ETF full name: The Technology Select Sector SPDR® Fund

Segment: technology

ETF provider: SSGA Funds Management, Inc.

|

XLK key details |

|

| Issuer | State Street Global Advisors |

| Dividend | $0.27 |

| Inception date | December 16, 1998 |

| Expense ratio | 0.12% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 15.54% |

| Average Annualized Return | 42.64% |

| Investment objective | Replication |

| Investment geography | Technology |

| Benchmark | S&P Technology Select Sector Index |

| Leveraged | N/A |

| Median market capitalization | $982.34 billion |

| ESG rating | MSCI 6.06/10 |

| Number of holdings | 74 |

| Weighting methodology | Weighted Market capitalization |

About the XLK ETF

The Technology Select Sector SPDR® Fund XLK was founded in mid-December 1998, and it tracks the Technology Select Sector Index. According to the most recent data, its market capitalization amounted to $982.34 billion, with an average annual return of 42.64%.

XLK Fact-set analytics insight

The XLK comprises 74 holdings, all of which are headquartered in the United States. Niche-wise, the situation is pretty clear-cut, with almost three-fourths of the holdings falling under the IT category, with an additional 20.5% of businesses dealing with semiconductors. The remaining holdings are from the communications equipment & electronics field.

The XLK, much like different ETFs based on the S&P 500 index, uses weighted market capitalization for its methodology.

XLK performance analysis

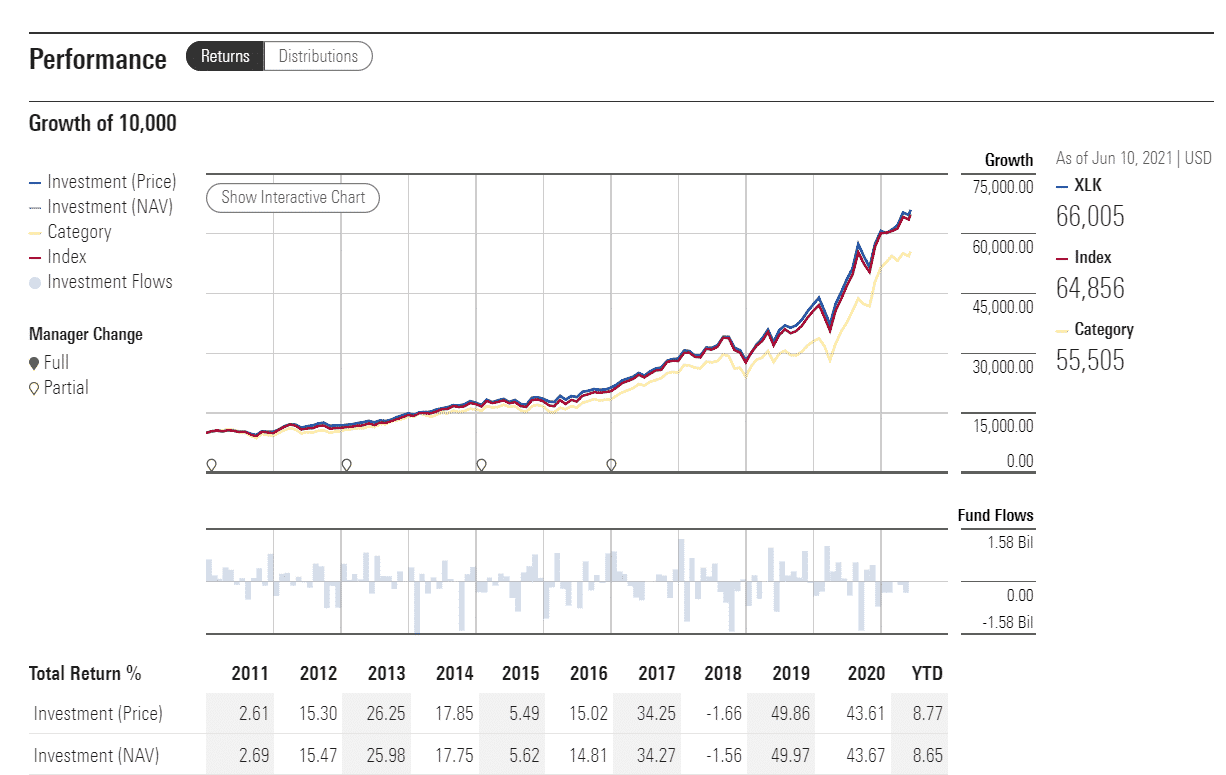

Like other indices that rely on the technology, the XLK ETF was quick to bounce back from the initial pandemic stock market shock and showed a definite upward trend ever since. Minor hiccups came amid inflation worries in March and after a worse-than-expected budget deficit report in mid-May.

Unlike other technology-based ETFs, the XLK is more sensitive to changes in the auto industry because one-fifth of its holdings are focused on semiconductors that have been in short supply in the past months.

The XLK ETF pays dividends every three months. For the last quarter, the dividend came in at $0.27 on the share at an expense ratio of 0.12%.

On the MSCI ESG scale, XLK ETF boasts a 6.06/10 A rating. In addition, the fund was declared to be of higher-than-average resilience in terms of environmental, governmental, and social changes.

|

XLK ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLK Rating | A | A | 3 | **** | 6.2/10 |

| XLK ESG Rating | 6.06/10 | A | N/A | N/A | N/A |

XLK key holdings

The XLK ETF relies heavily on technology, but even more so, it has put almost half of its eggs in the basket belonging to only two companies. The good news is, Steve Jobs and Bill Gates founded those companies. With more than 40% of the pull coming from Apple and Microsoft, and the recent trend that the two tech giants have been on in the past year, the higher-than-expected yearly return becomes much clearer.

On the financial side, both Visa and Mastercard made their way into the fund’s top ten holdings, as well as PayPal, whose earnings per share skyrocketed by over 1200% in the first fiscal quarter of 2021, compared to the same period the year before.

Here are the top 10 holdings making up the XLK ETF.

| Ticker | Holding name | % of assets |

| AAPL | Apple Inc. | 21.0% |

| MSFT | Microsoft Corporation | 20.24% |

| NVDA | NVIDIA Corporation | 4.62% |

| V | Visa Inc. Class A | 4.15% |

| MA | Mastercard Incorporated Class A | 3.37% |

| PYPL | PayPal Holdings Inc. | 3.23% |

| ADBE | Adobe Inc. | 2.58% |

| INTC | Intel Corporation | 2.45% |

| CSCO | Cisco Systems, Inc. | 2.41% |

| CRM | salesforce.com, Inc. | 2.31% |

Industry outlook

The technology sector shows no signs of slowing down if we ignore the minor setbacks that occur occasionally and focus on long-term growth. As far as Apple goes, even Berkshire Hathaway’s Warren Buffett admitted that he regrets selling Apple stock the year prior.

While Microsoft’s CEO repeatedly stated that the company isn’t looking to dazzle anyone and focuses on longevity and sustainability, the Redmont-based behemoth also reportedly plans to unveil its most significant upgrade in the last ten years in a little under two weeks.

The potential drawback could be the global chip shortage, which could prove a problem for holdings dealing with semiconductors. Multiple CEOs within the industry expect the crisis to go on for at least a couple of years.

Comments