ETF full name: Grayscale Bitcoin Trust

Segment: Bitcoin

ETF provider: Grayscale Investments, LLC

|

GBTC key details |

|

| Issuer | Grayscale Investments, LLC |

| Inception date | September 25, 2013 |

| Expense ratio | 2% |

| Management company | Grayscale Investments, LLC |

| Investment objective | Track the market price of Bitcoin, fewer fees and expenses |

| Investment geography | US |

| Benchmark | CoinDesk Bitcoin Price Index (XBX) |

| Leveraged | No |

| Assets under management | $33.7 billion |

| Number of holdings | 1 |

| Weighting methodology | N/A |

About the GBTC

The Grayscale Bitcoin Trust (GBTC) is a financial vehicle that allows investors to invest in Bitcoin indirectly. Grayscale Investments, the issuer of the fund, aims to convert it into an exchange-traded fund (ETF).

The shares in the fund track the price of Bitcoin after fees and other expenses. Launched on September 25, 2013, the GBTC tracks the CoinDesk Bitcoin Price Index (XBX).

The US regulators haven’t yet approved a Bitcoin ETF. But Grayscale recently said that it was committed to turning the GBTC into an ETF. The Grayscale Bitcoin Trust was the first Bitcoin fund to be converted into an SEC-reporting company. Chaos, illegal activities, and lack of proper regulation of cryptocurrencies are the main reasons why the Securities and Exchange Commission (SEC) hasn’t approved a Bitcoin ETF yet. The GBTC might be the first.

GBTC FactSet analytics insight

The Grayscale Bitcoin Trust has a staggering $33.7 billion in assets under management. Grayscale is one of the world’s largest buyers of Bitcoin, and GBTC is the most liquid Bitcoin investment product.

Though shares in the GBTC are supposed to track Bitcoin closely, they almost always trade at a premium to the price of Bitcoin. Despite the premium, investors choose to put their money in GBTC rather than Bitcoin for a few reasons. If you invest in Bitcoin, you’d worry about storing it. Your Bitcoin wallet might be hacked. There is no such risk with investing in a Bitcoin trust like GBTC.

Another reason is that the GBTC has a bunch of tax advantages. Many types of Roth IRA, IRA, and other investor accounts offer tax breaks on Bitcoin trusts like GBTC.

Since the trust invests only in Bitcoin, it doesn’t have any weighting methodology. It simply pools money from wealthy investors into a fund to buy Bitcoin. Grayscale then lists the fund on the stock exchange, where its shares trade like any other stock.

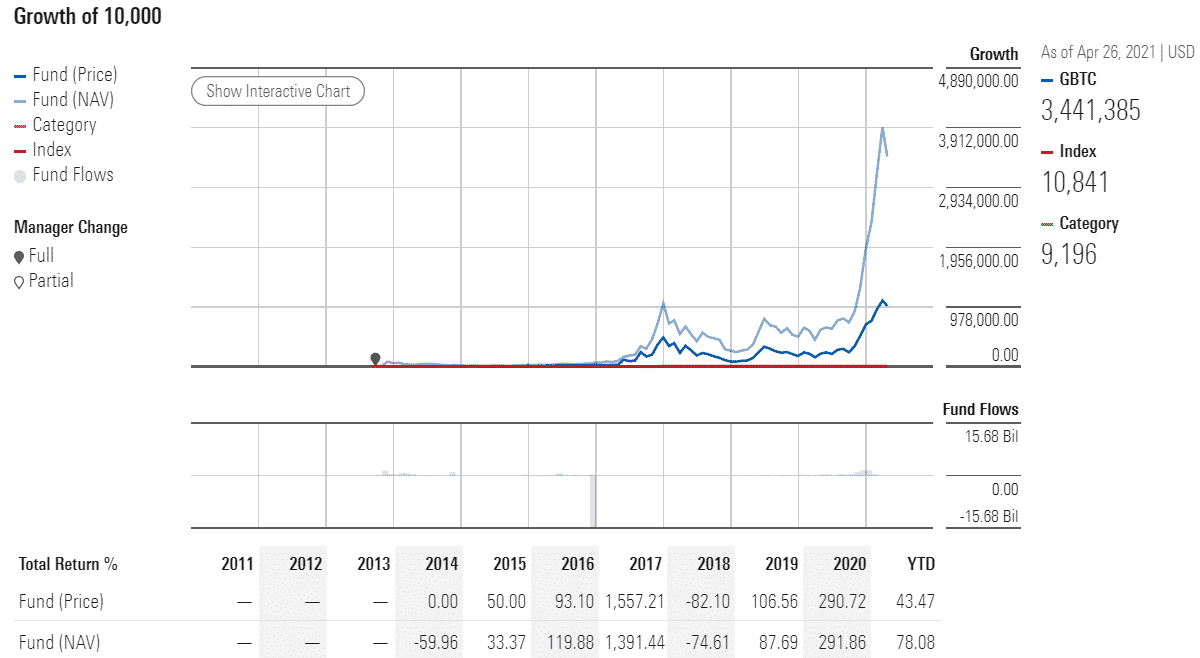

GBTC annual performance analysis

The massive rally in Bitcoin over the last year has fueled the GBTC share price. Shares of the Grayscale Bitcoin Trust have shot up 572.79% over the last year. Since its inception in 2013, the fund has returned an eye-popping 34692.86%.

The US Federal Reserve has flooded the market with trillions of dollars in fresh liquidity. It has sparked concerns about inflation and the value of fiat currency. As a result, more and more investors are turning to Bitcoin and other digital currencies.

GBTC key holdings

The Grayscale Bitcoin Trust holds a single asset — Bitcoin. According to Bitcoin Treasuries, it owns 654,885 Bitcoin. It means the GBTC alone holds 46% of all the 1.4 million Bitcoin held by publicly traded companies worldwide.

Industry outlook

The crypto economy is still in its infancy. Despite their growth in the last few years, cryptocurrencies such as Bitcoin are yet to be embraced by the masses. Crypto economy regulations have just begun to take shape. Even though regulatory risks remain, the adoption of Bitcoin by large corporations such as Tesla has strengthened investors’ conviction in crypto assets.

Comments