tracks the performance of the Indxx U.S. Infrastructure Development Index, net of expenses, and fees. It invests at least 80% of its total assets in the holdings of its composite index, exposing investors to equities engaged in construction, raw material production, engineering, industrial transportation, and heavy machinery production.

PAVE ETF is ranked № 3 by US News among eleven of the best infrastructure ETFs for long-term investing.

The top three holdings of this non-diversified ETF are:

- Nucor Corporation – 3.83%

- Deere & Company – 3.08%

- CSX Corporation – 3.03%

Despite launching in 2017, PAVE ETF is the largest infrastructure ETF with $4.94 billion in assets under management, with investors’ parting with $47 annually for every $10000 invested. This fund has a ceiling weight cap of 3% and a floor cap of 0.3%, which mitigates against concentration risk. In addition, it includes holdings across the market caps to provide both value and growth attributes in addition to its diversification through REITs, BDCs, and MLPs.

The result is a fund made to mint money for its investors, despite all its holdings having to generate at least 50% of their revenues from activities in the United States; 3-year returns of 61.96% and 1-year returns 11.21%.

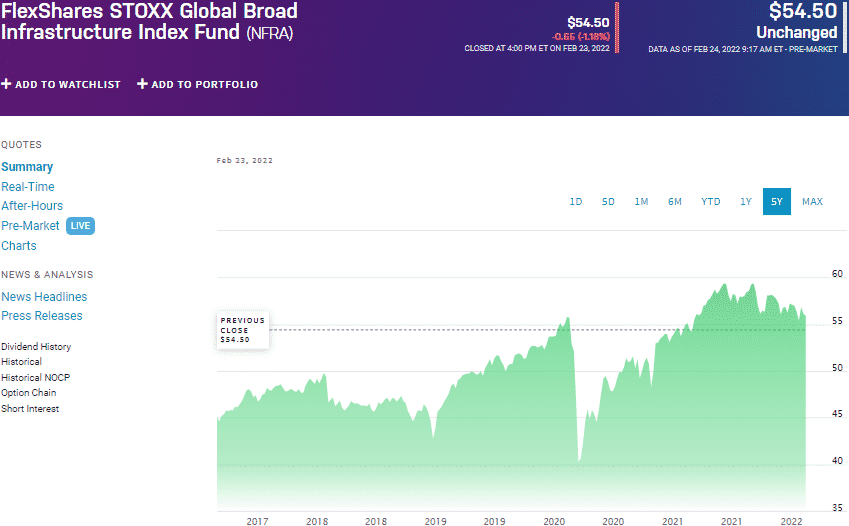

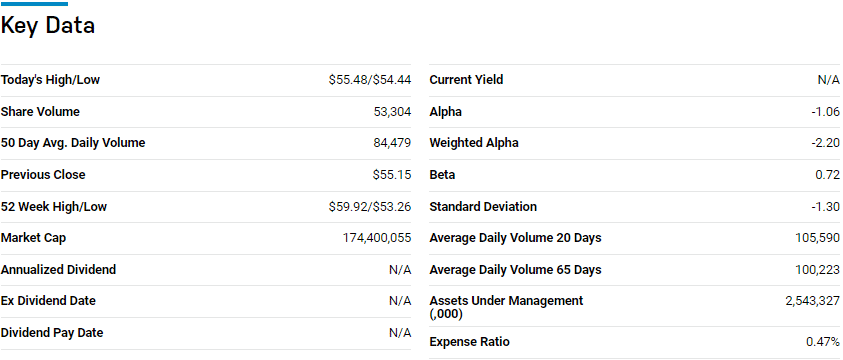

№ 3. FlexShares Stoxx Global Broad Infrastructure ETF (NFRA)

Price: $54.50

Expense ratio: 0.47%

Dividend yield: 2.28%

NFRA chart

The FlexShares Stoxx Global Broad Infrastructure ETF tracks the performance of the STOXX Global Broad Infrastructure Index, net of fees, and expenses. Under normal circumstances, it invests at least 80% of its total assets in the composite index holdings and investment assets of similar economic characteristics, as well as the underholding’s ADRs and GDRs. It exposes investors to global infrastructural equities, especially domiciled in developed markets.

The top three holdings of this non-diversified ETF are:

- Canadian National Railway Company – 4.51%

- Verizon Communications Inc. – 3.52%

- Comcast Corporation Class A – 3.37%

NFRA ETF is considerably large, with $2.54 billion in assets under management, with an expense ratio of 0.47%. This ETF is a diversified play on both the US and global infrastructure space since it includes equities domiciled abroad operating in their home countries and equities domiciled abroad but operating in the US, with a splash of US equities for good measure.

Its straddling of several economic segments, communication, energy, transportation, and utilities has resulted in a stable fund that provides value, growth, and consistent income; 5-year returns of 38.23%, 3- year returns of 21.10%, 1-year returns of 2.29%, and a dividend yield of 2.28%.

Final thoughts

Due to their attachment to government spending, infrastructural investments are a great inflation hedge asset, with the potential for huge returns. With the current high inflation levels and increased government spending on infrastructure, the three ETFs might outperform the broader market and result in phenomenal gains.

Comments