If you read any trading article, chances are someone has mentioned leverage and how it can be detrimental to your gains. People fear it and try to instill that same dread into other investors. Then again, many use it with great success daily.

So what is that thing that allows only some to utilize this valuable trading tool? Today, we will learn what leverage is, how it works, and how and when you can include it into your trading strategy to maximize your gains.

What is leverage?

Let’s explain it with an example. Say you want to buy a stock worth $100, and you only have $1,000 that you can invest. If the ten stocks you own rise by 10%, you are standing to get 100 dollars in total.

However, if you are sure you are investing in the right shares, you can trade on leverage and amplify your returns. Leverage comes in different ratios and sizes, but let’s take a plain 5:1 leverage to make things extra simple. You take leverage, and suddenly, you no longer have $1,000 to invest but $5,000. If the stocks follow the same trend, you will have made $500 instead of $100 without investing more.

Like real-life leverage helps you lift more weight with less effort, the financial leverage allows you to make greater returns with less of your capital paid upfront. This tool always works the same way, whether to buy stocks, real estate, ETFs, or other securities.

What are the downsides of leverage?

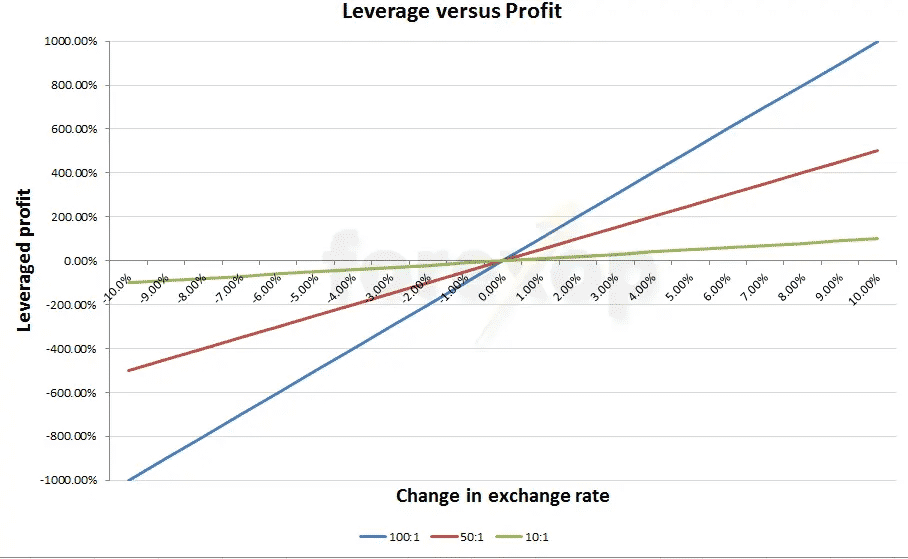

The main thing to be on the lookout for when utilizing leverage is that this investment vehicle should always be seen for what it is — a double-edged sword. In other words, the same way the leverage allows you to multiply your returns, it also expands your losses should the security you invested intake a different path from the one you betted on.

In our initial example, leverage brought you 500 dollars instead of $100 you would have made with your own money after a 10% rise in stocks. If those shares fell by 10%, you would have ended up with a loss of $500, which is exactly half of what you had available to invest.

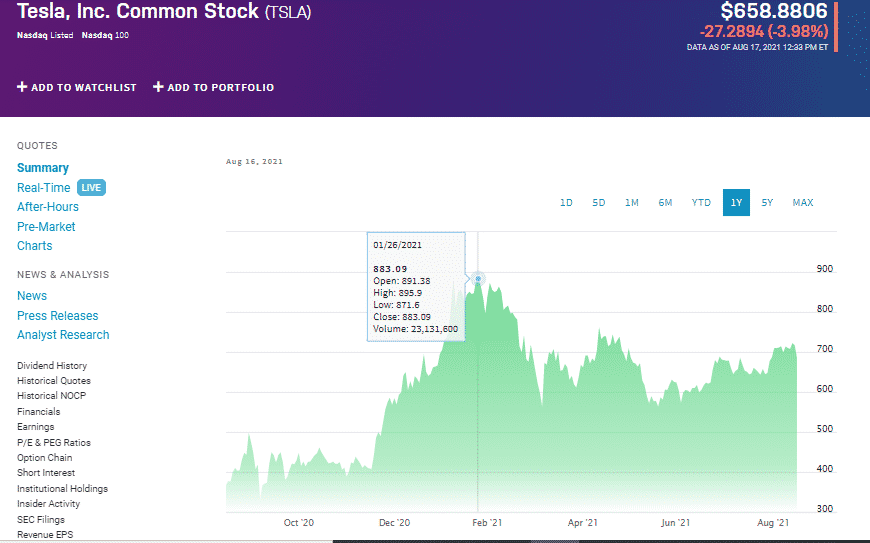

Tesla Inc. Common Stock chart

Tesla Inc. stocks here traded at their all-time high of over $883. The difference between the price of its shares on January 4 and January 26 was $154. If you were sure that the electric vehicle maker would skyrocket in 2021, you could have used the leverage and multiplied the returns by the amount you felt fit. This is just one example of how this popular trading tool can be put to good use when you are sure that your call is the right call.

How can you make the best of using leverage?

The most important thing is to take leverage seriously, as it is not a joke. The second most important thing is to not tremble at the mention of it. A healthy approach to leverage is the best option here. Let us elaborate.

Imagine you have been watching every game of your favorite basketball team. Nobody saw it coming, but you could anticipate this game was going to be their big win. Their best player will return after the injury, and he has been playing well for the past couple of try-outs. Moreover, the opposing team is undergoing a leadership crisis, and the two of their best players are not on speaking terms.

In that case, it can be understandable for you to want to borrow money to bet on your team. At that point, it’s no longer a bet. It’s an educated guess. The same goes for leverage.

- If you are following the news articles, that could affect the security you invested in. If you feel confident that the security you picked will follow a particular trend, it makes total sense for you to use leverage and cash out on your hard work.

- Secondly, finding a broker that offers the proper leverage for you is undeniably a must. It will always bode you well to find a ratio of leverage you can handle and tolerate even if things go south. So if the broker offers only 400:1 leverage, and it seems a little too steep for you, by all means, keep on looking.

- Lastly, it is essential to start small. Keep in mind that you can always take higher leverage once you feel confident enough in your skills and experience. Start with a, say, 10:1 leverage, and feel the things out. Many traders find trading with leverage too risky and stressful. Some even described it as “driving a luxurious car that your rich friend lent you.” While it can give you the benefits you might enjoy, the price of it can be too great for some in an emotional and psychological sense.

Final thoughts

As usual, we left the most important thing for last. Leverage is a perfect investment vehicle, but it is just one of many. If you don’t feel comfortable using leverage, you can make hefty profits without coming near it.

The vital thing you should remember is that any trading and investment strategy needs to fit your personal preference, your financial goals, and your own set of skills and traits.

It is not something that people should fear, but it is also not one of those things you can reach for without thinking about the consequences first. That way, you can use this fire we mentioned at the beginning to cook something nice, instead of burning down the kitchen.

Comments