BigPoppa is a trading solution that is one of several advisors designed by the BenderFX company. The presentation explains the core functionality of how the system is going to work on a terminal. The devs claimed that “This is the official site for our known products: Benderv2, Benderv4, Shizuka, and BigPoppa.” So, it’s time to check how good they are.

We have various details about the system functionality explained. So, to make it readable we united them in the following list.

- The advisor was designed for the purpose of giving us automatic trading on our terminal.

- The system should be used on a demo account first.

- The devs have already sold 300 copies of the system.

- It executes orders based on “Fibonacci retracements, Price Action with Money management.”

- The system makes more profits on a volatile market.

- We should have at least $500 on the balance.

- The monthly profit can be 30-50%.

- We can work on M15 and H1 time frames.

- There are ten sets of numbers.

- This system can be attached to the same terminal as the Shizuka robot.

- The devs provide us with an invitation link to the Telegram channel.

- “BigPoppa, combines the best of Benderv2 and Shizuka, fibo retracements, money management features, capital preservation and price action. We have put all together into this excellent EA and it’s proving to be more and more profitable.”

- There are various useful features implemented: Trailing Stop, Hedging Limit number of trades and Equity Stop.

- “Price Action: We do not fully rely on the crossover, we also validate that this crossover has more than 75% of winning chances.”

- The owners mentioned backtest reports.

- “Each of the set files from our products were obtained using genetic algorithm techniques, which optimized the parameters to maximize profit factors while keeping a low drawdown.”

Trading strategies and currency pairs

- It works with a price action strategy as the main one.

- Most likely, we can work with any cross pair.

- Trading is allowed on M15 and H1.

The presentation hasn’t featured a backtest report even after mentioning that there should be them. It’s a significant con because we don’t have the information about how the system was tested on the past data and if it was profitable at all. Usually, average devs are proud to show that their system can make profits.

