Suppose you bought 10,000 shares at 35 cents apiece, for a total of $3500. If the stock price rises to $2, you will earn $16,500, quadrupling your investments and then some. However, trying to pick and time the stock market has been proven to be next to impossible.

Rather than deal with all this headache, ETF providers have penny stock ETFs, also known as microcap exchange-traded funds. There is no clear-cut way of telling if the following penny stock will evolve into a Tesla or Amazon. The only sure thing is that if these penny stock companies thrive, you will have invested cheaply for exceptional value and growth.

Penny stock ETFs to double money: how do they work?

To understand penny stock ETFs and how they can double your money, we first define a penny stock. Initially, penny stocks were defined literally to include only those equity shares trading at less than a dollar. The securities and exchange commission redefined penny stocks to include those trading at $5 and below.

Penny stocks ETF to ensure a balanced pool of holdings usually invests in equities of organizations with a market capitalization of not more than $300 million. Therefore, penny stock ETFs are a pool of equity organizations within the penny stock definition that have floated shares to fund particular projects and expand.

The best penny stocks ETFs to double your money in 2022

In most cases, the investment world has eyes for the large-cap stocks and those making waves in their niches, leaving the penny stock world a store of value for those that dare. The penny stock ETFs below take the sting off investing in penny stocks while providing value and a chance to double your investment.

№ 1. AdvisorShares Dorsey Wright Micro-Cap ETF (DWMC)

Price: $36.4766

Expense ratio:0.10%

Annual dividend yield: N/A

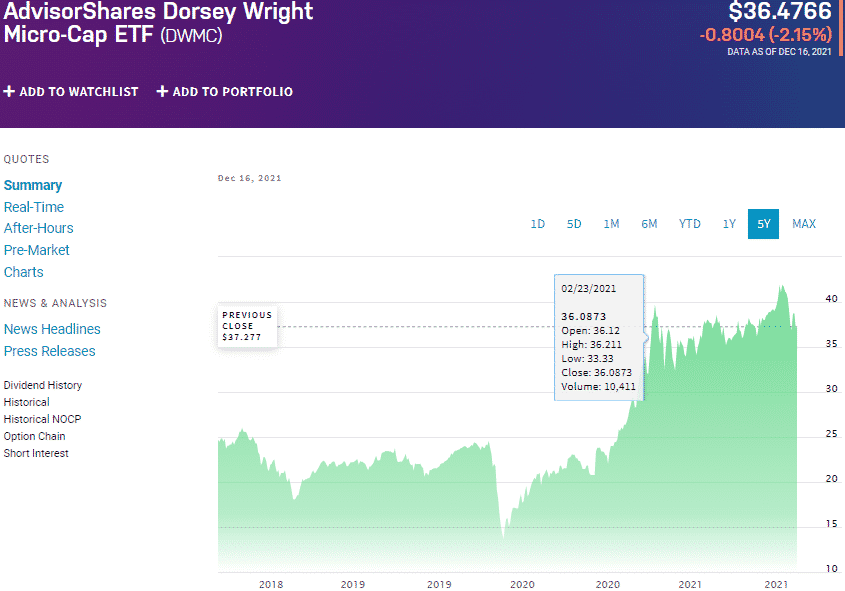

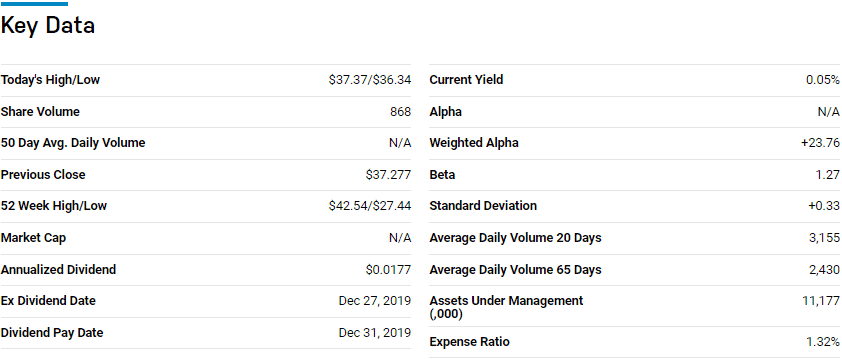

DWMC chart

The Advisor Shares Dorsey Wright Micro-Cap ETF is an actively managed fund that invests at least 80% of its total assets in micro-cap equities and associated ADRs. However, it takes a structured approach to its active management by picking the best stocks from the Russel 2000 index based on strength, in addition to 1000 of the best microcap equities.

