ETF full name: SPDR S&P Bank ETF

Segment: US Financials

ETF provider: State Street Global

| KBE key details | ||

| Issuer | State Street | |

| Inception date | November 08, 2005 | |

| Expense ratio | 0.35% | |

| Average Daily $ Volume | $224.52 M | |

| Investment objective | Replication strategy | |

| Investment geography | US Financial Equities | |

| Benchmark | S&P Banks Select Industry Index | |

| Net assets under management | $2.71 Billion | |

About the KBE ETF

Suppose you want to invest broadly in the global economic trends while at the same time achieving targeted exposure to a particular segment. In that case, the financial service sector is a great starting point. A centralized financial system means that most transactions flow through the banks, making this ideal for gauging the economic pulse. However, analyzing banking stocks requires financial expertise most of us cannot afford. For this reason, we have banking ETFs, and the SPDR S&P Bank ETF is an excellent place to start.

KBE fact-set analytics insight

SPDR S&P Bank ETF tracks the yield performance and total returns of the S&P Banks Select Industry Index, net expenses, and fees. It invests at least 80% of its total assets in the holdings of its composite index, exposing investors to large US publicly traded leading regional banks and national money centers. In addition, it can also invest in cash and cash equivalents, other equities not included in the tracked index, and money market instruments, exhibiting similar economic characteristics to the tracked index holdings.

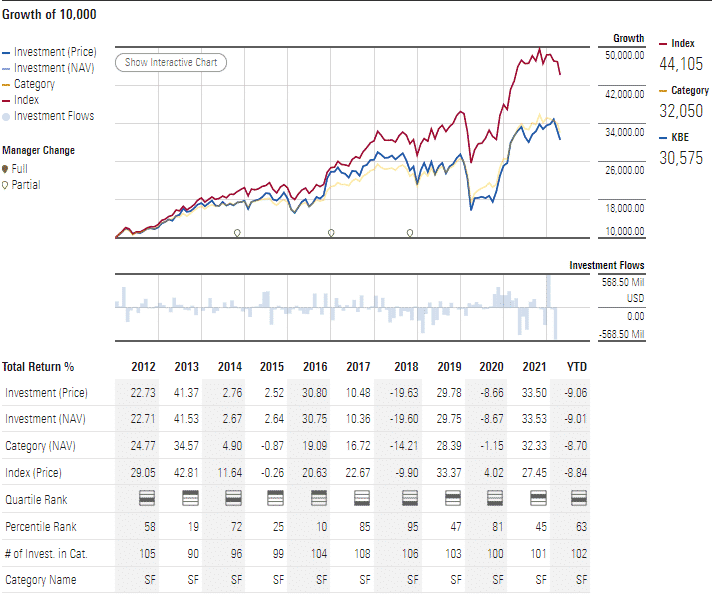

KBE annual performance analysis

Being a pioneer fund in the financials segment provides the liquidity and financial muscle, making this ETF resilient in market downtime. At its launch, an investment of $10000 would now be worth $30575, not even accounting for a decent annual dividend yield of 1.94%.

KBE ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.COM | MARKETWATCH | Morningstar.com | Money.usnews.com |

| IPO rating | A+ | BBB | Quantile 3 | ** | Rank 9 in Financials |

| IPO ESG rating | 5.52/10 | 5.52/10 | N/A | 27.31/50 | 5.7/10 |

KBE key holdings

SPDR S&P Bank ETF comprises upwards of 100 equities in the financials segment and is one of the most liquid and popular funds operating in this space. It is also one of the most resilient funds because of its equal weighting hence mitigation against concentration risk.

The top ten holdings of this fund are.

| Ticker | Holding | % Assets |

| JXN | Jackson Financial Incorporation Class A | 1.4% |

| VOYA | Voya Financial, Inc. | 1.4% |

| SI | Silvergate Capital Corp. Class A | 1.3% |

| ESNT | Essent Group Ltd. | 1.3% |

| EQH | Equitable Holdings, Inc. | 1.3% |

| NTRS | Northern Trust Corporation | 1.3% |

| BKU | BankUnited, Inc. | 1.3% |

| CFR | Cullen/Frost Bankers, Inc. | 1.3% |

| EWBC | East West Bancorp, Inc. | 1.3% |

| WTFC | Wintrust Financial Corporation | 1.3% |

Industry outlook

Most funds allocate more weight to large financial institutions in the banking segment. The result of this is usually funds that are highly susceptible to the volatility of the funds with the most significant weighting. The KBE ETF diverges from this by providing an equally weighed fund of over 100 holdings, free of concentration bias. With talks of double-digit rate hikes in June and July, this fund offers a diversified yet focused exposure to the US banking segment.

Comments