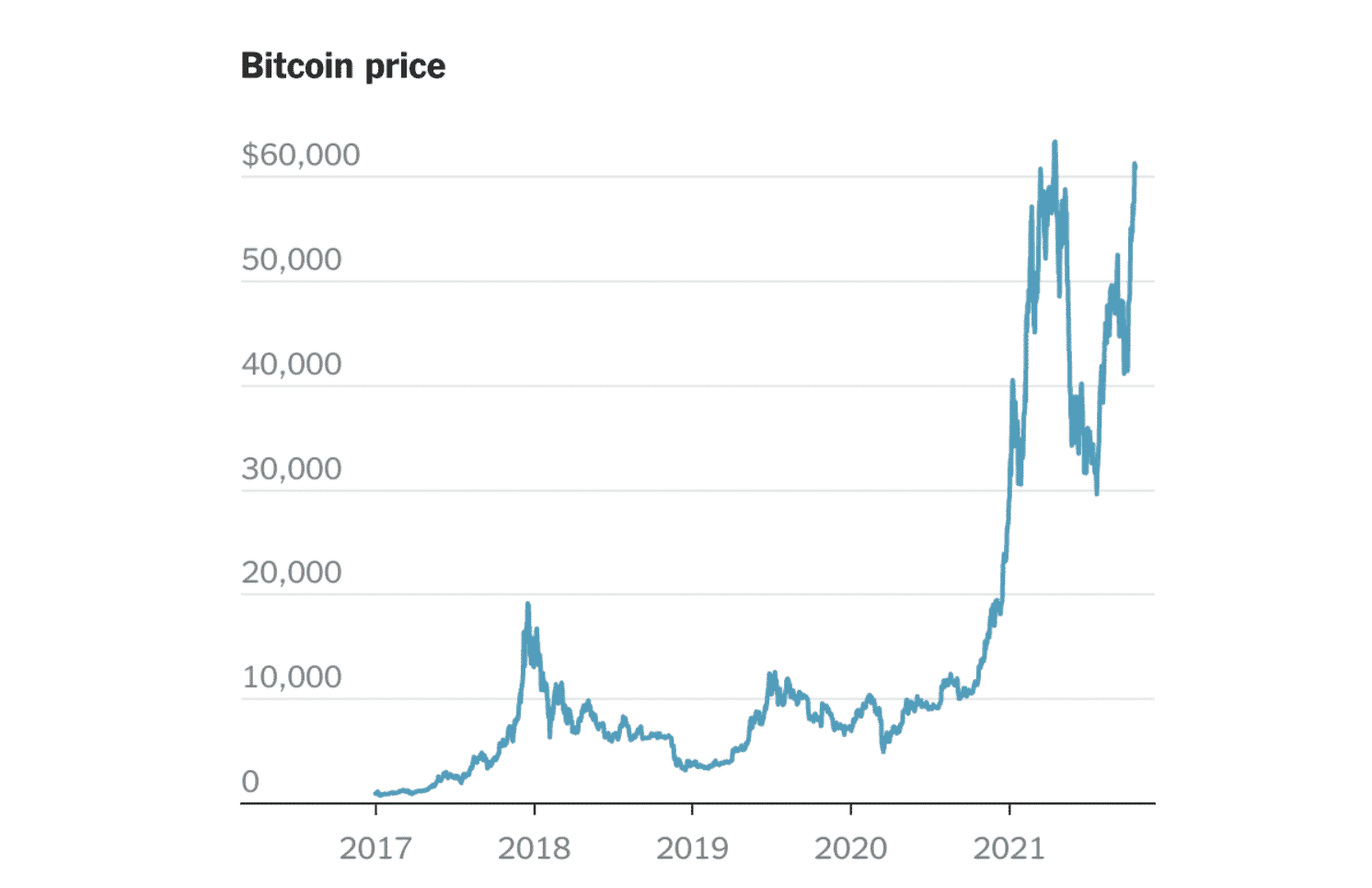

The world’s leading cryptocurrency is coming to Wall Street! Where there is a buck to be made, ultimately, Wall Street will follow. The crypto market has grown from $397 billion in November 2020 to $2.8 trillion as of 2nd November 2021. It is a staggering 600% annual growth.

Though not a pure-play Bitcoin ETF, the ProShares Bitcoin Strategy ETF launched on 19th October 2021 and became the fastest ETF to reach the $1 billion assets under the management mark. Three days later saw another fund linked to the price of Bitcoin launched under the Valkyrie Funds flagship, Valkyrie Investments’ Bitcoin Fund.

These might not be ETFs directly related to the cost of BTC, but their acceptance in the world’s largest and most popular exchange could be the turning point the cryptocurrency world has been waiting for in seven years.

What is a Bitcoin ETF, and how does it work?

To understand the hype and noise behind BTC-based or cryptocurrency ETFs, let’s look at what a cryptocurrency ETF comprises and works.

An exchange-traded fund is an investment vehicle consisting of a basket of economically-like investment assets. As such, rather than invest in individual assets and hold them, ETFs allow investors to invest in several assets without actually owning them.

