Real estate is one of the few attractive sectors in all economic situations. The good news is that you don’t have to own property or REITs to be part of this industry; you have the option of investing in the home builder’s segment.

This is a multibillion-dollar corner of the $10 trillion construction industry. Rather than deal with the hassle of picking out individual stocks with the hope of them being the next D.R Horton, why not bet on the whole industry with a homebuilder’s ETF and be invested in one of the best performing segments in the globe?

Homebuilders ETFs: how do they work?

Homebuilders’ ETFs comprise equities in the residential housing provision space, and all organizations generate significant revenues from providing ancillary services to this segment. However, most of these equities also operate on the broader construction segment. As such, homebuilders’ ETFs features herein might overlap to include construction equities, but they draw significant revenues, the norm is 30%, from residential housing business activities.

Top three homebuilder’s ETFs with high demand and low supply

The ideal assets to invest in are guided by supply and demand forces only. The major challenge with the world we live in is that ideal conditions rarely exist. However, the homebuilder’s equities are primarily guided by demand and supply market forces and are usually used to measure economic health.

With governments injecting economic stimulus to spur economic resurgence and the office life being disrupted with many working from home, the homebuilder’s segment is in pole position to benefit. The following ETFs offer excellent exposure to this construction industry niche.

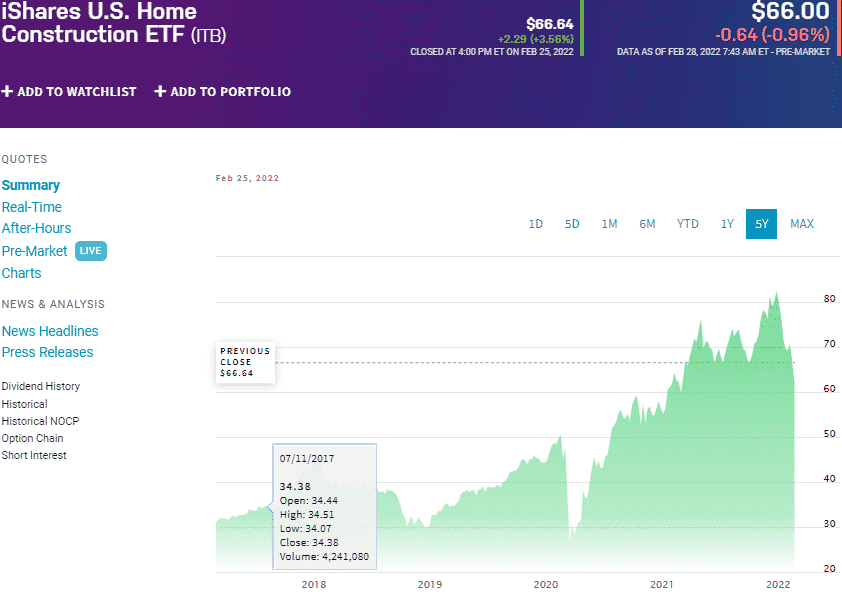

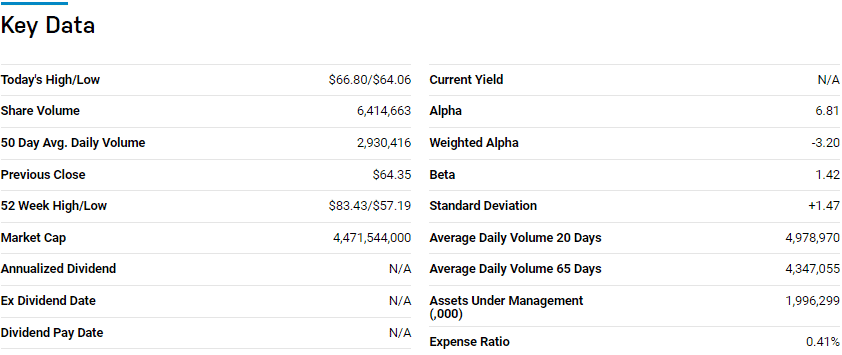

№ 1. iShares US Home Construction ETF (ITB)

Price: $66.00

Expense ratio: 0.41%

Dividend yield: 0.42%

PKB chart

Sometimes it is best to stick with a pioneer in every field, especially if it has significant assets under management. The iShares US Home Construction ETF is the pioneer homebuilder’s ETF and tracks the Dow Jones U.S. Select Home Construction Index.

It invests a minimum of 90% of its total assets in the components of its tracked index, exposing investors to the US home construction equities market. The remaining 10% is invested in futures, swap contracts, cash, options, and cash equivalents, exhibiting a correlation to the composite index.

