ETF full name: iShares US Real Estate ETF

Segment: Real estate

ETF provider: State Street Bank and Trust Company

| IYR key details | |

| Issuer | Blackrock |

| Dividend | $0.44 |

| Inception date | June 12, 2000 |

| Expense ratio | 0.42% |

| Management company | Blackrock Inc. |

| Average 3-year return | 9.31% |

| Average annualized return | 8% |

| Investment objective | Representative Sampling Strategy |

| Investment geography | Real Estate Equities |

| Benchmark | Dow Jones US Capped Real Estate Index |

| Leveraged | N/A |

| Median market capitalization | N/A |

| ESG rating | BBB: 4.5 out of 10 |

| Number of holdings | 82 |

| Weighting methodology | Market capitalization |

About the IYR ETF

The iShares US Real Estate ETF was launched at the turn of the 2nd millennium, June 2000. This ETF tracks the performance of large and medium market cap companies in the real estate industry. 90% of its investments are in the US Dow Jones Real Estate Index. The IYR fund has $6.5 billion in assets under management and, since its inception, an average yearly return of 8%.

IYR Fact-set analytics insight

Investing in the IYR fund gives access to 85 companies from the diversified real estate industry. The top five sector holdings include health care REITs, specialized REITs, residential REITs, industrial REITs, and retail REITs.

The iShares US Real Estate ETF invests in growth and value stocks, making it a diversified portfolio in market capitalization, medium, and large-cap companies across the real estate sector. The appeal of this ETF lies in the structure of the REITs-based funds. It requires them to distribute 90% of their income, a great source of current income to investors.

The IYR adopts a weighted market capitalization for its weighing methodology.

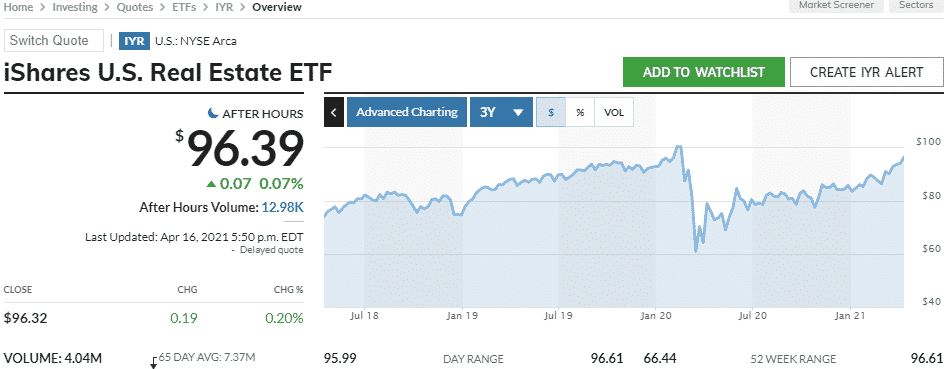

IYR performance analysis

In addition to providing investors with current income, the IYR ETF has since its inception proven to offer excess returns in bullish markets while displaying no correlation with the traditional bond and stock markets.

Despite many investors shunning the real estate industry due to the housing crisis in the US, the IYR has still managed a 9.31% return for its investors over the last three years. Since mid-December of 2020, the IYR ETF has been trading above the 200 moving average and the expectation, according to Nasdaq analysts, is for this bullish run to hold steady.

On the MSCI scale, IYR ETF has a BBB rating. According to most experts, the fund is of average resilience in the face of environmental, governmental, and social changes.

|

IYR ETF RATING |

||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com |

| IYR Rating | A | A 92 | 3 | *** |

| IYR ESG Rating | BBB: 4.53 out of 10 | BBB: 4.53 out of 10 | N/A | BB: 16.36 out of 50 |

IYR key holdings

The diversified real estate holdings in this ETF help manage the volatility associated with REITs. The top holding is American Tower Corp. — 8.5%, a Boston company operating in all continents by offering real estate investment services. It also develops, owns, and operates multitenant communications properties.

The second-largest holding in this fund is Prologis Inc., a REITs company specializing in real estate operations and strategic capital segment. It is renowned for its development and operation of logistics propertied. As the world evolves more into a global village, this specialization will drive the company’s growth and that of the IYR.

Taking the top three berths is Crown Castle International, a Texan REITs company specializing in wireless infrastructure access. Technology in the world we live in relies heavily on wireless technology, making CCI positioning of utmost importance for its growth and the IYR fund growth.

Here are the top 10 holdings making up the IYR ETF.

| Ticker | Holding name | % of assets | Shares held |

| AMT | American Tower Reit Corporation | 8.61% | 2,246,424.00 |

| PLD | Prologis Reit Inc. | 6.49% | 3,738,255.00 |

| CCI | Crown Castle International Corporation | 6.04% | 2,180,346.00 |

| EQIX | Equinix Inc. | 4.47% | 418,518.00 |

| DLR | Digital Realty Trust Reit Inc. | 3.3% | 1,427,734.00 |

| PSA | Public Storage Reit | 3.18% | 772,292.00 |

| SPG | Simon Property Group Inc. | 3.01% | 1,668,377.00 |

| CSGP | CoStar Group Inc. | 2.79% | 200,168.00 |

| SBAC | SBA Communications Corporation | 2.47% | 555,218.00 |

| WELL | Welltower Inc. | 2.47% | 2,119,780.00 |

Industry outlook

With the interest rates at near-zero as part of the fiscal stimulus to spur post-covid economic recovery, Likos at Money news believes it is time to invest in REIT funds.

ETFs like the IYR will be the go-to investment instruments during this period as they offer low-cost portfolios that provide high returns without compromising the associated risk. As the world recovers from the coronavirus, the real estate sector will be the avenue that protects them from inflation.

Comments