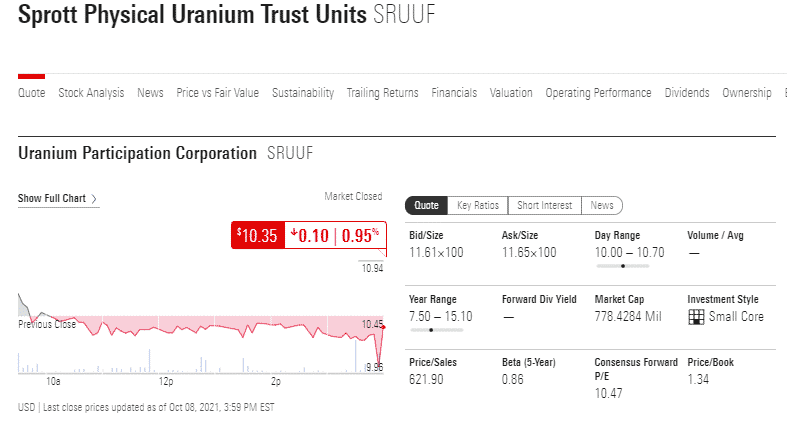

ETF full name: Sprott Physical Uranium Trust (SRUUF)

Segment: Global Uranium Market

ETF provider: Sprott Incorporated

| SRUUF key details | ||

| Issuer | Sprott Asset Management LP | |

| Dividend | N/A | |

| Expense ratio | 0.35% | |

| Investment objective | Replication Strategy | |

| Investment geography | Global Physical Uranium Market | |

| Benchmark | Uranium Spot Price | |

| Net Assets under Management | $1.22 billion | |

About the SRUUF ETF

Until recently, the mention of uranium would elicit thoughts of the cold war race for weaponry and horrific accidents. Thanks to technology and scientific evolution, this once feared mineral might be the best bet if the global community ever achieves decarbonization.

Since 2000, the global electricity demand has doubled, with the demand expected to double again in the next two decades. With the entire international community agreeing that the next phase of human evolution should be powered by clean energy, estimates on demand for nuclear energy doubling by 2050 is a worst-case scenario.

France and China have shown that nuclear power is not only scalable, cost-efficient, and with minimal carbon footprint, it is also safe. The Sprott Physical Uranium Trust is a fund that holds physical uranium bullion, and to some, might be responsible for the current uranium market’s bull run.

SRUUF fact-set analytics insight

Sprott Physical Uranium Trust is a passively managed fund that seeks to replicate the performance of uranium as a commodity after liabilities and expenses. Rather than seek profitability, this fund seeks to reflect the actual price of uranium.

SRUUF performance analysis

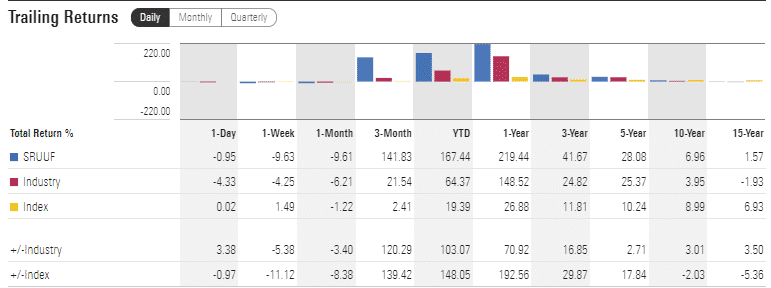

Despite uranium having been on a bear market since the Fukushima nuclear disaster, a look at the total returns for this fund show that it has been good to its investors for the last 15 years. With the intensification of clean energy adoption, the bearish uranium era has ended with SRUUF ETF has the forefront of buying and storing physical uranium in readiness for the nuclear energy niche to grow exponentially.

After several years of meager returns, SRUUF investors for the last three years have been smiling to the bank, with the nuclear energy market promising to make those smiles permanent for quite a while; 3-year returns of 41.67%, pandemic year returns of 219.44%, year to date returns so far of 167.44%.

SRUUF ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch.com | Morningstar.com | Money.usnews.com |

| IPO Rating | N/A | N/A | N/A | N/A | N/A |

| IPO ESG Rating | N/A | N/A | N/A | 33.20 out of 50 | N/A |

SRUUF key holdings

SRUUF being a commodity ETF, does not have any underlying holdings. It buys and holds physical uranium stocks and sells them depending on demand and market rates.

It holds uranium in two forms:

- U3O8 with 30,614,382 kilograms

- UF6 with 300,000 kgs.

To put these stocks in context, 19 million kilograms of U3O8 can power France, powered 70% by nuclear power and the world’s leading nuclear exporter, for nine months.

Industry outlook

SRUUF might be the reason why uranium is on such a bullish run given the stocks of physical uranium it’s buying and storing. But it is not the only thing putting uranium on the map of the world.

Presently, the nuclear space has 53 nuclear reactor projects in various completion stages around the globe, with the developed economies pushing for alternative energy sources with zero greenhouse gas emissions.

In addition, the global community has taken note of the detriments of fossil fuels, and the majority is advocating for decarbonization. As such, nuclear energy provides the best alternative to fossil fuels by having a minimal carbon footprint, giving scalability at relatively lower prices, and safely. With uranium as the critical component for nuclear energy, SRUUF might just be amassing the stocks to skyrocket as this energy niche takes off.

Comments