BigPoppa trading statistics

BigPoppa trading results

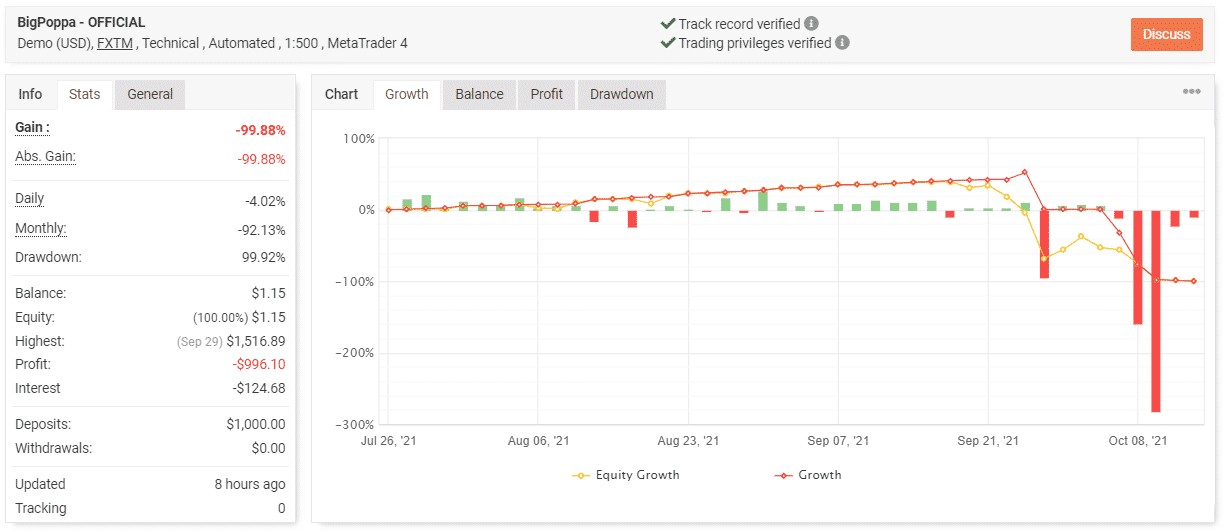

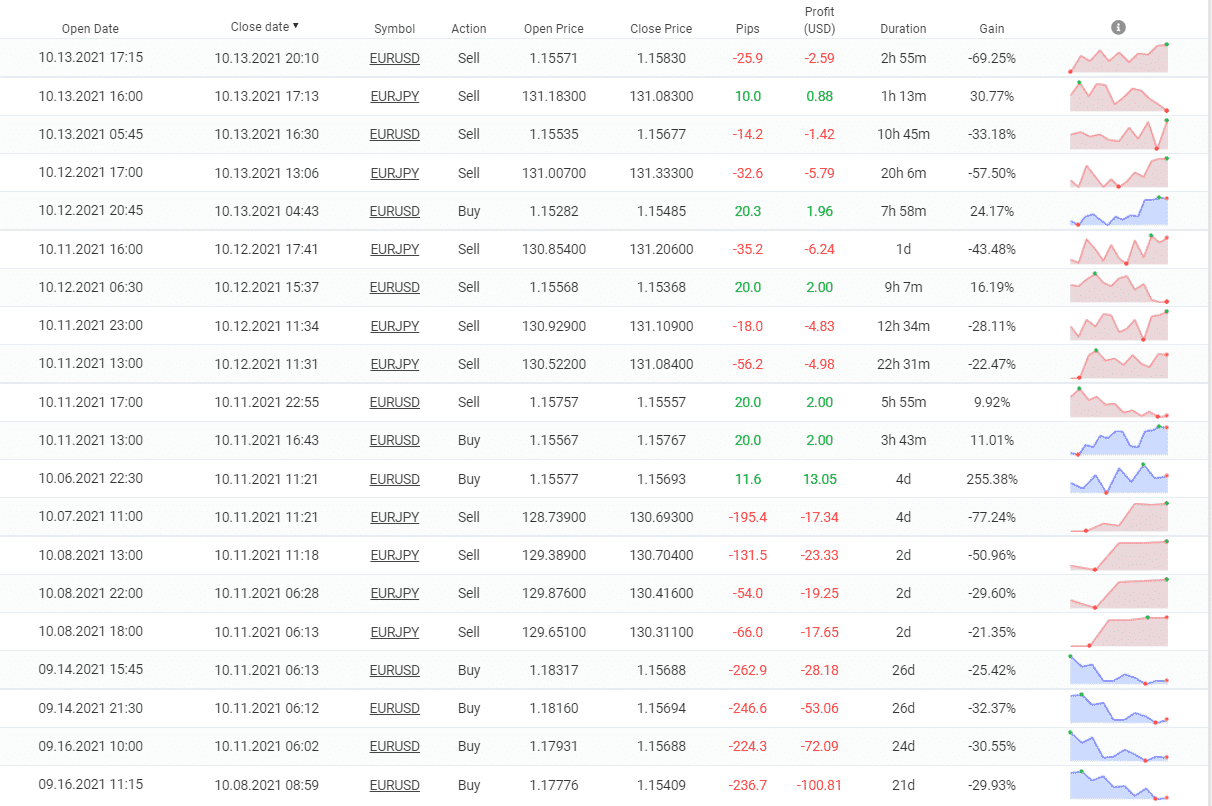

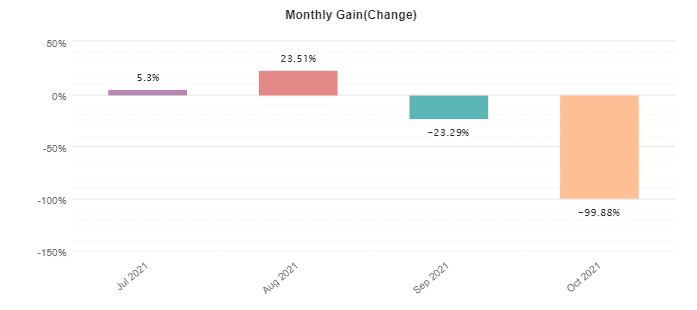

We have an account on Myfxbook that was blown but it wasn’t removed by the developers from the site. It was a demo account on FXTM where the robot worked with 1:500 leverage on MT4. It had a verified track record. The account was created on July 26, 2021, and deposited at $1,000. Since then, the absolute gain amounted to -99.88%. The monthly profit was -92.13%. The maximum drawdown was 99.92%.

