ETF full name: VanEck Vectors Environmental Services EVX ETF

Segment: Environmental services

ETF provider: VanEck

| EVX key details | |

| Issuer | VanEck |

| Dividend | $0.39 |

| Inception date | October 10, 2006 |

| Expense ratio | 0.55% |

| Management company | VanEck |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 55.59% |

| Investment objective | Replication |

| Investment geography | Environmental services |

| Benchmark | NYSE Arca Environmental Svcs (TR) |

| Leveraged | N/A |

| Median market capitalization | $22.58 billion |

| ESG rating | MSCI 5.96/10 |

| Number of holdings | 24 |

| Weighting methodology | Weighted Market capitalization |

About the EVX ETF

VanEck Vectors Environmental Services EVX ETF was founded in October 2006 to track the New York Stock Exchange Arca Environmental Svcs (TR). The fund’s market capitalization stands at $22.58 billion, with an average annual return of 55.59%.

EVX Fact-set analytics insight

The EXV comprises 24 holdings, 86% based in the United States, with the remainder of the units located in Canada. EXV made it offer exposure to businesses that stand to gain from a global increase in demand for waste disposal and management of industrial by-products.

The EXV exchange fund uses weighted market capitalization for its methodology.

EVX performance analysis

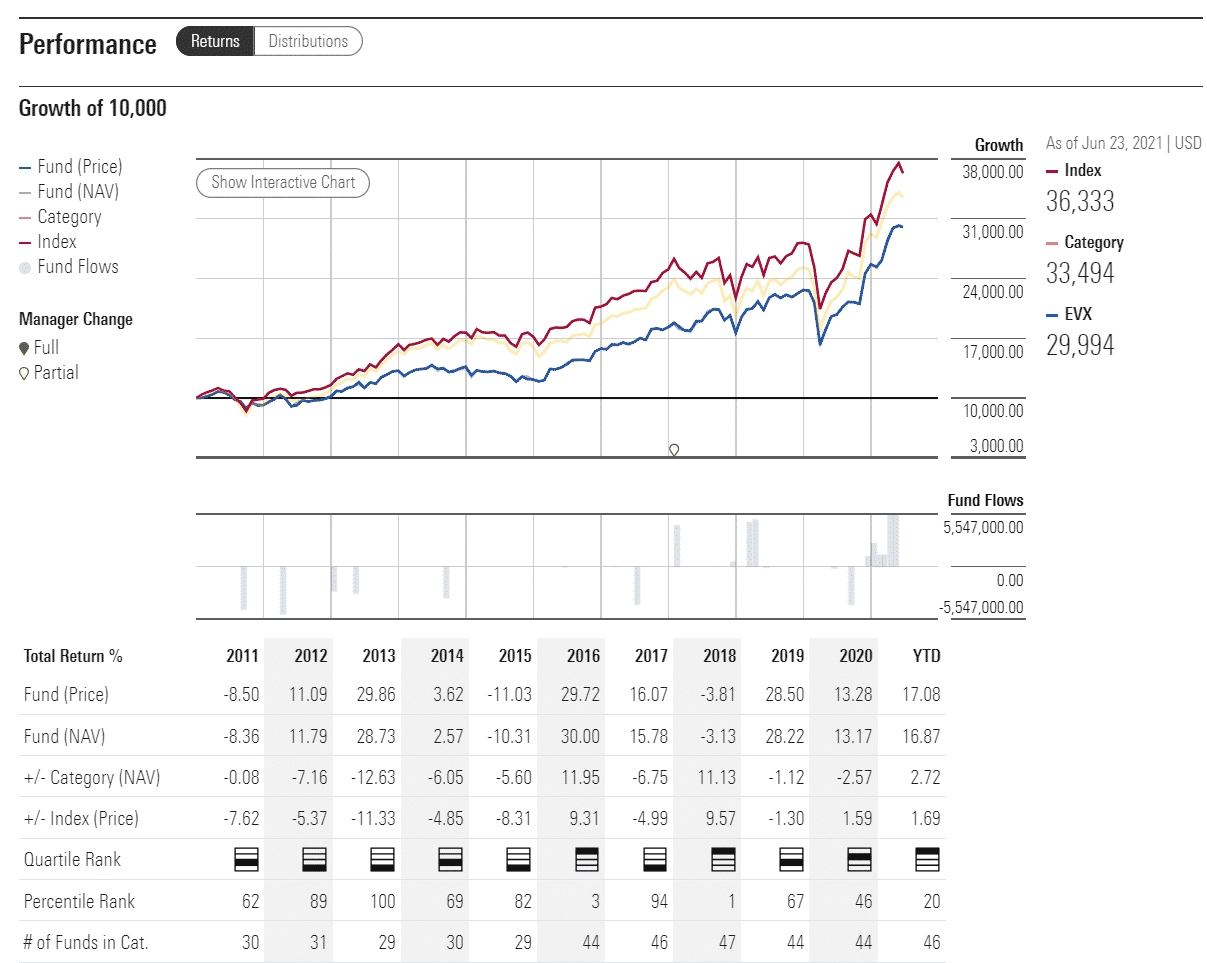

As most of the fund’s holdings rely on the need of large industrial companies for waste management, its trends correspond closely to those of the industrial conglomerates. Like the graph goes to prove, the fund observed a plummet with the emergence of the Covid-19 pandemic. So the industrial activity around the world came to a near-halt due to lockdowns.

With the vaccine rollout, the industry seems to be picking up. Just in May, the producer prices in Germany soared more than 7%, according to Destatis, hinting that the industrial production in Europe and the US is starting to gain speed. The further sentiment will most likely largely depend on the additional course of the pandemic and the consequent reopening of the economy.

The EVX ETF pays dividends four times per year. For the last quarter, the dividend amounted to $0.39 on the share at an expense ratio of 0.59%.

