ETF full name: Invesco S&P Global Water Index ETF

Segment: Global water

ETF provider: Invesco

| CGW key details | |

| Issuer | Invesco |

| Dividend | $0.66 |

| Inception date | May 14, 2007 |

| Expense ratio | 0.57% |

| Management company | Invesco |

| Average 3-5 EPS | N/A |

| Average Annualized Return | 45.26% |

| Investment objective | Replication |

| Investment geography | Global water |

| Benchmark | S&P Global Water Index |

| Leveraged | N/A |

| Median market capitalization | $12.0 billion |

| ESG rating | MSCI 7.8/10 |

| Number of holdings | 50 |

| Weighting methodology | Weighted Market capitalization |

About the CGW ETF

Invesco S&P Global Water Index ETF CGW was initiated in May 2007 and is meant to track the S&P Global Water Index. Its market capitalization amounts to $12.00 billion, with an average yearly return of 45.26%.

CGW Fact-set analytics insight

The CGW consists of 50 holdings, 52% of which are in the United States. With the rest of its holdings geographically dispersed, the United Kingdom amounts to approximately 15% of the units. As far as the industries go, almost 52% of the companies are related to industrials, with the utilities following a 36% share.

The CGW, like other ETFs based on the S&P index, uses weighted market capitalization for its methodology.

