For most people, investing can be challenging. Keeping all critical information up to date on one company, let alone the entire portfolio, can be complicated.

Investors need to keep an eye on considerations such as whether their shares are adequately distributed across industries to balance risks, whether the company’s financial statements indicate stability, or whether the price is at a level requiring action.

Unsurprisingly, legendary investor Warren Buffett said that “The best strategy for the vast majority of people is just to buy inexpensive ETFs.”

Let’s get to know what ETF brokers offer the most bang for your buck.

What do brokers do?

It is an institution that serves as an intermediary between you and the exchange. Due to many people interested in investing, security exchanges usually only take orders from members. Those members are brokers.

There are also discount brokers who, as opposed to the regular ones, don’t offer investment advice but execute your desired positions. They trade on your behalf in exchange for either a fee or commission, which are significantly lower.

Top five online ETF brokers

In most cases, traditional online brokers offer many asset classes such as stocks, bonds, mutual funds, and of course, ETFs. Thus, the investment process works in much the same way as in any other brokerage firm.

For example, you will need to find a broker that suits your needs and then open an account. After confirming your identity, you will need to deposit funds. After your account is set up, you will need to select the ETF to invest in. It is important to note that if you have not entrusted your money to a mutual fund, you will need to invest on your own.

Suppose you are looking for a regulated broker that offers various ETF markets, low fees, competitive spreads, and many day-to-day payment options. In that case, we suggest exploring the following five brokers.

1. Charles Schwab

Trading commission: $0

Minimum amount to open a brokerage account: $0

Number of ETFs without a commission: all

If you are a beginner and want to invest safely, there is no better option for you than Charles Schwab. The company came to be in 1971, and it only got better as time passed by.

Not only does the firm offer a comprehensive, and we do mean wide, set of ETFs for you to choose from, they also provide them at no fee whatsoever. Those include top-tier names like Invesco and State Street.