On the MSCI ESG scale, EVX ETF has a 5.96/10 A rating. The fund was declared to be of higher-than-average resilience in environmental, governmental, and social changes.

EVX ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| EVX Rating | A | A | 4 | *** | N/A |

| EVX ESG Rating | 5.96/10 | A | N/A | N/A | N/A |

EVX key holdings

The EVX ETF relies on the companies dealing in waste disposal and management, with the industry’s two leading companies in the fund’s top ten holdings. Waste Connections, Inc. is an American/Canadian company specialized in comprehensive industrial waste collection and management. Its net income in the past quarter jumped by more than 11%, hinting at a strong recovery from the same period a year prior when the Covid-19 lockdowns first started taking place.

Fund’s second most prominent holding, Waste Management, Inc., showed similar resilience, with its quarterly investors’ report noting that the firm’s revenue gained 10% on an annual basis.

Here are the top 10 holdings making up the EVX ETF.

| Ticker | Holding name | % of assets |

| WCN | Waste Connections, Inc. | 10.84% |

| WM | Waste Management, Inc. | 10.67% |

| RSG | Republic Services, Inc. | 10.56% |

| ECL | Ecolab Inc. | 9.47% |

| STE | STERIS Plc. | 5.9% |

| AQUA | Evoqua Water Technologies Corp. | 3.95% |

| SCHN | Schnitzer Steel Industries, Inc. Class A | 3.78% |

| CVA | Covanta Holding Corporation | 3.74% |

| SRCL | Stericycle, Inc. | 3.29% |

| CLH | Clean Harbors, Inc. | 3.26% |

Industry outlook

While the specificity that EVX offers makes it a less-than-ideal option for investors seeking to build a long-term portfolio, dabbing into the waste management sector could also prove to have its benefits.

With potential short-term gains that could come with the bounce-back in the industrial activity, this fund can also offer long-term upsides considering the waste management trends and forecasts for the future.

The sector itself is expected to jump by a whopping $259 billion until 2027 in the United States alone, according to the business data platform Statista. With some of the largest companies from the sector as holdings, the EVX might be a helpful addition.

Comments