The world has felt the pinch of higher gas prices globally, and there is no respite in sight. It then comes as no surprise with the soaring gas prices that the natural gas market is expected to reach upwards of $1.03 trillion in 2022 and continue growing at a CAGR of over 7.7%.

Top natural gas ETFs: how do they work?

Like many natural resources, the demand and supply of natural resources are largely at the mercy of uncontrollable factors such as weather. Combine this with the difficulties and costs associated with natural gas transportation, and what you have is a highly volatile commodity, susceptible to wild swings in the trading markets.

It is for these reasons that natural gas ETFs exist. These ETFs comprise equities and other organizations involved in the exploration, distribution, marketing, and sale of natural gas, allowing investors a stake in this market.

Top natural gas ETFs for 2022

With the rising natural gas prices and the volatility associated with this market, investors can mitigate against the inherent risks in this market and make a killing in 2022 via the three ETFs below.

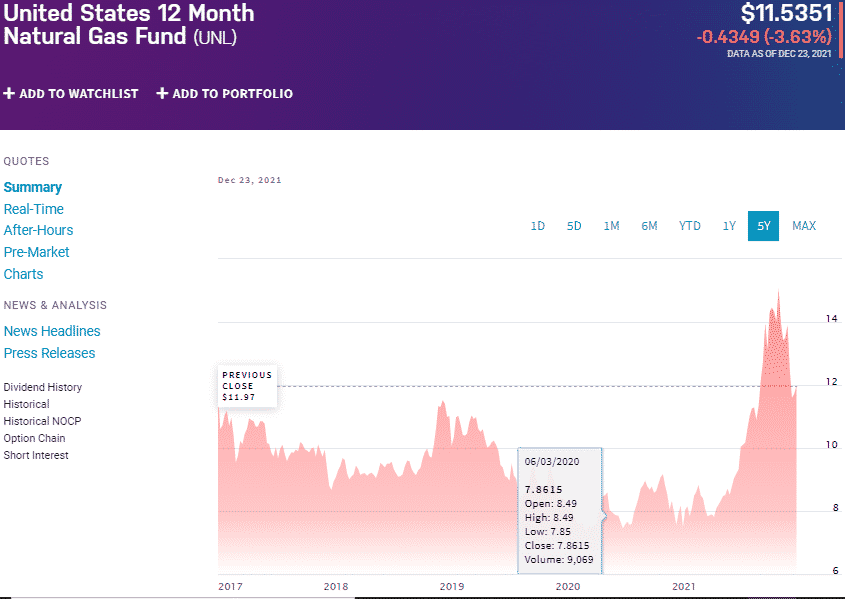

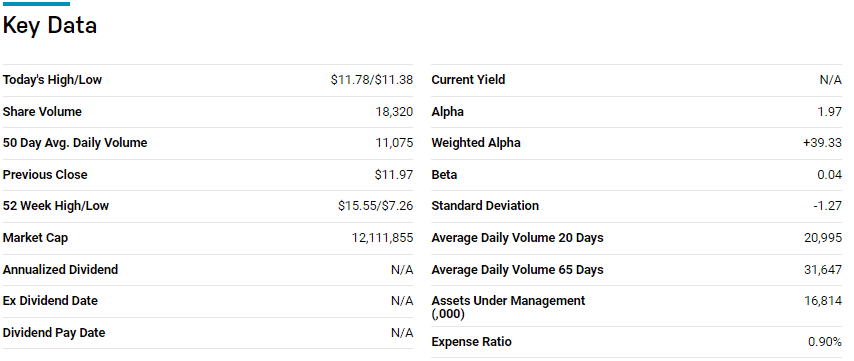

№ 1. United States 12 Month Natural Gas Fund LP (UNL)

Price: $11.5351

Expense ratio:1.35%

UNL chart

The United States 12 Month Natural Gas Fund tracks the performance of one-year natural gas features as delivered to Louisiana Henry Hub. The futures contracts of the UNL are traded on the ICE Futures Europe NYMEX and ICE Futures US or the other US and foreign exchanges and have a maturity period of between a month and 11 months.