BigPoppa rading details

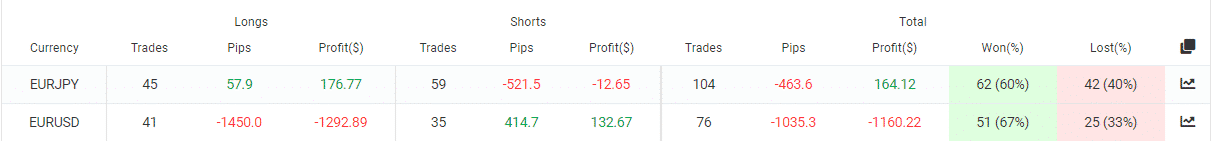

BigPoppa has traded 180 orders with -1498.9 pips. An average win was 18.55 pips when an average loss was -53.65 pips. The win rate for longs was 60% and 64% for shorts. The average trade length is two days. The profit factor is low standing at 0.43.

BigPoppa trading directions

It worked with EURJPY and EURUSD. EURJPY is the most traded pair with 104 orders executed.

BigPoppa hourly activities

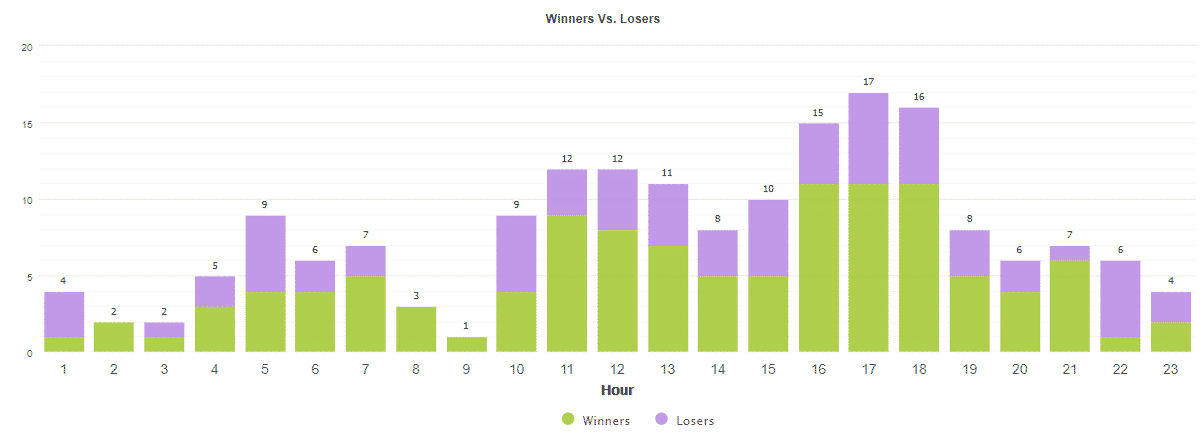

The system traded during European and a bit during Asian trading sessions.