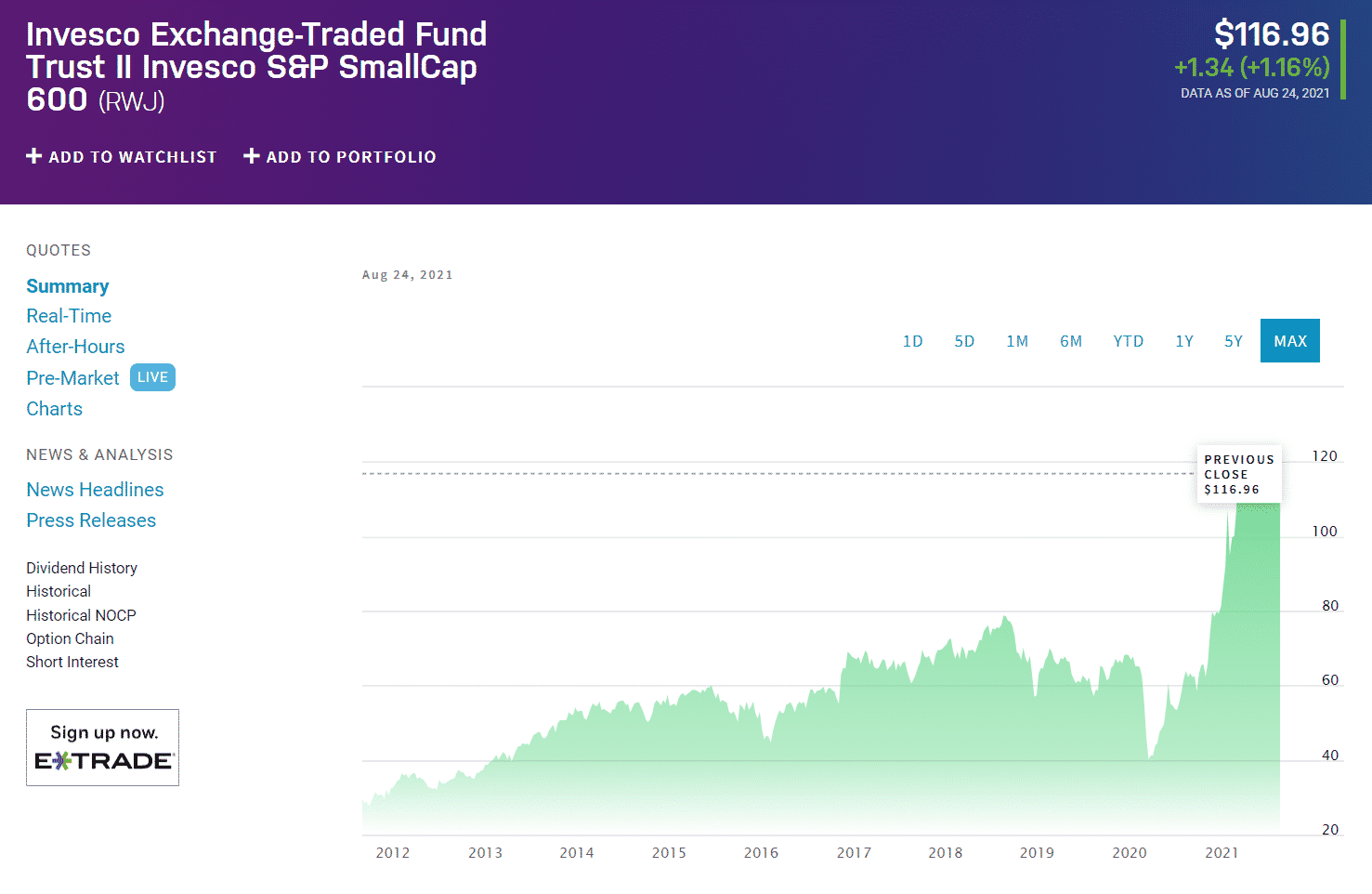

Invesco Exchange-Traded Fund Trust II Invesco S&P chart

Let’s take a look at this RWJ fund by Invesco. It invests in public equity markets of the United States. It invests in stocks of companies operating across diversified sectors. The chart proves that the broker provides you with exposure to some of the best-performing funds out there. Opening and maintaining a brokerage account with Schwab is also free.

2. eToro

Trading commission: $0

Minimum amount to open a brokerage account: $50

Number of ETFs without a commission: all

eToro is an Israeli firm, but it does have offices in the United States, the United Kingdom, Australia, and Cyprus. Unless you are a niche investor interested in a tiny and narrow field, the chances are that eToro will have an ETF for you.

It also charges $0 for commission, and it covers a huge number of different markets in geographical terms. You will be able to invest in ETFs tracking staple benchmarks like the Dow Jones, the S&P 500, and London’s FTSE 100.