The top three holdings of this ETF are:

- Calix, Inc. – 2.07%

- Kornit Digital Ltd. – 1.41%

- IDT Corporation Class B – 1.34%

DWMC ETF has $11.2 million in assets under management, with one of the highest expense ratios on this list at 1.32%.

Active management and concentrating on strength penny stock equities has this ETF in an elite group of ETFs that have posted positive results in their first year of operation; 3-year returns of 88.29%, pandemic year returns of 36.82%, and current year to date returns of 31.91%. With quarterly rebalancing to weed out stocks the fall below its 50% strength threshold, this ETF is a constant provider of both value and growth.

№ 2. iShares Micro-Cap ETF (IWC)

Price: $134.52

Expense ratio: 0.60%

Dividend yield: 0.59%

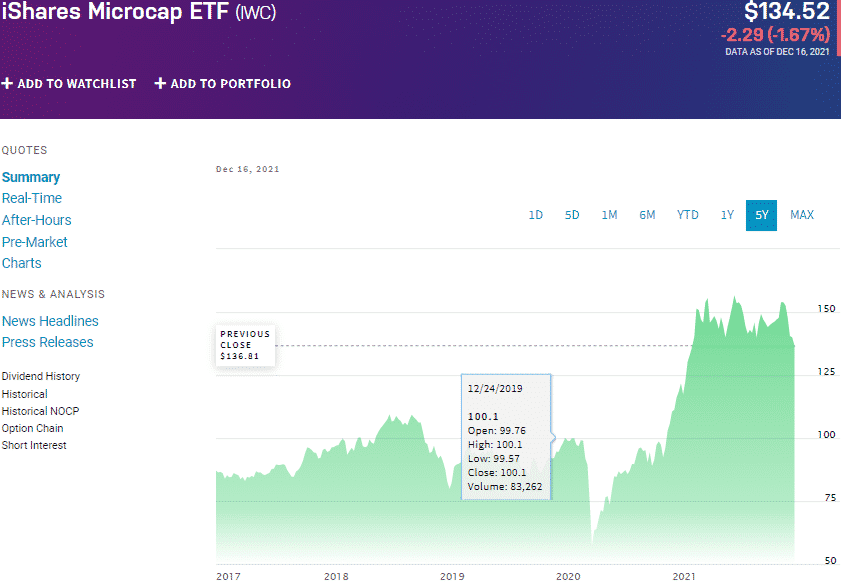

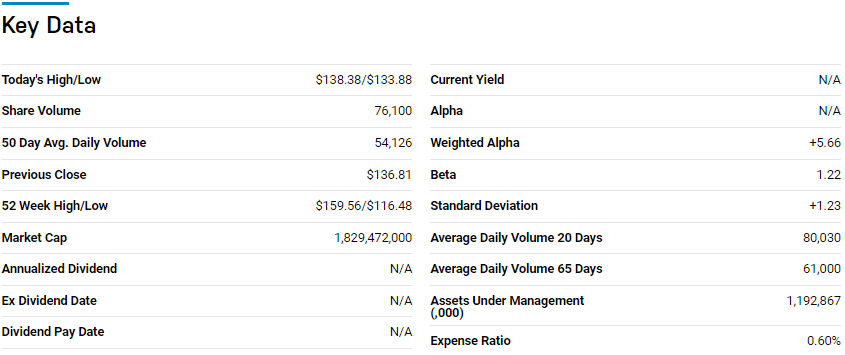

IWC chart

The iShares Microcap ETF tracks the Russell Microcap Index, investing at least 80% of its total assets in the component securities of the underholding and any other securities of like economic characteristics. The remaining 20% of the total assets are invested in financial instruments and other securities that ensure the ETF meets its objective. Investors in this penny stock ETF get exposure to the US penny stock equity market.

This ETF is ranked № 25 by US News analysts among 58 of the best small blend ETFs for long-term investing.

The top three holdings of this ETF are:

- Civitas Resources, Inc. – 0.56%

- Apollo Medical Holdings, Inc. – 0.55%

- Houghton Mifflin Harcourt Company – 0.40%

IWS ETF has $1.19 billion in assets under management, with investors’ parting with $60 annually for every $10000 invested. This penny stock ETF has a slight bias to take advantage of a technology-run world but otherwise is evenly distributed across sectors and under holdings to spread the inherent risk in penny stock investing.

