ETF full name: Invesco China Technology ETF

Segment: Chinese technology stocks

ETF provider: Invesco Ltd.

| CQQQ key details | |

| Issuer | Invesco Ltd. |

| Dividend | 0.47% |

| Inception date | December 08, 2009 |

| Expense ratio | 0.70% |

| Management company | Invesco Capital Management LLC |

| Investment objective | Track the investment results of the FTSE China Incl A 25% Technology Capped Index |

| Investment geography | China |

| Benchmark | FTSE China Incl A 25% Technology Capped Index |

| Leveraged | No |

| Weighted average market cap | $485.38 billion |

| MSCI ESG rating | 3.65 out of 10 |

| Number of holdings | 107 |

| Weighting methodology | Modified market-cap-weighted |

About the ETF

The Invesco China Technology ETF was launched in December 2009. It used to track the AlphaShares China Technology Index until June 24, 2019. The ETF now tracks the FTSE China Incl A 25% Technology Capped Index, including constituents of both the FTSE China A Stock Connect Index and FTSE China Index. It is a market-cap-weighted index with position limits.

The ETF and the index are rebalanced every quarter. It gives investors exposure to the Chinese technology stocks, covering stocks listed in China and the United States.

CQQQ FactSet analytics insight

CQQQ tracks the Chinese tech industry. The information technology sector alone accounts for 49% of the ETF. The communication services sector is not far behind at 40%.

All other sectors such as consumer discretionary — 8.65%, industrials — 1.25%, and financials — 0.52% have limited exposure.

Since the ETF is all about the Chinese tech companies, investors who understand the Chinese economy, tech sector, and growth potential could take strategic positions. Most Chinese funds give investors limited exposure to the tech sector.

The FTSE China Incl A 25% Technology Capped Index is a modified market-cap weighted index. The most extensive stock cannot exceed 10% exposure, and the second-largest stock is restricted at 9%. Stocks with higher than 5% weightage are collectively capped at 40%.

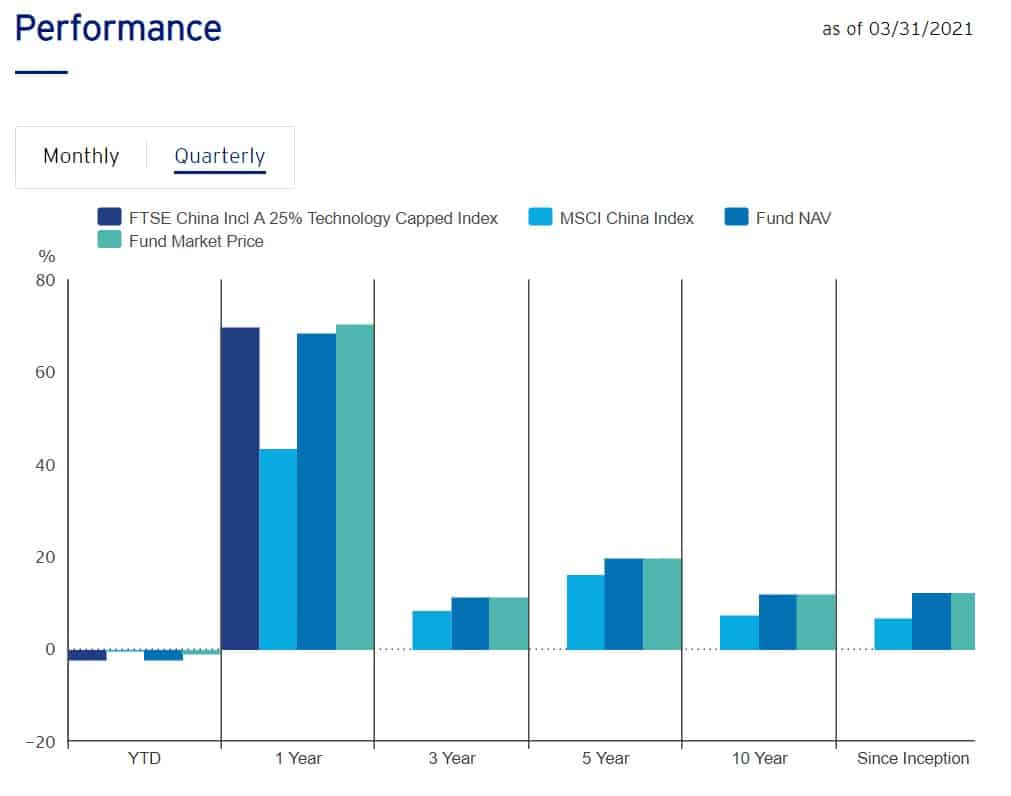

CQQQ annual performance analysis

Over the last year, the fund has delivered a stellar 68.52% return amid the tech stocks rally. The adoption of technology products and services has skyrocketed during the COVID-19 pandemic.

The 3-year returns stand at 11.18%, and 5-year returns were an impressive 19.67%. Since its inception, the ETF has returned 12.16% annually.

Given the massive population of China and its economic growth potential, technology stocks in the country still have plenty of runway for future growth.

|

CQQQ ETF RATING |

||||

| Resource | ETF DATABASE | ETF.com | MarketWatch | Morningstar.com |

| CQQQ | A+ | D – | 5 | 4 |

| MSCI ESG Rating | – | 3.65/10 | – | – |

CQQQ key holdings

Chinese tech behemoth Tencent Holdings Ltd is the most significant constituent in the ETF with a 10.51% weightage. Tencent is the company behind the mega app WeChat, which has over a billion active users. Meituan is the second-largest holding with 8.28% weightage, and Sunny Optical Technology Group Co Ltd is close behind at 7.88%.

The search engine giant Baidu Inc has a 7.37% weightage in CQQQ. It is rounding out the top five in the American Depository Receipt of Tencent Music Entertainment Group at 4.45%.

These are the ten most extensive constituent stocks in CQQQ.

| Ticker | Holding name | % of assets |

| 700 HK | Tencent Holdings Ltd | 10.51% |

| 3690 HK | Meituan | 8.28% |

| 2382 HK | Sunny Optical Technology Group Co Ltd | 7.88% |

| BIDU | Baidu Inc ADR | 7.37% |

| TME | Tencent Music Entertainment Group ADR | 4.45% |

| 268 HK | Kingdee International Software Group Co Ltd | 4.25% |

| ATHM | Autohome Inc ADR | 4.09% |

| GDS | GDS Holdings Ltd ADR | 3.84% |

| YY | JOYY Inc ADR | 3.45% |

| 1024 HK | Kuaishou Technology | 3.39% |

Industry outlook

Geopolitical tensions between the United States and China have negatively affected ETFs tracking Chinese companies in the past. But the Chinese government has been actively supporting the domestic technology companies by offering incentives and subsidies.

Comments