Slippage is a common term for traders who perform frequent trades in the financial market. Billions of dollars worth of crypto assets change hands without central exchanges, intermediaries, or authorities. So slippage is also an issue of the crypto marketplace that needs to be ironed out.

However, learning the definition of slippage is mandatory, why it occurs in the crypto market, and methods to avoid it while trading cryptocurrency. This article will describe all these basic facts and list the top five ways to avoid sliding on any decentralized exchange.

Three things to know about slippage before starting:

- It is the price difference between when anyone submits an order and when the blockchain confirms the offer. So the price difference between the paid cost and quote price is slippage.

- It occurs when price changes so rapidly due to the demand and supply. However, some crypto assets have lack liquidity due to newness or popularity. So the spread between the highest bid and lowest ask price is vast, and the price of these assets may dramatically change during transactions.

- The formula to determine slippage

$ of slippage / (LP – EP) x 100 = % slippage. Where, LP = limit price/ worst expected price and EP = expected price.

The top five ways to avoid slippage while trading crypto

Several methods are available to deal with the slippage of crypto assets. The top five ways among them are

1. Using more “gas”

Everyone may want to process their transactions when the block space is scarce, an ideal situation for occurring slippage. If you use regular or standard fees (gas) during times like this, your trade might be stuck or remain pending for a more extended period than usual. During that period the price can change more than you expect.

If you can bump up your gas fee in this situation, it will help you avoid that wide price change, or you won’t get fewer coins. It will leave less wiggle room for any slippage to impact your transaction and settle your trade more effectively.

