ETF full name: Horizons Global Uranium ETF (HURA)

Segment: Global Nuclear Energy

ETF provider: Mirae Asset Management

| HURA key details | ||

| Management | Horizons ETF Management | |

| Dividend | 0.38% | |

| Inception date | 15th May 2019 | |

| Expense ratio | 0.85% | |

| Average Daily $ volume | $21.19K | |

| Investment objective | Replication Strategy | |

| Investment geography | Global Nuclear Energy Equities | |

| Benchmark | Solactive Global Uranium Pure-Play Index | |

| Weighted Average Market Cap | 20% of the net asset value of the fund | |

| Net Assets under Management | $49.5 million | |

| Number of holdings | 36 | |

| Weighting methodology | Weighted average market cap | |

About the HURA ETF

For the first time in nine years, a glance at the uranium market will show a bullish rally, with uranium prices at the highest they have ever been. What is this attributable to? In addition to the coronavirus disrupting mining activities, among other economic activities, the global community is now cognizant of the detrimental effect of fossil fuels, creating an appetite for green technology and clean energy. While solar and wind energy is the first thing to consider about clean technology, they are overly reliant on weather conditions, necessitating new alternative energy sources.

Nuclear energy provides a scalable, efficient, and cost-effective way of achieving the globally demanded load power with zero emissions. The problem is that the uranium supply cannot meet these demands, creating opportunities for investors to make money. Rather than pick among the limited uranium equities, gambling on which ones will be the front leader in the race for these opportunities, why not invest in uranium ETFs and bet on the entire niche. Mirae investment launched the Horizons Global Uranium Index ETF in 2019, providing investors with an investment vehicle with tentacles in the global uranium market.

HURA fact-set analytics insight

The Horizons Global Uranium Index ETF tracks the Solactive Global Uranium Pure-Play Index. The composite index categorizes its holdings in two:

- Those whose primary activity is a uranium exploration and mining;

- Those involved in direct investment and participation in the uranium market.

This ETF’s original listing is with the Toronto exchange, with its holdings listed with the developed economies stock exchanges.

HURA performance analysis

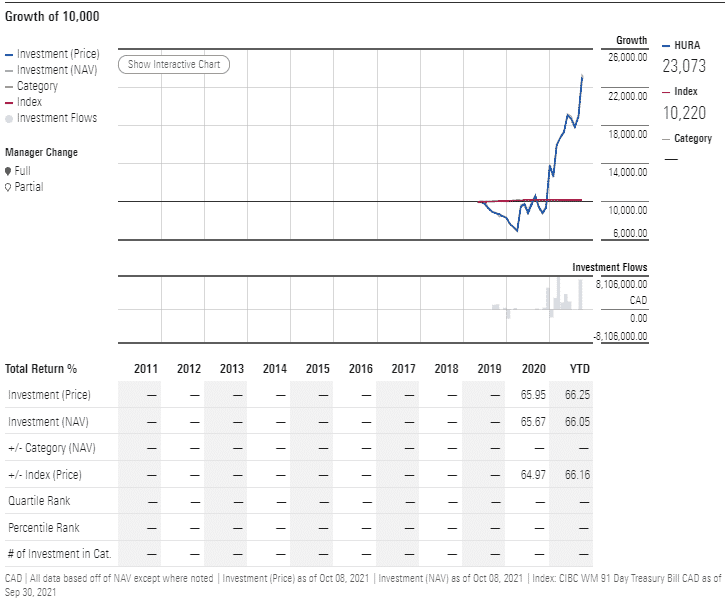

HURA chart

With just two years of existence under its belt, HURA’s performance shows a lot of promise for its investors; 1-total returns of 65.67%, with year-to-date returns of 66.05%. Though historical performance is not a guarantee of future returns, such a performance right from inception is something worth noting.

HURA key holdings

HURA’s holding base comprises 31 organizations, currently with assets under management of $41.5 million in just over a year. With quarterly rebalancing and the explosion of this energy industry niche, expectations are for more organizations to come on board.

The top ten uranium and nuclear energy equities comprising the HURA are as below.

| Ticker | Holding name | % of assets |

| KAP | National Atomic Co Kazatomprom JSC ADR | 21.39% |

| CCO | Cameco Corp. | 19.63% |

| YCA | Yellow Cake PLC Ordinary Shares | 17.49% |

| NXE | NexGen Energy Ltd | 9.20% |

| DML | Denison Mines Corp. | 4.49% |

| PDN | Paladin Energy Ltd | 4.18% |

| EFR | Energy Fuels Inc. | 3.35% |

| 1164 | CGN Mining Co Ltd | 2.89% |

| UEC | Uranium Energy Corp. | 2.58% |

| LEU | Centrus Energy Corp. | 1.71% |

Industry outlook

The scientific and investment communities are in agreement that nuclear energy provides the best low-carbon baseload energy source. In addition to this, the ever-increasing prices of crude oil, natural gas, and coal have created an appetite for transitioning to nuclear energy to match the US, China, and France.

With developing economies going for zero emissions, the global stage for nuclear power to take center stage. It is making uranium a sustainable investment class asset. The HURA launch might have coincided with a niche attaining critical mass, providing investors a front-row seat to atomic gains. Of course, if they will play right.

Comments