SPY investors can start smiling if the last two weeks are anything to go by because its earnings season just kickstarted.

After rallying even further to finish its best week of 2022 so far, would the SPY confirm the start of its earning season, or would the bears’ rain on parade?

Monday market opening continued last week’s opening phenomena, a gap up of 0.1%. Given the bullish rally that accompanied the previous week’s gap-up, this opening phenomenal was an omen for a largely bullish week. From this point onwards, the markets were largely sideways with bullish inclination, testing last week’s resistance level severally, $450.6, before breaking it to test the yearly pivotal level at $458.4. However, despite this pivotal level testing being accompanied by a 0.5% gap up on Thursday, it proved quite a formidable resistance level. On Friday, it gave bearish SPY investors respite and pushed prices down to trade at the $449.21 level.

Quarterly earnings reports for major SPY holdings are still streaming in, and with most of them being positive, investors’ jitters on the economic resumption having slowed are slowly ebbing. A better-than-expected job report for January despite the rising Omicron coronavirus cases also shows economic recovery-three-month payroll high.

The markets also experienced a yield jump from 1.5% to 1.93%. It was fueled by the decline in prices of the 10-year US treasuries as a reaction to the FEDs hawkish view and their prioritization on curbing the out-of-control inflation. Despite the consumer price index supporting this to show an inflation rate of 7.5%, the highest since 1982, the SPY weathered all this to finish the week in the green, +0.65%.

Top gainers of the current week

Materials sector

A second week in the green saw investors jitter on a slowing down economy quelled, resulting in investment inflows into the materials sector to close the week with a +2.71% change.

Financial Services sector

The start of the earnings season and continued positive economic indicators saw inflows into the financial services sector for a second week running to finish the week with a +1.45% change.

Industrial sector

Following in the footsteps of the materials sector, the industrial sector benefitted from investor confidence in the full economic resurgence in 2022 to finish the week in the positive with a +0.76% change.

Losers of the current week

Sectors had hit by the market volatility, and the explosive inflation data were:

Communication Services sector at — 1.35%

Real Estate sector at — 1.44%

Utilities sector at — 2.26%

An improving economy and hawkish FED view saw investors move from defensive sectors to inject their investment in sectors that will drive economic resurgence, despite the rising inflation rates.

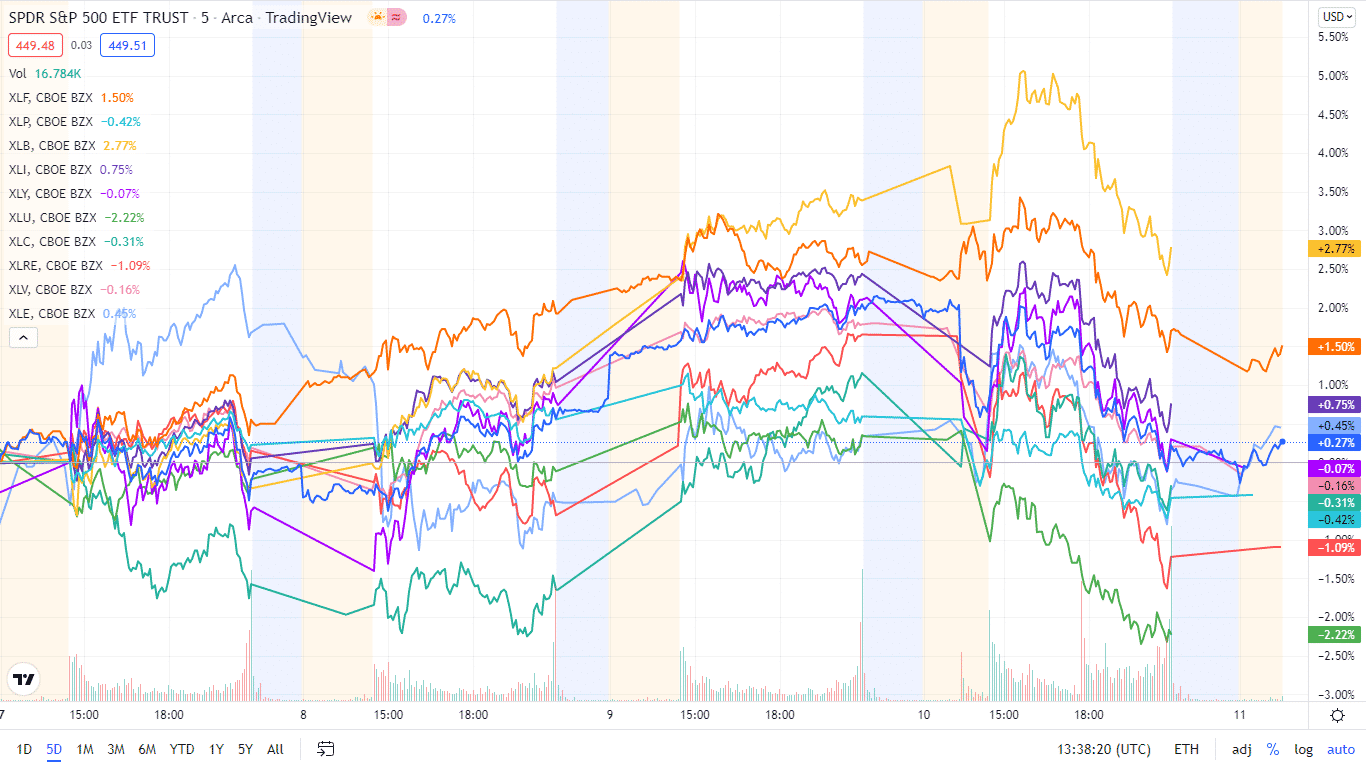

Below is a performance chart of the S&P 500 over the week and its component sectors.

The S&P 500 individual sectors’ weekly chart

The following breakdown shows how the S&P 500 ended the week, using their corresponding ETFs. The week was largely sideways for the SPY but with a bullish inclination resulting in sectors splitting between finishing the week in the red and in the green.

The S&P 500 individual sector, weekly performance breakdown |

|||

| 1. | Materials | XLB | +2.71% with the accompanying materials select sector ETF |

| 2. | Financial Services | XLF | +1.45% with the accompanying financial select sector ETF |

| 3. | Industrial | XLI | +0.76% with the accompanying industrial select sector ETF |

| 4. | Consumer Discretionary | XLY | +0.59% with the accompanying consumer discretionary select sector ETF |

| 5. | Information Technology | XLK | +0.10% with the accompanying information technology select sector ETF |

| 6. | Healthcare | XLV | -0.12% with the accompanying healthcare select sector ETF |

| 7. | Consumer Staples | XLP | -0.59% with the accompanying consumer staples select sector ETF |

| 8. | Energy | XLE | -1.01% with the accompanying energy select sector ETF |

| 9. | Communication Services | XLC | -1.35% with the accompanying communication services select sector ETF |

| 10. | Real Estate | XLRE | -1.44% with the accompanying real estate select sector ETF |

| 11. | Utilities | XLU | -2.26% with the accompanying utilities select sector ETF |

Comments