CGW performance analysis

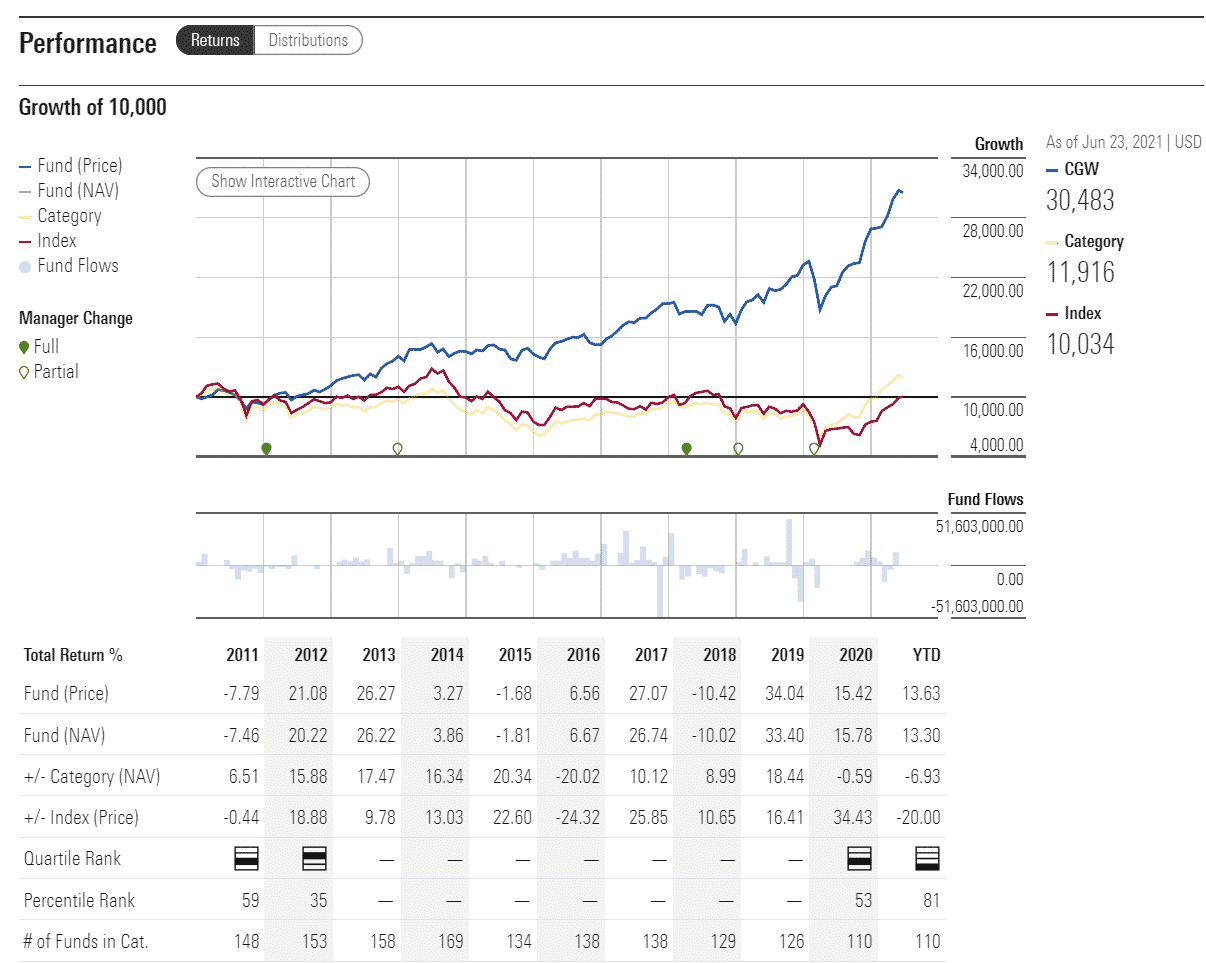

Unlike other industries that the Covid-19 pandemic has heavily impacted, CGW is appealing to the investors primarily due to the prospective scarcity of water supplies, which, coupled with the rising global population, could propel the shares of companies that deal with water supply and treatment. After the initial shock caused by disruptions in operations due to Covid lockdowns, the ETF has been on an upward path ever since, as the graph goes to prove.

The CGW ETF pays dividends quarterly. For the last quarter, the dividend amounted to $0.66 on the share at an expense ratio of 0.57%.

On the MSCI ESG scale, XLK ETF has a 7.88/10 double-A rating. The fund was declared to be of higher-than-average resilience in environmental, governmental, and social changes.

CGW ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| CGW Rating | AA | AA | 4 | ***** | 3.8/10 |

| CGW ESG Rating | 7.88/10 | AA | N/A | N/A | N/A |

CGW key holdings

The CGW ETF relies on the infrastructure companies and water equipment and materials firms, with no dominating role by either of the holdings, save for maybe American Water Works Inc.

So the US firm is the only unit close to a double-digit share in the ETF. The company reported a 7% growth in its earnings per share in the year’s first trimester.

Close behind is the American water technology provider Xylem, which posted a 12% jump in revenue in the last three-month period. While the trend may not be as whopping as some seen by the technology companies, or the pharmaceutical firms, the upticks still prevail throughout the constituents’ list.

Here are the top 10 holdings making up the CGW ETF.

| Ticker | Holding name | % of assets |

| AWK | American Water Works Company, Inc. | 9.75% |

| XYL | Xylem Inc. | 8.91% |

| VIE | Veolia Environnement SA | 5.48% |

| HLMA | Halma plc | 5.39% |

| GEBN | Geberit AG | 5.21% |

| PNR | Pentair plc | 4.67% |

| WTRG | Essential Utilities, Inc. | 4.56% |

| UU | SUEZ SA | 4.13% |

| SEV | United Utilities Group PLC | 3.59% |

| SVT | Severn Trent plc | 2.91% |

Industry outlook

The global population has been on a continual upward path, and the United Nation’s latest communique warned that over 2 billion people already live in countries with high water stress. It means that almost one-third of the people live in countries with either scarce water supply or subpar water quality. With climate change underway, the projections don’t get a lot less gloomy.

Water management companies sound like a solid choice to invest in; it would seem. For the most part, that thinking stands to reason. One possible pitfall is that the strength of the tie between the water scarcity and the fund’s performance is difficult to determine. While the water ETFs are on a safer side, be sure to check the concentrations before you invest and be prepared for less-than-spectacular profits.

Comments