UNL ETF has $16.8 million in assets under management, with an expense ratio of 0.90%. With diversification across multiple maturity periods, this natural gas ETF mitigates against the inherent risk in natural gas investing and provides an inflation hedge asset.

Therefore, it comes as no surprise that this ETF has been posting positive returns for the last half a decade; 5-year returns of 3.92%, 3-year returns of 4.58%, and pandemic year returns of 48.84%. Given the continued appetite in the state for natural gas and year-to-date returns of 51.98%, this ETF is worth a look if considering US natural gas investing.

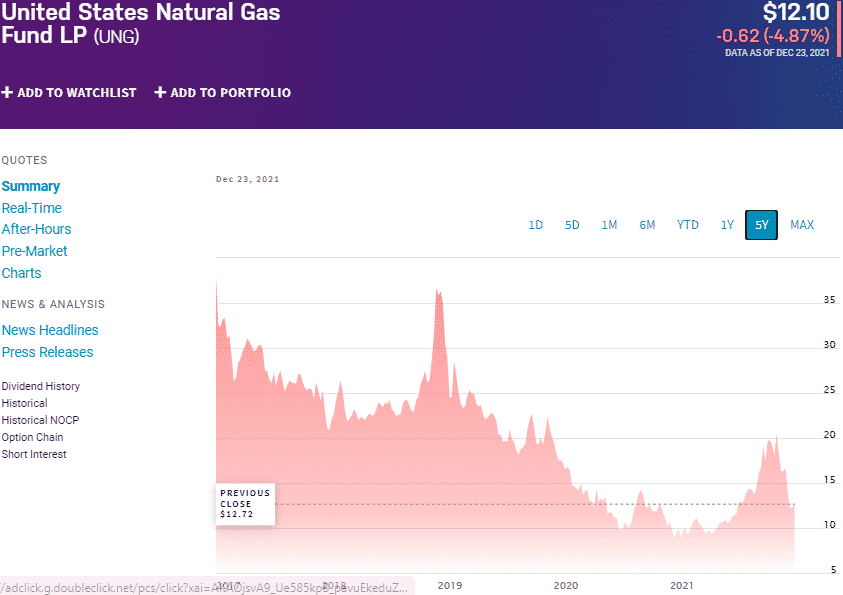

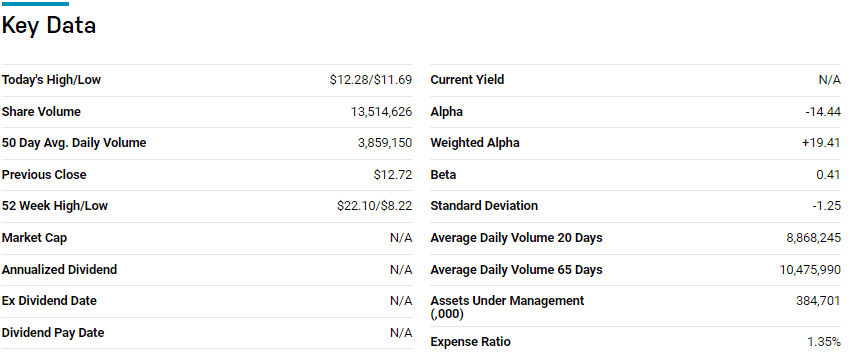

№ 2. United States Natural Gas Fund LP (UNG)

Price: $12.10

Expense ratio: 1.35%

Annual dividend yield: N/A

UNG chart

The fund tracks the performance of short-term natural gas features as delivered to Louisiana Henry Hub. The futures contracts of the UNL are traded on the ICE Futures Europe NYMEX and ICE Futures US or the other US and foreign exchanges. They have a maturity period of a month, disqualifying anything with a maturity period of fewer than two weeks.