When it comes to the Bitcoin ETF, its structure follows that of commodities. It is an exchange-traded fund whose objective is to mimic the price of Bitcoin. Therefore, it will expose investors to the leading cryptocurrency without dealing with the intricacies involved with direct BTC trading or the security and complex storage requirements coupled with owning Bitcoin. By not being holders of BTC, its investors get to mint money off this emerging market.

Why lobby for Bitcoin ETFs when you can invest in it directly?

Why lobby for a Bitcoin ETF that will mirror the price of BTC and nothing more? First and foremost, investing in a BTC ETF eliminates the need to own Bitcoin and eliminates the associated security and storage hassles. The ETF will trade in the established exchanges, eliminating the need for crypto wallets, simplifying BTC investing for those interested.

This ETF will also facilitate short-selling. Bitcoin has had a phenomenal bullish run in the last one and a half years, but it hasn’t been all smooth sailing. Bitcoin, despite being the world’s most popular cryptocurrency, experiences significant volatilities.

Investors in the cryptocurrency space either sell their coins in a market downturn or ride the bearish wave and hope their accounts aren’t depleted before markets turn back in their favor. ETF structure allows for short selling and making a buck even in times of market downturn without sacrificing held investments.

However, the attributes that have endeared ETFs to the global investment community are also why investors are keen on a Bitcoin ETF rather than BTC, simplicity, and low cost. At present, the value of a single Bitcoin coin is $62151.8, and trading it requires knowledge on the cryptocurrency dos and don’ts.

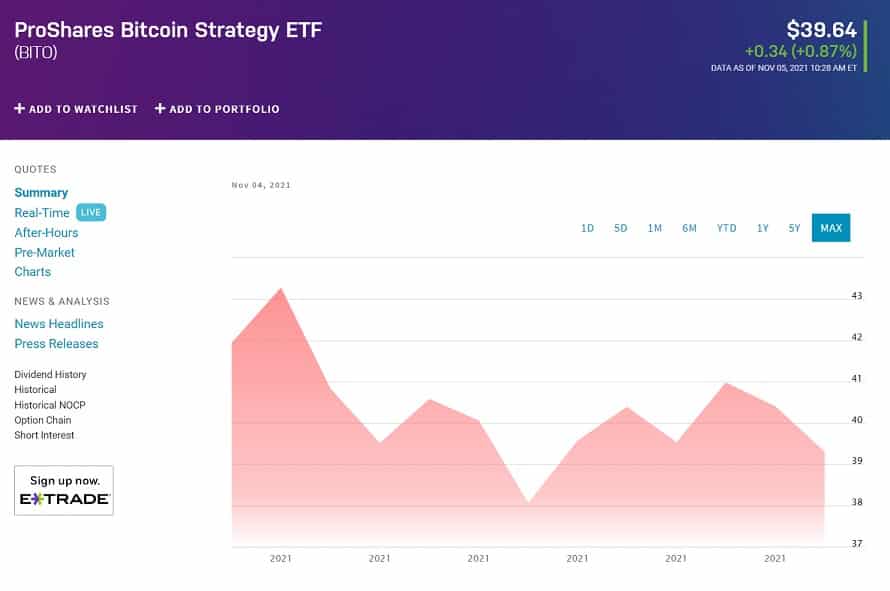

BITO chart

At the same time, the BITO ETF is trading at $39.64 per share. With Bitcoin ETF, investors will be part of the cryptocurrency market for a fraction of the value.

Bitcoin ETF approval journey

BTC ETF launch has been in the works for the last seven years, even though most people only remember the Winklevoss Bitcoin Trust, which was rejected by SEC in 2017. Cameron and Tyler Winklevoss were the brains behind this ETF and despite SEC shutting them down, they have been working to ensure a Bitcoin ETF choice for investors-patented an ETF firm under the name Winklevoss IP LLP.

A dig into the SEC archives shows that despite the application period for Bitcoin ETF having lapsed on most of them, there is no status attached, meaning they are still under consideration. Coupled with several crypto ETF issuers recalling their applications for Ethereum, future ETFs and Bitcoin ETF approval might be around the corner.

It is a sentiment that the SEC opening of public participation on matters Bitcoin ETF only affirms that it is no longer a matter of if but when.

Final thoughts

Trading of Bitcoin futures ETFs drama-free shows that the SEC fears might be unfounded. US citizens are increasingly sending funds to offshore accounts to facilitate investments in unregulated sectors, otherwise illegal if done from a local account.

The SEC on the back of most public participants lobbying pro-Bitcoin ETF approval, coupled with a slim opportunity to regulate an aspect of an otherwise unregulated market, might swing it in the approval way. In addition, on the launch of BITO ETF, only approximately 15% were retail investors within the first two trading days. It means that the broader financial world is aware of BTC and the investment opportunities that it provides.

Bitcoin volatility provides excellent opportunities for minting money, especially if done via ETFs. In addition, having a Bitcoin ETF fuels BTC gains, which act as a catalyst for gains across the entire cryptocurrency market since most coins’ prices are intrinsically tied to that of Bitcoin. For now, though, there are blockchain ETFs with exposure to BTC that ETF investors can use to play into the Bitcoin market as they await the SEC to make a decision.

Comments