ITB is ranked № 8 by US News among thirty-six of the best consumer cyclical funds for long-term investing.

The top three holdings of this ETF are:

- D.R. Horton, Inc. –13.89%

- Lennar Corporation Class A – 12.20%

- NVR, Inc. – 8.28%

ITB ETF is the largest homebuilder’s ETF and boasts $2.00 billion in assets under management, with an expense ratio of 0.41%. It is a diversified fund, with some of its holdings being construction equities not involved in homebuilding. However, this fund carries a concentration risk as its top three holdings account for 34.37% of its total weight. Despite the risk mentioned above, this fund is a solid returns provider; 5-year returns of 127.24%, 3-year returns of 88.77%, and 1-year returns of 13.54%.

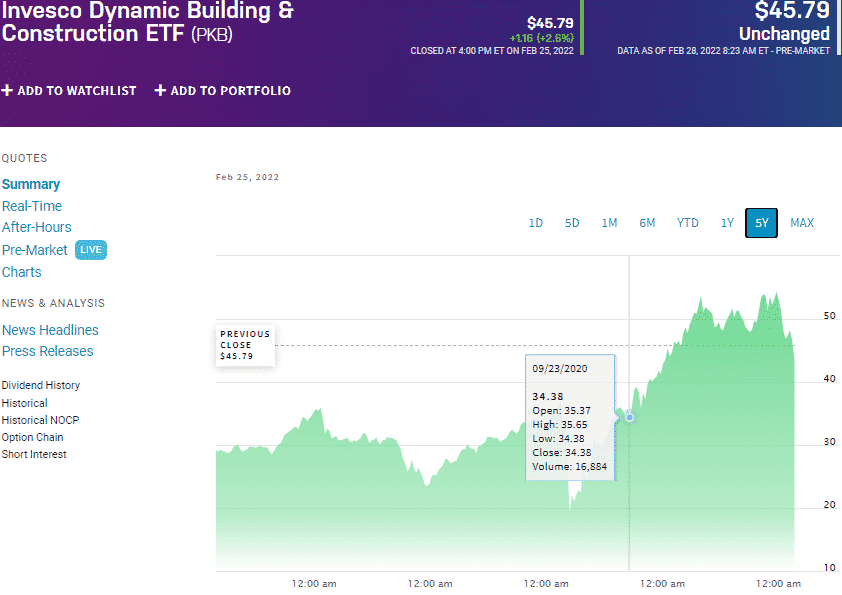

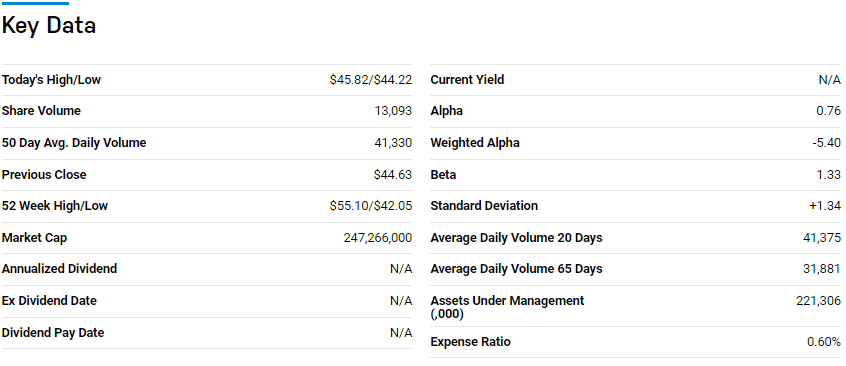

№ 2. Invesco Dynamic Building and Construction ETF (PKB)

Price: $45.79

Expense ratio: 0.60%

Dividend yield: 0.22%

PKB chart

The Invesco Dynamic Building and Construction ETF tracks the performance of the Dynamic Building & Construction IntellidexSM Index, net of expenses, and fees. It invests at least 90% of its total assets in the holdings of its composite Intellidex. It exposes investors to US equities operating in the building and construction industry, construction and engineering services related to building and remodeling residential buildings, and commercial and industrial properties.

PKB ETF is ranked № 11 by US News among thirty-five of the best industrial ETFs for long-term investing.

The top three holdings of this ETF are:

- NVR, Inc. – 5.51%

- Vulcan Materials Company – 5.39%

- Martin Marietta Materials, Inc. – 3.38%

The PKB ETF has meager assets under management, $219.8 million, given that it is a year older than the ITB ETF. It is also a tard more expensive for investors to part with $60 annually for a $10000 investment. However, it brings more diversification across the construction industry. Coupled with its quant-based equity screening methodology to ensure Alpha generating stocks, it has a history of consistent returns; 5-year returns of 63.42, 3-year returns of 64.30%, and 1-year returns of 2.38%. This fund also mitigates against concentration risk by having a relatively even weight distribution.