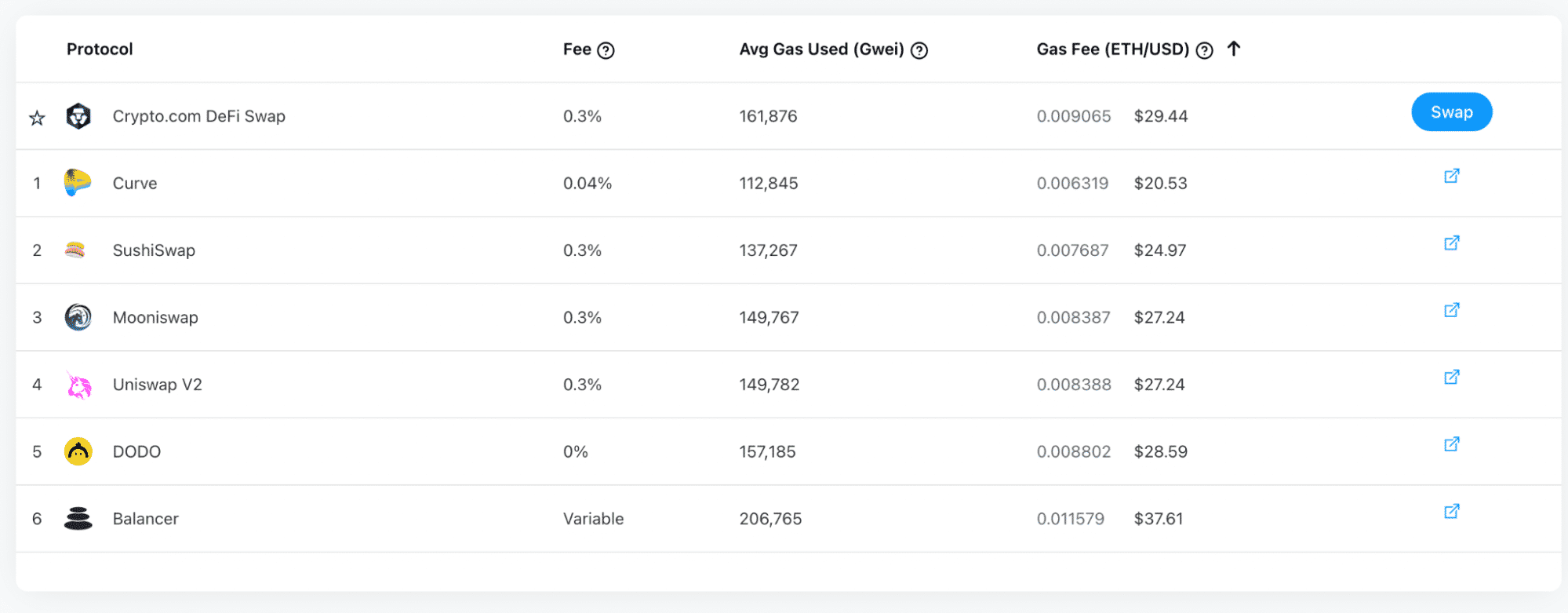

Ethereum gas fees

The above image shows the list of exchanges and gas fees on swaps. Investors should choose the perfect platform where the gas fees are low and high transaction speed.

2. Execute trades on layer two solution

If you follow the previous way, it will increase your overall cost. To avoid this, you can trade on layer two solutions to execute faster transections without paying more. The layers two rolls up bunches of transactions away from the main Ethereum chain and later submit them in a big batch.

In this way, everyone makes individual transactions cheaper as everyone splits the significant transaction’s cost. Optimism, Polygon, and Arbitrum are examples of the popular Layer two rollups.

3. Limit orders

Another popular way to avoid slippage is to use limit orders. When you use limit orders instead of market orders, you will set the minimum sell limit or the maximum buy limit, and your order will execute when your conditions meet with the price movement in both cases. It may require no instant execution of trades, but you can avoid slippage by following this technique.