This diversification has allowed this fund to thrive even during the pandemic despite its investment geography; 5-year returns of 70.26%, 3-year returns of 63.61%, pandemic year returns of 17.08%, and current year to date returns of 16.19%. With exposure to over 1300 microcap equities, you can be sure that there is a higher chance that this basket contains the next Tesla or Amazon or both, hence worth a look.

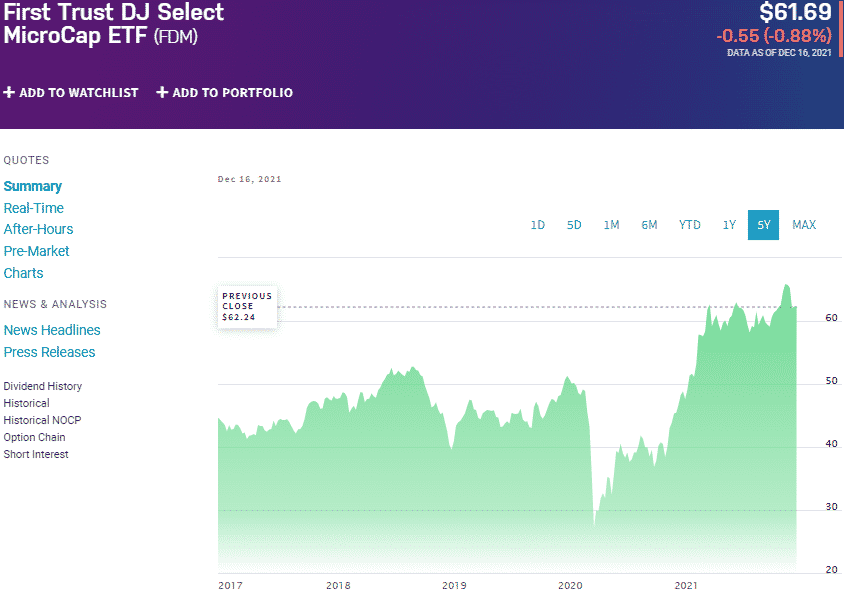

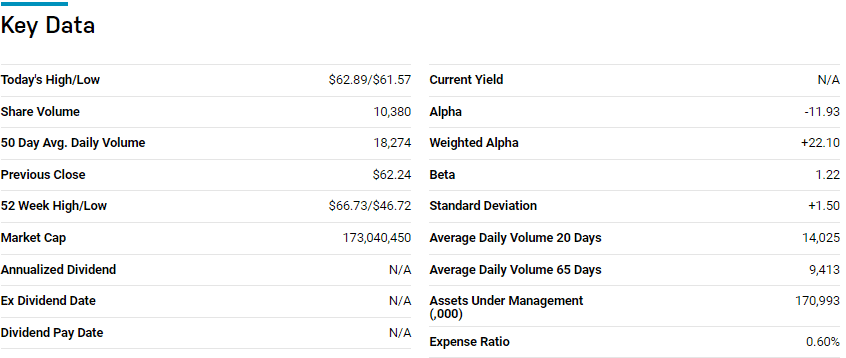

№ 3. First Trust Dow Jones Select Micro-Cap Index Fund (FDM)

Price: $61.69

Expense ratio: 0.60%

Dividend yield: 1.02%

FDM chart

First Trust Dow Jones Select Micro-Cap ETF tracks the performance of the Dow Jones Select Micro-Cap Index, investing at least 80% of its total assets in micro-cap organizations publicly traded in the US.

FDM ETF is ranked № 13 by US News analysts among 25 of the best small-cap value funds for long-term investing.

The top three holdings of this ETF are:

- Ingles Markets, Incorporated Class A – 1.15%

- Advansix, Inc. – 1.12%

- Andersons, Inc. – 0.99%

FDM ETF has $171.0 million in assets under management, with an expense ratio of 0.60%. Given the volatility and inherent risk of penny stock investing, this ETF weeds out perceived worst performers by concentrating on solid fundamentals and high liquidity.

The selection method shows in the historical performance where this ETF outperforms both its category and segment averages; 5-year returns of 52.71%, 3-year returns of 55.17%, pandemic year returns of 31.32%, and current year to date returns of 30.70%.

Final thoughts

After significant economic distress, small and micro-cap equities tend to outperform the broader markets. As the world recovers from the coronavirus and the economy open up, the ETFs above have the potential to double your money as their underlying holdings stretch their legs and cover their growth leg rooms.

Comments