ETF full name: The Global X Nasdaq 100 Covered Call ETF QYLD

Segment: technology

ETF provider: State Street Bank and Trust Company

|

QYLD key details |

|

| Issuer | Mirae Asset Global Investments Co., Ltd. |

| Dividend | $0.22 |

| Inception date | December 12, 2013 |

| Expense ratio | 0.60% |

| Management company | Global X Funds |

| Average 3-5 EPS | x |

| Average Annualized Return | 7.3% |

| Investment objective | Replication |

| Investment geography | Technology |

| Benchmark | Nasdaq 100 |

| Leveraged | N/A |

| Median market capitalization | $830.5 billion |

| ESG rating | BBB: 5.1 out of 10 |

| Number of holdings | 104 |

| Weighting methodology | Weighted market capitalization |

About the QYLD ETF

The Global X Nasdaq 100 Covered Call ETF QYLD was launched in December 2013. The ETF aims to track the CBOE NASDAQ-100 BuyWrite V2 Index by fully replicating the benchmark. While it invests globally, the vast majority of trading takes place in the United States. It has a weighted average market capitalization of $830.5 billion and an average yearly return of 7.3%.

QYLD Fact-set analytics insight

The QYLD ETF includes 104 companies, more than 65% are from the technology and communication sectors. Another 30% of the constituents are from the consumer and healthcare niches.

The Global X Nasdaq 100 Covered Call ETF QYLD tracks an index that holds tech-heavy Nasdaq 100’s stocks and looks to collect premiums from selling call options. Similar to other ETFs based on the US100, the QYLD adopts a weighted market capitalization for its methodology.

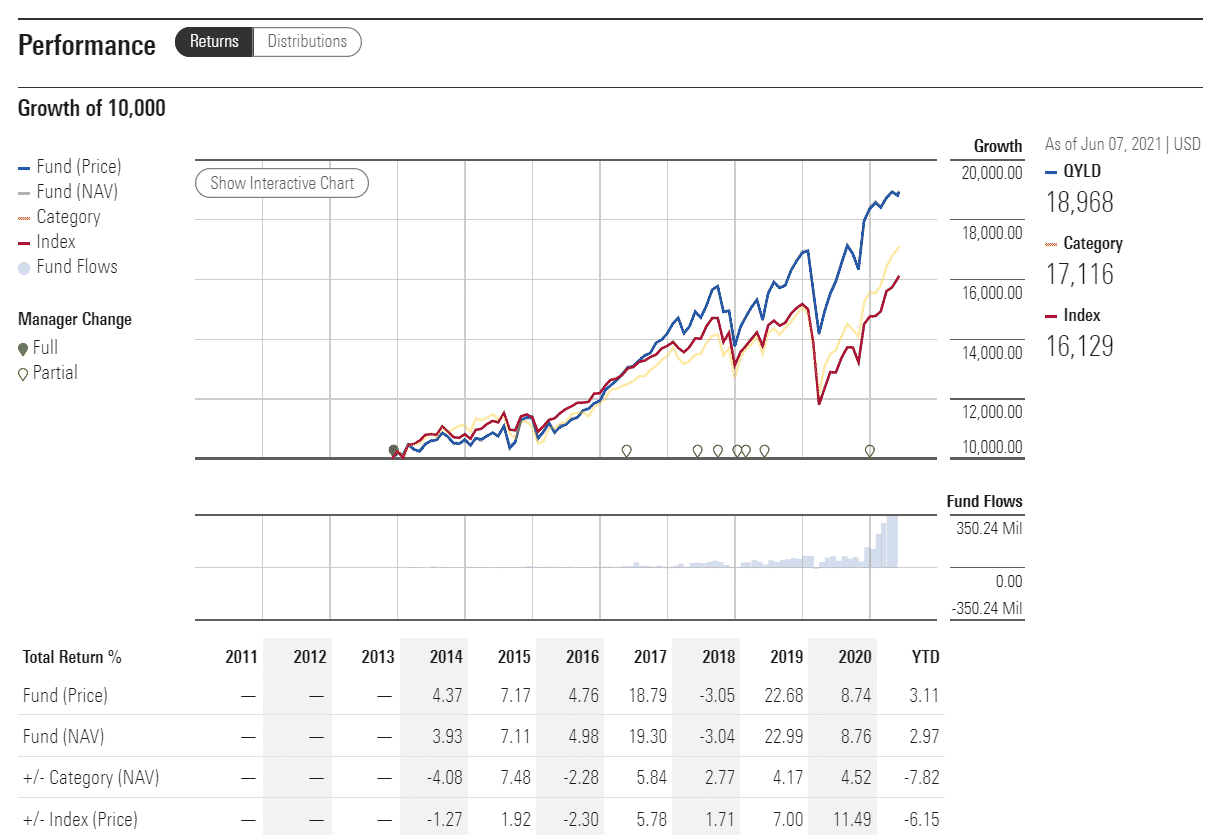

QYLD performance analysis

After the initial plunge that came with the emergence of the coronavirus pandemic, the technology sector bounced back much faster than the remaining industries. It is mostly due to society’s heavy reliance on new technologies needed to continue the activities interrupted by the outbreak of Covid-19.

The ETF’s year-to-date gains amount to 11.09%, mostly mirroring the trend of Nasdaq 100. The expectations regarding the technology sector are somewhat vague at the moment, as some analysts predict that the vaccine rollout could somewhat slow down the tech rally. On the other hand, new technologies are expected to continue developing and consecutively propel the stocks.

The QYLD ETF pays quarterly dividends, the most recent of which amounted to $0.22 on the share at an expense ratio of 0.6%.

On the MSCI scale, QYLD ETF has a 5.1/10 BBB rating, according to most experts; the fund is of average resilience in the face of environmental, governmental, and social changes due to its wide variety of holdings ranging from CCC to AAA.

QYLD key holdings

The top 10 holdings making up the QYLD ETF are some of the most prominent technology companies and the most notable names in the tech industry. The cumulative weight of the tech behemoths stands at 52.6%.

On the technology side, QYLD invests in Apple, Microsoft, Google’s parent Alphabet Inc., but it also comprises retailer giant Amazon.com Inc, as well as Elon Musk’s Tesla Inc. The sheer popularity of the companies guarantees a massive volume pulled.

Here are the top 10 holdings making up the QYLD ETF.

| Ticker | Holding name | % of assets |

| AAPL | Apple Inc. | 10.88% |

| MSFT | Microsoft Corporation | 9.8% |

| AMZN | Amazon.com Inc. | 8.45% |

| FB | Facebook Inc. A | 4.12% |

| GOOGL | Alphabet Inc. C | 4.11% |

| TSLA | Tesla Inc. | 3.87% |

| GOOGL | Alphabet Inc. A | 3.7% |

| NVDA | NVIDIA Corporation | 3.2% |

| PYPL | PayPal Holdings Inc. | 2.4% |

| CMCSA | Comcast Corporation | 2.05% |

Industry outlook

While the dot-com bubble still strikes fear to the very hearts of traders who remember the market in 2000 first-hand, the tech stocks proved to be quite resilient in these trying times. Although the benchmark is not really characterized by low volatility, technology, consumer services, and health care showed a solid capacity for growth despite the crisis.

Comments