ETF full name: Communication Services Select Sector SPDR Fund

Segment: communication services

ETF provider: ALPS Portfolio Solutions Distributor, Inc.

| XLC key details | |

| Issuer | State Street Global Advisors |

| Dividend | $0.13 (est. June 21) |

| Inception date | June 19, 2018 |

| Expense ratio | 0.12% |

| Management company | Global Equity Beta Solutions |

| Average 3-5 EPS | 19.27% |

| Average Annualized Return | ~5.79% |

| Investment objective | Replication |

| Investment geography | Communications |

| Benchmark | S&P Communication Services Select Sector Index |

| Leveraged | N/A |

| Median market capitalization | $623.79 billion |

| ESG rating | 1.33/10 |

| Number of holdings | 26 |

| Weighting methodology | Weighted market capitalization |

About the XLC ETF

The Communication Services Select Sector SPDR Fund XLC was initiated in June 2019. It aims to provide accurate exposure to companies from telecommunication services, media, and interactive media and services. The benchmark seeks to represent the communication service sector constituents of the S&P 500 index. It has a weighted average market capitalization of $623.79 billion and an average yearly return of ~5.79%.

XLC Fact-set analytics insight

The XLC ETF comprises 26 companies, all of which are located in the United States. Regarding sector diversification, 59.53% of the companies are from the internet sector, with 18.04% of the constituents from broadcasting.

The Communication Services Select Sector SPDR Fund XLC boasts its targeted approach or allows investors to take strategic positions instead of traditional style-oriented investing. Much like other ETFs based on the S&P 500, the XLC uses a weighted market capitalization methodology.

XLC performance analysis

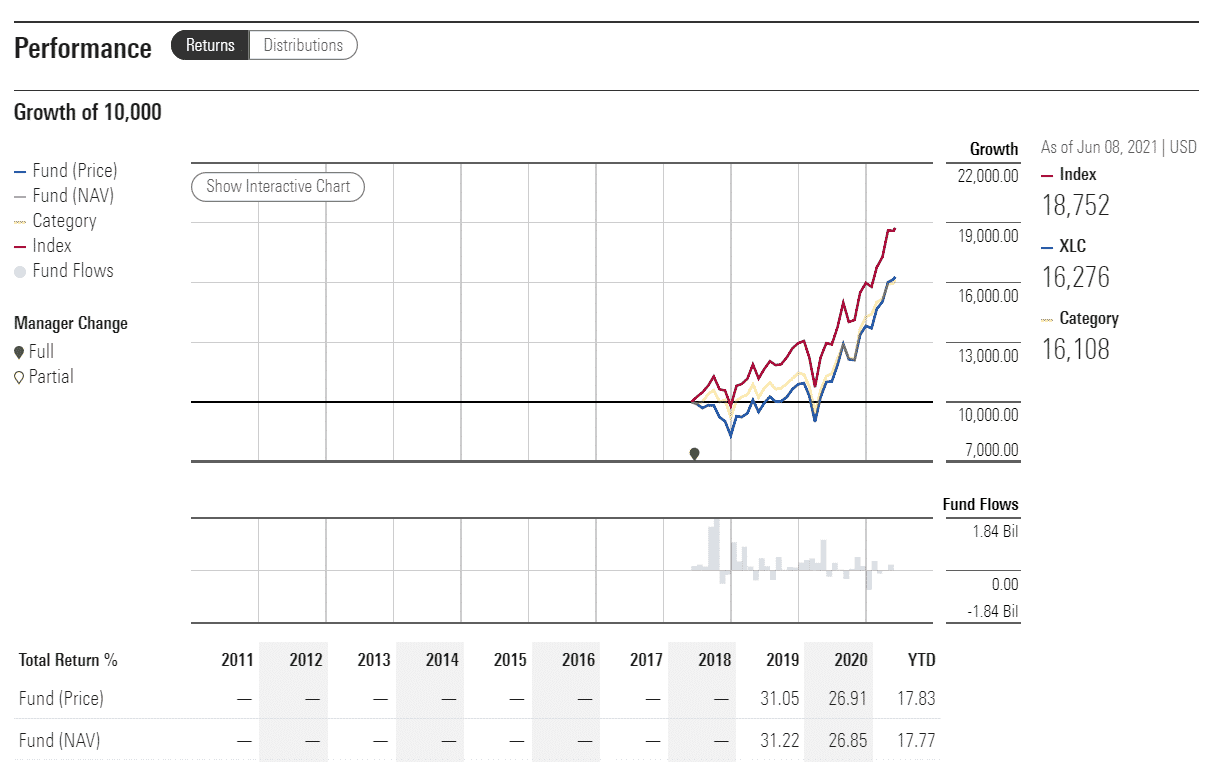

The Covid-19 pandemic brought about the fund’s plummet, much like in the case of other benchmarks, but, as the chart clearly shows, it was mostly uphill from that point on. Moreover, given the ETF’s reliance on internet niche firms and the communication sector, it is easy to contemplate the gains that have occurred after the initial shock has pared.

The ETF’s year-to-date gains amount to a whopping 43.9%, corresponding, in most part, to that of the S&P 500 benchmark. At the same time, it isn’t easy to expect the reliance on online communications to be quite as heavy as during the first wave of worldwide lockdowns and working-from-home orders. So it remains to be seen to which extent the overall situation and work arrangements return to their pre-pandemic levels.

The XLC ETF pays dividends four times a year, the closest of which is estimated to amount to $0.13 on the share at an expense ratio of 0.12%.

On the ESG scale, XLC ETF has a 1.3/10 rating, according to analysts. The fund is of average resilience in terms of environmental, governmental, and social changes.

|

XLC ETF RATING |

|||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com | Money.usnews.com |

| XLC Rating | A+ | A | 11 | N/A | 6.3/10 |

| XLC ESG Rating | 1.33/10 | 1.33/10 | N/A | N/A | N/A |

XLC key holdings

The ETF’s top 10 holdings are internet companies with some of the largest market capitalization out there. Social media giant Facebook and Google’s parent Alphabet carry 48% of the ETF’s weight. On the communications front, the fund covers T-Mobile US, Charter Communications, and Verizon. Verizon unveiled in May that it will sell its Yahoo! and AOL businesses in a deal valued at $5 billion.

From the entertainment niche, the ETF includes streaming giant Netflix, as well as Walt Disney Company. The sheer popularity of the companies mentioned among the investors makes it easy to anticipate a significant volume pull.

Here are the top 10 holdings making up the XLC ETF.

| Ticker | Holding name | % of assets |

| FB | Facebook Inc. Class A | 23.06% |

| Alphabet Inc. Class A | 12.58% | |

| GOOG | Alphabet Inc. Class C | 12.35% |

| TMUS | T-Mobile US Inc. | 4.81% |

| CHTR | Charter Communications Inc. Class A | 4.5% |

| ATVI | Activision Blizzard Inc. | 4.32% |

| CMCSA | Comcast Corporation Class A | 4.32% |

| VZ | Verizon Communications Inc. | 4.09% |

| NFLX | Netflix Inc. | 4.02% |

| DIS | Walt Disney Company | 4% |

Industry outlook

After the surge that the ETF’s holdings experienced during the pandemic, the traders were afraid of a possible downfall that might come after the crisis has subsided.

On the optimistic note, despite the vaccine rollout in the world’s largest economies well underway, the ETF has proven resilient to the times. This has been the case despite less pronounced reliance on telecommunications than during the outbreak’s most severe spikes.

Comments