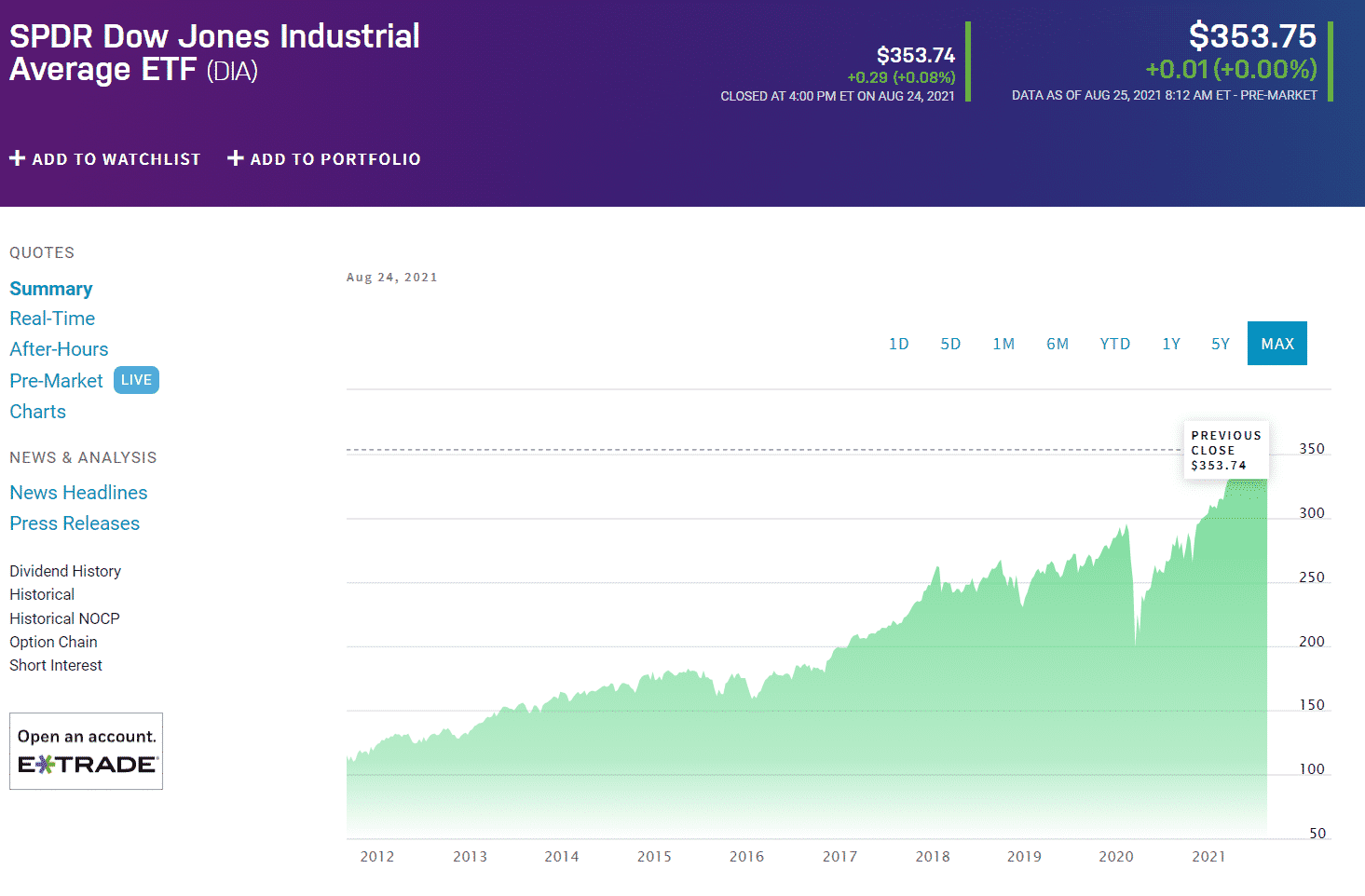

SPDR Dow Jones Industrial Average ETF (DIA) chart

A chance to invest in the Dow Jones Industrial Average doesn’t come often, but this DIA ETF does just that. If you want to get in on the action with America’s finest, you are in luck.

Another upside of eToro is that the minimum investment for either a fund or a share is $50, so you can easily buy a fraction of a fund if that is all you can afford.

3. Ally Invest

Trading commission: $0

Minimum amount to open a brokerage account: $0

Number of ETFs without a commission: all

Ally Invest is not as impressive as some other brokers regarding assets under management, but it excels in customer service. There is no minimum investment, so it is also easily accessible to people starting.

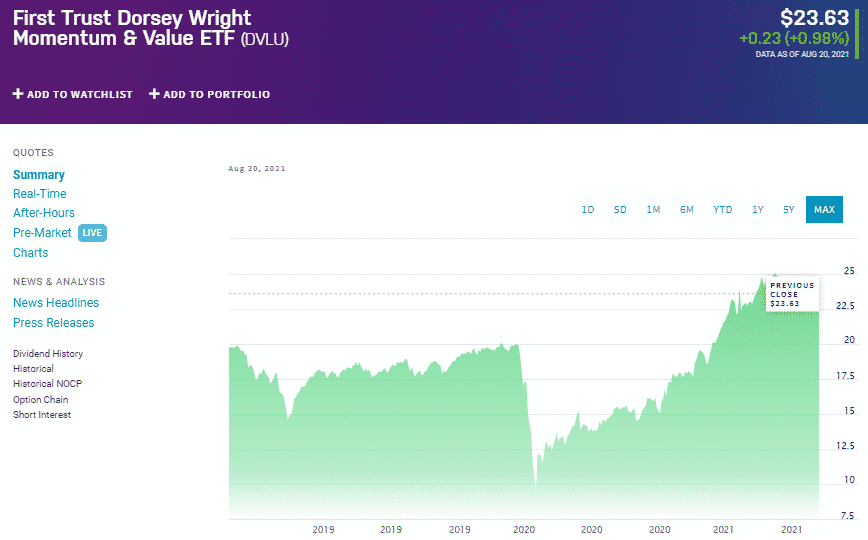

The brokerage doesn’t charge commissions for any of its 100 ETFs, but there is a catch. To make trading free of charge, you have first to hold the fund for a minimum of 90 days. DVLU tracks an index of 50 large- and midcap value stocks exhibiting relative strength.

First Trust Dorsey Wright Momentum & Value ETF chart

For beginners, Ally Invest is a good choice, primarily due to its detailed breakdown of ETFs, which not only allows you to grasp more details but does so in a very analytical yet straightforward way.

4. Merrill Edge

Trading commission: $0

Minimum amount to open a brokerage account: $0

Number of ETFs without a commission: all

Merrill Edge launched in 2010, and it is a part of Bank of America. That should be enough in and of itself, but we are prepared to take it one step further.

