The coronavirus has ensured the way of life as we know pre-pandemic is a sight in the rearview mirror. Despite new variants of the virus cropping up now and then, the vaccination drive across the globe has experts ensuring the populace that the worst is in the past.

As a result, central banks and governments are in the process of coming up with and implementing monetary policies and economic initiatives that will spur fast economic resurgence to a semblance of pre-pandemic levels. However, this is not good news for the investment markets, primarily guided by supply and demand. Any outside forces driving the economy and, therefore, the investment world results in volatilities that can wipe out a portfolio if due diligence is shunned.

Since the turn of 2020, on the tailwind of coronavirus, the norm has been market uncertainty, characterized by high volatility, massive selloffs, and unprecedented market movements. The same is expected to continue in 2022, necessitating investment assets that limit significant market moves.

Composition of risk reduction ETFs

The popularity of exchange-traded funds stems from their high liquidity, relatively cheaper cost, but above all due to their low-risk investment compared to stocks. Nevertheless, ETFs aren’t created equal. Passively managed ETFs whose composition and investment strategy ensure risk reduction by limiting big market moves. They accomplish this for investors by being low beta ETFs with the trade-off being more than average dividends for their investors.

The best three ETFs to reduce investment portfolio risk in 2022

To limit portfolio risk, investors use a variety of strategies ranging from stock picking to different investment class investing. The problem with most of these strategies is that they require extensive investment knowledge and experience and a specific nuance to guarantee a chance at success. Rather than go through all this hassle and the pain of picking the wrong stocks or combination of investment assets, why not invest in the following three exchange-traded funds whose sole purpose is to limit portfolio risk?

№ 1. Vanguard FTSE Developed Markets ETF (VEA)

Price: $50.57

Expense ratio: 0.05%

Dividend yield: 2.41%

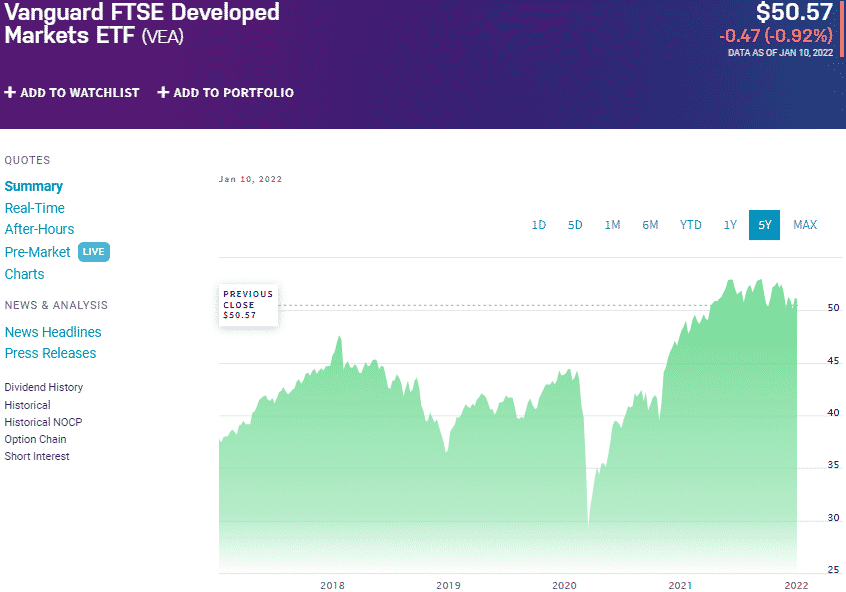

VEA сhart

The Vanguard FTSE, Developed Markets Fund, tracks the FTSE Developed All Cap ex US Index, investing all of its assets in the holdings of the tracked index. It exposes its investors to the developed global economies beyond the US borders. As a result, investors gain exposure to upwards of 4000 of the best equities globally across the cap divide.

VEA ETF is ranked № 25 by US News analysts among seventy-nine of the best foreign large blend ETFs for long-term investing.

The top three holdings of this non-diversified ETF are:

- Nestle SA – 1.76%

- Roche Holding AG – 1.35%

- Samsung Electronics Co Ltd – 1.26%

VEA ETF has $110.29 billion in assets under management, with an expense ratio of 0.05%. This ETF has recorded returns of 58.11% and 3-year returns of 47.06% in the last five years. In addition to its broad holding base and even weight distribution, the mix of large, mid, and small-cap equities allows for both value and growth attributes, resulting in a fund that offers consistent income, 2.41% dividend yield, and returns even in uncertain market environments.

№ 2. iShares MSCI USA Min Vol Factor ETF (USMV)