BigPoppa daily activities

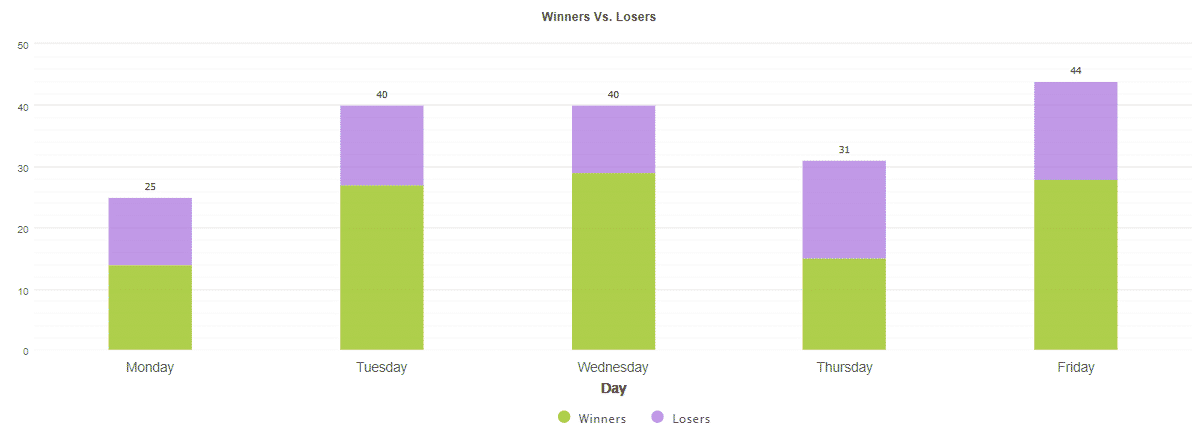

Monday with 25 orders and Thursday with 31 orders are the less traded days.

BigPoppa closed orders

The robot has lost much in October 2021.

BigPoppa monthly profits

So, it couldn’t manage to survive.