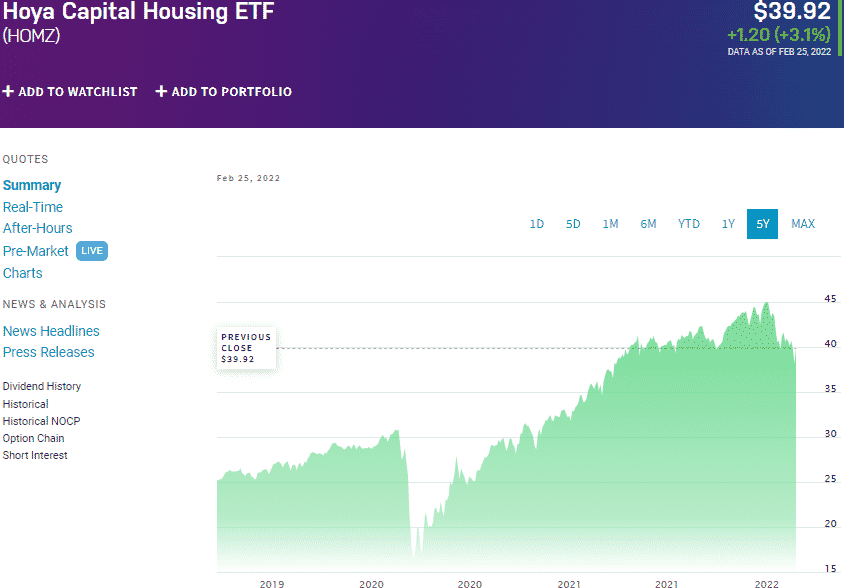

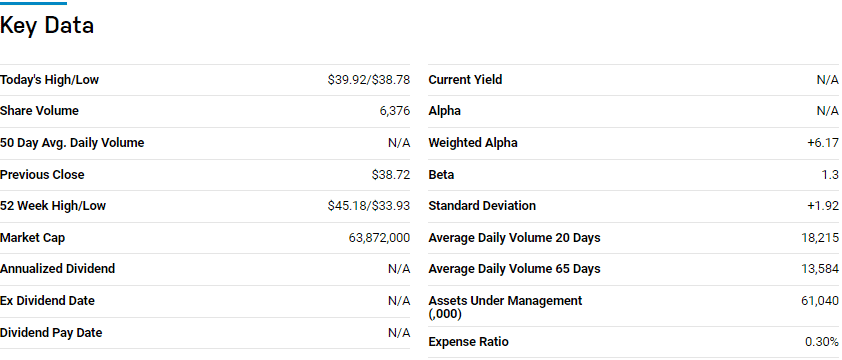

№ 3. Hoya Capital Housing ETF (HOMZ)

Price: $39.92

Expense ratio: 0.30%

Dividend yield: 2.62%

HOMZ chart

Compared to the other funds in this list, the Hoya Capital Housing ETF was pretty new in March 2019. This fund tracks the performance of the Hoya Capital Housing 100 TM Index, net of fees and expenses, investing a minimum of 80% of its total assets in real estate and housing-related companies. The result is a fund made up of 100 holdings of the best-performing housing equities across the US residential housing segment.

The top three holdings of this non-diversified ETF are:

- Lowe’s Companies, Inc. – 2.87%

- Home Depot, Inc. – 2.60%

- Tricon Residential Inc. – 1.82%

The HOMZ ETF has $62 million in assets under management, with a relatively low expense ratio of 0.30%. This ETF is a diversified play on the entire residential and business housing value chain; homeownership and rental operations, home improvement and furnishing, financing, technology, services, and home construction and building.

Concentrating on the best equities in the four niches coupled with semi-annual rebalancing and reconstitution has resulted in a return generating fund, 15.25% returns in its first 12 months of trading.

Final thoughts

The coronavirus has changed how the globe operates on a day-to-day basis. Before the pandemic, the norm was moving into the city. Still, with the widespread adoption of remote working and fear of densely populated areas, home building and renovation demand is expected to hit the roof. Couple this to a pent-up house buying demand due to uncertainty over the last two years, and this niche of the construction industry is on the verge of mega returns. The three ETFs above have the diversification to ensure consistent demand in this high-demand low-supply market.

Comments