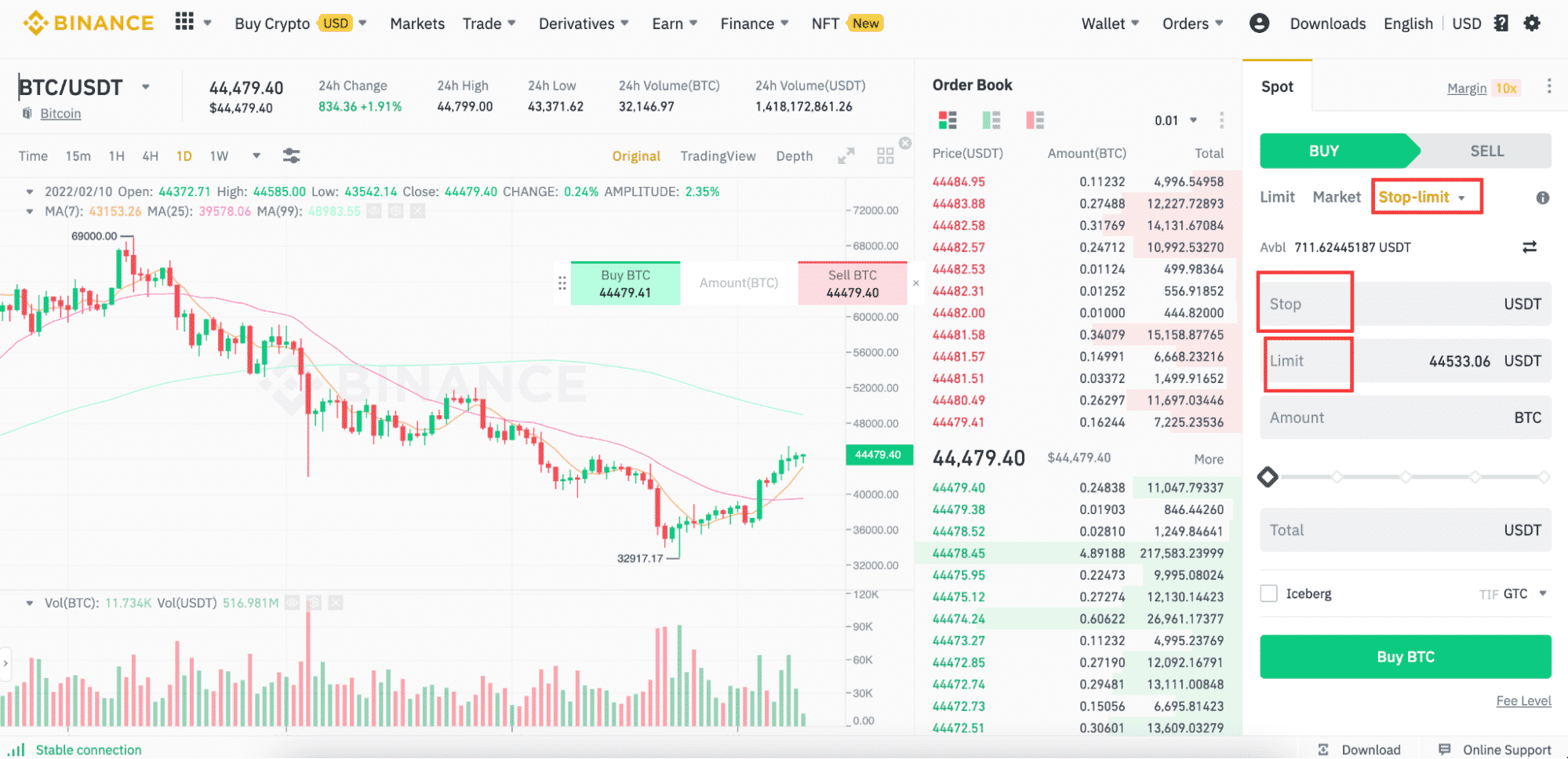

Binance limit orders

The above image shows how the limit order works in the crypto chart. Here you have to input the buying price at a specific level based on your analysis with a suitable stop level. Once the price reaches your previously set level it will automatically activate your trade.

4. Over-the-counter (OTC) desk

Using an OTC desk is one of the best ways to avoid slippage, particularly executing a massive order. It enables individuals to find a fixed price for executing any specific buy order. The transaction doesn’t perform by any exchange; instead, OTC finds buyers and sellers looking to execute large trades and sets them up directly. The price agreement occurs upon the buyers and sellers in this way, so it doesn’t involve any slippage issue as exchanges do.

5. Adjust slippage tolerance levels

Another popular way is to adjust slippage tolerance levels as the most major decentralized crypto exchange platform enables this option for traders. Individual traders can adjust slippage tolerance percentage either increase or decrease depending on market context while executing any order.

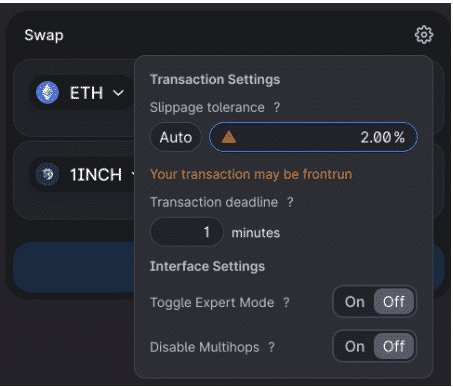

Uniswap slippage percentage adjusting

For example, UniSwap allows adjusting slippage by clicking on the simple setting at the swap interface’s top right corner.

If you expect the slippage percentage to swing more dramatically while executing any trade on peak hour, you can set your slippage percent value too low. So the transaction won’t occur as long as it keeps hitting outside of the level you mark.

On the other hand, you may have to pay more for each token when you set the slippage percentage level too high. It is suitable depending on a more effective trading strategy and when the individual is highly personal. Note that if you keep your slippage tolerance too low, that may cause repeatedly fail your order, eating your gas fee.

Final thought

Slippage is a common term for nearly any financial asset. Professional crypto investors use this term to mature the potential transaction cost of trades. Anyone should consider measuring slippage when deciding to trade in a new marketplace. Whether a novice trader or a professional crypto trader, it is essential to measure slippage to keep your asset’s value intact while converting it into currencies or other assets.

Comments