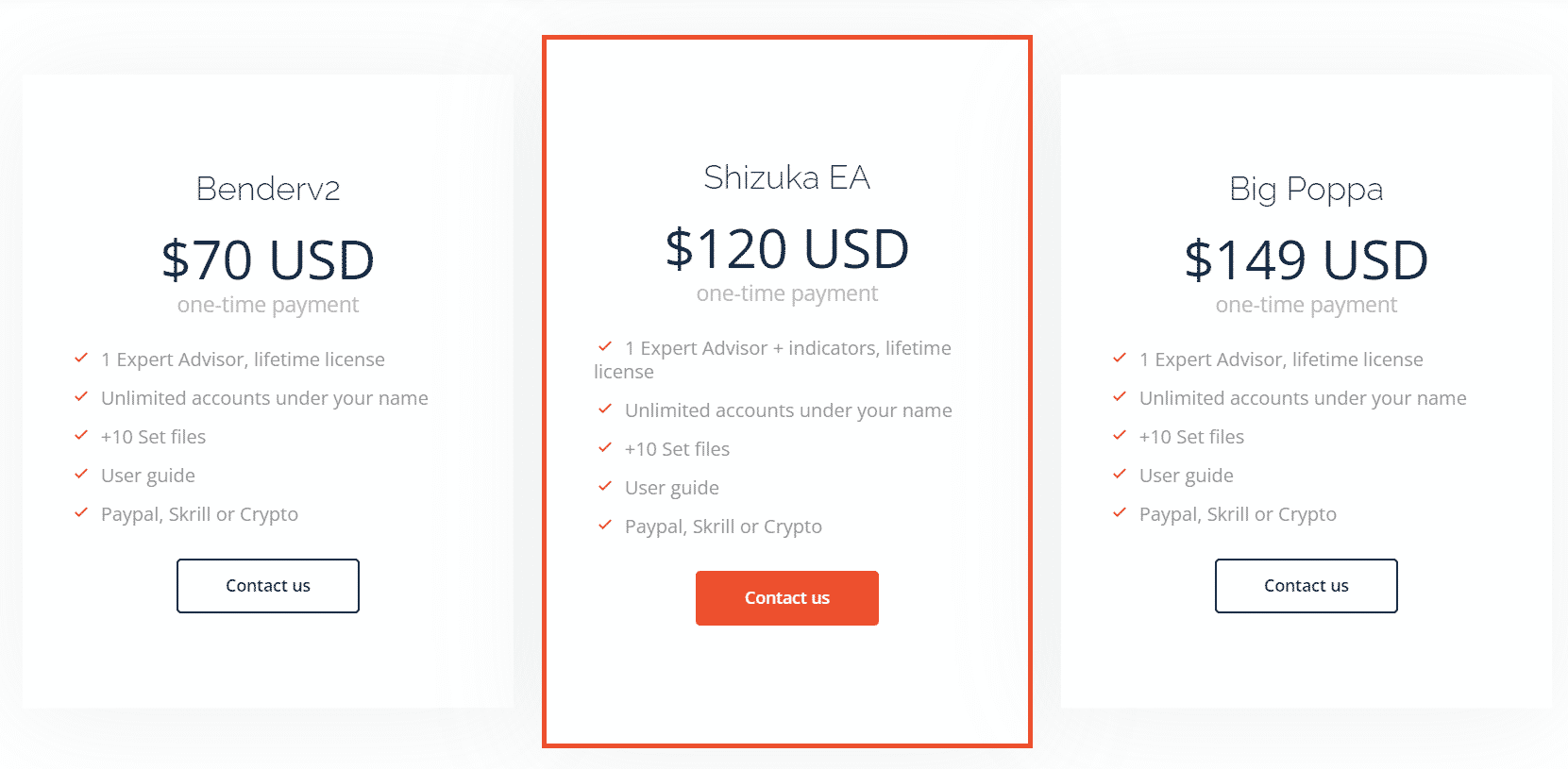

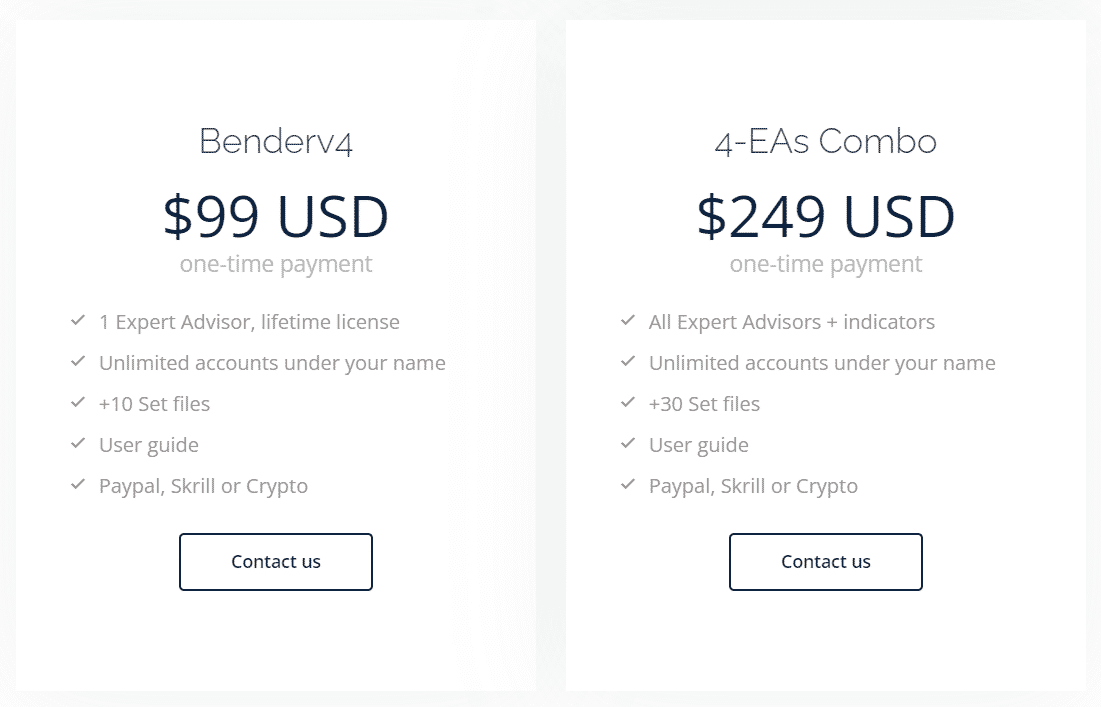

Pricing and refund

BigPoppa pricing details

BigPoppa pricing details

The devs updated their offer and provided a new design to it. BigPoppa costs $149 for one real account license. There are ten set files. We are allowed to pay by PayPal, Skrill, and Crypto only. This means that the developers provide no refund policy.

What else you should know about BigPoppa

The devs didn’t reset the robot to trade on another account. Most likely, it wasn’t even updated.

People feedback

The presentation isn’t featured by testimonials from real clients that would tell us about their experience and success they had with using this system.

Comments