UNL ETF has $384.6 million in assets under management, with an expense ratio of 1.35%. With no diversification across multiple maturity periods, unlike the UNG, this natural gas ETF is ideal for short-term traders.

Therefore, it is no surprise that the UNL has performed better over the shorter period than more extended periods; 5-year returns of -65.93%, 3-year returns of -60.00%, pandemic year returns of 29.00, and year to date returns of 31.52%. UNG is a great starting point if looking into the natural gas short-term investment pool.

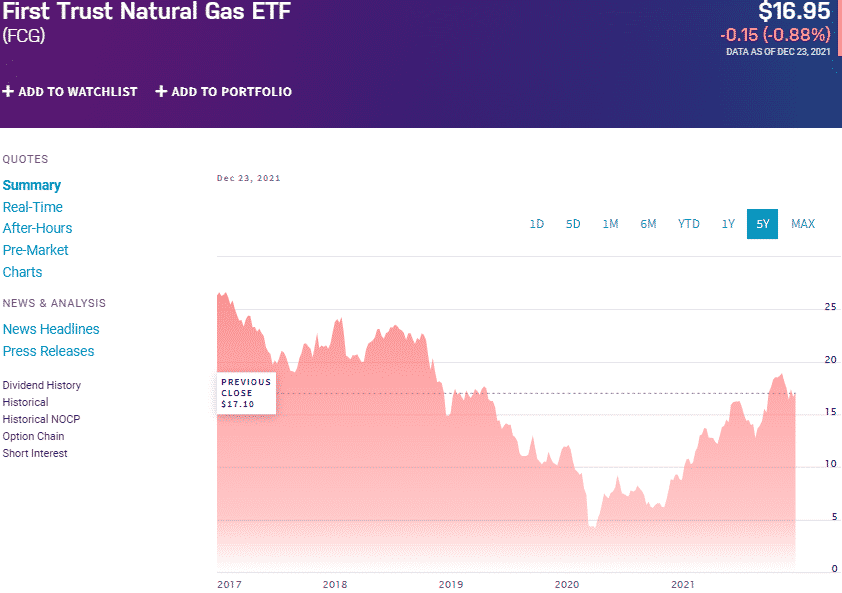

№ 3. First Trust Natural Gas ETF (FCG)

Price: $16.95

Expense ratio: 0.60%

Dividend yield: 1.58%

FCG chart

The First Trust Natural Gas Fund tracks the ISE Revere Natural Gas Index, investing at least 90% of its net assets in the underlying holdings, their depository receipts, and the tracked index’s MLP units. It exposes investors to middle and large-cap equities deriving at least 50% of their revenues from natural gas-related activities, majorly midstream activities, and natural gas exploration.

The top three holdings of this ETF are:

- Western Midstream Partners, LP — 4.86%

- ConocoPhillips — 4.38%

- DCP Midstream LP — 4.36%

FCG has $424.9 million in assets under management, with investors having to part with $60 annually for every $10000 investment. It offers a different play of the natural gas market free of contango restrictions, providing a leveraged avenue.

The five-year returns were not anything to write home about, but since then, this ETF has recovered to outperform both the category and segment averages; 5-year returns of -28.79%, 3-year returns of -28.27%, pandemic year returns of 88.26%, and year to date returns of 94.05%. The FCG is an excellent option for rising commodity prices, making it a favorite come 2022.

Final thoughts

Natural gas is essential for power generation and cooking, heating, and cooling houses. With the global population’s appetite for renewable energy growing, existing companies’ expenditure on new products will continue going down, increasing the price of scarce natural gas commodities.

Solar, wind, nuclear energy, hydrogen, and other alternative energy sources are still miles away from satisfying the global energy demands setting the stage for natural gas prices to soar even higher in 2022 as the world recovers from coronavirus.

As the curtain falls on 2021 and the global economy recovers from Covid-19, the three ETFs above have the potential to make phenomenal returns.

Comments