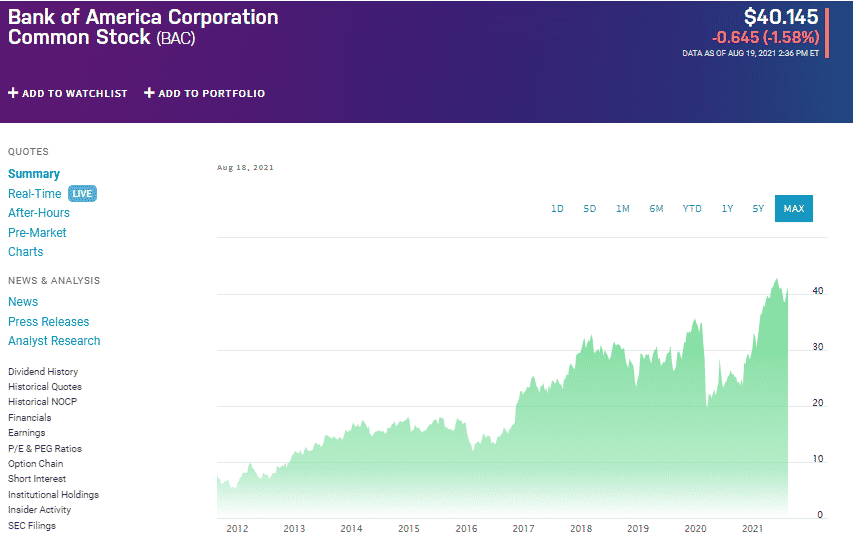

Bank of America Corporation Common Stock chart

The chart illustrates how the stock of Merrill Edge’s parent company, Bank of America Corporation, moved since its inception.

Beginners and seasoned investors alike could use the benefits offered by Merrill Edge to a significant extent. That is especially the case if their strategy is to buy and hold.

The only downside of ETF brokering services is higher fees, which can be a drag for some investors. On the other hand, the credibility that the Bank of America name carries is more than worth it. As an excellent final thought, clients with $20,000 in qualifying assets are eligible for added benefits.

5. Fidelity Investments

Trading commission: $0

Minimum amount to open a brokerage account: $0

Number of ETFs without a commission: all

Fidelity is more on an active side. Yes, this platform will serve you with no issues if you are a typical long-term investor, but it will do wonders for you even if you are more active in your investments or a full-time trader.

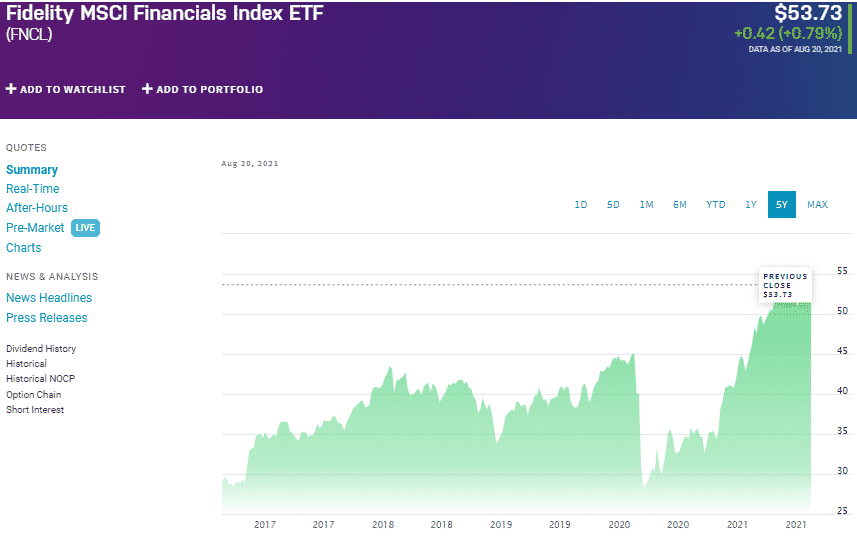

Fidelity MSCI Financials Index ETF chart

FNCL tracks a market-cap-weighted index of US financial companies across the entire market-cap spectrum. While other features regarding the analytics and executions are top-notch in all five members of our top-5 squad, there is one thing that sets Fidelity apart from the rest of the herd. It doesn’t require you to put the uninvested funds into the money fund manually. The software will do that for you and then make it available when needed.

The only con of Fidelity is that you have to be a United States resident to create an account, which is kind of a bummer for investors from other parts of the world.

Final thoughts

Finding the right ETF issuer is a no-brainer because you don’t have to limit yourself to one. With brokers, things are a lot trickier. The good news is that there is an endless pit of reviews and comments that go way deeper into the matter itself.

As always, preparation and research are essential. Do your part to determine what broker could work the best for you, and it will be worth it in the long run.

Comments