Price: $78.35

Expense ratio: 0.15%

Dividend yield: 1.38%

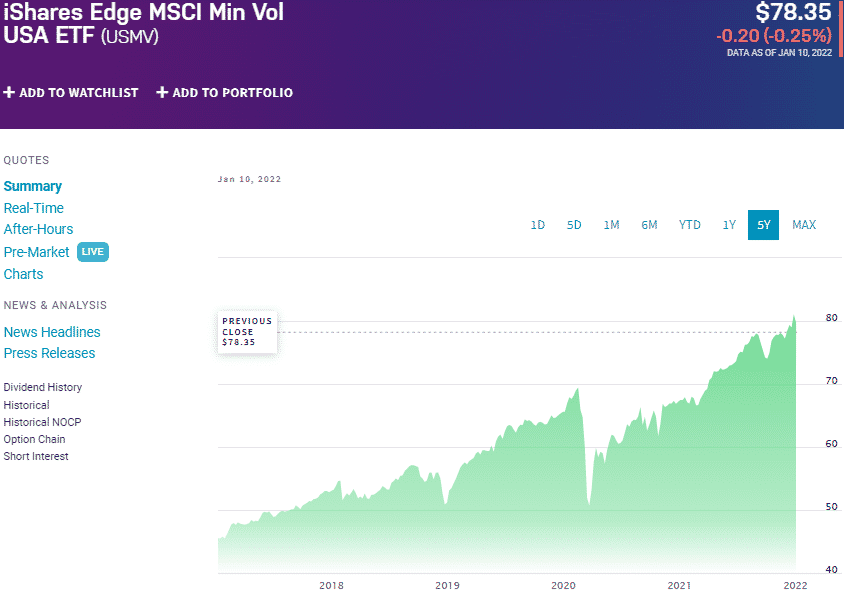

USMV chart

iShares MSCI USA Min, Vol Factor ETF, tracks the MSCI USA Minimum Volatility (USD) Index, investing at least 80% of its total assets in the underlying holdings of the composite index and other holdings of like economic characteristics. The result is a fund that exposes investors to more than 200 equities with the lowest volatility compared to their peers.

USMVETF is ranked № 52 by US News analysts among 237 of the best large blend ETFs for long-term investing globally.

The top three holdings of this non-diversified ETF are:

- Johnson & Johnson – 1.57%

- Verizon Communications Inc. – 1.56%

- Kroger Co. – 1.54%

The USMV ETF has $29.65 billion in assets under management, with an expense ratio of 0.15%. The special screening of this ETF’s underholding’s historically low volatility allows investors to enjoy significant upside in times of market downturn; 5-year returns of 88.86%, 3-year returns of 58.57%, and 1-year returns of 17.09%. As the most extensive low-volatility offering on Wall Street, USMV can be trusted to make a buck no matter the economic condition in 2022.

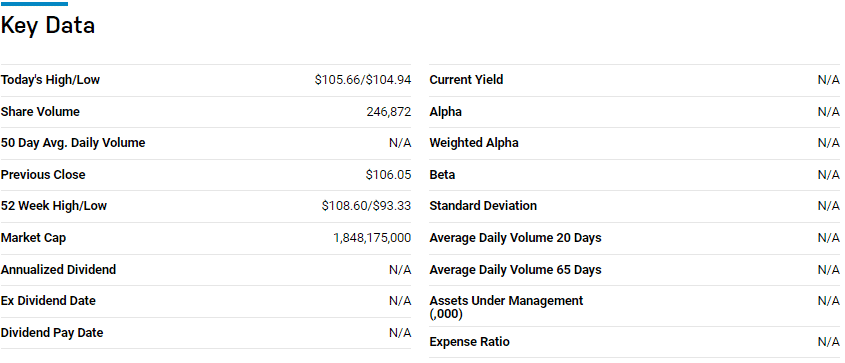

№ 3. iShares MSCI Global Min Vol Factor ETF (ACWV)

Price: $105.61

Expense ratio: 0.20%

Dividend yield: 1.63%

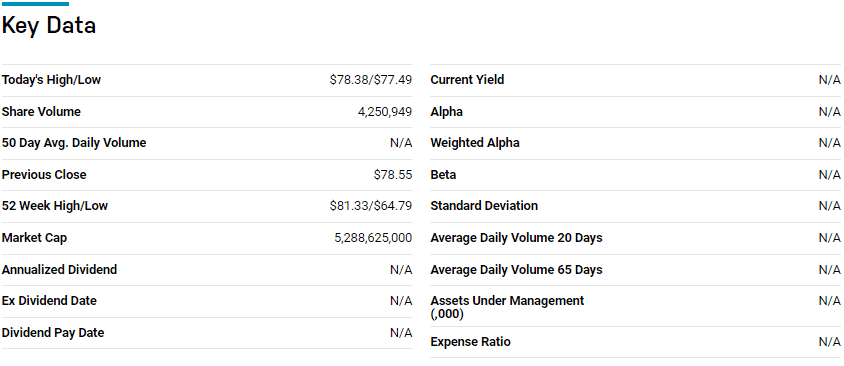

ACWV chart

iShares MSCI Global Min Vol Factor ETF tracks the MSCI ACWI Minimum Volatility (USD) Index, investing at least 80% of its total assets in the underlying holdings of the composite index and other holdings of like economic characteristics. The result is a fund that exposes investors to more than 398 global equities with the lowest volatility compared to their peers across the developed and emerging markets.

ACWV ETF is ranked № 6 by US News analysts among 37 of the best significant blend stock funds for long-term investing globally.

The top three holdings of this non-diversified ETF are:

- Verizon Communications Inc. – 1.57%

- Roche Holding Ltd – 1.51%

- Waste Management, Inc. – 1.44%

The ACWV ETF has $5.48 billion in assets under management, with an expense ratio of 0.20%. The special screening of this ETF’s underholding’s, low volatility among peers, and its global exposure allows investors to enjoy significant upside in times of market downturn; 5-year returns of 60.44%, 3-year returns of 38.40%, and 1-year returns of 11.10%.

In addition to global diversification, this fund has diversified across the different sectors, ensuring that it can weather almost any market downturn.

Final thoughts

The current economic uncertainty and volatile markets have left investors wondering where to place there had earned monies and ensure a tidy return. The low volatility funds above have diversification and beta, giving them the upside potential even in a market downturn.

Comments